EXTRANS GLOBAL - Air Freight News - Week 46 2024

Air Cargo General

1) Will 'Trump 2.0' hit e-commerce hard?

- If Trump were to enter a second term, it is expected that the e-commerce transportation market from China would inevitably face a temporary impact.

- Many global market experts are concerned that the demand for e-commerce, specifically air freight, which has become absolutely reliant, may significantly decline.

- The problem is that the Biden administration, which has been sluggish for various reasons, is likely to end the “de minimis” rule, which exempts U.S. imports valued under $800, soon.

- In this case, not only will shipping costs rise, but delays are also expected due to customs clearance and inspections, meaning that even if goods are transported by air, the time taken for delivery to end consumers will significantly increase. Ultimately, this analysis suggests that the volume of air freight will inevitably shrink.

- "As costs increase not only from a financial perspective but also due to administrative burdens, the time taken for transportation from the point of origin to the destination will lengthen, reducing the attractiveness of air transport and causing carriers to lose some of the speed advantages they currently have," an industry expert forecasts.

- According to market players, e-commerce volumes are currently imported into the U.S. in minimal-sized packages, allowing for very quick customs clearance, so for routes from China to the U.S., products can be delivered to end consumers within 7 to 9 days. However, if there are general reporting requirements, it can take about a week just to pass through customs.

- However, other experts believe that while the volume of shipments from e-commerce platforms may decrease psychologically, the likelihood of this being a long-term trend is low. This is because the elimination of “de minimis” will take a considerable amount of time, and policymakers, who will have to consider the aftermath, are more likely to use methods to continually raise psychological pressure rather than hastily implement it.

- Although shipping delays are expected, end consumers already using these platforms are accepting and adapting to the fact that the receipt of e-commerce goods will be delayed. The issue, however, is where the burden of increased costs due to customs duties will fall, particularly regarding how e-commerce platforms will handle this.

- In conclusion, it is still too early to accurately determine what specific measures Trump’s second term would take and what impact it would have.

- Some believe that despite the pressures from the Trump administration, demand for e-commerce will continue. However, shippers concerned about future conditions may expedite shipments, and there is also an analysis suggesting that the scale of e-commerce on the Asia-Europe/U.S. trade routes may decrease in the short term.

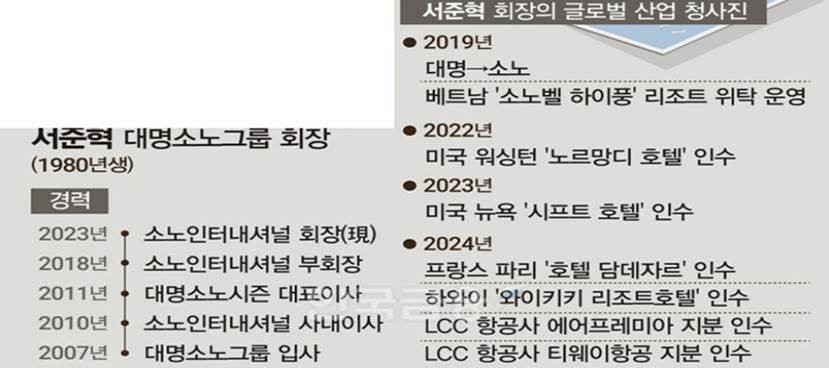

2) Daemyung SoNo's Bold Move: Riding LCCs to a 'Global' Big Picture

- Daemyung SoNo Group, a hotel and resort company, has recently emerged as a hot topic in the aviation industry by becoming the second-largest shareholder in two low-cost carriers (LCCs), T'way Air and Air Premia. This is expected to accelerate Chairman Seo Jun-hyuk's long-standing goal of entering the global market.

- However, the possibility of a management dispute with T'way Air and Air Premia seems to be a challenge that Daemyung SoNo Group will need to resolve.

- Daemyung SoNo Group’s holding company, Sono International, signed a contract in October to acquire half of the shares held by JC Partners, which co-operates Air Premia. They also obtained a call option to purchase the remaining 50% by June next year. Currently, the largest shareholder of Air Premia is AP Holdings (46%), and the second-largest is JC Partners (22%).

- The major shareholder of T'way Air, Yerimdang, is also showing signs of instability. Yerimdang holds 39.85% of T'way Holdings. T'way Holdings has a structure where special relations and T'way Air account for 29.97% of the shares. Sono International has acquired 26.77% of T'way Air, with only a 3.20% gap from Yerimdang.

- Daemyung SoNo Group has maintained its existing position by stating, "We do not consider acquiring management rights in either company." Regarding AP Holdings' intention to defend its management rights, they also stated, "Since we have no plans regarding management rights, we have no additional comments." While there is much external commotion, Chairman Seo Jun-hyuk's long-anticipated 'global business expansion' is becoming visible.

- Chairman Seo previously attempted to acquire T'way Air in 2011 when he was the head of Daemyung Enterprise (now Daemyung SoNo Season). Although he withdrew from the acquisition at that time due to disagreements on price, this was when he began to show serious interest in the aviation industry.

- Born in 1980, Chairman Seo is the eldest son of the late founder Seo Hong-song. After the founder passed away in 2001, his mother, Honorary Chairwoman Park Chun-hee, designated him as the successor. After joining Daemyung SoNo Group in 2007, he became a board member of key affiliates such as Sono Hotel & Resort and Daemyung Corporation within three years. He was promoted to vice chairman in 2018 and finally ascended to the position of chairman in 2023.

- At the time of his promotion to vice chairman, he began to actively outline plans for 'global expansion.'

3) Large airlines urgently need countermeasures as they will not go to the new airport.

- Despite the opening of the new airports in Daegu-Gyeongbuk and Busan's Gadeokdo, Incheon Airport's own research indicates that their presence will be minimal. Based on this internal study, Incheon Airport is currently reviewing a fifth-phase expansion.

- However, the conditions for international route operations presented by the two major domestic airlines in the study suggest that it will be realistically difficult for the two new airports to meet these requirements, indicating that countermeasures are needed.

- The projected opening date for the Daegu-Gyeongbuk and Busan Gadeokdo new airports is 2030, and the Incheon International Airport study estimates that the proportion of new international passengers using these two airports during this period will be only 1.03% of the total passenger volume across the country.

- Even after an additional 20 years, this figure is expected to rise only to 2.44%, suggesting that the role of the new airports will be extremely limited.

- The core factors presented by the two major domestic airlines, Korean Air and Asiana Airlines, for international route operations are based on criteria such as "an average occupancy rate of over 80% and operations at least three times a week."

- Aviation experts predict that the two new airports in Daegu-Gyeongbuk and Gadeokdo will be unable to meet these conditions, and thus, large airlines are likely to continue using Incheon Airport.

- This situation contradicts the original intent of constructing new airports to open air routes for the region and promote balanced national development. The Incheon Airport study does not reflect the so-called "induced demand" that new airports generate, nor the demand from low-cost carriers that are expanding into long-haul routes in Europe and elsewhere.

- In fact, there is a global trend of low-cost carriers gaining strength, and last year, the proportion of passengers using low-cost airlines surpassed that of full-service carriers.

- "Since low-cost carriers are currently specializing in regional routes, they have the ability to supply routes based on local demand if the local community desires it."

- If Incheon Airport proceeds with the fifth-phase expansion without considering these points, the survival of the new airports in the Yeongnam region will likely become even more challenging.

4) Air Cargo Market Regulations Will Increase Next Year’ - IATA Releases ‘2025 Strategic Priorities Report’

- With the introduction of the Air Cargo Advance Screening (ACAS) system by the United States, it is expected that regulations requiring advance information in the global air cargo industry will expand.

- Recently, the International Air Transport Association (IATA) pointed this out in its ‘Cargo Operations 2025 Strategic Priorities Report,’ predicting that starting with the United States, major countries such as the European Union (EU), Canada, the United Arab Emirates (UAE), and the United Kingdom will successively implement similar regulations, leading to over 35% of global air cargo being subject to these regulations by 2025.

- In particular, following the implementation of ACAS in the U.S. in 2018, the EU introduced the Import Control System 2 (ICS2), under which approximately 800,000 cargo shipments are reported daily, thereby expanding regulations for advance information provision. Canada plans to implement similar regulations starting in November 2024, while the UAE and the UK are also targeting implementation by 2025.

- IATA has urged the air cargo industry to expedite the adoption of sustainable packaging materials. With global e-commerce revenues expected to reach approximately $6.3 trillion by the end of 2024, the use of packaging, particularly single-use plastics (SUPP), is rapidly increasing.

- According to an ATA survey, 75% of the air cargo industry has developed strategies to reduce single-use plastic usage; however, they face difficulties in implementation due to cost and quality issues. The survey revealed that only 35% reuse single-use plastics, 26% use recycled plastic products, and only 11% have adopted biodegradable plastic products. However, it was found that over 40% of companies have adopted reusable alternatives.

- As air cargo regulations tighten in various countries, new challenges are emerging for the South Korean air cargo industry.

5) Airline/GSA Movement

- TK: Strengthening cargo network cooperation through AIVANCA transatlantic cargo operations. Starting on November 3, cargo flights from IST-LGG-MIA will commence in collaboration with AV to enhance the network in Latin America.

top