- Company

-

Specialized Products

Warehousing Solution

Specialized Freight Solutions

Multimodal Freight Solutions

GSA, CSA & SC

- Service

- Blog

- Cargo Tracking

- Contact Us

- Site Map

The Power of Logistics to Move the World!

It's the Power of extrans.

EXTRANS GLOBAL - Air Freight News - Week 45 2025

1. Air Cargo General

1) November Air Cargo Market – Driven by AI and E-Commerce

Taiwan-based Dimerco Express, a global freight forwarder, stated in its November Asia-Pacific market trend analysis report that the global air cargo market has entered a clear recovery phase since November.

Since October, shipments of artificial intelligence (AI) servers and e-commerce products have surged, driving freight rates upward—particularly on routes to North America and Southeast Asia. Exports from South Korea have also entered a moderate growth phase.

Dimerco noted that the temporary suspension of U.S.-China tariffs, combined with disrupted sea freight, has led to rapidly tightening capacity on major routes.

Demand for air cargo originating from South Korea is steadily increasing, centered on North America routes. IT-related goods such as semiconductors and electronic products, along with e-commerce cargo, are driving the market. Dimerco emphasized that booking for North America routes requires at least one week’s advance notice.

Demand is also expanding on routes from Incheon to key Asian production hubs such as Singapore, Phnom Penh, and Kuala Lumpur. Cargo volumes for machinery and equipment on Incheon-Southeast Asia routes are growing steadily, and competition for capacity is expected to intensify further after mid-November.

Dimerco added: “In China, pre-tariff shipment volumes are rising, pushing up freight rates on routes to the U.S. West Coast (USWC) and Southeast Asia. Hong Kong and Taiwan are also performing strongly due to increased shipments of high-tech components and IT equipment.”

The Southeast Asian market has entered peak season demand ahead of Black Friday and Christmas. Volumes on Vietnam-Thailand to U.S. routes have surged, leading to extremely tight capacity—with some regions experiencing 3–5 day shipment delays.

“Peak season demand to North America and expanded shipments of high-value electronic products will drive the air cargo market through mid-November,” Dimerco said. “Sea freight supply conditions and the outcome of U.S.-China tariff negotiations are expected to shape market trends from late November to year-end.”

In conclusion, the November air cargo market is seeing a “late peak season rebound” driven by AI and e-commerce products. A short-term decline in volumes is expected in December due to year-end inventory adjustments, with new demand from inventory restocking likely to emerge in Q1 2026.

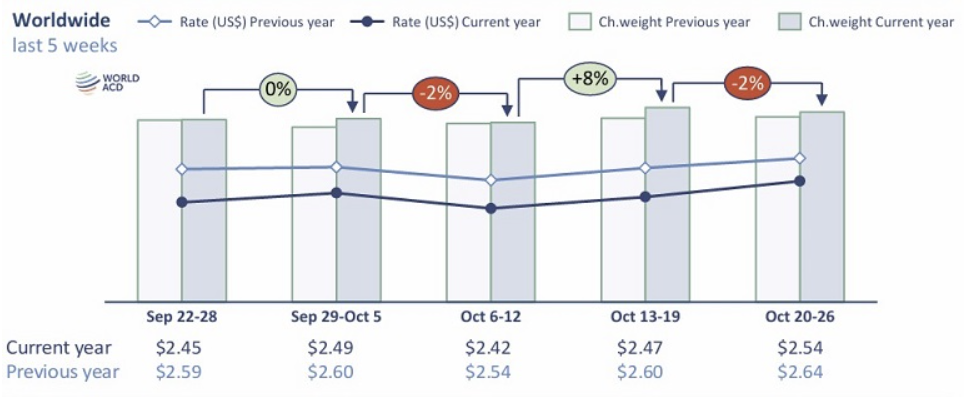

2) WorldACD – Air Freight Rates Surge 4% in Late October, Signaling Full-Fledged Peak Season

The global air cargo market entered a strong upward trend in the last week of October, marking the official start of peak season. Despite a temporary drop in volumes due to India’s Diwali (Festival of Lights) holiday, air freight rates from the Asia-Pacific region soared—reflecting clear demand recovery ahead of year-end.

In Week 43 (October 20–26), global air cargo spot rates rose an average of 4% week-on-week (WoW). Mirroring trends from the same period last year, rates from the Asia-Pacific, Europe, and North America all increased by over 5%, driving the global average.

In contrast, rates in the Middle East and South Asia fell by 4%, with volumes dropping 16%. As a result, global total volumes declined 2% WoW—though excluding India-origin shipments, the drop narrowed to just 1%.

Notably, air freight rates from the Asia-Pacific region showed a sharp upward trend ahead of the year-end shopping season:

- Asia-to-U.S. rates rose 8% WoW.

- China-to-U.S. rates surged 11% to $5.40 per kg, a 2024 high.

- South Korea-to-U.S. rates jumped 21% to $5.73 per kg, the highest since July.

- Vietnam-to-U.S. rates also increased by 6%.

This upward momentum is attributed to recovering demand for e-commerce and IT products ahead of the U.S. Thanksgiving holiday, following China’s National Day and South Korea/Taiwan’s Chuseok holidays. Capacity constraints are intensifying as North America-bound flight schedules fill up rapidly.

Meanwhile, Asia-to-Europe rates were relatively less volatile but still rose 2% WoW to $4.02 per kg:

- China-to-Europe rates climbed 2% to $4.08 per kg, the highest since early June.

- South Korea-to-Europe rates rebounded 5%, extending gains for two consecutive weeks.

- Vietnam-to-Europe rates also increased by 5%.

“Rate strength from Asia is expected to continue in the near term as Black Friday and Christmas shipments concentrate from early November,” WorldACD stated. “Major routes from China and South Korea are likely to maintain above-year-ago rate levels.”

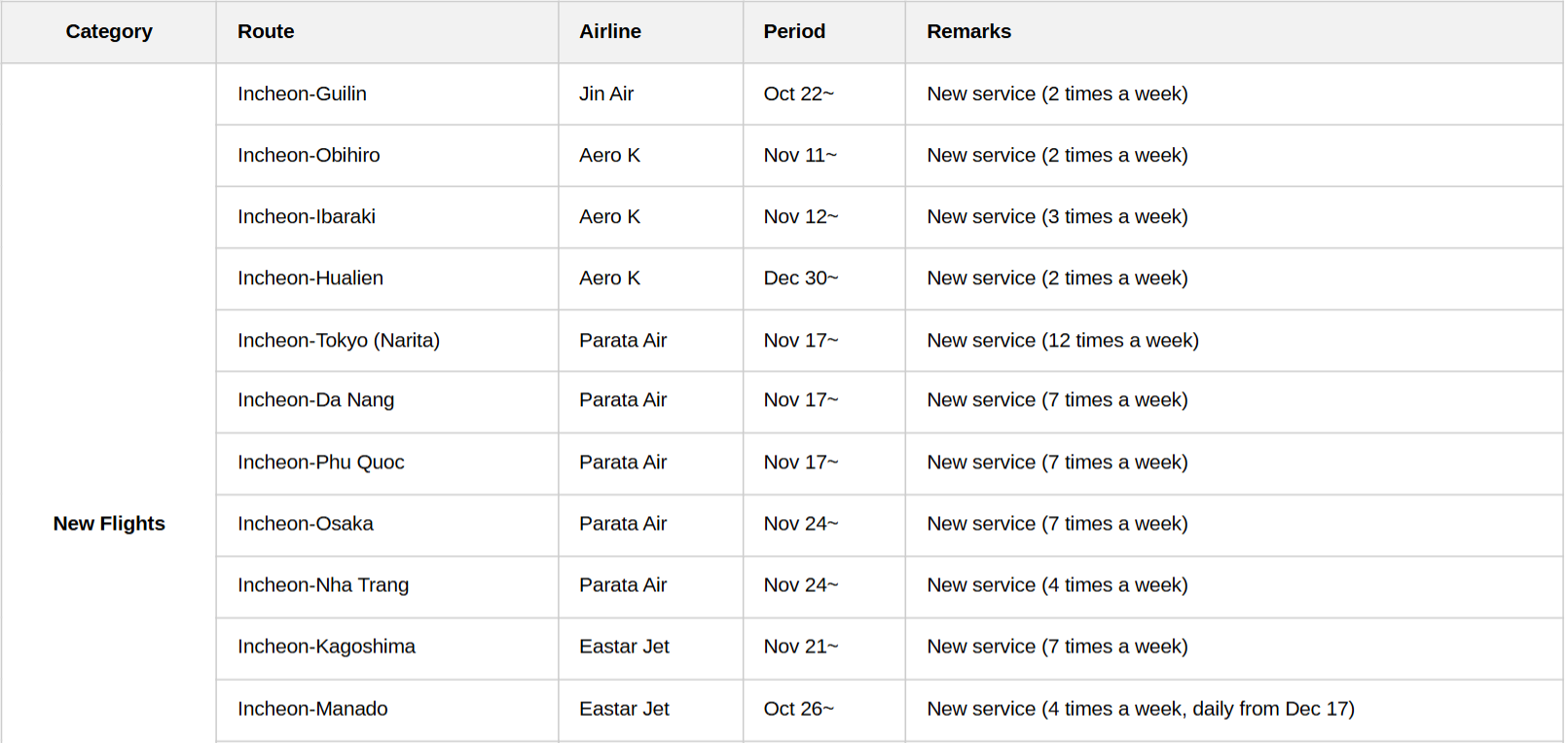

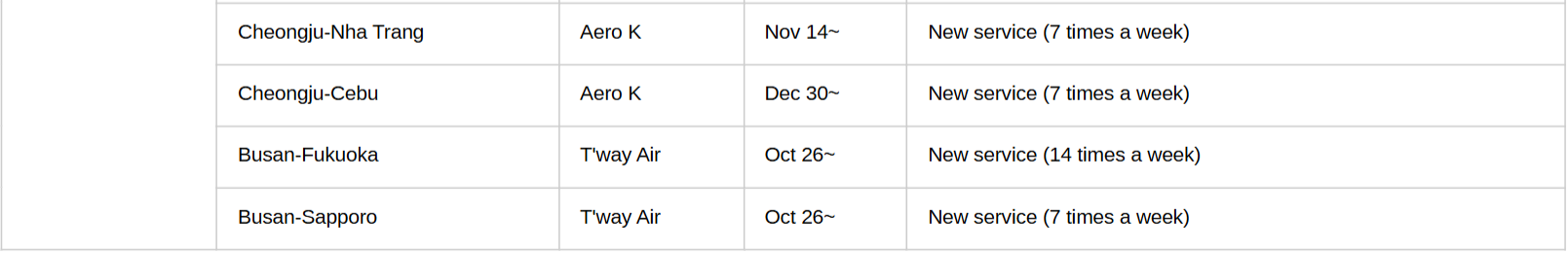

3) Drought in New Route Launches for Winter Season – LCCs Adjust Expansion Pace

According to South Korea’s Ministry of Land, Infrastructure and Transport, international flight frequencies for this year’s winter season are expected to reach a maximum of 4,973 weekly—slightly up from 4,897 weekly last year but marginally down from 4,980 weekly in 2019.

New route launches are fewer than in previous years, with no domestic or foreign airlines expanding capacity on long-haul routes. This comes as international air supply has already grown to competitive levels, coupled with slowing growth in domestic overseas travel demand. While conditions vary by airline, several are facing fleet shortages.

In response, South Korean airlines are adopting a “focus strategy,” prioritizing proven popular destinations in Southeast Asia, Japan, and China—markets where winter season demand is strong.

- Parata Airlines will launch 7 weekly flights on new routes starting November 17.

- The Nha Trang route, already served by 9 domestic and foreign airlines, will welcome Aero K’s Cheongju-Nha Trang route (7 weekly flights).

- Jin Air, which maintains stable sales on the Incheon-Nha Trang route, will double frequencies from 7 to 14 weekly during the winter season.

- For Da Nang: Parata Airlines will launch new Incheon-Da Nang flights, while Jin Air plans to increase Busan-Da Nang frequencies from 7 to 14 weekly.

Airlines are implementing cautious strategies, focusing on routes with stable load factors from their existing networks.

4) “Loss-Making Flights” Even During Peak Season – Aviation Industry Earnings Shock

South Korea’s aviation industry is facing heightened crisis as it recorded an earnings shock during the Q3 peak season. Despite the traditional summer-autumn boom period, earnings failed to improve due to a combination of intensifying global supply competition, high exchange rate burdens, and worsening cost structures.

Korean Air, the first to release results, reported Q3 consolidated revenue of KRW 4.085 trillion and operating profit of KRW 376.3 billion—down 6% and 39% year-on-year (YoY), respectively. Net profit plummeted 67% YoY to KRW 91.8 billion.

The challenge extends beyond Korean Air: Asiana Airlines and low-cost carriers (LCCs) are also expected to see simultaneous declines in revenue and operating profit in Q3, pressured by high exchange rates, rising lease costs, and intensified competition.

Jeju Air is projected to be the hardest hit. According to financial data firm FnGuide, its operating profit is estimated to drop 95.4% YoY to KRW 2.2 billion. Air Busan’s operating profit is forecast to fall 60% YoY to KRW 15 billion, while Jin Air’s is expected to decline 48% YoY to KRW 20.9 billion.

The Q4 outlook remains bleak, though short-term recovery in passenger demand is anticipated due to October’s extended Chuseok holiday. Additionally, the extension of visa-free entry for Chinese group tourists until next year is expected to have a positive long-term impact on route expansion and load factor improvement.

5) Airlines Movement

- China Southern Airlines (CZ): Deployed B787 aircraft on the ICN-CAN route (3 weekly flights) from October 26 to November 14.

- China Eastern Airlines (MU): Launched 2 weekly flights on the PVG-EZE route (aircraft model: B773) from December 4 to March 27, 2026.

- Virgin Atlantic (VS): Scheduled to operate daily non-stop flights on the ICN-LHR route starting March 29 next year (aircraft model: B787-9 Dreamliner).

top