EXTRANS GLOBAL - Air Freight News - Week 03 2024

Air Cargo General

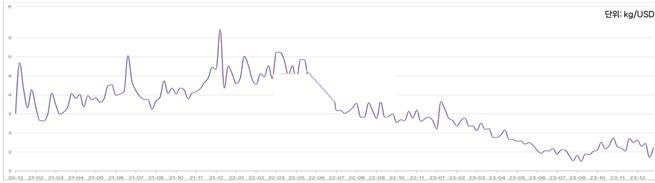

1) Freightos Air Index (FAX): Situation of the 2nd week of January

- According to Freightos Air Index data, the global average airfreight for the 2nd week (1/7~1/14) increased by +9.9% compared to the previous week, reaching $2.56/kg.

(2024 lowest: $2.30 / highest: $2.60 / average: $2.40 | 2023 lowest: $2.20 / highest: $3.60 / average: $2.70)

- The airfreight levels from Asia to North America remained similar to the previous year, while Asia to Northern Europe continued its decline since mid-December. However, with longer sea transportation times, an increase in air cargo is expected.

- China-North America route decreased by 8% to $5.36/kg. China-Northern Europe route increased by 38% to $4.11/kg, reflecting the start of increased demand due to the Honghai chaos.

- Northern Europe-North America route decreased slightly by 1% to $1.81/kg. North America-Northern Europe route remained stable at $1.05/kg.

- Northern Europe-China route decreased by 2.4% to $1.27/kg. Northern Europe-Japan route decreased by -0.6% to $1.74/kg. Northern Europe-South Korea route decreased by -1.3% to $1.54/kg. Northern Europe-Southeast Asia route decreased by 4.9% to $1.35/kg.

- Southeast Asia-North America route increased significantly by 11.3% to $3.36/kg. Southeast Asia-Europe route remained stable at $1.80/kg. Southeast Asia-South America route increased by 0.4% to $4.55/kg. Japan-Northern Europe route decreased by 9.2% to 2.67. North America-Southeast Asia route surged by +25.0% to $2.00/kg.

2) EU Approves Merger of Korean Air (KE) and Asiana (AZ)

- The European Union (EU) is expected to approve the merger of Korean Air and Asiana Airlines, as reported by Reuters on the 12th.

- In November of last year, Korean Air and Asiana Airlines decided to sell Asiana's cargo business and return some routes in Europe, leading to EU antitrust authorities approving the merger. The final approval is awaited from the U.S. and Japanese governments.

- A Korean Air official mentioned that they haven't received official merger approval from the EU yet, but they believe the merger will be finalized as they have mostly met the conditions set by the EU.

- After EU approval, the U.S. and Japan's approvals are pending, with Japan expected to decide this month and the U.S. in the first half of the year. If approved, the merger between Korean Air and Asiana Airlines is expected to be completed in the second half of this year, creating a mega carrier ranking among the world's top 10 with revenue of 20 trillion won and a fleet of over 230 aircraft.

3) Jeju Air Bids for Asiana Cargo: T'way Air Expands to Europe from June

- Jeju Air is reported to have submitted a solo bid for Asiana Airlines' cargo business, leading to a competition between Jeju Air and T'way Air for the second position in the aviation industry. T'way Air is likely to acquire the lucrative business of Asiana Airlines, especially routes to four European cities (Paris, Frankfurt, Rome, Barcelona).

- Jeju Air is said to be the only bidder for Asiana's cargo business, as other contenders like Air Premia, Air Incheon, and Eastar Jet reportedly dropped out of the acquisition process.

- Asiana Cargo, with 11 aircraft as of the third quarter of last year, is the second-largest air cargo airline in Korea, following Korean Air. During the same period, the international air cargo revenue recorded 1.1293 trillion won. The surge in air cargo demand during the COVID-19 pandemic, when sea transportation became challenging and the global supply chain collapsed, contributed to significant performance improvement.

- Jeju Air, traditionally focused on passenger services, has been accelerating its pace in the cargo business. In June 2022, it became the first low-cost carrier (LCC) to introduce cargo-only planes. In December of last year, it brought in its second cargo plane. Currently, it handles some of the volumes from the rapidly growing Chinese direct procurement market, including AliExpress and Tmall.

- The biggest beneficiary of the merger between Korean Air and Asiana is evaluated to be T'way Air. Due to the nature of the aviation industry, where profitability increases with longer flight distances, the acquisition of routes to four European cities simultaneously is expected to fundamentally change the business structure of the airline.

- T'way Air has been preparing for long-distance flights since the beginning of 2022 when the pandemic was at its peak. It introduced three A330-300 aircraft for long-haul routes, preparing for stable operations on four European routes. The European Aviation Safety Agency (EC) has reportedly set a condition for both companies to start operating flights to four European cities from June as a preemptive measure for the merger.

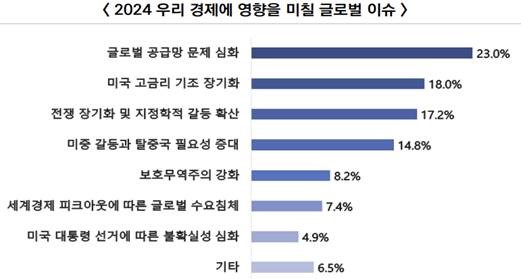

4) 2024 Global Supply Chain Issues Seen Through Keywords

- Member companies of the Korea Economic Association identified 'Deepening Supply Chain Issues' and 'Prolonged U.S. High-Interest Rates' as the global keywords that will transcend the new year of 2024. The expectation is that the U.S.-China conflict will 'persist or intensify.'

- In a survey on '2024 Global Issues and Response Plans' (122 responses), companies mentioned 'Deepening Global Supply Chain Issues' (23.0%), 'Prolonged U.S. High-Interest Rates' (18.0%), and 'Prolonged War and Geopolitical Escalation' (17.2%) as the major global issues of 2024.

- Other significant issues affecting the Korean economy include the 'increasing necessity of decoupling from China' (14.8%), 'strengthening protectionist trade policies' (8.2%), 'global demand slump due to the peak in the world economy' (7.4%), and 'increased uncertainty due to the U.S. presidential election' (4.9%).

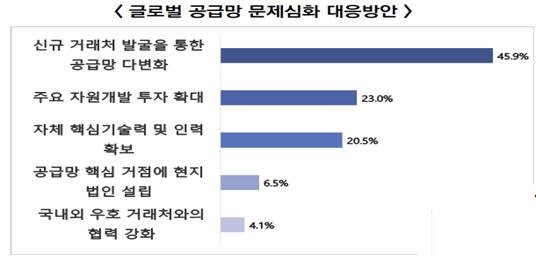

- Regarding responses to major issues, companies stated that they would 'respond through building new partnerships' for global supply chain issues and prolonged war and geopolitical escalation. For the movement toward global supply chain protectionism, the majority responded with 'diversifying supply chains through discovering new trading partners' (45.9%) or 'expanding investment in major resource development' (23.0%).

- For the escalation of war and geopolitical conflicts, a large number of responses (63.9%) indicated that they would 'seek alternative export/import destinations.' Following this, 'no special response plan' (13.9%) and 'portfolio restructuring' (13.1%) were mentioned in the survey.

5) Airline/GSA Event Update

(1) Silk Way West (7L) announces exclusive direct flights from ICN to GYD starting from the 21st of the month.

After receiving five B777F aircraft last year, Silk Way West expanded its routes to JFK, DAC, DEL, LGG, and LEJ. In order to increase supply in the Korean market, the route that previously transited Japan (GYD-KIX-ICN-GYD) will now operate as a direct route (GYD-ICN-GYD). Schedule: ICN-GYD 7L122 (D5) 07:30/11:30, 7L1244 (D7) 05:00/09:30, 7L 129 (D1) 16:30/20:30

(2) SriLankan Airlines (UL) reduces frequency on the Colombo-Incheon route from February 9th.

ICN-CMB 3W2W UL471 D1 0700/1200, D3 1215/1715 A333, 2/9~3/30

(3) Air Macau (NX) increases Seoul-Incheon flights to 2 daily from March 31st.

ICN-MFM 2W14W NX821 1414/1715, NX825 0955/1300 A320, from 3/31. MFM-ICN NX822 0835/1315, NX826 1625/2125

(4) MSC Cargo receives the fourth 'B777' cargo aircraft.

Expected to strengthen the Hong Kong-Dallas route, following the opening of the Milan-Narita route in October of last year, and the commencement of operations on the Quito-Rege route twice a week and the Jalapa-Mexico City route once a week in November.

(5) China Southern Airlines (CZ) to operate Wuhan-London route starting from March 31st.

WUHLHR CZ607 1150/1615 B787-8 D37, LHRWUH CZ608 1915/1300+1 B787-8 D37

top