- Company

-

Specialized Products

Warehousing Solution

Specialized Freight Solutions

Multimodal Freight Solutions

GSA, CSA & SC

- Service

- Blog

- Cargo Tracking

- Contact Us

- Site Map

The Power of Logistics to Move the World!

It's the Power of extrans.

EXTRANS GLOBAL - Air Freight News - Week 36 2025

1. Air Cargo General

1) Eastar Jet to Launch Incheon-Yantai Route Starting September 19

Eastar Jet (Represented by Cho Jung-seok) announced on the 28th that it will launch a route to Yantai, China. The Incheon-Yantai route will operate daily, 7 times a week starting from September 19 this year.

- Outbound Flight: Departs Incheon International Airport at 7:00 AM and arrives at Yantai Penglai International Airport at 7:30 AM (local time hereinafter).

- Inbound Flight: Departs Yantai at 8:30 AM (local time) and arrives at Incheon International Airport around 11:00 AM.

Yantai, also well-known as the home of "Yantai Gaoliang Liquor" (referred to as "Yeontae Gaeryangju" in Korean), is a coastal city located in the northern part of China’s Shandong Peninsula. It serves as a key economic hub, hosting industrial parks and factories of major Chinese and South Korean enterprises.

Additionally, Yantai offers excellent accessibility, with a flight time of less than 90 minutes from Incheon. It is also recognized as a competitive tourist destination, featuring landmarks such as Penglai Pavilion, beautiful natural scenery, and a cluster of renowned golf courses.

An Eastar Jet official stated, "The Incheon-Yantai route is expected to generate stable commercial demand. With the approval of visa-free entry for Chinese group tourists starting from the end of September, we anticipate a rise in inbound tourism demand and will further strengthen our China route network."

2) Global Maritime Shipping Volume Slows Amid U.S.-China Tariff Impacts – E-Commerce Shifts Focus to Europe

The expansion of the U.S. high-tariff policy to segmented product categories across industries has heightened uncertainty in the global trade and logistics market. Trade investigations into specific goods like pharmaceuticals, semiconductors, wood, and furniture have been successively concluded, raising the possibility of additional tariff impositions.

In a recent Freightos Weekly Update, the platform noted, "While some countries have reached trade agreements with the U.S., specific implementation conditions remain incomplete, so tariffs on relevant products are still being levied." It further explained, "Due to delays in implementation, more time will be needed to confirm the actual impact on cargo volume and freight rates."

Maritime Shipping Demand

Regarding maritime shipping demand, China plans to send a top-level trade negotiation team to Washington after the U.S. extended the 30% base tariff (implemented since May) by 90 days. Although the tariff suspension temporarily boosted maritime demand on U.S.-China routes, overall cargo volume and freight rates have continued to decline, driven by increased ship supply.

Analysis indicates that July would typically be the peak of the peak season for U.S.-China shipping. However, with tariffs set to expire in August, cargo was shipped in advance, concentrating peak-season demand earlier. Subsequent freight rates dropped sharply.

Air Shipping Demand

Starting from the 29th, the U.S. will fully eliminate the De Minimis Exemption for all low-value imported goods. This has disrupted global postal and express logistics networks, with major postal operators in Europe and Asia temporarily suspending package shipments to the U.S.

Since the U.S. revoked the De Minimis Exemption for goods originating from China in May, the volume of B2C e-commerce cargo from China has plummeted by up to 50%. Nevertheless, Chinese e-commerce companies have shifted their focus to Europe to expand exports: during the same period, the value of e-commerce imports from China to Europe more than doubled.

Air Cargo Freight Rates

Air cargo freight rates remained relatively stable. According to the Freightos Air Index, the China-Europe route maintained a rate of $3.52 per kg last week, while the China-North America route rose by 2% to $5.57 per kg. This stability is attributed to the reorganization of cargo aircraft routes and the redistribution of capacity.

3) South Korea’s Ministry of Land, Infrastructure and Transport – Full Implementation of Safety Enhancement Measures for Lithium Battery Air Transport

To prevent safety accidents involving lithium battery-related air cargo and comply with international regulations, South Korea’s Ministry of Land, Infrastructure and Transport (MOLIT) has announced specific safety enhancement measures targeting airlines and freight forwarders, with plans for full implementation.

Requirements for Airlines

- Provide training on lithium battery and electronic device identification for X-ray inspection personnel.

- Mandate pre-safety inspection certification and annual regular training for agencies handling palletized cargo.

Requirements for Freight Forwarders

For cargo over 15kg labeled with lithium battery markers, freight forwarders must conduct unpacking inspections in collaboration with customs brokers.

In line with MOLIT’s guidelines, Korean Air plans to strengthen security inspections for Sea & Air cargo originating from China (SCC codes: SEA, SNM, etc.) starting September 1. The enhanced measures include:

- Stricter Security Inspections for Loose Cargo: Mandatory X-ray scanning, random unpacking inspections, and penalties for detecting dangerous goods.

- Stricter Security Inspections for Mail Parcels: Prohibition of ELI/ELM (specific mail types) transport on passenger aircraft; parcels will only be accepted as BUP (Business Parcel) cargo after 100% X-ray scanning.

- Stricter Self-Inspections for Hidden Dangerous Goods (Hidden DG) by Shippers/Freight Forwarders: Shippers and forwarders must confirm whether cargo contains dangerous goods in advance (via House Data, Packing List, etc.) before delivering the cargo.

However, short-term concerns include slower logistics processing due to the safety measures. Additionally, since the only facilities with X-ray capabilities at Incheon Airport (other than those owned by airlines) are commercial shipper terminals, cargo congestion may occur.

4) Global Air Cargo Freight Rates Resume Downtrend – Weak Performance on Asia-Europe-U.S. Routes

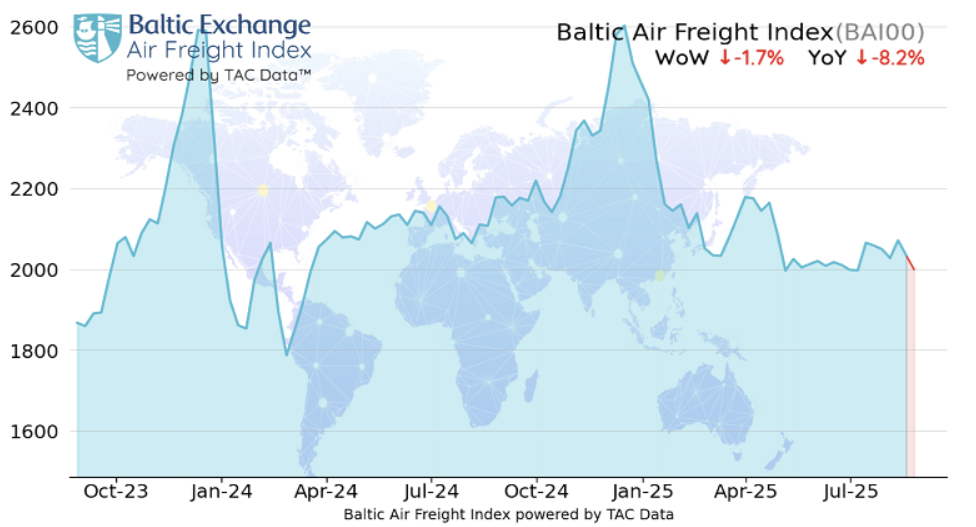

Global air cargo freight rates have resumed a downward trend in August, a traditional off-peak period between peak seasons. As of August 25, the Baltic Air Cargo Index (BAI00) fell by 1.7% week-on-week and was 8.2% lower than the same period last year.

Despite sustained high demand in some industries (e.g., textiles, pharmaceuticals, electronics, and semiconductors) and shipping delays in specific markets due to supply shortages, overall market freight rates have failed to reverse their downward trajectory.

Notably, on major routes originating from China: freight rates to Europe remained stable, while rates to North America declined slightly. The newly added "Northeast Asia-Mexico" route this week followed a similar trend.

- Hong Kong-origin spot rates showed no significant fluctuations, but the Hong Kong Air Cargo Index (BAI30) – which reflects both spot and contract rates – fell by 2.3% week-on-week and 9.8% year-on-year.

- The Shanghai Air Cargo Index (BAI80) decreased by 0.4% week-on-week and 8.3% year-on-year.

- For Vietnam-origin routes: rates to Europe fell, while rates to North America rose; Bangkok-origin rates to North America also increased.

- Seoul-origin routes showed mixed regional trends: rates to Europe rose, while rates to North America fell.

- For India-origin routes: rates to the U.S., Germany, and Europe overall increased week-on-week but remained significantly lower year-on-year.

5) Airlines Movement

WestJet

- Route Adjustment: The Incheon (ICN)-Calgary (YYC) direct route will operate until October 25, after which it will be suspended (temporarily halted due to reduced winter passenger demand).

- Aircraft & Frequency: Boeing 787; 6 flights per week.

SK Scandinavian Airlines

- New Route Launch: First flight to Copenhagen (CPH) on September 13.

- Flight Details: Flight No. D1356; Aircraft type: Airbus A350.

top