EXTRANS GLOBAL - Air Freight News - Week 30 2025

Air Cargo General

1) Will the European air cargo hub airport change to Liège Airport?

- The landscape of the European air cargo market is changing. While traditional major hub airports such as Frankfurt and Amsterdam Schiphol are seeing stagnant or declining cargo handling performance, Belgium's Liège Airport (LGG) has shown double-digit growth since the beginning of this year and is rapidly emerging as a new central axis.

- Liège Airport handled a total of 331,84 tons of cargo in the second quarter of this year, an increase of 14.5% compared to the same period last year. During this period, the number of flights reached 7,120.

- For the first half of the year, it handled a total of 626,690 tons of cargo, a 10% increase compared to the same period last year. According to Rotate, a global air cargo capacity database, Liège Airport's supply capacity compared to the beginning of the year has also increased by 8% compared to last year.

- Liège Airport stated, "Liège continued its stable growth momentum in the second quarter, and the future prospects are also positive." It explained that the core factors of the upward trend are especially Liège's unique operating model as a 'cargo-only airport', the introduction of the new brand 'Cargoland', and an aggressive sales strategy.

- It is also noteworthy that Liège Airport showed balanced growth in overall European export and inland routes, in addition to the continued strength of routes to mainland China and Hong Kong.

- It is analyzed that the recent movement to abolish the US De Minimis system, which caused some e-commerce cargo to be diverted to Europe instead of the US, also affected the increase in cargo volume at Liège. In fact, Liège Airport recorded double-digit growth rates in the e-commerce sector throughout the first half of the year, and it was confirmed that the growth momentum became more pronounced especially from May.

- Despite several external variables such as the weak US dollar, geopolitical instability in the Middle East, and uncertainty in the global trade environment, which are pointed out as risk factors, Liège Airport expressed strong confidence, saying, "There are no signs of weakness in overall cargo demand, including trade flows with the US." In fact, imports and exports between Liège and the US increased by 34.5% in the first half compared to the same period last year.

- In particular, Liège is attracting various high-value-added cargo groups such as pharmaceuticals, fresh food, and special transport cargo, in addition to e-commerce, attracting the attention of logistics companies and airlines.

- Liège Airport expects the overall cargo volume this year to also record double-digit growth, and the performance in the fourth quarter is particularly promising.

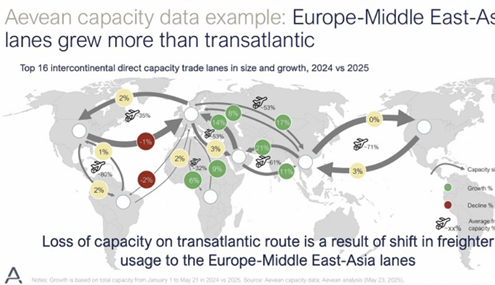

2) Aevean - Changing the Landscape of Global Air Cargo Market Data

- Aevean stated in its recently released product portfolio summary report that it provides the highest level of real-time analysis information in the industry in four core areas: cargo capacity, aircraft fleet information, air trade, and e-commerce data.

- Aevean's 'Fleet Capacity Database' predicts changes in future cargo capacity by analyzing the actual fleet status and new orders of global airlines.

- The new supply of air cargo in 2024 decreased by about 60% compared to 2019, which is explained by the fact that airlines have focused more on narrow-body aircraft rather than wide-body aircraft after the pandemic.

- Interestingly, Middle Eastern airlines have newly ordered transportation capacity equivalent to the size of their currently operating cargo aircraft. This indicates that the Middle East region will strengthen its dominance in air cargo supply in the future.

- The 'Air Trade Database' provides monthly data on air trade between countries and presents important insights into the import trends of IT products between the US, China, and Vietnam.

- From March to April 2025, the air cargo volume of notebook computers imported by the US from Vietnam increased by more than 8,000 tons compared to the same period last year, which requires an additional 1.5 or more wide-body cargo aircraft per day. On the contrary, the overall air import volume of notebook computers and smartphones plummeted by 70% year-on-year, showing that the polarization between products and supply sources is intensifying.

- In addition, the 'E-commerce Database' is a tool for analyzing air cargo volume of cross-border e-commerce based on HS codes. In particular, low-cost e-commerce air cargo from China grew at an average annual rate of 38% between 2021 and 2024, accounting for 55% of US-China air trade cargo volume as of 2024.

3) The Outlook for the Air Cargo Market in the Second Half of the Year Remains Uncertain - Uncertainty in the Recovery of Demand Decline on US-China Routes

- Due to the impact of tariff increases between the US and China and changes in the De Minimis system, the uncertainty in the outlook for the air cargo market in the second half of the year has increased.

- Especially with the sharp decrease in cargo demand between China and the US, a major market, attempts are being made to diversify logistics centered on other routes, but

- It is unclear whether the demand can maintain a continuous recovery momentum by the end of the year.

- At Freightos' webinar "Global Freight and Trade War Outlook" held on July 10, it was mentioned that "based on May, the air cargo volume on US-China routes decreased by 11% year-on-year and 12% month-on-month," and "this is a direct impact of tariffs and De Minimis system reforms."

- On the contrary, in other routes, cargo volume increased to a certain extent as e-commerce shippers secured alternative transport routes. Levin said, "As platforms originating from China diversify their markets outside the US, growth has been observed in other routes such as Asia-Europe, Taiwan, and Vietnam," and "the overall global air cargo volume increased by 3% year-on-year by May."

- Regarding IATA's recent forecast that "the 2025 air cargo market will remain at the 2024 level," Levin mentioned that "the trend of annual cargo volume depends on how well the market adapts to the new supply chain in the second half of the year and whether demand can be generated from routes other than China-US."

- On the other hand, it is analyzed that since the tax collection time has been postponed to August, many shippers have shipped goods in advance, so this policy will not have a significant impact on air cargo demand in the short term.

- Changes have also been detected on the supply side. According to Freightos, the supply of wide-body cargo aircraft on trans-Pacific routes decreased by about 13% compared to the average of the previous month. As a result, some cargo aircraft are being redeployed to routes such as Taiwan, Vietnam, and Asia-Europe, and the supply on Asia-Europe routes increased by 18% compared to the previous month.

- Ultimately, as the central axis of the air cargo market is shaking due to the US-China trade war, logistics companies are focusing on route diversification and supply chain restructuring.

- It is certain that the air cargo market is in a situation where global supply capacity exceeds demand due to the recent loss of e-commerce demand.

- The air cargo market in the second half of the year may fluctuate greatly depending on the recovery of e-commerce demand and changes in global trade policies, so the industry is still paying close attention.

4) Korean Air - Introducing 9 New Aircraft in the Second Half of the Year

- Korean Air is expected to receive 9 new aircraft in the second half of the year

- It was announced on the 18th that Korean Air mentioned this at the NDR (Non-Deal Roadshow·Corporate Briefing Session). It is known that 23 aircraft will be secured this year, focusing on medium-sized aircraft such as the B787. Last year, Korean Air President Cho Won-tae signed a contract worth about 30 trillion won with Boeing to purchase 30 B787-10s (including 10 preliminary orders).

- The number of large and medium-sized aircraft of Korean Air decreased from 92 at the end of last year to 90 at the end of June this year, while the number of small aircraft increased from 47 to 48 during the same period. Including cargo aircraft, the number slightly decreased from 162 to 161 during the same period.

- In contrast, the number of B787-10, a large and medium-sized aircraft, increased from 5 at the end of last year to 9 at the end of June this year. During the same period, B747-8i decreased from 7 to 5, B777 from 36 to 34, and A330 from 22 to 19.

- Korean Air's in-house engine maintenance capacity is about 100 units per year, and it is expected to significantly expand to more than 360 units per year when the Yeongjongdo engine maintenance cluster is completed in 2027. Korean Air said, "It is expected that more than 100 units of non-Captive (non-affiliated) engine maintenance performance will be generated annually in addition to the affiliate fleet. By performing in-house maintenance of B787 and A350 engines, it is expected to reduce maintenance costs and improve aircraft operation efficiency. Last year, we also obtained in-house maintenance authority for the RR Trent XWB engine." It also said, "The relocation of Asiana Airlines to Incheon Airport T2 has been postponed to January 2026, but LCC (low-cost carrier) subsidiaries Air Busan (July) and Air Seoul (September) are scheduled to move to T2 in turn.

- It is predicted that the integration-related procedures will proceed without major disruptions in the second half of the year."

top