EXTRANS GLOBAL - Air Freight News - Week 27 2025

Air Cargo General

1)While demand for air cargo from China to the U.S. and Europe continues to be sluggish, signs of recovery are emerging in Southeast Asian markets.

- Despite no clear signs of recovery in air cargo demand from China to the U.S. and Europe, e-commerce volumes have significantly decreased compared to previous years, and regular cargo flights continue to be canceled. Conversely, air cargo demand departing from Southeast Asian countries like Thailand and Vietnam is gradually recovering ahead of the July customs deadline.

- According to a Dimerco report, as political instability in the Middle East is likely to impact Asia-Europe air routes, airlines are expected to reduce flight frequencies to adapt to route and capacity changes.

- "Intra-Asia routes connecting China, Taiwan, Vietnam, Thailand, Malaysia, and Singapore still see strong demand, with freight rates rising year-on-year due to supply shortages," it explained.

- Driven by increased export demand for AI and high-tech products, supply shortages are expected on U.S. routes (Dallas, Chicago, LA). Air freight rates from Taipei to the U.S. are on the rise. While demand for India routes is stable, supply remains tight on Chennai and Mumbai routes, so advance booking is recommended for urgent shipments. Meanwhile, from June 16, the fuel surcharge for TCI and TCII routes was adjusted to NT$28 per kg, and TCIII routes to NT$10 per kg.

- Asiana Airlines has reduced the Tianjin-Incheon route to twice a week since June, while Japan Airlines has resumed the Tianjin-Narita route four times a week (Wednesday to Saturday). Total air cargo volume has shifted to a downward trend since June, especially for Europe-bound shipments. Due to summer high temperatures, there may be cases where airlines cannot load cargo, raising concerns about supply shortages.

- Supply to Vietnam has expanded due to full-capacity additions, while supply to Thailand remains tight. Air China has newly deployed a weekly Tuesday Shanghai-Hanoi direct cargo flight (B747), and Delta Air Lines has resumed the Shanghai-Los Angeles route three times a week (Monday, Thursday, Saturday) using an A350-900 passenger aircraft. However, overall market demand is weak due to sluggish e-commerce and electronic cigarette exports to the U.S.

- While Temu's full-fillment model is partially recovering, overall market demand remains at a low level. Polar Airlines suspended cargo flights from Guangzhou to Cincinnati in June, and the resumption in July will be determined by demand. Delays may occur in customs clearance procedures for dual-use goods exports due to strengthened customs checks.

- Long-haul route freight rates are declining but are expected to stabilize at current levels. Asian regional demand is strong, and supply remains tight.

- The market has been relatively stable since May, but export volumes to the U.S. have slightly decreased, with demand at a similar level to last month. U.S. bookings must be made at least two weeks in advance, and freight rates for Asian routes (including Singapore) are similar to last month. The fuel surcharge will slightly decrease from June 16 to July 15.

- Freight rates and supply remain stable, but U.S.-bound air freight rates may rise when the U.S. 90-day customs moratorium, scheduled to end on July 9, expires.

- Freight rate volatility may increase depending on supply and demand, so continuous monitoring is recommended.

- Escalating Middle East tensions may impact freight rates and supply for EU and U.S.-bound shipments, while air demand is increasing as an alternative to sea logistics delays.

- Shrink wrapping is recommended for shipments to monsoon-affected areas. However, prior acquisition of 'EPR (Extended Producer Responsibility)' certification is required for using plastic packaging materials under Indian customs regulations.

2)T'way Airlines (TW) to Operate 4 Weekly Flights on Vancouver (YVR) Route, Canada

- Starting July 12, T'way Airlines (TW) will operate four weekly flights on the Canada Vancouver (YVR) route using an A330-300 aircraft.

- Additionally, Jeju Air (7C) will operate daily flights on the Singapore (SIN) route from the 24th, using a B737-800 aircraft.

- Meanwhile, China's Juneyao Airlines (HO) will operate four weekly flights on the Wuxi (WUX) and Jeju (CJU) routes from the 2nd, using an A320 aircraft.

- India's IndiGo (6E) has begun operating three weekly flights each from Mumbai (BOM) to Manchester (MAN) and Amsterdam (AMS), using a B787-9 aircraft.

- China Eastern Airlines (MU) will operate one weekly flight on the Nanjing (NKG)-Paris (CDG) route from the 9th and three weekly flights on the Shanghai (PVG)-Copenhagen (CPH) route from the 17th, using a 777-300ER and A330-200 aircraft, respectively.

- Etihad Airways (EY) of the United Arab Emirates (UAE) will operate four weekly flights on the Abu Dhabi (AUH)-Atlanta (ATL) route from the 2nd, using an A350-1000 aircraft, expanding to daily operations from November.

- United Airlines (UA) of the U.S. will also operate daily flights on the Tokyo (NRT)-Kaohsiung (KHH) route in Taiwan, using a 737-800 aircraft.

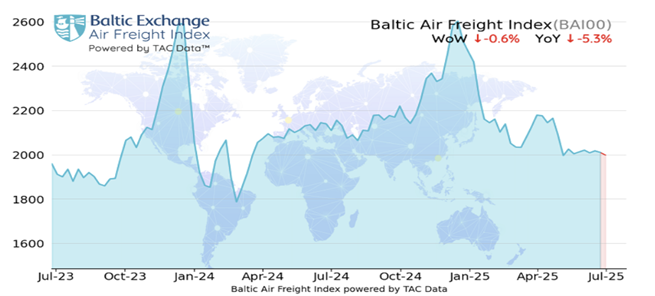

3)Global Air Cargo Freight Rates Slightly Decline – TAC Index Shows Market 'Wait-and-See' Despite Middle East Turmoil

- Global air cargo freight rates slightly declined last week, continuing a correction trend. The Baltic Air Freight Index (BAI00) as of June 30 fell 0.6% week-on-week and 5.3% year-on-year, according to the TAC Index.

- This decline occurred despite recent major disruptions to Middle East flights, with the overall market decline considered rather limited.

- Particularly, even after the 90-day customs moratorium agreement between the U.S. and China, the trend of cargo flights shifting significantly from Pacific routes to other regions has not fully reversed, with some market participants holding a somewhat pessimistic view on future global demand prospects.

- First, air freight rates from China varied by route: slightly declining for Europe-bound shipments but rising in U.S. dollar terms for North America-bound ones.

- The Hong Kong-origin freight index (BAI30) fell 1.5% week-on-week to 10.9% below the previous year, while the Shanghai-origin freight index (BAI80) rose 0.5% week-on-week but remained 7.6% below the previous year.

- Markets outside China in Asia also showed mixed trends: India-origin Europe-bound freight rates rose, U.S.-bound rates fell, while Vietnam-origin U.S.-bound rates rose and Europe-bound rates fell.

4)T'way Airlines' 'Dream of Direct Routes' vs. 'Reality of Losses' in Sole Route Betting

- T'way Airlines has consecutively launched exclusive international routes to less competitive destinations such as Zagreb (Croatia), Bishkek (Kyrgyzstan), and Tashkent (Uzbekistan) in the first half of this year.

- This is interpreted as a strategy to expand its global market presence, build a long-haul network, and pursue a differentiated brand image of "T'way Airlines' unique skyway." The aviation industry expects this strategy to effectively preempt demand in specific regions.

- "T'way Airlines has well-utilized structural opportunities such as the recovery in demand for medium- and long-haul routes after the pandemic and the allocation of some slots to LCCs during the merger process of Korean Air and Asiana Airlines," evaluating that exclusive routes can strengthen T'way Airlines' unique brand image and absorb monopolistic demand in specific regions.

- However, price competitiveness and operational efficiency remain challenges to address. For the Zagreb route, despite being an LCC, freight rates are set similarly to or even higher than those of major airlines. There are concerns that diluting the core strength of LCCs—"low prices"—could weaken its identity.

- Additionally, the medium- and long-haul aircraft (A330-300) owned by T'way Airlines cannot fly directly to Zagreb, requiring mid-air refueling at Bishkek (Kyrgyzstan) Airport.

- The aircraft deployed on the Zagreb route on June 14 last year was replaced with an Osaka-bound aircraft due to mechanical defects, sparking controversy, with some criticizing that T'way Airlines rushed into operations without proper preparation after securing the Zagreb route in 2020.

- In this context, T'way Airlines, recently acquired by the Dae Myung Soo Group, has appointed a new CEO: a task force (TF) executive in charge of aviation business at Soo International, a former Korean Air executive. This CEO, a 'field-type leader' with a major in aeronautical engineering and over 20 years of experience in aircraft maintenance, MRO (maintenance, repair, and overhaul), human resources management, and policy planning at Korean Air, is expected to address the first test of financial structure improvement.

- As of the first quarter of this year, T'way Airlines' debt ratio reached 4353%, with losses exceeding 117.7 billion won. While exclusive route expansion could be the key to long-term profitability improvement, risk management of initial investment burdens, market uncertainties, and external variables like high exchange rates and interest rates is essential.

top