EXTRANS GLOBAL - Air Freight News - Week 12 2024

Air Cargo General

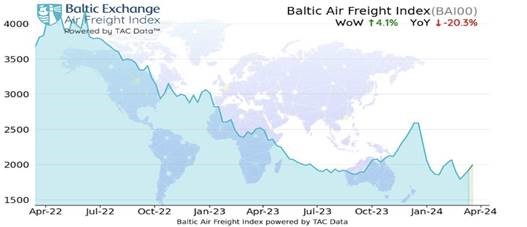

1) Global air cargo rates have been continuously rising for three weeks in a row.

-

TAC Index, which releases aggregated reports on global air cargo rate trends, recently revealed in their report as of March 18th that air freight rates worldwide have been consistently on the rise.

-

TAC calculates the rate changes for global and major origin destinations, and their Baltic Air Freight Index (BAI00) recorded a weekly increase of 4.1%, marking the third consecutive week of growth. The year-on-year decline rate (-20.3%) has significantly weakened, indicating a positive trend in the overall market.

-

The outbound index from Hong Kong, BAI30, also saw a 5.9% increase compared to the previous week, with almost all Chinese-origin rates showing a strong upward trend. Additionally, the Shanghai-origin index, BAI80, recorded an 8.9% increase, indicating a reduction in the decline rate for European and US-bound rates, which had fallen by (-7.6%) compared to the same period last year. This suggests a positive signal for Chinese export demand.

-

On the other hand, the indices representing the Frankfurt and Chicago markets, which provide insights into the European and US markets respectively, have both shown a continuous decline in rates on a weekly basis.

2) Korean Air and T'way Air have dispatched pilots - > Commence transfer of 4 European routes.

-

Korean Air has entered the process of transferring four European routes (Paris, Rome, Barcelona, Frankfurt) to T'way Air starting from June. The move represents a concrete step in the deployment of Korean Air pilots to T'way Air.

-

When the European Union (EU) competition authorities raised concerns about Korean Air's monopoly on European routes in light of the merger with Asiana Airlines, Korean Air decided to transfer these routes to T'way Air and provide related support. This decision has triggered subsequent actions.

-

On the 12th of last month, Korean Air sent an email to its A330 flight attendants, recruiting candidates for pilot dispatch to T'way Air. The recruitment targets include captains and first officers, with a total of around 100 personnel. The dispatch period is up to two years, and the dispatch will be carried out sequentially.

-

It is expected that T'way Air will also accelerate its expansion of European routes. From June, T'way Air plans to operate flights to four destinations, starting with Paris, France.

-

There are mixed reactions within the company regarding this dispatch recruitment. An anonymous industry insider stated, "Korean Air has not provided specific information regarding the scale of allowances or other details related to the dispatch." They also mentioned that there may be varying preferences among the pilots regarding this move.

-

Another industry insider mentioned, "Some people think that working at T'way Air (through the dispatch) would be more comfortable than at Korean Air." They also noted that T'way Air has clearer routes available for pilot dispatch compared to Korean Air, which is believed to be attracting more applicants.

-

Meanwhile, Korean Air is currently focusing its efforts on obtaining approval from the remaining U.S. competition authorities for the merger with Asiana Airlines after receiving conditional approval from the EU.

3) The e-commerce logistics market has experienced an annual average growth of 22.6%.

-

The global e-commerce logistics market is expected to grow at an average annual rate of 22.6% until 2032. Consequently, it is anticipated that by 2032, the market will reach a value of around $2.4128 trillion (approximately 319.7 trillion won) worldwide.

-

According to the International Air Transport Association (IATA), it is projected that by 2027, approximately 30% of global air cargo volume will be attributed to e-commerce logistics. Currently, e-commerce logistics accounts for approximately 20% of global air cargo volume.

-

During the recent World Cargo Symposium (WCS) held in Hong Kong, IATA revealed that as of 2023, there are over 2.6 billion online buyers worldwide. Among them, more than 34% make purchases at least once a week, and on a monthly average, over 79% make purchases at least once.

-

As of last year, global e-commerce sales reached $5.7 trillion. It is expected to surpass $8 trillion this year. Approximately 80% of global e-commerce logistics volume is transported through air cargo, while the remaining 20% utilizes other transportation modes such as inland transportation.

-

Based on data from 2022, the number of global e-commerce transactions reached 1.7 billion, growing over four times compared to 2014. It is forecasted to grow by over 50% to reach 2.56 billion transactions by 2027, compared to the figures in 2022.

4) In the acquisition of Asiana Airlines' cargo division, SkyLake and Pavilion PE have thrown their hats into the ring.

![]()

-

Low-cost carrier (LCC) Air Premia, which is actively pursuing the acquisition of Asiana Airlines' cargo division, has secured a financial investor (FI). It is interpreted that they have invited multiple partners to strengthen their financial capabilities.

-

Air Premia has formed a consortium with private equity funds (PEFs) SkyLake Equity Partners (hereinafter SkyLake) and Pavilion Private Equity (PE) and recently submitted a Letter of Intent (LOI) for the acquisition of Asiana Airlines' cargo division.

-

This deal is seen as a preemptive measure to address the issue of monopolies that may arise after the merger between Korean Air and Asiana Airlines. European authorities conditionally approved the merger of Korean Air and Asiana Airlines, assuming the sale of Asiana Airlines' cargo division and the transfer of some European passenger routes.

-

As the acquisition of Asiana Airlines' cargo division progresses, the consortium partners' aspects become apparent. In particular, Air Premia's partnership with SkyLake, which is considered a prominent domestic PEF fund, has attracted attention from the M&A industry.

-

In the banking industry, it is believed that Air Premia is strengthening its financial capabilities by welcoming SkyLake, which has a blind fund, as an ally and forming a partnership with a PEF that has a strong background in the aviation industry, to gain an advantageous position in the acquisition process.

-

Last year, SkyLake completed the formation of a blind fund worth 1.2 trillion won. If SkyLake continues to participate in the acquisition process with Air Premia, the consortium is likely to receive a passing grade in terms of financial capabilities.

-

Furthermore, Air Premia has connections with SkyLake. Air Premia, established in 2017, is an LCC led by former SkyLake Vice President Lee Eung-jin and aviation industry expert Kim Jong-chul.

-

In addition to SkyLake, Air Premia has also welcomed Pavilion PE as an acquisition partner, which has a strong understanding of the transportation market.

-

Pavilion PE is a PEF fund management company established in 2016 by Yoon Young-gak, the current CEO of Pavilion Asset Management. Yoon, who is known as the eldest son-in-law of the late Park Tae-jun, the honorary chairman of POSCO, has accumulated knowledge of the mobility and transportation market while serving as an external director of KG Mobility (formerly SsangYong Motor) and has also been involved in the KG Mobility acquisition process.

-

Considering that Air Premia's largest shareholder is PEF fund manager JC Partners, it can be said that these three FIs have joined forces for the acquisition of Asiana Airlines' cargo division.

-

In addition to Air Premia, it is expected that there will be further movements among potential buyers. Various scenarios are anticipated, including utilizing the major shareholders of each company to strengthen financial capabilities or forming partnerships with strategic investors (SIs).

5) Airline/GSA Event Update:

(1) Korean Air (KE) Expands International Flights for the Summer Season

Resumption of flights: From April 2nd, Incheon to Zurich route operates 3 times a week. From April 23rd, Incheon to Changsha route operates 3 times a week. From April 24th, Incheon to Chengdu route operates 4 times a week.

Capacity increase: From 3 times a week to 4 times a week for Incheon to Budapest route. From 3 times a day to 4 times a day for Incheon to Bangkok route.

Incheon to Dallas route increases from 4 times a week to daily operation.

(2) Vietnam Airlines (VN) Starts Munich Route from October 2nd

HAN and SGN to MUC route operation. Hanoi operates twice a week, Ho Chi Minh City operates once a week, and SGN will increase to twice a week from December.

The fourth European route after FRA, LHR, and CDG.

(3) Eastar Jet (ZE) Resumes Incheon to Shanghai Route

ICN-PVG 3 times a week from April 19th, 7 times a week from July.

Resuming after a 2-month hiatus since February 2020, with plans to operate more than 12 routes including Japan, Taiwan, and Southeast Asia, starting with this route.

top