- Company

-

Specialized Products

Warehousing Solution

Specialized Freight Solutions

Multimodal Freight Solutions

GSA, CSA & SC

E-Commerce

- Service

- Blog

- Cargo Tracking

- Contact Us

- Site Map

The Power of Logistics to Move the World!

It's the Power of extrans.

EXTRANS GLOBAL - Air Freight News - Week 35 2025

Air Cargo General

1) Recent Sharp Decline in Global Air Cargo Volume – 7% Overall Drop, While Korea-origin Flights to the Americas Rebound by 6%

According to data released by WorldACD, the global air cargo volume from August 11 to 17 (Week 33) plummeted by 7% compared to the previous week. This is primarily attributed to holidays, including Japan’s Obon Festival and the Assumption of Mary (August 15) in major European countries.

By region, outbound cargo volumes saw notable declines from Europe (-11%) and the Asia-Pacific (-8%), with the Middle East & South Asia (MESA, -4%), North America (-3%), and Africa (-3%) also trending downward. Japan’s export volume shrank significantly: cargo volume on flights from Japan to the Americas plummeted by 53%, and to Europe by 44%, directly impacted by temporary shutdowns of Japanese companies.

The Asia-Pacific to Americas route also fell by 9% overall due to the sharp drop in Japan-origin cargo. However, after two consecutive weeks of double-digit declines (-10% or more), Korea-origin cargo to the Americas rebounded by 6%, showing signs of partial recovery. In contrast, China (-6%) and Hong Kong (-3%) continued their downward trends, while Thailand (-12%) and Singapore (-19%) recorded declines for the third consecutive week. Additionally, a 4-day flight suspension caused by a strike by Air Canada cabin crew also contributed to the contraction of cargo volume on North American routes.

Freight rates, on the other hand, remained relatively stable. The global average spot rate in Week 33 was $2.64 per kg, the same as the previous week but 3% lower than the same period last year. By region, rates fell in the Asia-Pacific (-8%) and MESA (-25%), while Europe maintained a year-on-year increase of 7.5%.

The spot rate for the Asia-Pacific to Americas route was $4.89 per kg, a 3% decrease from the previous week, but remained relatively stable over the past three months. The average rate for the Asia-Pacific to Europe route was $3.76 per kg, unchanged from the previous week. However, while rates from Japan (-10%) and China (-3%) declined, those from Korea (+5%), Vietnam (+4%), and Malaysia (+9%) rose.

2) Five-Year High – T’way Air Turns the Tide with Cargo Revenue

T’way Air, which has expanded its presence in the low-cost carrier (LCC) sector, is advancing to the next level. Although it still faces partial losses in revenue and assets, the airline is actively seeking new growth drivers such as cargo, aiming to build long-term cash flow momentum through these avenues.

In the first half of this year, T’way Air achieved approximately KRW 23.6 billion in revenue growth from air cargo transportation fees, a significant increase compared to the KRW 9.34 billion recorded in the first half of last year. Alone in the April-June quarter, the airline generated KRW 14.9338 billion in cargo revenue. T’way Air plans to offset losses in passenger revenue with cargo income and strive for profitability going forward—this strategy can be seen as a "temporary substitute" until its core passenger revenue stabilizes.

There are differences between T’way Air and Air Premia. In February 2024, Air Premia’s total revenue reached KRW 491.6 billion, with its belly cargo business (utilizing aircraft belly space) contributing 13.2% of total revenue, driven by e-commerce demand from China. This supported the airline in achieving its highest performance to date, with the cargo segment estimated to be worth approximately KRW 65 billion.

In contrast, T’way Air’s cargo revenue only amounted to KRW 22.357 billion by the end of last year. While it generated income from belly cargo using aircraft such as the A330 and B777, this figure was modest compared to its passenger revenue (approximately KRW 1.24824189 trillion). During the 2020-2021 COVID-19 pandemic, cargo transportation revenue was even classified as "other income" in its financial statements, reflecting its minimal share at the time.

This year, however, the situation has changed dramatically: T’way Air’s cargo revenue has already exceeded KRW 23.56203 billion, surpassing its annual cargo revenue from 2022 to 2024 (KRW 22.4 billion in 2023 and KRW 17.1 billion in 2022), marking a five-year high. In the first quarter of this year alone, its cargo revenue reached KRW 8.62821 billion.

Actual cargo handling volume has also grown significantly: T’way Air’s cargo volume increased from just 3,200 tons in 2018 to 7,800 tons in 2022, 16,800 tons in 2023, and 19,000 tons in 2024, expanding year by year.

Although T’way Air launched its Zagreb (Croatia) route in May and other Western European routes between August and October, it has actively increased cargo transportation to Eastern European countries such as the Czech Republic, Hungary, and Poland (in addition to cargo arriving in Zagreb). This segment now accounts for nearly 20% of its total accumulated cargo volume in 2024.

For the Incheon-Rome route, a total of 2,160 tons of import and export cargo has been transported. T’way Air stated, "By loading large cargo such as auto parts and machinery into ULDs (Unit Load Devices, air cargo containers) using the belly cargo space of large aircraft, we have secured stable cargo performance."

T’way Air’s hopes extend beyond cargo—it also has high expectations for its Vancouver (Canada) route. While no meaningful performance or statistics have been compiled yet (as the route only launched a month ago), Vancouver is a "golden route" that no other airline except Korean Air operates. Thus, T’way Air expects to further increase its North American cargo flight revenue with Canada as its base.

According to the Ministry of Land, Infrastructure and Transport’s Aviation Information Portal System, approximately 16,515 tons of cargo was transported from Incheon to Vancouver between January and July this year. In 2024 and 2023, the cargo volume between Korea and Canada was 27,299 tons and 27,088 tons, respectively.

3) U.S.-China Tariff Uncertainty Drives Surge in Air Cargo Charter Demand – Shippers Seek Rapid Transport Before Final Agreements

As the U.S. imposes high tariffs on China and other major trading partners one after another, uncertainty for supply chain managers has peaked. Particularly with tariff implementation deadlines frequently extended or changed, companies are actively using air cargo charters to import goods before these deadlines, according to analysis.

Recently, Jack Burt, Senior Vice President of Cargo at Chapman Freeborn USA, stated, "High tariffs are likely to reduce international trade volumes and thus negatively impact air cargo demand. However, over the past few months, air cargo volume has actually surged in certain industrial sectors, driven by increased demand to ship goods before tariffs take effect."

The key driver of this demand is undoubtedly air cargo charters. Since sea, rail, and road transport typically struggle to respond quickly enough to meet tariff deadlines, supply chain managers use charters to prioritize high-value and time-sensitive cargo.

As tariff targets change frequently by country and product category, the types of cargo transported via charters have also diversified. From textiles and industrial machinery to high-end electronics and cryptocurrency mining servers, all goods requiring shipment before deadlines have become major cargo categories for charters. Notably, specialized cargo aircraft capable of handling heavy machinery are inherently limited in the market, further intensifying demand pressure for such charters.

Charter brokers, leveraging their experience in humanitarian aid and emergency relief, have already established global networks to organize flights on short notice. Therefore, even amid heightened tariff uncertainty, they can meet urgent demand without additional staffing.

Some supply chain managers use retainer contracts to develop customized charter plans for when needed, and in general, shipments can be arranged within 48 hours. Experts predict, "As the U.S.-China tariff deadline (extended to November 10) approaches, air cargo charter demand is likely to surge again. In the short term, 'pre-shipment' demand will continue; however, in the medium to long term, tariff barriers may lead to a contraction in overall air cargo demand."

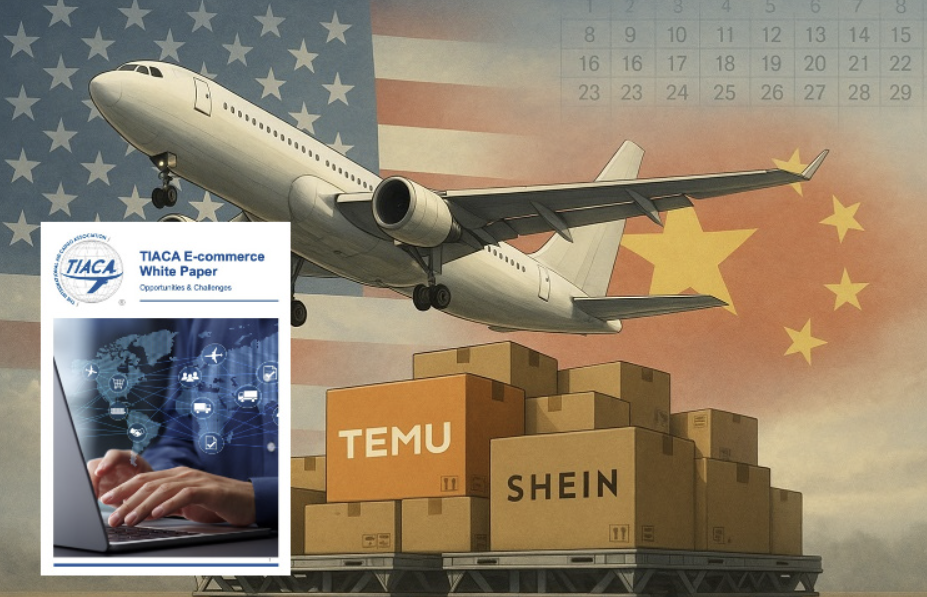

4) TIACA – E-Commerce Air Cargo Expected to Double in 10 Years

In a report released on August 21, the International Air Cargo Association (TIACA) stated that e-commerce remains resilient and its related air cargo volume is expected to double within the next 10 years.

As of 2024, e-commerce accounts for approximately 20% of global air cargo volume. The report analyzes that the shift in consumption patterns driven by the COVID-19 pandemic and the spread of platform-based business models are fundamentally reshaping global supply chain structures.

Notably, after the U.S. eliminated its de minimis tax exemption policy, cargo volume from China and Hong Kong dropped sharply. However, cargo volume from Southeast Asia and other Asia-Pacific countries to the Americas and Europe is recovering rapidly, showing a trend of diversified trade flows.

In 2024, e-commerce air cargo volume from China reached 4.4 million tons, with an average annual growth rate of 38% since 2021. The scale of e-commerce air cargo in South China (centered on Guangzhou, Shenzhen, and Xiamen) has doubled compared to 2019, while central and western regions such as Chengdu, Chongqing, and Kunming have grown by over 30% in just one year. Nevertheless, affected by U.S. regulatory policies, the business models of major e-commerce platforms such as Temu and Shein have been disrupted, leading to a 30% reduction in cargo aircraft supply on relevant routes.

The report emphasizes that e-commerce is not merely a "new cargo category" but a "turning point" that is transforming air logistics operations. It covers 16 core areas, including market outlook, safety and security (lithium batteries, cyber threats, etc.), customs clearance and management, data standardization, last-mile delivery and reverse logistics, and sustainability and innovation (application of AI, drones, and Sustainable Aviation Fuel/SAF). The report also provides policy recommendations and industry-specific best practices.

Furthermore, the report notes, "E-commerce is fundamentally changing the way the air logistics industry operates. This white paper provides a actionable roadmap for the industry to prepare for the next phase of growth." It also emphasizes that digitalization, innovation, and cross-industry collaboration can transform e-commerce logistics into a safer and more eco-friendly ecosystem.

5) Airlines Movement

T’way Air (WE) Announces Winter International Passenger Route Schedule

- Incheon (ICN) – Tokyo Narita (NRT): 7 weekly flights starting October 26; additional 5 weekly flights starting November 1, totaling 12 weekly flights (operated with A330).

- Incheon (ICN) – Osaka Kansai (KIX): 7 weekly flights (operated with A320); additional 4 weekly flights operated with A330 from October 26 to 31 only.

- Incheon (ICN) – Da Nang (DAD): 7 weekly flights (A330); Incheon (ICN) – Phu Quoc (PQC): 4 weekly flights (A330); Incheon (ICN) – Can Tho (CXR): 4 weekly flights (A320).

Asiana Airlines (OZ) Winter Schedule (October 26, 2025 – March 28, 2026)

- Suspends Incheon (ICN) – Almaty (ALA) and Incheon (ICN) – Tashkent (TAS) passenger routes (previously operated with A333).

Turkmenistan Airlines (T5)

- Launches service to Ashgabat Airport (ASB, capital city) starting September 12: Weekly passenger flights every Monday (launched in July); weekly cargo flights/military flights operated with A332 every Friday.

top