- Company

-

Specialized Products

Warehousing Solution

Specialized Freight Solutions

Multimodal Freight Solutions

GSA, CSA & SC

- Service

- Blog

- Cargo Tracking

- Contact Us

- Site Map

The Power of Logistics to Move the World!

It's the Power of extrans.

EXTRANS GLOBAL - Air Freight News - Week 46 2025

1. Air Cargo General

1) Ministry of Land Initiates Traffic Rights Redistribution – Dawn of the LCC Long-Haul Era

As traffic rights redistribution following the merger of Korean Air and Asiana Airlines gains momentum, industry analysis suggests T'way Air is highly likely to benefit from policy support, leveraging its experience in operating Europe/North America routes and performance at regional airports.

The Korea Fair Trade Commission has officially launched the process of redistributing traffic rights and slots on monopolistic air routes, as required by the merger conditions for Korean Air and Asiana Airlines.

The government aims to reduce the concentration of the aviation market dominated by full-service carriers (FSCs), encourage low-cost carriers (LCCs) to enter long-haul routes, and restore a competitive environment.

The routes subject to redistribution include: 4 U.S. routes (Incheon-Seattle, Incheon-Honolulu, Incheon-Guam, Busan-Guam), 1 UK route (Incheon-London), 1 Indonesian route (Incheon-Jakarta), and 4 domestic routes (Gimpo-Jeju, Gwangju-Jeju, Jeju-Gimpo, Jeju-Gwangju).

If alternative airlines are selected, new operations on these routes could commence as early as the first half of next year. Previously, 6 routes including Incheon-San Francisco, Incheon-Frankfurt, and Incheon-Rome have already been redistributed to Air Premia, United Airlines, and T'way Air in accordance with measures by U.S. and EU competition authorities.

The Ministry of Land, Infrastructure and Transport views this redistribution phase as an opportunity to restructure the aviation industry. Through its "Measures to Enhance the Competitiveness of the Air Transport Industry," the ministry plans to prioritize allocating additional traffic rights on FSC-dominated routes (such as Southeast Asia and Europe) to LCCs and expand exclusive traffic rights for regional airports. Aligned with this policy direction, T'way Air—equipped with both long-haul operation experience and a strong track record at regional airports—has been named a top candidate for policy benefits.

Analysts note that if aviation authorities further expand exclusive traffic rights for regional airports and incorporate long-haul operational capabilities into traffic rights evaluation criteria, T'way Air’s existing performance is likely to give it a competitive edge over rivals.

However, some point out that the long-haul market will not automatically translate into "opportunities." Long-haul routes involve high fixed costs, including aircraft lease fees, maintenance expenses, and long-haul flight crew salaries. Failure to ensure operational efficiency could lead to worsening profitability. In particular, the structural risks of long-haul routes are emphasized—stable operations are difficult without sufficient internal capabilities, given the heavy burden of fixed costs such as aircraft leases, maintenance, and crew recruitment.

2) Passenger Planes Instead of Freighters – Asiana Expands European Routes as a Gamble, Putting T'way on Edge

Asiana Airlines is set to significantly expand its European routes in the first half of next year, accelerating the strengthening of long-haul passenger routes as a strategy to fill the profitability gap left by the sale of freighters ahead of its merger with Korean Air. Meanwhile, T'way Air— which focuses on European routes—is facing increased pressure from intensified competition.

Asiana Airlines will launch new routes to Milan, Italy in March next year and Budapest, Hungary in April. Operating regular flights from Incheon, Milan will be served 3 times a week (Tuesday, Thursday, Saturday) and Budapest 2 times a week (Friday, Sunday), both using 311-seat A350 aircraft. Asiana decided to launch these new routes considering the high commercial and tourism demand in both cities.

With these additions, Asiana Airlines’ European route network will expand from 7 existing destinations (London, Paris, Frankfurt, Rome, Barcelona, Prague, Istanbul) to 9. The Incheon-Barcelona route will also be increased from 5 weekly flights to daily operations starting September next year.

Asiana Airlines’ expansion is interpreted as a "strategic move" beyond simple route addition to recover profitability. In August last year, Asiana sold all 11 of its freighters to meet the merger conditions for acquisition by Korean Air. Cargo operations accounted for 24.4% of the company’s total revenue last year, so the sale led to a rapid deterioration in profitability.

In fact, Asiana Airlines’ net cargo volume in September fell 75% year-on-year, and its operating profit for the third quarter of this year is expected to drop 62% year-on-year to 49 billion won. In response, the company is leveraging "belly cargo" transport (using the lower deck of passenger planes) instead of freighters, while focusing on the long-haul passenger segment to boost performance.

Asiana’s European route expansion is expected to pressure T'way Air. T'way entered major European cities such as Zagreb, Rome, Paris, Barcelona, and Frankfurt last year, but overlapping routes with Asiana’s new destinations are likely to trigger cutthroat competition.

Notably, the Barcelona route was transferred to T'way by Korean Air as part of merger remedies. Asiana’s expansion on this route has heightened subtle tensions in the market, though the expansion itself does not violate antitrust measures as it increases consumer choice.

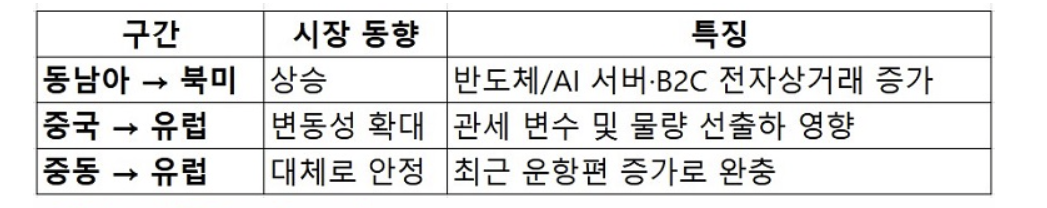

3) Global Air Cargo Market Sees Moderate Growth in Q4, Widening Regional Demand Gaps (by DHL Report)

Entering Q4 2025, the global air cargo market maintains a moderate growth trajectory. Demand is primarily driven by cross-border e-commerce and high-tech cargo such as semiconductors and AI servers originating from the Asia-Pacific region, while industrial goods like traditional manufacturing and automotive products remain sluggish.

Although global demand is increasing, sustained declines in freighter supply are expected to further amplify freight rate volatility across routes.

From January to September this year, global air cargo demand rose 4% year-on-year, with the Asia-Pacific (ASPA) region leading the expansion at 5%. This growth is mainly attributed to increased exports of cross-border e-commerce, semiconductors, and high-value technology products from China, Taiwan, and Vietnam to North America and Europe.

Freighter Supply Declines, Partially Offset by Belly Cargo

Global air cargo capacity (available tonnage) remained virtually flat year-on-year in September, primarily due to a 7% drop in freighter operations since the start of the year.

In contrast, the recovery in passenger demand has increased belly cargo capacity, partially offsetting the overall supply decline. However, capacity constraints persist on specific high-value cargo routes such as Asia-Europe and Southeast Asia-North America.

Additionally, the rapid aging of older large freighters and delays in new aircraft deliveries are increasing medium- to long-term supply uncertainty. According to Airbus projections, the global freighter fleet is expected to grow by approximately 45% over the next 20 years. As of October, the global average air freight rate stood at $2.48 per kg, up 3% week-on-week, driven by a higher proportion of high-yield cargo and increased volumes from the Asia-Pacific region.

The DHL report forecasts that global air cargo demand will maintain stable growth of 3-4% annually through 2026.

However, it highlights three key risk factors requiring attention:

- Escalation of U.S.-China technological trade regulations

- Delays in replacing aging freighters and bottlenecks in modified passenger-to-freighter (MPC) conversions

- Increased fuel cost burdens from the mandatory use of Sustainable Aviation Fuel (SAF)

In summary, the market is expected to face heightened route-specific and time-specific freight rate volatility, as demand recovers but supply struggles to keep pace.

4) China – 169 New Air Cargo Routes Launched This Year

China has launched 169 new air cargo routes so far this year.

According to the China Federation of Logistics & Purchasing, a total of 169 new air cargo routes were opened in China from January to September, adding more than 352 round-trip cargo flights per week.

By region, the new routes are distributed as follows: 81 in Asia, 66 in Europe, 15 in North America, 3 in Oceania, 2 in South America, and 2 in Africa.

By cargo type, the routes primarily handle cross-border e-commerce goods, high-tech manufacturing products, high-value-added cargo, automotive parts, machinery and equipment, and fresh food.

In September alone, 17 new air cargo routes were launched, adding more than 46 round-trip cargo flights per week.

5) Airlines Movement

- Uzbekistan Airways (HY): Confirmed an order for 8 additional B787 Dreamliners on November 6, expanding the total order to 22 aircraft.

- Asiana Airlines (OZ): Will launch new routes to Milan (MXP), Italy (3 weekly flights starting March 31, 2026) and Budapest (BUD), Hungary (2 weekly flights starting April 3, 2026). The Barcelona (BCN) route will be increased from 5 to 7 weekly flights starting September 2026.

- Martinair (MP): Started operating 3 weekly flights on the ICN-AMS route from October 28, using B747BCF aircraft. The return route (D2) operates as Ams-HKG-ICN.

- Network Aviation Group: Will launch 1 weekly B747F flight on the LGG-JNB route starting at the end of October.

top