EXTRANS GLOBAL - Air Freight News - Week 25 2024

Air Cargo General

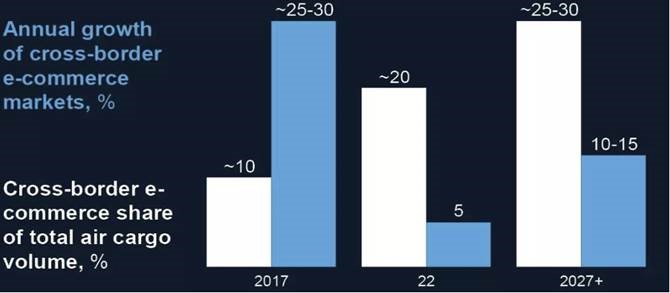

1) The minimum tax threshold regulation is not enough to curb the influx of Chinese e-commerce

-

As the surge in demand for Chinese e-commerce is spreading from the US to Europe and the rest of the world, going beyond just economic issues to become a political and social problem, the analysis suggests that the minimum tax threshold (de minimis) regulation being considered as a countermeasure is also not enough to curb the demand for Chinese e-commerce.

-

This is because it will only inconvenience market consumers, without providing a fundamental solution. The view that this will curb the demand for platforms like Temu or Shein is too simplistic, as pointed out.

-

A representative of a global cargo airline in Europe also noted that even though the minimum tax threshold in Europe is 150 euros (around $160), the demand for e-commerce has not decreased. The product prices of the current e-commerce platforms are in price ranges unrelated to this threshold.

-

Market analysis firms also pointed out that while purchase power may differ due to exchange rates between the US and Europe, the similar demand increase trends in both countries despite the 800 dollar vs 160 dollar difference in thresholds, raises doubts about whether lowering or abolishing the threshold alone can curb the current e-commerce demand.This is analyzed as a phenomenon driven by the strong desire of major developed market consumers for low-cost products.

-

Even if the US Congress were to lower the duty-free threshold for imports from specific countries through legislation, e-commerce platforms have the capacity to adapt by relocating their manufacturing facilities to the US or neighboring countries.

-

While it is true that last week the US CBP seized large shipments citing inspection of Chinese cargo flights, local sources clarified that this was simply to verify if the customs brokers were following proper procedures for e-commerce shipments, and the concerns about comprehensive inspections of all cargo flights, seizures of e-commerce shipments, and even cancellation of Chinese cargo flights were somewhat exaggerated.

2) Air Incheon selected as the preferred bidder to acquire Asiana Airlines' cargo business

-

Asiana Airlines' cargo business has selected Air Incheon, a dedicated cargo airline, as the preferred bidder to acquire the business.

-

On the 17th, Korean Air held a board meeting and announced that it has selected Air Incheon as the preferred negotiation partner for the sale of Asiana Airlines' cargo business.

-

Korean Air explained that it comprehensively considered factors such as transaction certainty, long-term competitiveness in maintaining and developing the air cargo business, and the consortium's ability to raise funds, in selecting Air Incheon.

-

Established in 2012, Air Incheon is Korea's first and only dedicated cargo airline. For this acquisition, the consortium includes strategic investor Inhwa Precision and financial investors Korea Investment Partners and Korea Investment Securities, in addition to the private equity fund Socius that acquired Air Incheon in 2022.

-

In the preliminary bidding, in addition to Air Incheon, low-cost carriers Air Premia and Eastar Jet also competed.

-

Korean Air plans to sign a memorandum of understanding on the sale next month after negotiating the contract terms with Air Incheon, and then seek approval from the European Union (EU) competition authorities.

-

Korean Air expects that the combination of Air Incheon's Asia-focused cargo operations and Asiana Airlines' long-haul network to the Americas and Europe, as well as its operation of mid- and large-sized cargo aircraft, will further strengthen the competitiveness.

-

Last year, the EU had stipulated the sale of Asiana Airlines' cargo business as a condition for approving the merger with Korean Air, citing concerns about the reduced competition in cargo transportation services.

-

Korean Air plans to complete the share acquisition and cargo business sale by the end of this year.

-

Korean Air stated that the selection of the preferred bidder comprehensively considered maintaining the existing competitive environment as well as the growth of the aviation cargo industry, a core national industry, and that it will diligently work to quickly complete the sale process and the share issuance transaction for the Asiana Airlines acquisition.

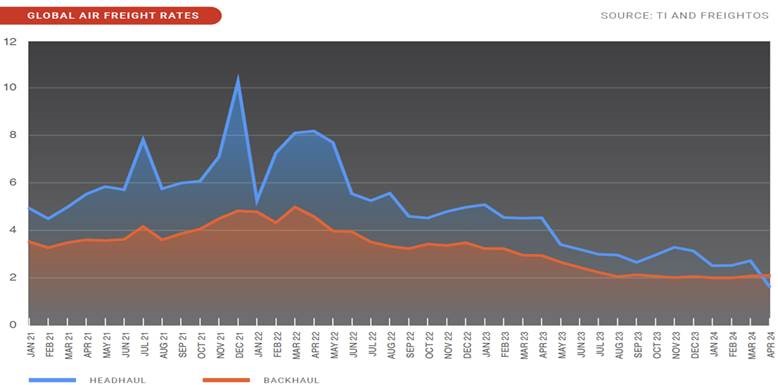

3) From the 3rd quarter of the second half of the year, freight rates are expected to remain strong, supported by strong demand

-

Looking at the freight rate situation, freight rates have been on an upward trend compared to the same period last year since April due to the concentrated demand for e-commerce. It is expected that the global freight rate upward trend will continue to be strong until the 3rd and 4th quarters.

-

Shippers are preferring long-term contracts to ensure stability, competitive freight rates, and stable operating performance. It is mentioned that the cargo yield from India, China, and Southeast Asia is still high, so airlines are reallocating flights to take advantage of these opportunities.

-

Additionally, the strong demand caused by the transportation disruptions due to geopolitical risks is continuing to stimulate air cargo demand, and the freight rates from Dubai are still higher than the same period last year. The cargo volume between Dubai and Europe is maintaining more than double the level of the same period last year, driven by the increase in SEA & AIR tonnage.

-

Although temporary, there are many potential factors that could increase air cargo demand, such as the surge in demand to transport materials to France ahead of the Summer Olympics, and the expected maritime strike in Canada.

-

According to the Air Freight Rate Tracker, the global air cargo market has started to recover from the exceptional market conditions of 2020-2022 since the first quarter of this year, and has maintained growth throughout the second quarter after a strong demand recovery from March.

-

As a result, the freight rate level is expected to maintain a slight upward trend in the current 3rd quarter, and the possibility of a freight rate increase is very high, reflecting the seasonal demand until the 4th quarter.

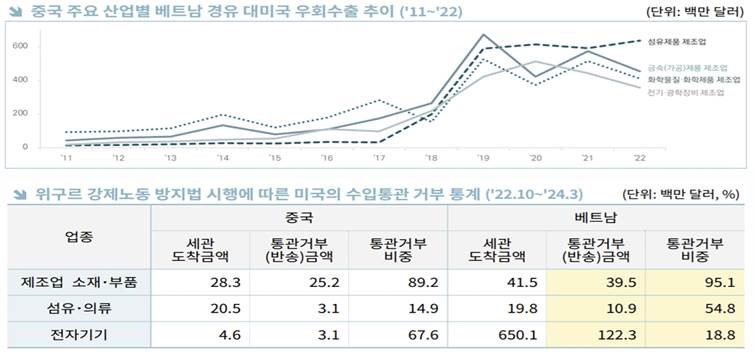

4) Since 2019, there has been a significant increase in the bypass export of Chinese goods to the US via Vietnam

-

The US is concerned that China's excessive production-based exports are driving out or seriously harming global competitors in the market.

-

This is not just a simple overcapacity issue, but a "problematic overcapacity" where production exceeds market demand, leading to the elimination of competitors or the risk of doing so.

-

Overcapacity is judged by capacity utilization rates, with lower utilization rates indicating greater overcapacity.

-

China's overall industrial capacity utilization rate is 73.6% in the first quarter of 2024, which is higher than South Korea's 71.3% and Thailand's 60.5%, but lower than the US's 77.4% and Germany's 81.3%.

-

Within China, the numbers do not indicate a problematic overcapacity. However, China's electric vehicle exports have seen a decline from 20% growth in January 2022 to -3% as of May 2024.

-

Meanwhile, China's auto production has increased by 22% over the past 5 years, and its share of the global auto market has grown from 28% to 33.5%.

-

In labor-intensive industries like textiles, apparel, and electronics assembly, where China can leverage low labor costs, Chinese companies have significantly expanded into Vietnam.

-

China's exports to the US via Vietnam have surged since 2019, when the Section 301 tariffs on China and the Uyghur Forced Labor Prevention Act were implemented.

-

Specifically, the bypass exports of products from China's Xinjiang region, which are targeted by the Uyghur Forced Labor Prevention Act (such as textiles, metal processing, and electrical/optical equipment), have seen a significant increase.

-

In 2019, China's bypass exports to the US via Vietnam grew by 160% year-over-year, reaching $4.1 billion. These bypass exports accounted for 40.6% of China's total manufacturing exports to Vietnam in 2019.

5) Airline/GSA Event Update

(1) Maersk Air Cargo, Reshuffling China-US Cargo

To respond to the changing demand for cargo from China to the US, Maersk Air Cargo is reported to temporarily suspend its existing cargo routes and establish a new cargo route connecting Zhengzhou (CGO), China and Rockford Airport (RFD), Chicago.

The cargo flight connecting Shenyang (SHE), China via Incheon Airport to Greenville-Spartanburg (GSP) has been temporarily suspended since June 1st.

To replace this, Maersk will operate a 3 times weekly Chicago route using a 767-300F, with a stopover in Anchorage, Alaska for refueling.

This move is seen as a precursor to Maersk deploying its first two 777 freighters, one each on the China-Europe and China-US sectors, as announced earlier, to restructure its China-based network.

(2) Air Cargo Supply Shortage in Second Half

The surge of e-commerce volume has become a main driver of the air cargo market, leading to significant constraints in cargo capacity supply.

As a result, air freight rates are expected to remain strong this year. Securing freighter capacity will emerge as a new issue in the air cargo market in the second half.

It is reportedly almost impossible to charter long-haul, widebody aircraft in the current market.

(3) Air Astana Resumes Incheon-Astana Service

Kazakh national carrier Air Astana (KC) will resume its Incheon-Astana route operation on June 15.

The scheduled flights will operate on Thursdays and Sundays. The departure from Incheon Airport is at 7:55 am, arriving at Nursultan Nazarbayev Airport at 11:40 am. The aircraft type is A321.

top