- Company

-

Specialized Products

Warehousing Solution

Specialized Freight Solutions

Multimodal Freight Solutions

GSA, CSA & SC

E-Commerce

- Service

- Blog

- Cargo Tracking

- Contact Us

- Site Map

The Power of Logistics to Move the World!

It's the Power of extrans.

EXTRANS GLOBAL - Air Freight News - Week 38 2025

1. Air Cargo General

1) Air Canada - ANA: Code Sharing on Korea-Japan Cargo Routes

Air Canada (IATA code: K) announced the launch of code sharing with All Nippon Airways (ANA, IATA code: NH) on Korea-Japan cargo routes starting from the 15th.

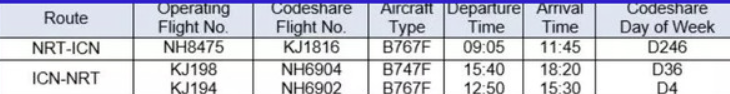

The routes covered by this collaboration are the Incheon (ICN) - Narita (NRT) routes operated jointly by both airlines. Accordingly, Air Canada will use ANA’s "NH" flight code for flights departing from Incheon, while ANA Cargo will be able to use the "KJ" flight code for flights departing from Narita.

Code sharing will be applied to 3 weekly flights operated by each airline respectively. ANA currently operates flight NH8475 departing from Narita every Tuesday, Thursday, and Saturday using a 767F freighter.

Air Canada operates flight KJ198 (using a 747F) departing from Incheon every Wednesday and Saturday, and flight KJ194 (using a 767F) every Thursday.

Meanwhile, ANA Holdings fully integrated Nippon Cargo Airlines (NCA, IATA code: KZ) as a wholly owned subsidiary on August 1st, officially becoming Japan’s largest "combination carrier" handling both passenger and cargo services.

2) Kalitta Air Adds 2 More B777 Freighters

Kalitta Air (IATA code: K4), a U.S.-based all-cargo airline, recently introduced 2 new B777-300ERSF freighters.

These freighters are converted aircraft, leased from AerCap, a professional aircraft leasing company. They were originally passenger planes operated by Emirates Airlines (EK) before being converted into freighters, with an aircraft age of 19.3 years.

The conversion work was carried out by Israel Aerospace Industries (IAI). In addition to these 2 B777-300ERSFs, Kalitta Air plans to introduce 3 more aircraft of the same model.

Currently, Kalitta Air operates a total of 32 freighters, including 22 B747-400s, 8 B777s, and 2 B777-300ERSFs. The airline currently operates both charter and scheduled cargo flights to Asia, Europe, the Caribbean, and other regions, with a focus on the United States.

3) VIG’s Growing Interest in Acquiring Air Premia - Rumors of Bundled Sale with Eastar Jet Surge

It has been confirmed that VIG Partners is formally reviewing the acquisition of shares in Air Premia. If the acquisition is successful, it is regarded as a major deal that will drastically reshape the landscape of South Korea’s low-cost carrier (LCC) industry.

VIG Partners is refining plans to acquire additional shares in Air Premia through JC Partners, the second-largest shareholder of Air Premia. The most likely scenario is that VIG (the largest shareholder of Eastar Jet) will first acquire Air Premia, integrate it with Eastar Jet, and then exit its stake.

Due to the detention of Kim Jung-kyu, Chairman of Tire Bank, his affiliated companies are unable to pay the remaining balance for the acquisition. Market rumors suggest that "JC Partners will transfer the stake to VIG via the ‘Drag Along’ right (co-sale right), and VIG plans to bundle the two airlines to create synergies before selling them to the market in 3 years."

Specifically, AP Holdings, a subsidiary of Tire Bank, must pay the remaining 9.94 billion won for the acquisition by the end of October. If it fails to do so, a "Drag Along" right will be triggered for existing shareholders JC Partners and Daemyung Sono Group. This right, specified in the shareholder agreement, allows minority shareholders to require majority shareholders to sell their shares together to a third party when the minority shareholders sell their own stakes, enabling a "bundled sale."

Previously, AP Holdings encountered obstacles in raising funds for the Air Premia acquisition after Chairman Kim Jung-kyu was sentenced to 3 years in prison on charges of tax evasion and embezzlement and placed in custody. In May this year, AP Holdings signed an agreement with JC Partners and Daemyung Sono Group to acquire a 22% stake in Air Premia for approximately 120 billion won, and has already paid a 20 billion won deposit. If AP Holdings ultimately fails to pay the remaining balance, JC Partners can also acquire AP Holdings’ existing 46% stake, forming a structure where a total of 68% of Air Premia’s shares can be sold to VIG Partners as a bundle. Daemyung Sono Group and JC Partners can minimize losses by splitting the 20 billion won deposit equally.

Although the deadline for paying the remaining balance is the end of September, it can be extended to the end of October if interest is paid. However, considering Chairman Kim’s current detention status, the market generally believes that it is practically impossible for AP Holdings to raise additional funds. Even if attempts are made to attract external investment, the "legal risks faced by the company’s owner" will be a key obstacle.

An insider from the investment banking (IB) industry stated: "VIG Partners’ strategy is a typical ‘Buy and Build’ model in the private equity fund industry—acquiring multiple companies in the same industry step by step to maximize economies of scale and synergies, and finally selling them at a high price." The insider further predicted: "In particular, the aviation industry has great potential for cost reduction through network effects and improved operational efficiency, so the corporate value is expected to increase significantly after integration. However, it should be noted that both airlines are currently in a state of deficit, so improving profitability in the short term may face challenges."

If VIG Partners’ strategy succeeds, the competitive landscape of South Korea’s aviation industry may undergo fundamental changes (such as competition with major airlines like Korean Air and Asiana Airlines), and significant adjustments to the domestic aviation industry ecosystem, centered on medium- and long-haul international routes, will also be inevitable.

4) Hawaiian Airlines Launches 5 Weekly Scheduled Flights on ICN-SEA Route

Hawaiian Airlines (IATA code: HA), a subsidiary of Alaska Airlines Group, officially launched 5 weekly scheduled flights on the Incheon (ICN) - Seattle (SEA) route starting from the 13th.

The route is operated using a B787-9 aircraft, with a general air cargo capacity of approximately 11 tons. A ceremony for the new route launch was held at the departure hall of Incheon Airport Terminal 1 on the 13th.

With the launch of this new route, the number of airlines operating on the Incheon-Seattle route has increased from 3 to 4, and the total number of weekly flights has risen from 21 to 26. This provides more options for tourists and business travelers heading to Seattle. Currently, Korean Air, Asiana Airlines, and Delta Air Lines each operate 7 weekly flights on this route.

Alaska Airlines Group, to which Hawaiian Airlines belongs, owns Horizon Air and Hawaiian Airlines in addition to its core member, Alaska Airlines (founded in 1932, a major airline based in the western United States). The group operates approximately 140 routes in North America, Central America, and the Pacific region, centered on hub airports such as Seattle, Portland, Los Angeles, San Francisco, and Anchorage.

5) Airlines Movement

-

Martin Air (MP): New route launch on October 28th Incheon (ICN) - Amsterdam (AMS): Operated every Tuesday, Thursday, and Saturday.

- Tuesday flight: ICN-AMS (via Hong Kong, HKG)

- Thursday and Saturday flights: ICN-AMS (non-stop)

-

Virgin Atlantic: Scheduled to launch daily non-stop flights on the ICN-London Heathrow (LHR) route by the end of March next year.

top