EXTRANS GLOBAL - Air Freight News - Week 28 2025

Air Cargo General

1) The global air cargo market is expected to grow by 4-6% in the first half of the year, but concerns about slowing demand in the second half

- Analysts note that the global air cargo market showed steady growth with a 4-6% increase in the first half of this year, driven by the booming global e-commerce and growth in manufacturing exports. However, the outlook for the second half remains uncertain due to factors such as U.S.-China trade policy uncertainties and geopolitical risks in the Middle East.

- According to DHL Global Forwarding's recently released June 2025 Air Cargo Industry Trends, global air cargo demand grew by 3.5% year-on-year from January to May 2025, with a 4% increase in May alone. Intra-Asia routes, in particular, led market growth with a 12% rise.

- DHL analyzed, "E-commerce and advance procurement of consumer goods remain the biggest growth drivers of the air cargo market. Semiconductors, electronic products, pharmaceuticals, and fresh goods are also boosting premium cargo demand."

- By region, Europe-North America (EU-AMNO) routes grew by 8%, and North America-Latin America (AMNO-AMLA) routes by 18%. Demand from Vietnam, Indonesia, Malaysia, and India is also on the rise due to supply chain restructuring and diversification of production bases.

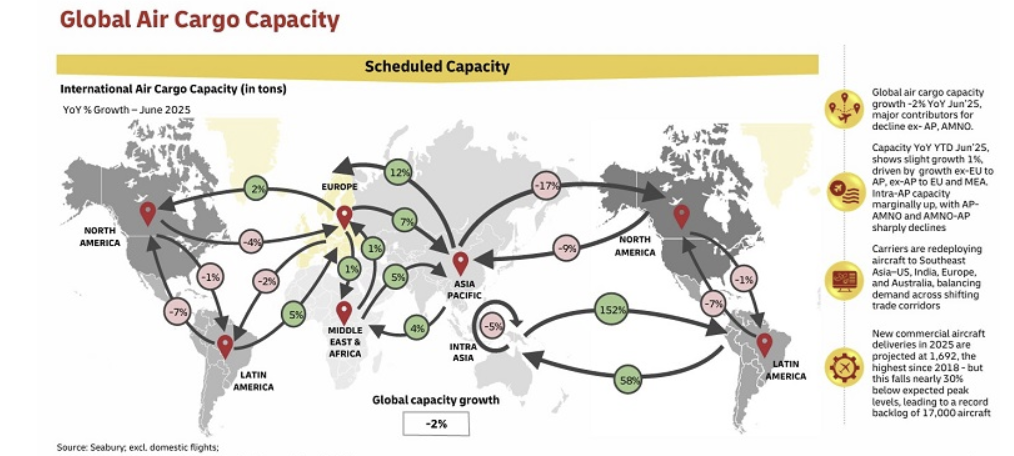

- On the supply side, global air cargo capacity fell by 2% year-on-year in June. While capacity decreased on Asia-Pacific (AP) and North America (AMNO) routes, it increased on Europe-to-Asia and Middle East-Asia (MEA) routes.

- Delays in aircraft supply and escalating geopolitical tensions are the main reasons for supply constraints. Currently, the global backlog of aircraft production stands at approximately 17,000 units, a record high, with the average aircraft age at 14.8 years. Due to parts shortages and delayed aircraft deliveries, airlines are shelving plans to launch new routes or increase flights, or redistributing existing routes.

- The Israel-Iran conflict in the Middle East has led to flight cancellations, and high temperatures have restricted cargo loading at Mexico City (MEX) and New International Airport (NLU), further contributing to reduced supply.

- Looking ahead to the second half of 2025, analysts say, "In Q1 and Q2, advance procurement was active due to concerns about U.S.-China tariff hikes, but the second half may slow down due to reduced export orders."

- In particular, exchange rate fluctuations caused by continued U.S. interest rate hikes and European rate cuts, as well as the global manufacturing downturn, are expected to be risk factors.

- However, the Asia-Pacific region is expected to continue driving global demand through e-commerce and manufacturing exports. Due to the diversification of production bases, demand for intra-Asia routes is also expected to remain strong.

- In summary, the global air cargo market achieved stable growth in the first half of 2025 amid complex factors such as booming e-commerce, supply chain restructuring, and geopolitical risks.

- In the second half of the year, regional differences are expected to intensify as demand slows and supply expands, seeking a balance.

2) Global air freight rates remain sluggish!

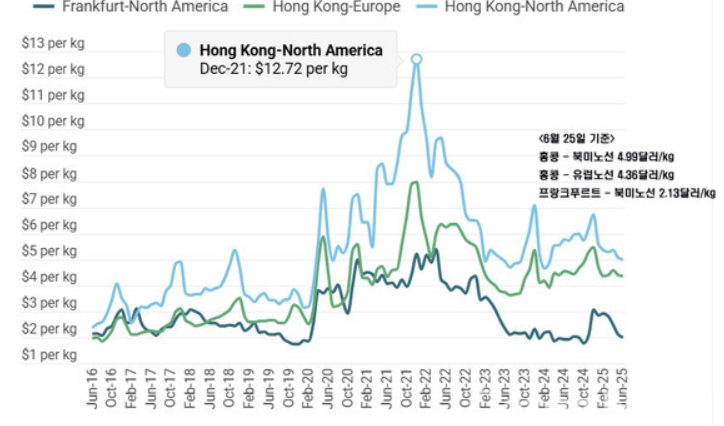

- It seems that global air freight rates are struggling to recover, possibly due to extreme heat. According to the Baltic Exchange Airfreight Index (BEA), the air freight rate for the Hong Kong-North America route in June was $4.99 per kg, down from $5.08 per kg in May and a 13.2% year-on-year decrease.

- This downward trend in freight rates is expected to continue in the short term.

- This is because passenger belly capacity is expected to increase significantly with the arrival of the summer vacation season. Conversely, air cargo demand is unlikely to recover due to intensified U.S. tariffs and the summer off-season. Notably, in June last year, there was a brief peak season as some sea freight shifted to air transport due to the Red Sea crisis.

- The average freight rate for the Hong Kong-Europe route in June was $4.36 per kg, slightly down from $4.39 per kg in May and 4.4% lower than the same period last year.

3) Clouds over the aviation industry's Q2 performance - "Cargo volume down, freight rates falling, LCCs 'continue to lose money'"

- Clouds are gathering over the aviation industry's Q2 performance this year. Low-Cost Carriers (LCCs), which returned to profitability in Q1, are expected to see wider losses in Q2.

- Full-Service Carriers (FSCs), which recorded record-high sales in Q1, also saw both sales and operating profits decline. This is attributed to reduced cargo transport due to the "Trump tariffs" and intensified passenger competition on medium and short-haul routes.

- Korean Air's consensus for operating profit on a standalone basis in Q2 this year is 384.9 billion won, a 6.9% year-on-year decrease.

- The consensus for Q2 sales is 4.038 trillion won, a 0.5% year-on-year decrease, contrasting with Q1, where sales grew to a record high despite a drop in operating profit.

- There is no consensus on the second quarter standalone basis for Asiana Airlines, which was acquired by Korean Air. However, IM Securities recently released a report on the performance outlook of Korean Air, predicting that Asiana Airlines will achieve an operating profit of 31.2 billion won on a standalone basis in the second quarter, which is expected to turn losses into profits. This is due to the reduction in depreciation expenses of the cargo business that will be sold in August, resulting in a 7.5% year-on-year decrease in overall operating expenses.

- The situation for LCCs is more severe. Three out of four domestic listed LCCs are expected to report operating losses. Jeju Air's consensus for operating loss on a consolidated basis in Q2 is 39.9 billion won, wider than the 5.3 billion won loss in the same period last year. Sales consensus is 351.1 billion won, a 21.8% year-on-year decrease. Since the Jeju Air passenger plane accident at Muan Airport in December last year, the number of flights in the first half of this year has decreased by more than 10% year-on-year, affecting performance.

- T'way Air is also expected to see wider losses. Its consensus for operating loss on a consolidated basis in Q2 is 41.5 billion won, up from 21.5 billion won in the same period last year.

- Jin Air is expected to swing to a loss. It recorded an operating profit of 0.9 billion won on a standalone basis in Q2 last year but is projected to post an operating loss of 1.4 billion won this year.

- The aviation industry's struggles in Q2 are due to reduced cargo volume and falling freight rates. The Baltic Air Cargo Index (BAI), a global air cargo freight rate indicator, stood at 1998 in the fourth week of last month, down over 20% from December last year. The main reason is the sharp drop in global cargo demand due to the full implementation of high U.S. tariffs in April.

- With the cargo business emerging as a new key revenue source for the aviation industry, falling cargo freight rates will inevitably hurt airlines' profitability, particularly Korean Air and Asiana Airlines, which operate dedicated cargo planes. Benefiting from the expansion of China's e-commerce market, Korean Air's cargo revenue in Q1 grew 6.0% year-on-year to 1.054 trillion won, accounting for a quarter of total revenue, while Asiana Airlines' cargo revenue rose 5.2% to 370.9 billion won.

- LCCs, which focus on medium and short-haul routes, struggle to cope with falling passenger fares as competition intensifies on routes to Japan and Southeast Asia.

4) French air traffic controllers' strike starting from the 4th - European airspace feared to be in chaos

- French air traffic controllers have announced a strike, putting European airspace in an emergency during the summer vacation season.

- According to Reuters and Politico Europe on local time 2nd, to cope with the nationwide strike by French air traffic controllers scheduled for 3-4th, France's civil aviation authority (DGAC) has asked airlines to reduce the number of flights passing through Paris airports by 40% on the 4th.

- Flights to and from Nice Airport need to be halved, and flights at Lyon, Marseille, Montpellier, Ajaccio, Bastia, Calvi, and Figari airports need to be reduced by 30%. There are concerns that the strike, combined with increased air travel demand during the full-fledged summer vacation season, could cause severe chaos.

- It is pointed out that other factors, such as a shortage of air traffic controllers, increased pilot fatigue, and excessive flights relative to airport size, could exacerbate European air traffic chaos this summer.

- "Airspace and airport runways are limited, and airports have capacity constraints. However, with no room for adjustment, any disruption will cripple the entire system, and this will happen again this summer," they noted.

- To make matters worse, the number of intra-European flights is expected to increase compared to last year.

- EU Transport and Tourism Commissioner Apostolos Tzitzikostas stated in a letter to member states' transport ministers in April, "Last summer, the busiest day in Europe saw 35,000 flights, and this year it is expected to reach 38,000."

5) Airlines Movement

- Vietnam Airlines: Plans to establish a dedicated cargo airline, converting A321 passenger aircraft into freighters, with a launch scheduled for mid-next year. The cargo business will operate completely independently.

- Its cargo business accounted for 65% of revenue in Q2.

top