EXTRANS GLOBAL - Air Freight News - Week 49 2024

Air Cargo General

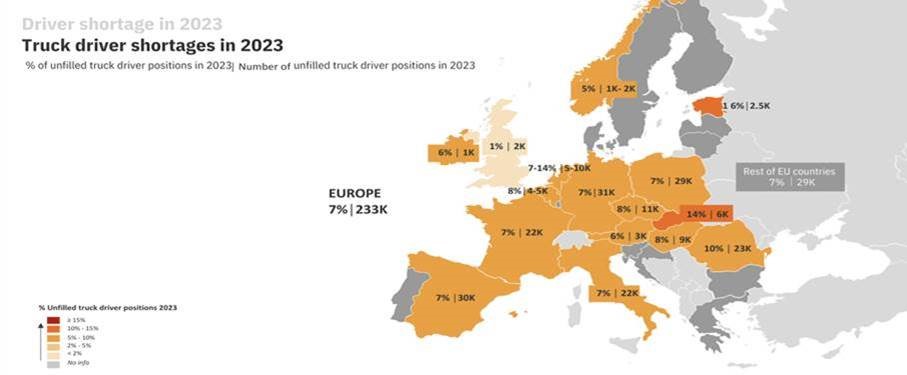

1) Europe's truck driver shortage crisis is worsening – disruptions in land transportation are driving up freight rates.

- A study has revealed that the European land transportation industry is facing serious difficulties due to a shortage of drivers.

- The annual driver shortage analysis report by the International Road Transport Union (IRU) indicates that there is a shortage of about 500,000 drivers in Europe, accounting for 12% of all driving positions. This situation is attributed to an economic slowdown and is similar to last year's levels.

- Notably, 70% of European transportation companies reported experiencing serious or very serious difficulties in hiring drivers, a slight decrease from 71% last year. However, the IRU predicts that the situation will worsen next year.

- An official stated, "Almost no companies expect these difficulties to decrease next year," and mentioned that due to an aging workforce and a 1.5% economic growth rate, transportation activities are increasing, leading to a projected rise in the current 12% vacancy rate to 15%.

- A larger issue is the declining number of skilled drivers. Transportation companies are sourcing new drivers regardless of gender or nationality, but the rising labor costs and the burden of training unskilled drivers are increasing.

- Additionally, the proportion of women among all employees in European transportation companies is 47%, but only 4% of truck drivers are women.

- Globally, the percentage of female truck drivers is around 7%. At the same time, the lack of young drivers is also a concern, with 36% of truck drivers in Europe being over 55 years old, many of whom are expected to retire within the next 10 years.

- Currently, only 6% of European truck drivers are non-European nationals. While hiring overseas labor could be a short-term solution, the complexities of current labor regulations and driving standards create challenges.

- Ultimately, the shortage of truck drivers in Europe poses a major threat to economic growth and the stability of logistics supply chains, highlighting the urgent need for systematic solutions across the industry.

2) The Ministry of Land, Infrastructure and Transport expands international flights, including increased direct flights to the Czech Republic - allocation of airlines to 15 routes.

- On the 27th, the Ministry of Land, Infrastructure and Transport announced plans to allocate transportation rights for 15 routes to eight national airlines during the Air Traffic Review Committee meeting.

- Specifically, three competitive routes were allocated: Korea-Czech Republic, Incheon-Tashkent (Uzbekistan), and Incheon-Guilin (China), along with 12 non-competitive routes, including Korea-Greece, Seoul-Nordic countries, Korea-Manila, and Korea-Kazakhstan.

- As a result of this allocation, direct flights to the Czech Republic will increase to seven times a week for the first time in 26 years, and the route to Guilin, China, will be resumed. The ministry stated that this will broaden access to various regions, including Central Asia and Europe, and further strengthen the international flight network.

- Meanwhile, for the three routes that had multiple airline applications, competition arose, and decisions were made through the 'Transportation Rights Allocation Rules' and the Air Traffic Review Committee review.

- First, during the air talks with the Czech Republic held in July, coinciding with nuclear cooperation and an official visit, the Korea-Czech route’s transportation rights were increased from four flights a week to seven for the first time in 26 years. Korea Air had previously operated solo with four flights a week, but now Asiana Airlines will receive three additional flights. This is expected to enhance economic and cultural cooperation between the two countries and improve travel convenience.

- The route to Uzbekistan will also see an increase. Following the air talks in September, the Incheon-Tashkent route was increased from ten to twelve flights a week, and during this review meeting, Jeju Air and T'way Air were each allocated one additional flight per week. Thus, these two airlines will now have four flights each, in addition to the three they received in the first half of the year, aiming to start operations next year. This is expected to strengthen Incheon International Airport's role as a hub connecting Central and East Asia.

- Additionally, among non-competitive routes where only one airline applied, Greece and the three Nordic countries (Denmark, Sweden, Norway) were allocated rights through this committee, laying the foundation for expanding new networks across Europe, as there had been no airline entry for these routes previously.

3) Jeju Air and T'way Airlines Compete for the 'LCC Throne' - Accelerating Alliances for Survival

- The merger between Korean Air and Asiana Airlines will not only establish a large airline (FSC) representing Korea but also integrate three low-cost carriers (LCCs) under the two companies, namely Jin Air, Air Busan, and Air Seoul, thereby creating a "mega LCC."

- After merging with Asiana Airlines, Korean Air plans to gradually integrate Jin Air (operating 29 aircraft), Air Busan (24 aircraft), and Air Seoul (5 aircraft) under its umbrella. A representative from Korean Air stated, "To enhance the competitiveness of our LCCs, we need to increase the fleet size and improve cost competitiveness through integrated operations," adding that "the launch timing of the integrated LCC will be decided through consultation among the three companies."

- If the three LCCs operate as an integrated unit, they would surpass Jeju Air (42 aircraft) in terms of the number of aircraft (58 aircraft) and become the largest. The revenue of the integrated LCC (based on last year's figures) would also reach 2.5 trillion KRW, far exceeding Jeju Air's 1.72 trillion KRW, and the market share for international passenger transport would rise to 14.9% (based on last year's figures), ahead of Jeju Air's 10.8%.

- In response, Jeju Air is also preparing to expand its size. Jeju Air CEO Kim Yi-bae stated in an internal announcement in July, "Airlines with private equity fund (PEF) stakes will eventually become targets for sale," and "if opportunities for mergers and acquisitions (M&A) arise, we will respond actively." Currently, the largest shareholders among LCCs with private equity funds are Eastar Jet and Air Premia.

- T’way Airlines is also challenging for the title of "LCC champion." During the merger process between Korean Air and Asiana Airlines, T’way Airlines acquired four European routes from Korean Air,

- Becoming the first domestic LCC to secure European routes, and received five aircraft along with over 100 pilots and crew members.

- T’way Airlines and Air Premia are engaged in a share competition between their first and second largest shareholders, and Daemyung Sono, a resort company, has recently been acquiring shares in T’way Airlines and Air Premia, becoming the second-largest shareholder of both companies. Industry insiders note, "Daemyung Sono is keeping an eye on airlines to expand its business area," and predict that "in the case of T’way Airlines, the difference in shares with the first-largest shareholder, Yerimdang, is not significant, so it could easily become the largest shareholder through market purchases."

- They added, "If the financially strong Daemyung Sono participates in the management of T’way Airlines, it could shake up the dynamics of the LCC industry."

4) Turkish Airlines Launches Service to Sydney, Australia - Successfully Operates Longest Route with A350

- Turkish Airlines, which operates in the most countries worldwide, has successfully completed its longest flight service with the addition of a new route to Sydney.

- The national carrier of Türkiye, Turkish Airlines, landed at Sydney Airport on November 29, expanding its global network to 351 destinations across six continents with this second route to Australia.

- The route between Istanbul and Sydney will be served by Turkish Airlines' new Airbus A350-900 aircraft. The Sydney route, which operates four times a week via Kuala Lumpur, has a flight time of 19 hours and covers a distance of 9,300 miles.

- Following the inaugural flight to Melbourne in March of this year, Turkish Airlines has successfully added Sydney as its second destination in Australia, further expanding its operational network.

top