EXTRANS GLOBAL - Air Freight News - Week 10 2025

Air Cargo General

1) Launching a 'Unified Airline' to Accelerate - Concerns about Side Effects such as Fare Increases and Route Reductions Due to Weakened Competition in Restructuring the 'Big 3' System

-

Following the merger of Korean Air and Asiana Airlines, Daemyung Sonoh Group has also secured management rights for T'way Air. As the possibility of a merger between Air Premia, in which Daemyung Sonoh is a major shareholder, and T'way Air arises, concerns emerge that the expansion of airlines may lead to reduced consumer benefits.

-

There is a potential for integration between Air Premia, where Daemyung Sonoh is the second-largest shareholder, and T'way Air. Daemyung Sonoh has been considering a merger with Air Premia since the acquisition of T'way.

-

T'way Air and Air Premia are low-cost carriers (LLCs) specialized in long-distance routes. T'way Air, which launched European routes as the first domestic LCC last year, has been steadily expanding its long-distance routes. It received four key European routes (Paris, Barcelona, Rome, Frankfurt) during the merger of Korean Air and Asiana.

-

Air Premia has adopted a differentiation strategy focusing on U.S.-centered routes and premium services. Like T'way Air, it has taken over five North American routes from Korean Air. If the two companies merge, Daemyung Sonoh could secure routes covering Southeast Asia, Europe, and the U.S., maximizing synergy in its core hotel and resort business.

-

LCCs under Korean Air and Asiana Airlines are also beginning to integrate. Jin Air, a subsidiary of Korean Air, and Air Busan and Air Seoul, subsidiaries of Asiana Airlines, recently signed a mutual boarding agreement for regular flights. This cooperation among LCCs, rather than with the parent companies, is drawing industry interest as a move toward the establishment of a unified LCC.

-

The existing domestic aviation industry maintains a structure divided into full-service carriers (FSCs) and LCCs. As airlines continue to announce mergers and acquisitions, a reorganization into merged airlines is expected. There are forecasts that a merger between T'way and Air Premia could pose a threat to Korean Air.

-

While the transition to a merger system presents an opportunity to consolidate the numerous airlines, many believe it could infringe on consumer benefits, leading to price increases. If a unified Korean Air, unified LCC, and the T'way-Air Premia 'Big 3' structure is established, analysis suggests that competition may diminish, resulting in a decrease in routes, a decline in service quality, and fare increases."

2) T'way Air - Slower Recovery of Performance Than Expected

-

T'way Air's performance in the fourth quarter of last year was disappointing, as feared. While revenue was similar to the third quarter of last year, a decline in fares and the impact of one-time costs led to a significant increase in operating loss (60.9 billion KRW).

-

Although T'way Air increased its international capacity by launching European routes, fares fell. The addition of seven aircraft last year was hampered by the inability to fly over Russian airspace due to the war, preventing the deployment of A330-300s on European routes. Instead, the introduced A330-200 has over 100 fewer seats.

-

Additionally, ongoing production issues among aircraft manufacturers have disrupted the supply of aircraft, and large foreign exchange losses related to maintenance provisions in the fourth quarter have likely contributed to the increased losses.

-

However, attention is drawn to T'way Air's potential amid the ongoing management dispute. Last week, Daemyung Sonoh Group's holding company Sonoh International secured management rights by acquiring 46.3% of T'way Holdings, the largest shareholder of T'way Air.

-

Although T'way Air's losses in European routes have not yet ended, its valuation this year may seem high. Still, it’s important to focus on the bigger picture that Daemyung Sonoh aims to achieve through the acquisition of T'way Air. The current losses are seen as growing pains, as the merger of the two major national carriers would create an opportunity for one full-service carrier (FSC) to have a vacant seat.

-

The turning point for T'way Air's performance is expected in the third quarter of this year, the peak season for European travel. Additional long-haul aircraft are expected to be deployed, and fares are likely to stabilize due to the merger of the two major national carriers.

-

Experts believe that considering a turnaround in the second half and the change of the largest shareholder, long-term growth potential remains unchanged. They suggest that this is a time to wait for new momentum, such as benefiting from European routes once the war with Russia concludes and the potential synergy with Air Premia.

3) Hawaiian Airlines to Launch Daily Nonstop Flights from SEA to ICN in October

-

Hawaiian Airlines (HA), part of the Alaska Airlines Group, will operate daily nonstop flights from Seattle (SEA) to Incheon (ICN) starting in October.

-

The airline states that the aircraft used will be a wide-body.

-

Additionally, starting May 12, the airline will also operate daily nonstop flights between Seattle and Narita (NRT), Japan.

-

Alaska Airlines merged with Hawaiian Airlines for $19 billion last September,

-

And the opening of passenger routes between Seattle and Incheon will enhance cargo capacity through belly space.

-

Furthermore, Hawaiian Airlines will strengthen its operations with two daily flights on the Honolulu (HNL) to Haneda (HND) route.

-

The airline also operates 24 weekly flights on routes between Honolulu and Osaka (KIX) and Fukuoka (FUK), Japan.

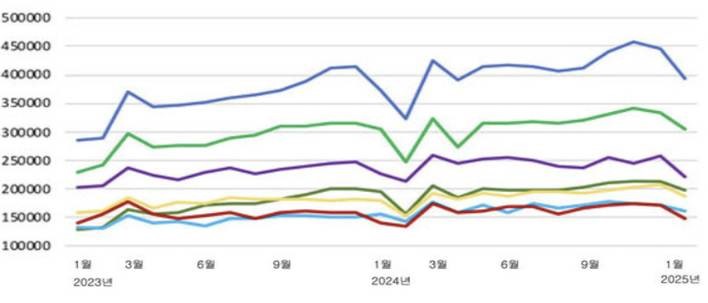

4) The cargo performance at major airports in Asia has been relatively strong

-

Air cargo at major airports in Asia saw a decline in January; however, it is evaluated as relatively strong compared to the same period last year.

-

Hong Kong (HKG) recorded 394,000 tons of air cargo in January, a 4.1% increase compared to the same period last year, marking 19 consecutive months of growth.

-

However, the sustained figure of 400,000 tons over the past seven months has fallen. Shanghai (PVG) also saw a slight decrease to 305,000 tons, reversing its 19-month growth trend to a decline, but still maintaining over 300,000 tons.

-

Incheon Airport (ICN) reported 222,000 tons in January, a 1.7% decrease, switching from a 16-month growth trend to a decline.

-

Guangzhou Airport (CAN) had a slight drop to 197,000 tons, having maintained double-digit growth for 16 consecutive months until May 2023.

-

Taipei (TPE) recorded 186,000 tons, a 4.1% increase. Singapore Changi Airport (SIN) reported 160,000 tons, a 2.3% increase. Japan's Narita Airport (NRT) recorded 147,000 tons, a 5.6% increase, maintaining growth for 10 consecutive months, but showing a 14% decrease compared to the previous month.

top