EXTRANS GLOBAL - Air Freight News - Week 05 2025

Air Cargo General

1) Reorganization into LCC 'Big 3'? - Jeju Air vs. Integrated Jin Air vs. Daemyung Sono

- As Daemyung Sono Group, the country's top resort company, announced the acquisition of T'way Air and Air Premia on the 22nd, a reorganization of the domestic low-cost carrier (LCC) market, which currently has nine companies, is expected to accelerate.

- Considering that Korean Air and Asiana Airlines will merge, integrating their LCCs, Jin Air, Air Busan, and Air Seoul, it is analyzed that the number of LCC companies could be reduced to less than half.

- If Daemyung Sono successfully acquires T'way Air, which has 37 aircraft, and Air Premia, which has six, it will surpass Jeju Air, the leading LCC with 41 aircraft.

- Unlike other LCCs that primarily focus on short-haul routes, they will also secure long-haul routes. T'way Air has taken over four European routes (Paris, Rome, Frankfurt, Barcelona) during the merger process of Korean Air and Asiana Airlines.

- Air Premia is currently operating strong-demand routes to Los Angeles and New York in the United States.

- If Daemyung Sono successfully acquires both airlines, the strongest competitor will be the integrated Jin Air. If Jin Air (31 aircraft), Air Busan (21 aircraft), and Air Seoul (6 aircraft) merge within two years, they will become the overwhelming LCC leader with 58 aircraft.

- A variable in this scenario is Eastar Jet, which has 15 aircraft. Since VIG Partners, a private equity fund (PEF), holds 100% of the shares, it is highly likely to be put up for sale at some point.

- Depending on who acquires Eastar Jet, the competitive landscape among the three major players—integrated Jin Air, Daemyung Sono, and Jeju Air—could change.

- Industry insiders predict that if Eastar Jet goes up for sale, Jeju Air will be the most interested. Unlike Daemyung Sono and integrated Jin Air, which need to focus on post-acquisition tasks and integration, Jeju Air has not made any significant mergers or acquisitions (M&A). Jeju Air CEO Kim I-bae mentioned to employees in July last year that "private equity funds that invest in airlines will eventually seek an exit (return on investment), so we need to be prepared when the opportunity arises." Jeju Air previously attempted to acquire Eastar Jet in 2019 but abandoned the plan.

2) Alaska Airlines' successful acquisition of Hawaiian Airlines resulted in a 38% increase in group revenue last year.

- Alaska Air Group has successfully completed the acquisition of Hawaiian Airlines, accelerating its cargo business expansion.

- As a result, Alaska Air Group announced that it recorded $348 million in cargo revenue.

- As of December 2024, a 38% increase from the previous year ($252 million).

- Of this, Alaska Airlines' cargo revenue was $279 million, up 14% year-over-year, while Hawaiian Airlines recorded $59 million in revenue, achieving over double the cargo revenue of $132 million in the fourth quarter compared to the same period last year.

- Following the integration with Hawaiian Airlines, Alaska Air Group announced a three-year strategic plan called "Alaska Accelerate" for December 2024.

- This plan aims to generate an additional $1 billion in profit, maximizing earnings through network synergies ($35 million), revenue management and optimization ($55 million), CMI, and others ($60 million).

- Meanwhile, Alaska Air Group completed the acquisition of Hawaiian Airlines for $1.9 billion in September 2024, which led to the signing of a cargo transportation and operation contract with Amazon.

- Subsequently, during the fourth quarter of 2024, Hawaiian Airlines added two A330-300 freighters from Amazon, bringing its total to six, and Alaska Air Group operates a total of six A330-300 P2F freighters for Amazon.

3) Korean Air's air cargo rises to global top tier, strengthening its foothold in the freight market.

- Korean Air has established itself as a top-tier player in the global air cargo market by transporting a wide range of items, from general cargo to special cargo.

- The importance of air cargo has increased since the COVID-19 pandemic, coupled with disruptions in maritime logistics, further expanding Korean Air's presence in the air freight sector.

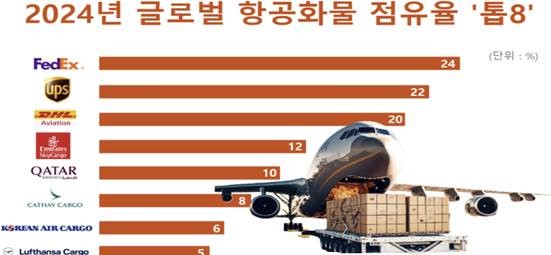

- According to aviation media Aviation for Aviators, Korean Air held a 6% market share in the air cargo sector last year.

- As of the end of last year, Korean Air operated 23 freighters, including B747-8F and B777F, serving 45 cities across 26 countries, transporting semiconductors, automotive and battery parts, IT and electronic products, clothing, pharmaceuticals, and perishable goods.

- Notably, Korean Air transports special cargo sensitive to minor vibrations, as well as perishable goods requiring specific temperature and ventilation, standing shoulder to shoulder with global competitors in the air cargo market.

- With strong demand for air cargo, performance has increased by double digits. In the third quarter, Korean Air's cargo business revenue reached 1.1198 trillion won, a 22% increase compared to the same period last year.

- In the fourth quarter, the company plans to respond organically to anticipated market changes due to U.S.-China political tensions and instability in the shipping market, while maximizing profits during the year-end consumer peak.

- Meanwhile, FedEx Express has emerged as a "top-tier" player in the global air cargo market, achieving a 24% market share by specializing in temperature-controlled transportation and next-day delivery.

- In terms of revenue, global logistics provider DHL solidified its position with estimated earnings of $20 billion, holding a 20% market share.

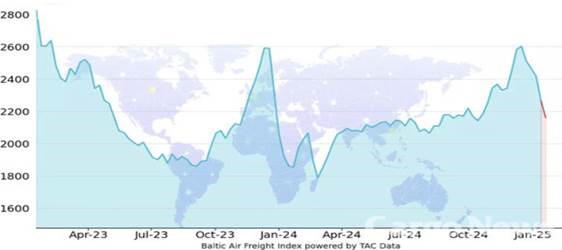

4) Global air cargo rates decline by 4.7% due to decreased demand.

- As demand decreases, global air cargo rates are showing a downward trend. However, they remain 16.6% higher compared to the same period last year.

- The reason for the high air freight rates compared to last year is that the demand for e-commerce continues to provide strong support.

- According to the TAC Air Freight Index, as of the 20th, global air freight rates have dropped by 4.7% compared to the previous week. However, due to increased early shipments in e-commerce before the Lunar New Year in Asia, rates are still strong compared to the same period last year.

- Accordingly, rates from Hong Kong (HKG) fell by 3% compared to the previous week but are still 14% higher than the same period last year. Similarly, rates from Shanghai (PVG) dropped by 5.4% from the previous week but are 125% higher compared to last year.

- The situation is similar for Europe and the Americas. Rates from Frankfurt (FRA) decreased by 5.9% compared to the previous week but are still 30.3% higher than the same period last year.

- Rates from London (LHR) also dropped by 8.8% compared to the previous week but are 13.4% higher than last year.

- Rates from Chicago (ORD) in the U.S. decreased by 3.6% from the previous week but are 38.3% higher than last year. Notably, rates from the U.S. continue to be strong, particularly on routes to Europe, China, and Latin America since the New Year.

5) GSA and Airline Trends

Air Premia (YP) will start operating four times a week to Incheon (January 24, 2025) and Da Nang (January 23, 2025).

ICN-HKG 787-900 D1357 0920-1115, HKG-ICN D1357 1245-1715 // ICN-DAD 787-900 D3467 1755-2045, DAD-ICN 2245-0545+1

top