旭辉空运国际 - 第44周24年航空业更新

航空货运概况

1) 中国发往欧洲的航空货物供应变化

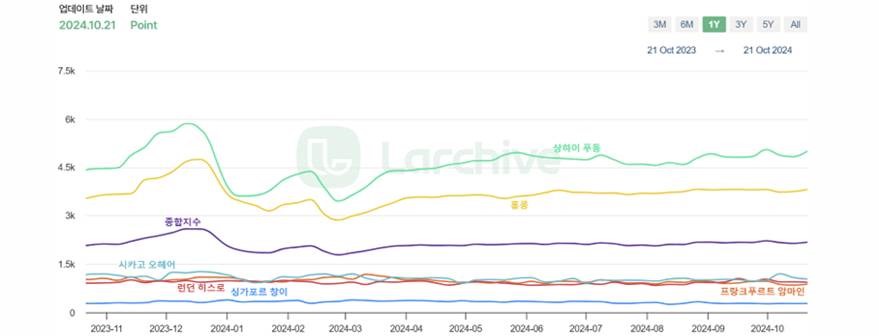

◇ 波罗的海航空运费指数第42周

-

随着中国至欧洲和美国的航线费用上涨,整体价格再次主导了市场。香港出发的出境航线指数较上周上涨1.6%,同比增长7.0%;上海的出境指数在大多数主要航线上呈现上涨趋势,达到5006点,较上周上涨3.6%,同比上涨12.6%。

-

另一方面,预计韩国出发的市场将在10月最后一周开始显著上涨,全球市场的定期包机合同增加,然而,相对过剩的供应仍将成为一个变数。

-

最近,欧洲航空公司纷纷退出中国市场或暂停航线运营,预计航空货物市场将出现波动。

-

北欧航空公司SAS和波兰航空公司LOT已决定分别停止哥本哈根-上海和华沙-北京航线的运营,同时芬兰航空、英国航空和维珍大西洋航空也在退出或推迟中国航线。这些变化的主要原因是由于俄罗斯-乌克兰战争导致的俄罗斯空域关闭,欧洲航空公司不得不选择较长的绕行路线,从而增加了成本和飞行时间。

-

相比之下,中国航空公司可以使用俄罗斯空域,保持通往欧洲的短途和经济航线。这使得欧洲航空公司在竞争中处于不利地位,并对连接欧洲和中国的航空货物运输市场产生直接和间接的影响。

-

根据欧盟统计, 中国是欧盟第二大贸易伙伴,2023年贸易额达到7390亿欧元,因此航空运输需求仍然很高。欧洲航空公司通过客机腹舱在欧洲与中国之间的电子商务商品运输中发挥了重要作用,但如果这些航空公司相继退出中国航线,货物供应能力将受到重大打击。

2) 预计美国年末消费支出将增加,但对美国航货出口延迟的担忧仍然存在

-

在中国至美国的航空货物运输中,国泰航空的代表表示:“预计来自中国大陆、东南亚和印度的电子商务、高科技和电子产品的需求将会强劲。”他还提到,南太平洋和美洲地区的鲜食品出口需求将会上升。

-

实际上,国泰航空在截至9月的第三季度记录了显著的业绩增长,南太平洋、东南亚和北美之间从香港和中国大陆的鲜食品运输有所增加。随着电子商务需求的激增,广东-香港-澳门大湾区对美国的出口量大幅增加。

-

随着年末旺季的临近,对美国的航空货物出口延迟的担忧加大。美国联邦航空局(FAA)最近建议航空公司加强程序,以应对年末电子产品交付激增带来的安全问题,市场分析认为可能会出现航空货物运输的短暂延迟等问题。

-

FAA预计将增加包括电子产品、电池驱动装置和易燃物质在内的货物,并警告说这可能会增加飞机上的烟雾、气味和火灾风险。因此,航空公司被告知要彻底重新审视货物的风险评估及相关程序,并增强机组人员的安全应对能力。

-

特别是,美国海关和边境保护局(CBP)已宣布,从11月12日起,将拒绝进口含有不明确货物说明的出口品。实际上,使用诸如“礼物”等模糊货物描述的情况,可能会使相关货物难以进入美国。该措施旨在加强安全管理,预计未来将有更严格的通关程序。

-

此次措施可能会特别影响计划在年末旺季期间出口电子产品和其他消费品的中国和韩国等出口企业。许多企业在此期间集中进行大量出口,因此由于加强的程序和规定,物流延迟的可能性增加。

-

因此,准备在年末季节进行美国航空货物出口的企业需要仔细审查FAA和CBP的新规定及程序,并制定相应的对策。

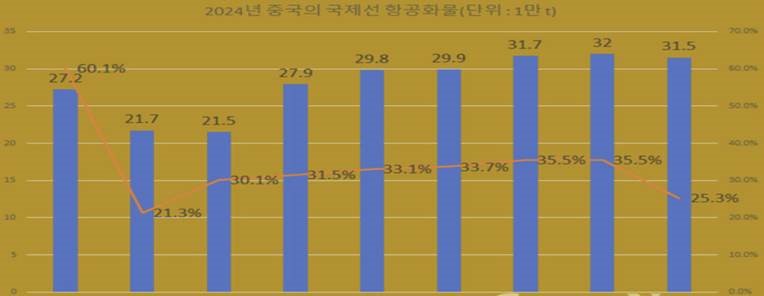

3) 中国航空货物连续四个月创新高:海运和空运需求强劲

- 在九月份,中国航空公司的航空货物(包括邮件)超过了80万吨,连续四个月创下新高。

- 特别是,国际航班达到315,000吨,比去年同期增长了25.3%,引领了整体上涨趋势。

- 因此,中国国际航班航空货物需求的上升导致我国家的海运和空运综合运输量增加。

- 在九月份,中国国内航班的航空货物也上升至484,000吨,增长了7.5%。

- 根据中国民用航空局(CAAC)的统计,1月至9月的总航空货物达到648.9万吨,比去年同期增长了24.4%。

- 国际航班占260.3万吨,增长了32.8%;国内航班也增加了19.4%,达到288.7万吨。

4) 韩亚航空与大韩航空合并:90%完成

-

“我们已经全力以赴。无论必须放弃什么,我们都会让合并成功。”在6月,韩亚航空董事长赵源泰在接受彭博电视采访时谈到与大韩航空的合并时如此说道。这是国内航空业历史上首次发生航空公司间的合并。对于推动合并的赵源泰(如图所示)来说,这意味着要开辟一条没有人走过的道路。特别是要超越关于在2020年管理权争夺战期间,以友好股权(10.58%)从产业银行获得支持作为收购亚航的代价的批评,合并后的发展将比合并本身更为重要。

-

如果T'way航空能在德国法兰克福航线稳定运营约一个月,预计欧洲委员会(EC)将在11月初之前最终批准大韩航空与亚航的合并。之后,如果美国司法部(DOJ)不对大韩航空和亚航的合并提起反垄断诉讼,合并将在2020年11月16日大韩航空决定收购亚航后约四年内完成。

-

合并后,大韩航空将成为拥有200多架飞机的超级航空公司。尤其是在全球新飞机供应短缺的情况下,大韩航空预计将通过利用亚航的飞机立即获得合并的好处。具体来说,大韩航空正在用空客A350和波音787飞机替换其长途机队,而亚航则是国内首家引进空客A350的航空公司,目前作为其主要长途机型运营。通过合并,大韩航空将能够提前通过亚航运营A350。此外,合并后如果有更多的闲置飞机,预计将能够提前返还或出售租赁成本高或机龄较老的飞机,从而提高运营效率。

-

然而,合并的代价也不容小觑。首先,大韩航空可能面临更大的短期财务压力。最紧迫的任务是降低亚航的负债率。去年年底负债率在1400%左右,但截至6月底已飙升至2952%,接近3000%。资产证券化(ABS)发行和预付款的增加导致负债上升,而由于累计亏损,资本减少。因此,预计大韩航空将在今年年底参与亚航的增资,以降低其负债率。

5) 航空公司/GSA 动态

• 从冬季时刻表开始,加拿大航空(AC)将货运部分从GSA销售转为ON STAFF制度,计划直接由总部销售。

• Air Premia(YP)将于11月前运营ICN-BCN航班,之后将停航。由于欧洲航班将开通SFO,计划将重心向美洲转移。

• T'way(TW)预计将从大韩航空(KE)获得2架B777-300ER的支持,包括机组人员和维修人员。计划在明年4月交付后,先进行国内航班运营,然后从5月开始投入欧洲航线。

top