旭辉空运国际 - 第19周25年航空业更新

航空货运概况

1) 大名索诺出售航空优先 - 第二家亚韩亚航空的梦想是否愈发遥远?

-

大韩Sono集团会长徐俊赫欲打造"第二韩亚航空"的梦想最终破灭,近日已将持有的Air Premia全部股份转让给Tyrebank。

-

分析认为韩国公平交易委员会(以下简称公正委)延迟企业合并审查是关键原因,集团意图先确保对T'way航空(德威航空)的控制权,再谋求航空业务扩张。

-

大韩Sono控股公司Sono国际近日向Tyrebank出售了与JC Partners共同持有的JC航空一号有限公司(JC SPC)22%的Air Premia股份。

-

去年10月大韩Sono以471亿韩元收购JC Partners持有的Air Premia 50%股份(22%股权),结合原有11%持股,本次出售预计回流现金约595亿韩元,实现124亿韩元差价收益。但徐会长雄心勃勃的Air Premia收购计划最终流产。

-

由于徐会长已完全放弃最初将T'way航空与Air Premia合并打造"第二韩亚航空"的计划,股权出售背景备受关注。实际上大韩Sono还持有对JC Partners剩余50%股权的优先购买权(可于今年6月后执行)。

-

多数观点认为,出售Air Premia是因公正委对T'way航空的企业合并审查长期拖延所致。

-

目前公正委正审查大韩Sono与T'way控股·T'way航空的企业合并案。大韩Sono原计划3月31日召开T'way航空临时股东大会改组董事会,但因未获批准导致收购失败。

-

公正委的审查已持续两个月仍无消息。通常企业合并审查期为申报后30天,最长可延至90天。

-

大韩Sono于2月27日提交审查材料,至今已超70天。虽然剩余审查期约20天,但因材料补充时间不计入审查期,业界普遍认为可能进一步延迟。此前公正委已要求两公司补充不完善材料。

-

分析指出,若T'way航空与Air Premia合并,可能打破现有国内航空业竞争限制体系,这或是出售主因。

-

此前大韩航空收购韩亚航空时,为通过审查曾将欧洲线移交T'way航空、美洲线移交Air Premia。若两公司合并,当初的航线分配将失去意义。大韩Sono出售股份或是为消除此顾虑,这与公正委当年对大韩-韩亚合并案的反垄断担忧一脉相承。

-

随着大韩Sono简化航空业务结构,市场关注公正委审查会否加速。集团计划于23日再开临时股东大会推进T'way航空董事会改组。

-

大韩Sono宣布出售后将专注T'way航空运营。虽然Sono国际曾有意收购国内唯一执飞美洲航线的中型航司Air Premia,但T'way航空计划7月开通温哥华航线并拓展北美市场,集团中长期战略已转向以T'way为核心拓展国际航线。

-

Sono国际相关人士表示:"出售Air Premia股权是战略选择,旨在集中资源发展T'way航空的运营与中长期增长战略。我们已定于23日召开临时股东大会,正等待公正委批准。"

2) 仁川航空(KJ)将于七月迁至整合的马谷办公室,收购了韩亚航空。

- 专注于货运的仁川航空于5月7日宣布,将在首尔江西区One Grove商务综合体开设综合办公室,并计划于7月收购韩亚航空的货运部门。

- 新办公室将于5月19日迁入,占地约4,132平方米(1,250坪),将作为公司管理、货运、航班运营以及安保等部门的总部。

- 包括仁川航空现有员工和韩亚航空货运部门员工在内的约350名员工将在此办公。

- 仁川航空已于上月29日完成了国土交通部对安全系统变更的第一阶段审查,这是合并的必要步骤,第二阶段审查将于5月12日进行。

- 仁川航空还计划加强其全球航线网络,包括拓展飞往美国和欧洲的主要航线。

- 该项目旨在将韩亚航空现有的货运航线和运输基础设施与仁川航空的运营灵活性相结合,最大限度地发挥协同效应。

3) 最低减量的取消影响:中国和香港的货运航班减少30%

- 自美国5月2日取消"最低免税限额"(De Minimis)制度以来,中国及香港始发的货运航班数量急剧减少。

- 近期市场分析机构估算,每日至少有2000吨航空货运运力从市场消失,预计将对美洲航线造成重大冲击。

- 根据美国电商及物流专业咨询公司Cirrus Global Advisors(CGA)分析,自上周五(5月3日)起,平均每日有19架次赴美货运航班被取消。

- 该数据已考虑同期UPS和FedEx缩减航班的情况,分析显示美国本土终端配送企业也正经历货量锐减。CGA认为影响范围已超越传统B2C电商领域。

- 另据航空货运数据机构Rotate实时运力数据库显示,截至5月6日,中国及香港赴美航线运载能力较一周前骤降30%。

- CGA相关负责人表示:"短期内航司难以做出停航决定。例如某韩国航司若每日执飞4班赴美货机,即使缩减至3班,飞机维护费和飞行员薪资等固定成本仍存在,全面停航并不容易。"

- 他警告称:"若消费者发现Temu平台上19美元的多孔插座现售价48美元,赴美航班数量必将进一步减少。"

4) 5月亚洲至美国航空货运量大幅萎缩

-

自2日起,美国取消对中国/香港地区800美元以下小额进口货物的简易通关程序,导致航空货运市场立即大幅萎缩。

-

2日后,从中国/香港进口至美国的每票800美元以下货物,将按产品价格的120%或每票100美元的标准征收关税。

-

6月1日起,单票关税将上调至200美元。美国表示将把目前仅适用于中国和香港的此项措施扩展至澳门地区。

-

受冲击最严重的企业是跨境电商物流主力希音(SHEIN)和拼多多(Temu)等平台。

-

美国电商/零售物流咨询公司"Cirus Global Advisors"预测,受此影响,跨太平洋航线的航空货运需求将同比腰斩。

-

数据显示,5月第一周经安克雷奇(ANC)中转的货运航班日均44.5班次,较前周的65.75班下降21.2%。

-

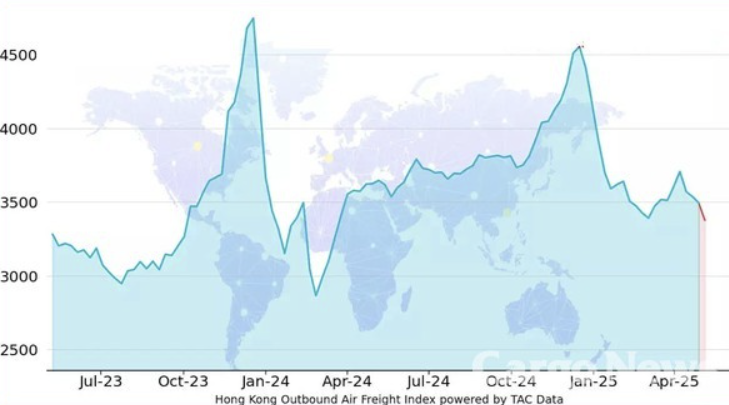

截至5日,全球航空货运平均运费周环比下跌4.5%。波罗的海空运指数显示,香港(HKG)始发货运价格周降3.3%,同比跌幅达7.4%;上海(PVG)始发货价周降2.34%,同比更下滑8.6%。

5) GSA和航空公司动态

- 自5月8日起,VN将以每周两次的航班(周二、周四)运营HAN-SVO2的787客机。由于乘客行李导致的承载能力不足,暂不进行货物销售,但在乘客减少时将以有竞争力的价格进行销售。

top