EXTRANS GLOBAL - Air Freight News - Week 35 2024

Air Cargo General

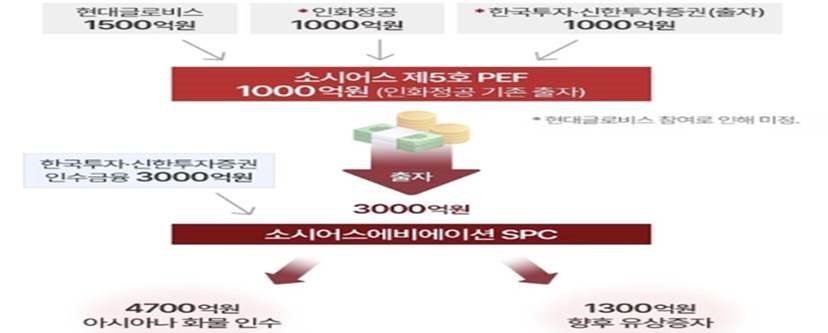

1) What is the funding structure for the sale of Asiana Cargo?

-

The sale of Asiana Airlines' cargo division has passed the halfway mark. SoSIA and Korea Investment Partners' PE division have decided to act as co-general partners (Co-GP) for the fund, and Hyundai Glovis has confirmed an investment of 150 billion KRW, joining as a strong ally. The acquirer has received a total of 200 billion KRW in letters of commitment (LOC) from Inhwa Precision and Korea Investment & Securities and Shinhan Investment Corp. However, with Hyundai Glovis joining as a variable, the investment amount from Inhwa Precision and others has become uncertain, but the likelihood of success has increased.

-

Initially, the SoSIA consortium aimed to raise 400 billion KRW. If Inhwa Precision contributes the full 100 billion KRW as originally planned, the consortium would only need to raise an additional 50 billion KRW to complete the funding. It has been reported that several financial investors (FIs) have expressed their willingness to participate.

-

Hyundai Glovis recently announced it would invest 150 billion KRW in the acquisition of Asiana Airlines' cargo division. This will expand the size of the existing fund “SoSIA No. 5 PEF,” which owns Air Incheon. Based on the LOCs received so far, the consortium has already met its target amount.

-

However, the emergence of Glovis has changed the dynamics. Hyundai Glovis will replace Inhwa Precision, which will become a priority investor without preemptive rights. If Inhwa Precision proceeds to invest an additional 100 billion KRW into the fund as planned, it will become the largest investor; otherwise, Hyundai Glovis (150 billion KRW) will hold that position.

-

The deadline for forming the fund is July 1 of next year, allowing about a year for preparations. As for Korean Air, it plans to close the acquisition agreement for Asiana Airlines based on the basic sale agreement signed with Air Incheon earlier this month, having received approval from the European Commission (EC). Following that, Air Incheon will need to file for corporate merger approvals in around ten countries, a process that is expected to take about six months, according to industry insiders.

-

Meanwhile, Hyundai Glovis has drawn a line, stating that it is currently not considering acquiring management control of Asiana's cargo division. However, industry insiders suggest that there is a high possibility it entered with the intent to acquire management control from the beginning.

2) Daemyung Sonoh Group has initiated actions to secure management control of T'way Airlines

-

On August 1, Daemyung Sonoh Season acquired a 10% stake (70.86 billion KRW, 3,290 KRW per share) in T'way Airlines from W Value Up. It appears that the remaining 1.87% stake of W Value Up was also acquired by individuals or affiliates designated by Daemyung Sonoh Group. As a result, Daemyung Sonoh's stake in T'way Airlines is now 26.77%. T'way Holdings/Yeolimdang has a stake of 29.74%, leaving only a 2.97% difference between the two companies.

-

So far, Daemyung Sonoh has invested a total of 189.7 billion KRW to acquire shares in T'way Airlines, and it is expected that Daemyung Sonoh will soon initiate actions to secure management control of T'way Airlines.

-

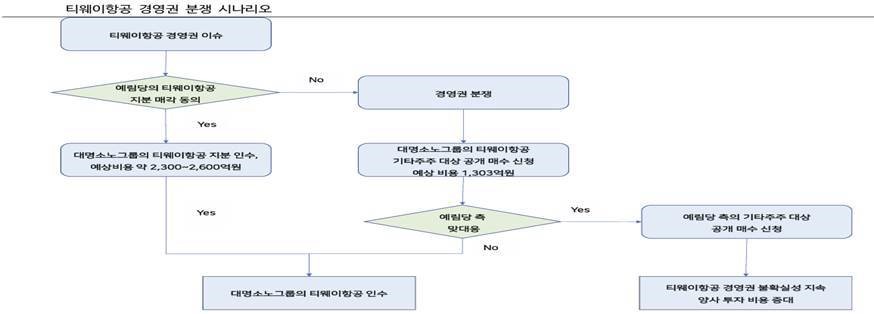

Expected scenarios: 1) Daemyung Sonoh Group's acquisition of T'way Airlines shares from Yeolimdang/T'way Holdings and 2) Management control dispute.

-

① Daemyung Sonoh's acquisition of T'way Airlines shares from Yeolimdang: This is currently the most likely scenario. Since early this year, the conversion of JKL Partners' convertible preferred shares into common stock has brought the shareholding ratios of JKL Partners and Yeolimdang in T'way Airlines closer together. The investment period has also approached three years, and it is expected that several discussions regarding exit strategies have taken place with Yeolimdang.

-

However, the reason Daemyung Sonoh has not yet acquired shares from Yeolimdang is presumed to be due to disagreements over the purchase price.

-

While JKL Partners sold shares to Daemyung Sonoh at 3,290 KRW per share (corporate value of 708.6 billion KRW), Yeolimdang is expected to negotiate for a higher price.

-

Considering the management control premium, it is assumed that negotiations are taking place around 4,000 KRW per share. If we assume a price of 4,000 KRW per share (corporate value of 861.5 billion KRW), Daemyung Sonoh would need to pay 256.2 billion KRW to Yeolimdang.

-

② Management control dispute: There are differences regarding the final negotiation price, and if Vice Chairman Na Sung-hoon's commitment to T'way Airlines' management control is firm, a management control dispute may arise. Currently, Daemyung Sonoh's determination to secure management control of T'way Airlines is clear, and if negotiations with Yeolimdang ultimately break down, there is a possibility of acquiring additional shares from other shareholders. Yeolimdang would also need to acquire shares from other shareholders in this scenario.

-

In the event of a management control dispute, Daemyung Sonoh would need to secure close to 50% of the shares, which means Daemyung Sonoh needs to acquire an additional 23.2% of T'way Airlines' shares, while T'way Holdings needs to secure 20.3%.

-

In this case, a public buyout may be a more reasonable approach in practice. If Daemyung Sonoh publicly buys the 23.2% stake at the acquisition price of 3,290 KRW per share from JKL Partners, it could secure management control for 164.6 billion KRW, which could be a more economical acquisition method than the sale price that must be paid to Yeolimdang.

-

However, a public buyout also carries the risk of a counter public buyout from Yeolimdang, so a cautious approach is necessary.

-

The timeline has accelerated compared to expectations, and an event is anticipated soon, making the possibility of scenario 1 quite high.

3) Investigation into the merger of Alaska Airlines and Hawaiian Airlines has ended (U.S. Department of Justice)

-

Recently, Alaska Airlines announced that the investigation by the U.S. Department of Justice (DOJ) into the merger with Hawaiian Airlines has concluded without any litigation. As a result, the $1.9 billion merger is expected to be finalized pending approval from the U.S. Department of Transportation (DoT).

-

If this merger is successful, it will be the largest M&A deal between U.S. airlines in the past eight years. In 2016, Alaska Airlines successfully merged with Virgin America in a deal worth $2.6 billion.

-

Alaska Airlines stated in a press release that "this decision represents significant progress toward the merger of the two companies," adding that it has collaborated with the Hawaii Department of Justice to further solidify and expand plans with Hawaiian Airlines (HA).

-

Meanwhile, this merger deal raised concerns last month when the DOJ extended the review period, suggesting the possibility of litigation to block the merger. Earlier this year, the U.S. Department of Justice blocked a merger between Spirit Airlines (SAVE) and JetBlue Airways (JBLU), which are the 6th and 7th largest airlines in the U.S. Alaska Airlines is the 5th largest airline in the country.

4) Chinese international air cargo increased by 36%

-

In July, China's international air cargo reached 320,000 tons, an increase of 35.5% compared to the same period last year.

-

Domestic air cargo also rose by 5.9% to 432,000 tons. As a result, the total air cargo volume increased by 18.4% to 752,000 tons.

-

According to statistics from the Civil Aviation Administration of China (CAAC), this strong performance in air cargo has led to a sharp increase in demand for 'Sea & Air' services to our country up until July.

China's demand for air cargo has shown positive growth for 18 consecutive months since February of last year. Additionally, it has experienced double-digit growth for 16 consecutive months since April of last year."

top