EXTRANS GLOBAL - Air Freight News - Week 18 2025

Air Cargo General

1) Air Premia Acquired by Tire Bank - Sale of JC Partners and Daemyung Sono Shares

- Tire Bank's AP Holdings has fully secured management control of the hybrid airline Air Premia (HSC). Previously, Daemyung Sono Group acquired an 11% stake in Air Premia from private equity firm JC Partners, leading to an intense competition for management control. Following mediation by JC Partners, Tire Bank Chairman Kim Jeong-kyu decided to purchase the shares held by Daemyung Sono Group Chairman Seo Jun-hyuk, concluding the competition for Air Premia's management.

- On the 2nd, JC Partners decided to sell its 22% stake in Air Premia, along with Daemyung Sono Group, to Tire Bank. The sale price is set at 1,900 won per share, totaling 119 billion won for the 22% stake. Tire Bank has already paid a deposit of 20 billion won and will settle the remaining amount by the end of September this year.

- JC Partners and Sono will each defer exercising their put and call options and will jointly manage Air Premia until the share sale is completed.

- Air Premia operates medium- to long-haul routes to North America and Europe. HSC combines the advantages of low-cost carriers (LCC) and full-service carriers (FSC).

- Air Premia is the only airline of its kind in South Korea. Its corporate value was recently estimated at around 470 billion won during Sono International's acquisition of an 11% stake.

- Recently, supported by strong travel demand, Air Premia has shown robust growth. Its annual revenue for 2023 is projected to be 375 billion won, a sevenfold increase compared to the previous year (53.2 billion won).

- The airline is also reporting operating profits. After recording an operating loss of 47.1 billion won in 2022, Air Premia achieved an operating profit of 18.5 billion won last year, marking a turnaround to profitability.

2) Jin Air Resumes Incheon-Qingdao Route After Two Years

- Jin Air has resumed its Incheon-Qingdao route after about two years and has begun accepting reservations.

- Starting May 30, Jin Air will operate the Incheon-Qingdao route daily, with one flight per day, seven days a week. Flights will depart from Incheon Airport at 1:50 PM (Monday, Tuesday, Wednesday, Friday, Saturday, Sunday) or at 12:15 PM (Thursday), with a flight time of approximately 1 hour and 30 minutes.

- Additionally, a coupon for an extra 5 kg of checked baggage is being offered, allowing a total of 20 kg of free baggage, including the standard 15 kg. This benefit applies to flights from May 30 to July 17. The coupon can be downloaded from the promotion page and applied at checkout.

- Meanwhile, South Korean travelers can enter China without a visa until December 31, allowing holders of regular electronic passports to stay in Qingdao for up to 30 days without a visa for tourism, business, or visiting friends and family.

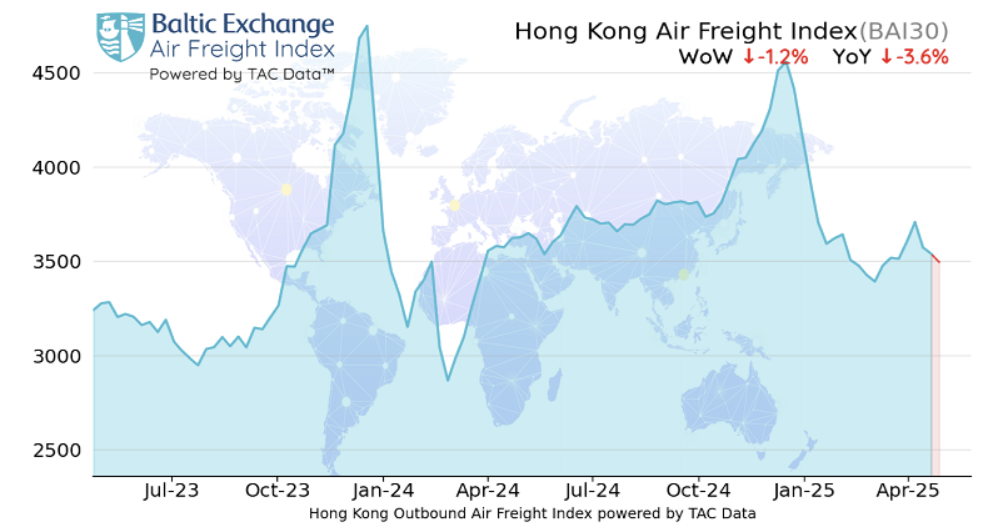

3) Air Cargo Freight Rates Begin to Decline - TAC Index Shows Decrease in Rates for All Routes to the U.S

- Last week, global air cargo rates showed a downward trend. As of April 28, the global Baltic Air Freight Index (BAI00) fell by 3.5% compared to the previous week.

- However, it remains slightly up by 0.8% compared to a year ago, which is noteworthy given the significant increase in rates due to the surge in e-commerce demand at that time.

- During the same period, jet fuel prices dropped by about 14.6%, suggesting that most air cargo carriers are still likely to be profitable.

- The issue lies in the recent confusion surrounding U.S. tariff policies. Additionally, there is concern about how the upcoming elimination of the De Minimis exemption limit on May 2 will lead to global trade disruptions. Some expected a last-minute increase in cargo volume before the exemption ends, but in reality, major route rates from China to both Europe and the U.S. have declined.

- The air cargo rate index from Hong Kong (BAI30) fell by 1.2% compared to the previous week and is 3.6% lower than the same period last year. The index from Shanghai (BAI80) dropped by 6.1% compared to the previous week and decreased by 4.8% year-on-year. While rates from Vietnam, Bangkok, and Seoul to Europe slightly decreased, rates from India to the U.S. continue to rise.

- Overall, there has been a notable decline in rates for routes to North America. The Frankfurt rate index (BAI20) experienced a sharp drop of 12.0% after recent increases, while the London Heathrow index (BAI40) fell by 13.9% compared to the previous week, and rates for routes to Southeast Asia, the Middle East, and the U.S. also decreased by 13.2% year-on-year.

4) Cancellation of Cargo Charter Flights from China Due to Sharp Decline in E-commerce Demand to the U.S.

- Due to a sharp decline in e-commerce demand from China to the U.S., cargo charter flights departing from China have been consecutively canceled.

- In a recently published monthly market report, Dimerco stated, "Since the end of April, several cargo charter flights have started to be canceled, and additional cancellations are expected in the coming weeks."

- This is attributed to the U.S. beginning to impose high tariffs of up to 145% on imports from China and the upcoming end of the de minimis exemption system for goods from China and Hong Kong. The de minimis system allowed Chinese e-commerce platforms to bring millions of parcels into the U.S. daily without customs inspection and duty-free.

- Currently, the de minimis exemption for goods from China and Hong Kong is set to end on May 2. However, the U.S. is maintaining tariff exemptions for certain tech products like smartphones, so these items are still being transported by air cargo.

- Additionally, it was noted that "overall e-commerce shipments have decreased by about 50% compared to the same period last year since mid-April."

- This atmosphere is spreading to major Chinese airlines, with rumors that they are internally reviewing plans to cancel services to the U.S. "If cancellations by regular carriers materialize, the supply of air cargo from China to the U.S. will further diminish," they warned.

- Moreover, many shippers planning shipments to the U.S. are postponing orders, citing uncertainty regarding the new tariffs between the U.S. and China, leading to an increase in deferred new orders.

- In contrast, demand for shipments from Southeast Asia and Taiwan to the U.S. appears to be relatively stable. "Thanks to the U.S. government granting a 90-day tariff waiver for Southeast Asia and Taiwan, shippers in those regions have been able to breathe a little easier," the analysis concluded.

top