旭辉空运国际 - 第50周24年航空业更新

航空货运概况

1) 大韩航空与韩亚航空合并第二轮 – 低成本航空公司的竞争开始。

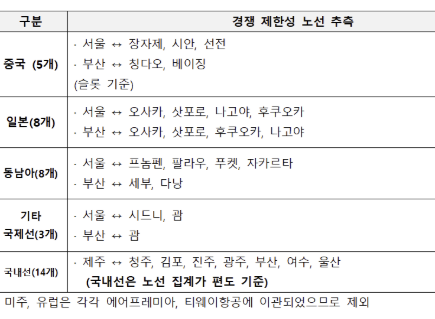

- 大韩航空与韩亚航空的合并将产生五家公司(大2,真航空、航空首尔、航空釜山),运营22条国际航线和14条国内航线。

- 公正交易委员会计划在大韩航空的新股收购完成的11日,最终批准合并,并将在三个月内召开实施监督委员会,审查现有的批准条件。由于多个监管机构的条件性批准相互交织,预计将很快进行航线调整。

- 国内航空业认为,航线调整应以国内低成本航空公司(LCC)为中心,以尽快解决大2旗下五家公司的垄断问题。

- 如果将航线重新分配给LCC,大2旗下五家公司的市场份额将迅速下降。例如,在中国航线方面,目前五家的市场份额为79%,调整后将降至53.6%,下降25.4个百分点。

- 一位LCC业内人士表示:“之前由现有航空公司运营的某些航线的运费在110万到160万韩元之间,如果由LCC运营,运费将大幅下降至60万到70万韩元,对航空消费者来说,LCC的航线分配可能是有利的。此外,如果LCC接管航线,将对航空市场的健康发展产生积极影响。”

- 如果通过大2旗下LCC(真航空、航空首尔、航空釜山)的整合诞生一个大型LCC,前3名的格局将会发生变化。目前,第一名的济州航空拥有41架飞机,而合并后的LCC理论上将增加到58架。现有公司迫切需要制定应对措施。在中短途航线的经营者数量不断增加并达到饱和的情况下,其他公司因大2合并延迟而感到新业务推进受到限制,这也是迫切需要解决的问题。

- 除去大2外,目前运营的LCC共有5家(济州航空、T'way航空、易星航空、航空Premia、Air Loke)。此外,过去收购Fly Gangwon的新兴公司Parata航空最近在金浦机场附近开设了办公室,而曾在地方机场如泗川机场运营航线的高航空也在寻求重新进入市场。这些LCC在巩固业务扩展意愿方面,大2旗下五家公司提供的航线必然成为关注的焦点。因此,预计在LCC行业内将展开激烈的竞争,以争夺大2旗下五家公司提供的航线。

2) IATA公告 - 航空货运需求连续15个月增长,但明年市场前景不确定。

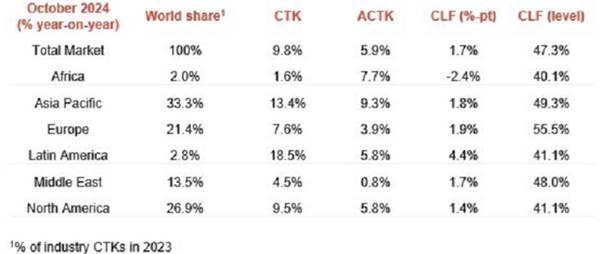

- 根据国际航空运输协会(IATA)发布的10月统计数据,航空货物需求同比增长9.8%,继续保持15个月的上升趋势。

- 10月全球航空货物供应量(可用CTK)增长5.9%,货物装载率上升1.7个百分点,达到47.3%。

- 供应量的增加主要归因于客机腹部货舱增加8.5%和货机增加5.6%。货机的供应量接近2021年的最高水平。

- IATA总干事威利·沃尔什表示:“2024年航空货物的收益率预计比2023年增加10.6%,比2019年增加49%。”他补充道:“2024年预计将是航空货物行业的重要一年,但对于2025年需要保持警惕。”

- 与此同时,IATA最近分析了一些市场指标,并强调以下内容:

- 9月全球工业生产增长1.6%,全球商品贸易增长2.4%,连续六个月增长。

- 全球制造业生产的采购经理人指数(PMI)保持在50以上,表明增长势头持续。

- 新出口订单指数低于50,显示出贸易的不确定性和疲软。

- 按地区来看,亚太航空公司的10月航空货物需求同比增长13.4%,表现最为突出,运力增长9.3%。

- 北美:需求增长9.5%,运力增长5.8%。

- 欧洲:需求增长7.6%,运力增长3.9%。

- 中东:需求增长4.5%,运力增长0.8%。

- 拉丁美洲:需求增长18.5%(最高增长率),运力增长5.8%。

- 非洲:需求增长1.6%(最低增长率),运力增长7.7%。

3) CAAC发布,来自中国的航空货物创历史新高 - 10月累计达到730万吨(比2019年增长19.3%)。

- 最近,中国民用航空局(CAAC)宣布2024年中国的航空货运量达到了“历史最高点”。

- CAAC表示,从1月到10月,运输的货物和邮件约为730万吨,比2019年增长了19.3%。

- 这一“历史峰值”得益于国际航线航空货物的“强劲增长”。前往出口目的地的国际航班货量激增48.5%,达到了293万吨。

- 在11月最后一周,前往国际目的地的货运航班较去年增长了100.4%。这一增长主要归因于中国的产业转型、一带一路合作的日益紧密以及跨境电子商务的快速发展。

- 然而,自唐纳德·特朗普总统上任以来,关税冲突不断升级,这引发了对中国航空货运行业长期前景的担忧。特别是电子商务可能面临风险,因为目前中国电子商务货量的三分之一(35%)以上是通过航班运往美国的,其余25%主要经过德国前往欧洲。

- 同时,波音最近在其2024年商业市场展望(CMO)中预测,到2043年,中国的货机数量将增加近三倍,这一增长将受到电子商务繁荣带动的需求推动。预计从2024年到2043年,中国将交付170架专用货机,包括新机型和改装机型。

4) 中国航空货物呈现激增趋势,但在特朗普回归之前必须加快行动。

- 随着唐纳德·特朗普准备重返白宫,美国公司正在急于确保从中国进口商品,以避免关税。因此,中国的航空货物也出现了激增。

- 根据彭博社在28日(当地时间)的报道,上周往返中国的国际货运航班达3485班。

- 这是自中国在2023年3月解除新冠疫情封控政策以来的最高纪录。中国交通运输部报告称,最近三周每周航班数量连续超过3400班。

- 今年1月至10月的货运航班数量同比增长73%。运送商品到中国的船只数量增加了8.3%。卡车和铁路运输也呈现两位数增长。

- 随着特朗普即将重返白宫,航空货物预计将进一步增加。特朗普在25日宣布,将对来自墨西哥和加拿大的进口商品分别征收25%的关税,对来自中国的进口商品征收10%的关税。在竞选期间,他多次表示将对中国进口商品征收60%的普遍关税。

- 彭博社指出,“由于特朗普预计将在明年1月底就职,美国公司可能会在他对中国、墨西哥、加拿大和其他国家的商品征收新关税之前尽可能增加采购,这可能导致航班数量进一步增加。”

5) GSA及航空公司动态

- 明年1月1日起,马士基航空货运将开通CGO-ICN-GSP航线的B777F货机。

- 夏威夷航空将在明年10月开通ICN-SEA的每周四次直飞航班。

- 北欧航空(SK)将于明年9月开通ICN-COP的每周四次直飞航班。

top