- Company

-

Specialized Products

Warehousing Solution

Specialized Freight Solutions

Multimodal Freight Solutions

GSA, CSA & SC

E-Commerce

- Service

- Blog

- Cargo Tracking

- Contact Us

- Site Map

The Power of Logistics to Move the World!

It's the Power of extrans.

EXTRANS GLOBAL - Air Freight News - Week 34 2025

1. Air Cargo General

1)Strengthening Safe Transportation of Sea & Air Cargo from China

The Ministry of Land, Infrastructure and Transport announced that enhanced safety measures for Sea & Air (Sea-Air Multimodal) cargo originating from China will take effect starting September 1st.

- First, as security screening procedures for Loose Cargo are strengthened, X-ray security screening will be mandatory for Sea-Air multimodal cargo from China.

- After conducting random selection for physical inspection, disciplinary measures will be imposed if hazardous materials are detected.

Security screening for parcels is also being tightened:

- Parcels are prohibited from being transported via EL/ELM (Express Logistics/Express Logistics Mail) and passenger aircraft. They can only be accepted as BUP (Breakbulk Cargo) after 100% X-ray inspection.

- The relevant freight forwarders must undergo on-site inspections and regular inspections twice a year.

Shippers and freight forwarders must also step up their own inspection efforts to detect Hidden Dangerous Goods (Hidden DG). Before transporting cargo, they are required to verify in advance whether the cargo contains dangerous goods by checking documents including AWB (Air Waybill) data and Packing Lists.

For freight forwarders that handle BUP operations directly, the authorities re-emphasize the requirement to conduct targeted physical inspections and verify compliance. In line with instructions to strengthen lithium battery safety measures, the Ministry of Land, Infrastructure and Transport will carry out physical inspections. During regular inspections of BUP freight forwarders, verifying and evaluating whether physical inspection procedures are implemented will be included as part of the assessment.

Going forward, freight forwarders must independently verify whether cargo contains hidden dangerous goods (Hidden DG) or lithium batteries before delivering it to airlines. Additionally, the Ministry of Land, Infrastructure and Transport stated that for packages (boxes) weighing 15kg or more with lithium battery labels, freight forwarders must coordinate with customs brokers to conduct physical inspections and affix inspection certification stickers to the boxes after inspection.

Furthermore, shippers in China must be required to provide a certificate of compliance with international lithium battery transportation regulations (ICAO Technical Instructions or IATA Dangerous Goods Regulations), and this certificate must be retained for a minimum of one year. Even personnel who do not handle dangerous goods must ensure that at least 20% of their staff complete training at specialized dangerous goods training institutions, enabling them to identify misdeclared lithium batteries.

2)Warning of Continued Global Air Cargo Shortage Until 2040

The global air cargo market is facing a structural freighter supply shortage crisis that will persist for more than a decade. This crisis stems from a combination of factors:

- Large-scale retirement of aging freighters,

- Gaps in new freighter production,

- Bottlenecks in passenger-to-freighter (P2F) conversions.

After the discontinuation of the B747 freighter, market expectations shifted to the B777 series and A350F. However, the B777-200F—currently the main production model—fails to meet ICAO carbon emission standards and is mandated to cease production by 2027.

The next-generation freighters that will succeed it—the B777-8F and A350F—are not expected to enter the market until at least late 2027 or after 2028, even in the best-case scenario. Additional challenges include:

- Delays in certification procedures for passenger-to-freighter (P2F) conversions,

- A shortage of aging passenger aircraft available for conversion into freighters.

Specifically:

- Certification procedures for the B777-300ERSF conversion program, led by Israel Aerospace Industries (IAI), have been delayed.

- Since the COVID-19 pandemic, rising demand for passenger travel has delayed the retirement of aging B777 models, leading to a reduction in the supply of used passenger aircraft and a sharp increase in their prices.

According to analysis by IBA, the cost of converting a B777-300ERSF—including engine repairs—approaches USD 100 million, which is comparable to the price of a new freighter. This seriously threatens the economic viability of P2F conversions.

Aging freighters such as the MD-11F and B747-400F are being retired at an accelerated pace. Eventually, the number of retired aircraft will begin to outpace new supply.

3)Asiana Airlines Signs Cargo Transportation Service Contract with ECS -

Specialization in Belly Cargo After Freighter Division Sale

Asiana Airlines (OZ) announced that it will continue its passenger belly cargo operations in Chicago in partnership with ECS Group, a global GSSA (General Sales and Service Agent) company.

Starting September 1st, the airline has begun receiving comprehensive services from the ECS Group for Chicago cargo transportation, including cargo sales, reservations, customer support, and ground operation coordination. The two companies had previously signed an air cargo sales and transportation service agency contract on August 11th, covering 33 major locations across 9 countries, including Europe, the Americas, China, Japan, and Southeast Asia.

This move comes after Asiana Airlines completed the sale of its freighter division on September 1st—responding to demands for corrective measures from the European Union (EU) and Japanese competition authorities to address monopoly concerns. The partnership with ECS aims to further specialize logistics services through its belly cargo operations.

The ECS Group is a specialized global air cargo sales and transportation agent (GSSA) that collaborates with over 100 airlines in more than 60 countries worldwide. Asiana Airlines’ flagship A350-900 passenger aircraft can carry a maximum of approximately 18 tons of cargo and luggage in its lower deck holds. The airline plans to actively cater to logistics demand requiring high punctuality and urgency—such as semiconductor components, fresh food, and small special cargo—as the main types of cargo transported to Chicago.

An Asiana Airlines official stated: “By combining ECS Group’s global network with Asiana’s professional capabilities, we will proactively respond to the global air logistics market and continue to provide systematic, specialized services.”

Meanwhile, using its passenger aircraft, Asiana Airlines transported approximately 158,000 tons of international belly cargo in the past year.

4)Signs of Reshuffling in Global Air Cargo Hubs – Istanbul, Guangzhou

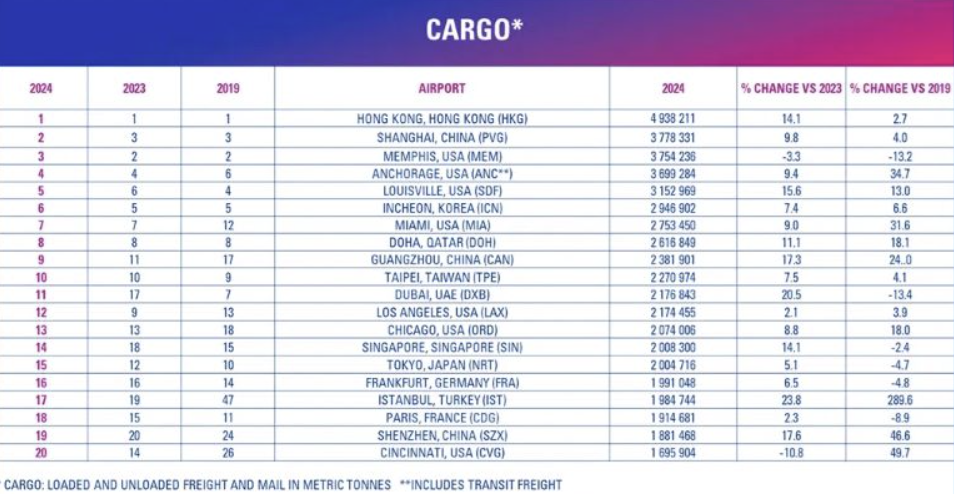

In 2024, the global air cargo market showed a clear recovery, leading to a major reshuffle in the rankings of key hub airports. Amid overlapping factors—including maritime logistics disruptions, nearshoring trends, and e-commerce growth—emerging hubs such as Dubai, Istanbul, and Guangzhou have rapidly risen, while Memphis (a traditional leader) has seen its position weakened.

According to the 2025 World Airport Traffic Data, global air cargo throughput in 2024 reached approximately 127 million tons, representing a 9.9% increase year-on-year and a 4.1% increase compared to 2019 (pre-pandemic levels). The combined throughput of the world’s top 20 cargo airports was 52.2 million tons, up 9% year-on-year and 10.8% compared to 2019.

Hong Kong International Airport (HKG) retained its 14-year streak as the world’s top cargo airport, handling 4.94 million tons (a 14.1% year-on-year increase).

- It was followed by Shanghai Pudong International Airport (PVG) and Memphis International Airport (MEM, USA). However, Dubai International Airport (DXB) stood out with a remarkable leap—climbing from 17th place in 2023 to 11th in 2024, handling 2.18 million tons (a 20.5% year-on-year increase). This growth was driven by a surge in demand for sea-air multimodal transportation triggered by the Red Sea crisis, as shippers chose Dubai as a transit hub.

Istanbul New Airport (IST) also maintained strong growth:

- Rising from 47th place in 2019 to 19th in 2023, IST climbed further to 17th in 2024.

- Its throughput last year reached 1.98 million tons, a 23.8% year-on-year increase and an astonishing 289.6% increase compared to 2019. Key drivers of this growth include Turkish Airlines’ aggressive network expansion and the expansion of advanced cold chain facilities.

Guangzhou Baiyun International Airport (CAN, China) jumped to 9th place, fueled by its specialization in e-commerce. The airport’s 2024 throughput increased by 17.3% year-on-year, supported by growing cargo volumes from global platforms such as Shein and Temu, as well as rising demand for pharmaceutical and fresh food logistics.

In contrast, Memphis International Airport (MEM) handled 3.75 million tons (a 3.3% year-on-year decrease) and slipped to 3rd place. This decline was attributed to the optimization of integrated express carrier networks and a reduction in low-margin e-commerce cargo. On the other hand, Miami International Airport (MIA) maintained its 7th-place ranking by leveraging its strength as a Latin American trade hub, handling 2.75 million tons (a 9% year-on-year increase).

Experts view this ranking reshuffle not as a short-term phenomenon but as a structural shift. They note that complex factors—including geopolitical risks, trade policies, e-commerce growth, and nearshoring—are redrawing the map of air cargo hubs. Looking ahead, while U.S.-China trade tensions and changes in tariff policies will continue to impact Asia-U.S. cargo volumes, trade within Asia and between Asia and Latin America is expected to emerge as new growth drivers.

5)Airlines Movement

Parata Air (WE): Winter Season International Passenger Route Operation Schedule

- ICN (Incheon) – NRT (Tokyo Narita): Starting October 26th, 7 weekly flights; additional 5 weekly flights from November 1st, totaling 12 weekly flights (operated by A330).

- ICN – KIX (Osaka Kansai): 7 weekly flights (operated by A320); only from October 26th to 31st, 4 weekly flights will be operated by A330.

- ICN – DAD (Da Nang): 7 weekly flights (A330)

- ICN – PQC (Phu Quoc): 4 weekly flights (A330)

- ICN – CXR (Cam Ranh): 4 weekly flights (A320)

Asiana Airlines (OZ)

Suspension of passenger routes for the winter season (October 26, 2025 – March 28, 2026):

- ICN – ALA (Almaty): Operated by A333 (suspended)

- ICN – TAS (Tashkent): Operated by A333 (suspended)

Air India (AI)

- Suspension of the ICN – DEL (Delhi) passenger route from September 5th to 26th (operated by B788).

top