EXTRANS GLOBAL - Air Freight News - Week 29 2025

Air Cargo General

1) What's scarier than tariffs is customs clearance issues - No countermeasures for the storm after the U.S. government abolishes de minimis

- Despite the global air cargo market being in the off-season, last week, the freight rates at major global air logistics hubs rose simultaneously. Especially with the possibility of the U.S. and China re-imposing tariffs, the strong upward trend in freight rates centered on China and Europe has attracted the market's attention.

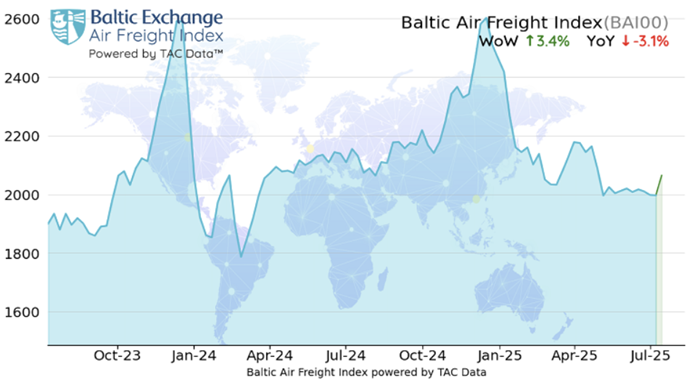

- According to the latest data released by TAC Index, an air cargo freight analysis agency, as of the 14th, the Baltic Air Freight Index (BAI00), which comprehensively covers global air cargo freight rates, rose by 3.4% compared with the previous week.

- This index is only 3.1% lower than the same period last year, indicating an unexpectedly strong performance even in the traditional seasonal off-season.

- In particular, the freight rates of major routes originating from China led the upward trend. According to the latest BAI spot index from TAC Index, the freight rate of the Hong Kong-origin route (BAI30) rose by 1.8% weekly, and the year-on-year decline was only 6.7%. The air cargo freight rate from Shanghai (BAI80) reached a weekly increase of 4.1%, narrowing the year-on-year decline to 3.0%.

- On the other hand, the freight rates from Vietnam to Europe did not change much, but those to the United States fell slightly. The freight rates from India rose on both routes to Europe and the United States.

2) Global air freight rates can't find their place!

- Recently, the U.S. announced that it would abolish the de minimis exemption applicable to imported goods under $800, making the global supply chain industry nervous due to the impact of tariff burdens. However, many logistics and supply chain experts point out that the spillover effect of this abolition policy may lie in the 'customs clearance system' rather than the additional tariff burden, not the 'tariffs' themselves.

- The de minimis exemption system (rather than in terms of cost) has been a core system that has enabled rapid and efficient distribution of goods for small and medium-sized e-commerce companies in the U.S. and overseas sellers. The administrative authorities have overlooked that the full abolition of this system will not only increase the tariff burden but, more importantly, generate a huge amount of additional customs declaration work.

- Regarding the issue of abolishing de minimis, in the reality of the logistics and transportation market, there are not enough personnel and systems to handle the increased customs declaration work, and some point out that this may result in a time cost burden greater than simply bearing additional tariffs.

- One expert pointed out, "The UK had a similar experience during the Brexit process. After Brexit, the annual number of customs declarations in the UK was expected to increase from 50 million to 300 million. At that time, there were warnings that 50,000 additional customs personnel would be needed to handle these declarations, but the UK government actually provided a budget of only 8 million pounds, which could only cover the training costs for about 3,500 people." He also warned that the U.S. government should learn from this lesson.

- However, after the announcement of the abolition of de minimis, the situation in the U.S. is not much different from that in the UK in the past. In this regard, economic professional media reported, "It is estimated that the U.S. needs at least 22,000 additional customs experts, but the U.S. Customs and Border Protection (CBP) is already suffering from a shortage of more than 5,000 personnel. Moreover, it takes at least 2 years to train a customs expert in the U.S."

- People in the logistics and supply chain market pointed out, "The bigger problem is that although the abolition of de minimis has become a reality, neither the government nor the industry has practically taken actions to secure the necessary personnel. Some policymakers claim that AI can replace human resources, but although AI can speed up work, it has limitations in handling the individual characteristics and exceptions of complex declarations."

- In the end, experts point out that the transformation of tariff policies must be supported by a systematic administrative system to make it a reality. It is certain that the U.S. full abolition of de minimis will be a major turning point in the global trade environment, but if the strengthening of the customs clearance system, which is the core of policy implementation, is not supported, the aftershocks such as logistics delays, administrative paralysis, and e-commerce supply chain chaos will be unavoidable.

3) Hungary - Emerging as a key hub of Europe's battery supply chain

- In the global automotive industry transformation centered on electric vehicles (EVs), Hungary is rapidly emerging as a core production base for Europe's battery supply chain. Beyond its role as an assembly base, it is becoming one of the few countries in Europe with a complete 'battery value chain' covering everything from raw material procurement, intermediate product production, cell and module manufacturing, to recycling and export. Based on 2023, Hungary's battery production capacity is about 87GWh, and the government aims to expand it to more than 250GWh by 2030. This scale can meet about 35% of Europe's total demand, and Hungary aims to enter the world's top 4 battery-producing countries (after China, the U.S., and Germany) in terms of output.

- Major South Korean battery cell manufacturers such as Samsung SDI and SK On, as well as material and component partners, took the lead in entering Hungary, which is the core of building this industrial ecosystem. South Korean companies have gained strategic advantages such as trade benefits within the EU region and compliance with local regulations by entering Hungary; the Hungarian government has designated these investments as strategic industries and provided comprehensive support policies such as tax incentives and infrastructure support. In the trend of strengthening sustainability and technical regulations in the battery industry, the supply chain restructuring in Hungary is expected to have a significant impact on South Korean companies' European market strategies.

- Hungary is establishing itself as a key hub of Europe's electric vehicle battery industry and is rapidly evolving from a simple production base to an integrated Green & Global Supply Chain (GSC) center covering front and rear supply chains, technology development, policy systems, and sustainability. Through the "National Battery Strategy 2030", Hungary aims to secure world-class battery production capacity, and while accepting the EU's environmental and trade regulations, it is making all-round efforts to attract Global Value Chain (GVC) investments.

- In this environment, South Korean companies have strategic opportunities in various aspects such as securing stable production bases in Europe, improving market access within the EU, and enhancing eco-friendly competitiveness. Samsung SDI and SK On are actively expanding their production capacity in Hungary, and through joint production of core materials, local processing, recycling, and building on-site customized logistics systems, they are meeting both supply chain stability and origin rules. In particular, the presence of South Korean companies in Hungary goes beyond simple entry and is playing a central role in the ecosystem.

4) 'Integrated Air Incheon' takes off on August 1st

- The integrated corporation of Air Incheon-Asiana Airlines reorganized its organization into 5 headquarters, 2 offices, 8 departments, 35 teams, 22 overseas branches, and 13 parts.

- Under the system of Representative Director Kwan-sik Kim, the Central Control Office, Sales Headquarters, Maintenance Headquarters, Flight Headquarters, Strategy Headquarters, and Management Headquarters are arranged. The head of the Sales Headquarters is Yun-gyu Oh, the head of the Maintenance Headquarters is Je-jin Jeon, the head of the Flight Headquarters is Jong-jin Lee, the head of the Strategy Headquarters is Hwan-gi Bae, and the head of the Management Headquarters is In-gu Kang. The head of the Safety and Security Office is Gil-seong Kim, and the head of the Comprehensive Control Office is Jae-gwang Song. In addition, Director Je-jin Jeon also serves as the head of the Maintenance Planning Department, and Director Jong-jin Lee also serves as the head of the Flight Planning Department, thus completing the organizational restructuring.

- A feature of this organizational restructuring is that many people from Asiana Airlines' Cargo Business Division have been appointed. On the contrary, some of the existing executives of Air Incheon have recently resigned or stepped back to secondary positions during the organizational restructuring process.

- The industry believes that after the representative Seung-hwan Lee stepped down during Air Incheon's acquisition of Asiana Airlines' Cargo Business Division, the system of representative Kwan-sik Kim from Kumho Asiana naturally strengthened the influence of Asiana Airlines personnel. Moreover, after the establishment of the integrated corporation, long-distance routes such as those to North America will be fully operated, and it is interpreted that this may be due to the consideration that the existing Air Incheon employees have relatively insufficient experience in operating medium and long-distance routes.

- Air Incheon is accelerating the chemical integration of about 200 of its own employees and about 800 Asiana Airlines employees. First, with the expanded organization and personnel, Air Incheon will set up a new Seoul office (Won Grove), which is about 1,250 pyeong in size, larger than the previously used office. Recently, an 'integration workshop' was held, and after the establishment, programs for employee integration and communication such as 'front-line meetings' for on-site operations and 'Communication Project' where Air Incheon and Asiana Airlines employees solve common tasks will also be promoted.

- After the establishment of the integrated corporation, preparations for the operation of North American routes are also underway. Air Incheon is considering operating cargo routes covering the eastern and western parts of the United States, including Los Angeles International Airport, San Francisco International Airport, Hartsfield-Jackson Atlanta International Airport, and Seattle-Tacoma International Airport. In addition, Air Incheon announced on the 6th that it will carry out a paid capital increase of 820 billion won through shareholder allocation to resolve related costs such as the acquisition price of Asiana Airlines and merger fees.

- There is also the possibility of trial and error in aircraft operation. The 737F model operated by Air Incheon and Asiana's 747F model differ in size, making transshipment operations difficult. Therefore, even if the two models are dualized into short-distance and medium-to-long-distance routes, if unavoidable transshipment work occurs, there is a high possibility of delayed operations compared to other companies. In addition, the remodeling of Incheon International Airport's 1st Cargo Terminal may also cause time delays in BUP cargo work from Air Incheon's perspective, which has relatively insufficient infrastructure.

- In addition, it is known that not only Korean Air but also other foreign airlines such as Delta Airlines are looking unfavorably at Air Incheon's move to fly to North America, so fierce competition is inevitable.

top