旭辉空运国际 - 第42周24年航空业更新

航空货运概况

1) 今年旺季“丰裕中的贫困”可能性增大……即使处理量增加,确保‘盈利能力’也可能会很困难。

- 虽然我们已经正式进入旺季,但全球航空货运运费在每周间出现轻微的涨跌波动,整体保持稳定。

- 到九月底发布的各种全球航空货运数据与进入旺季前没有显著差异。虽然稳定,但所谓的“热”旺季,货物积压的情况尚未出现。

- 市场参与者普遍认为,目前仍处于旺季的初期阶段,需要继续观察,专家们也通过分析运费和货运指数的趋势显示出稳定的模式。

- 然而,一些负面情绪逐渐增加,出现了“预期的需求可能不存在”的评论。

- 一位业内人士提到:“虽然需求没有显著收缩或运费暴跌,但显然货物水平将远低于市场预期,今年的旺季将不是真正的旺季。”

- 另一方面,关于旺季市场也出现了不同的看法。一位专家质疑:“仅仅因为货量增加,真的算是旺季吗?”他指出,对于市场参与者而言,真正的旺季是保证创纪录的盈利,无论需求如何。

- 换句话说,近期的全球市场及韩国市场应关注市场运费下降的趋势,而非需求重量的问题。

- 一位业内人士指出:“从航空公司的角度来看,已经通过区块合同和包机将相当一部分供应空间转移给BSA,他们当前以最高的市场和合同价格运营,声称这已经是旺季。”

- 然而,在占据绝对份额的电子商务转运需求的韩国出口航空货运市场中,混合货运代理和BSA公司实际上已沦为中介,面临有限需求的价格竞争,导致发货人和普通货代的运费相对较低。

- 运费差异最终被转嫁给专业的BSA或航空货运混合公司,成为既定事实。

- 尽管如此,全球市场以及国内公司仍然设想着像COVID-19时期的旺季,抱着对“巨额收益”的期待,不愿放弃对十月市场的期待。

- 然而,一些专家深表担忧:“市场上有太多有些冒险的包机合同公司。到十二月时,可能会有很多公司后悔。如果需求激增,机场变得繁忙,但真正的‘收益’得不到保障,那么今年的旺季出现‘丰裕中的贫困’的可能性非常高。

2) 手握T'way和Air Premia的大明索诺 – ‘第二个亚细亚’的轮廓。

- 大明索诺连续收购T'way航空和Air Premia的股份,开始参与国内航空产业的重组。大明索诺表示这只是简单的收购,但许多人认为这是获取管理权的步骤,同时也讨论了合并两家公司或选择其中一家作为现实方案。

- 大明索诺集团的控股公司Sono International与私募基金管理公司JC Partners签署合同,以471亿韩元收购其持有的Air Premia 26.95%股份的一半。

- 他们还获得了在明年6月之后收购剩余股份的认购权,这将使他们成为Air Premia的第二大股东,此外,还讨论了收购最大股东AP Holdings持有的30.4%股份的方案。

- 此前,大明索诺从JKL Partners手中获得了T'way航空26.77%的股份,成为第二大股东。与最大股东Yerimdang的股份差距在3%左右,因此如果愿意,他们可以通过增持股份争取成为最大股东。

- 大明索诺表示这是出于“业务多元化”,因此对收购T'way航空和Air Premia的管理权保持距离,但业界普遍认为,大明索诺在航空业的投入使得其成为第二大股东的可能性不大,进一步提到可能会全面获得T'way航空和Air Premia的管理权,并在长期内考虑合并。

- 两家公司因韩国航空公司与亚细亚航空的合并,被选为分别在欧洲和美洲替代亚细亚航空的航空公司,合并后有可能形成“第二个亚细亚航空”。

- T'way航空拥有3架A330-300、4架A330-200、27架B737-800和2架B737-8,而Air Premia拥有5架B787-9,除去从韩国航空短期租赁的A330-200,总共有37架飞机。

- 虽然与拥有46架大型飞机的亚细亚航空相比存在困难,但如果两家航空公司按照既定的中长期计划,到2030年各自能获得20架A330和20架B787,水平将会相似。

- 此外,T'way航空正在以法国巴黎为中心建立欧洲航线,而Air Premia在洛杉矶和纽约等美洲航线没有重叠。

- 航空业界一直呼吁需要能够与韩国航空、亚细亚航空及其子公司Jin Air、Air Busan、Air Seoul竞争的大型航空公司。

- 然而,现实中由于大明索诺收购两家航空公司的难度,讨论的方案也包括只收购T'way航空或Air Premia其中一家。

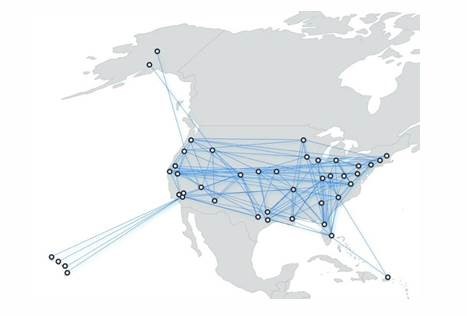

3) 美国亚马逊 – 正式进入一般航空货运市场!

- 亚马逊的航空物流子公司Amazon Air最近通过LinkedIn宣布,已开始向包括货运代理在内的各种客户出售货物空间。

- Amazon Air目前拥有超过100架货机,每天执行超过250个航班,包括与合作航空公司的航班。

- 亚马逊的航空物流部门“亚马逊航空货运”自2016年起开始全面运营。

- 目前,它每天向美国54个机场提供货运航班,拥有超过100架货机。主要机型包括B737、B767和A330货机。

- 主要服务不仅包括一般货物,还涵盖药品、易腐烂的商品、危险品和包裹等广泛的货物运输服务。

- 之前有传言称Amazon Air仅向一些长期固定客户非正式分配货物,但此次公告正式化了这一过程。

- 亚马逊最近加入了美国航空货运代理协会(Air Forwarders Association),与货运代理建立了官方合作关系。

- 他们还引入了临时航班运营、货物包机服务以及出售货物空间的BSA(区块空间协议)服务,提供与典型货运航空公司相当的服务水平。

- 特别是,通过这一举措,亚马逊旨在将其航空物流业务从简单的电子商务配送服务扩展,并将其以北美为中心的航空物流网络拓展至全球市场,从而在航空公司、联邦快递(FedEx)和UPS等全球航空物流公司以及其他全球整合商中展开竞争。

4) 由于孟加拉国达卡机场的严重基础设施问题,出口航空货运运费暴涨。

-

孟加拉国的货运代理开始通过中国向美国西部运输货物,而不是使用中东枢纽,原因是航空货运费用高,这使中国航空公司受益。

-

随着达卡出口航空货运费的上升,中东枢纽的拥堵加剧了地区紧张局势,导致航空公司在最近几周取消航班。

-

孟加拉国主要的货运代理之一Expo Freight上个月通过中国向美国运送了100吨货物,Wax Logistics和APS Logistics也使用了这一路线。

-

孟加拉国的航空货运市场对波动性非常敏感,超过70%的货物以现货价格进行运输。

-

截至9月22日,从孟加拉国到欧洲的现货运费达到了每公斤5.34美元,为两年半以来的最高水平,接近2021年11月疫情高峰时的5.71美元。负载因素仍然非常高,达到96%。

-

此外,从欧洲到孟加拉国的现货运费已达到每公斤2.25美元,自7月底的低点以来有所上涨,但仍低于6月初的2.90美元。

-

从孟加拉国到美国的现货运费也达到了每公斤7.83美元,为两年来的最高水平。

-

截至目前,亚太地区到北美的航空货运能力较去年增加了16%,到欧洲的能力增长了19%。上周,前往欧洲的能力较去年增加了21%,而前往北美的能力增长了13%。

-

Expo Freight的一位代表解释说:“我们决定选择通过中国的路线,因为我们无法在现有航线上获得所需的货物空间。通过中国的运输每公斤比通过中东便宜约1美元,而且中国航空公司提供充足的货物空间,使其成为可行的替代方案。”

-

达卡的基础设施差劲也是路线变更的一个因素。孟加拉国的本地货运代理因达卡机场的扫描仪问题和中东的拥堵而寻求替代路线,现有的经印度德里或SEA&AIR运输的路线也受到关注。与此同时,达卡机场的日均出口量约为700-800吨。

5) GSA及航空公司动态

-

沙特利雅得航空 – 计划从明年开始全面运营。目前已确认向波音订购39架B787-9,另有33架的追加订单选项,全部用于长途航线。计划以利雅得(RUH)为枢纽,在五年内运营超过100条航线。目前没有加入航空联盟的意向,相关人士表示将加强航空公司之间的合作关系。

-

T'way航空欧洲航线扩展 – 从11月25日起,将在现有每周三次的FRA/FCO/BCN航线上增加一班航班。新增航班的日期为FRA周一、FCO周三和BCN周六,每条航线将达到每周四班。

top