EXTRANS GLOBAL - Air Freight News - Week 45 2024

Air Cargo General

1) T'way Air Launches All European Routes – Rated 'Successful' with an Average Load Factor of 85%

-

T'way Air's average load factor for its major European routes has exceeded 80%, indicating that it has surpassed the breakeven point. The European Commission (EC) had stipulated successful transfer of major European routes as a condition for the merger approval of Korean Air and Asiana Airlines, suggesting a positive outlook for the merger.

-

T'way Air's load factor for its European routes is reported to be 84.5%. From August 8 to 24, the total seat supply for T'way’s routes to Rome, Barcelona, Paris, and Frankfurt was 46,494, with 39,287 passengers boarding. The typical breakeven point is 80%. Based on the average load factor, it appears to be operating above the breakeven point.

-

There are some variations by route. The Incheon-Rome route, which started on August 8, has the highest load factor at 92.5%. The Incheon-Paris route, which began operations on August 28, barely exceeded the breakeven point with a load factor of 81.9%. However, the load factors for the Incheon-Barcelona and Incheon-Frankfurt routes were 79.9% and 76.9%, respectively.

-

The routes to Rome, Barcelona, Paris, and Frankfurt are also key requirements for the merger of Korean Air and Asiana Airlines. In response to concerns from the EC about Korean Air's monopoly on European routes, Korean Air agreed to transfer these routes and provide crew and aircraft support. The EC is expected to monitor whether T'way establishes its European routes when making the final approval of the merger.

-

An industry insider stated, "Korean Air has fulfilled most of the prerequisites, including selling off Asiana Airlines' cargo division. If T'way Air's European routes stabilize, there will be no further reason to delay approval."

2) Despite the outlook of a global economic slowdown, manufacturing growth from Asia continues

-

According to the Asia-Pacific cargo market analysis report, the peak season for air cargo that began right after China's National Day holiday, along with the growth of e-commerce, is driving up freight rates in conjunction with the launch of new electronic products.

-

In particular, the supply of major intra-Asia air routes is limited, and airlines are allocating more cargo capacity to long-haul routes in pursuit of higher profits, making November the busiest month of the peak season.

-

Consequently, most forwarders operating in the Chinese market are experiencing increased demand for cargo to the U.S. and Europe, leading to congestion at some airports, with recommendations to complete bookings at least a week in advance.

-

Furthermore, in southern China, e-commerce volumes are surging ahead of year-end discounts such as Singles’ Day on November 11, Black Friday, and Christmas, causing rising freight rates. It is noted that space for flights departing from China is extremely limited.

-

Additionally, it is stated that "in South Korea, increased semiconductor demand has led to a shortage of air cargo space to the U.S., and this supply constraint is expected to continue until the end of the year. Booking at least two weeks in advance is recommended, reflecting a critical flow in the Korean semiconductor supply chain."

-

However, contrasting situations are emerging in Southeast Asia by country. In Vietnam, many manufacturers are accelerating production to meet fourth-quarter orders, leading to expected space shortages, while Malaysia is showing signs of export slowdown.

-

Moreover, securing space for long-haul transportation is proving difficult in Singapore and the Philippines, resulting in upward pressure on freight rates.

-

In particular, India's Diwali festival, which lasts until November 3, is expected to drive a surge in demand for consumer goods such as electronics, clothing, and decorations, raising concerns about shortages in air and sea cargo space. This could lead to delays due to labor shortages on-site, in addition to simply causing freight rate increases.

-

Although negative forecasts dominate the peak season outlook, overall, the peak season for the air cargo market in 2024 is expected to see increased pressure on freight rates and space due to factors such as rising year-end demand, expanding e-commerce, high oil prices, and a strong U.S. dollar.

3) Current Air Cargo Supply/Demand and Price Trends Update

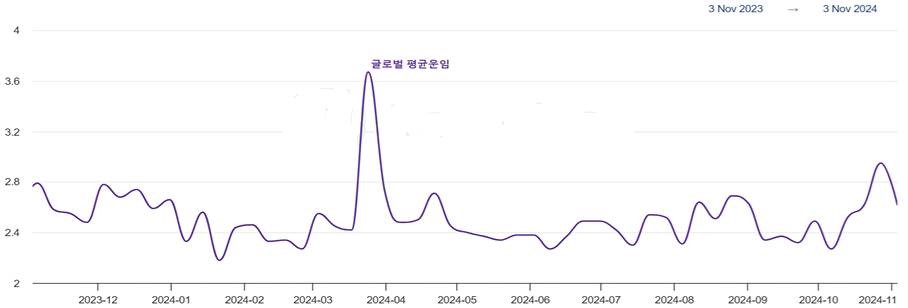

- According to reports in week 43, air cargo volumes in Asia have increased, indicating that the peak air cargo season is beginning.

- With the recovery of air cargo demand from China, the global air cargo market is entering a full peak season. As the traditional peak season approaches, global air cargo rates have finally started to rise again.

- This upward trend is attributed to increased demand for export routes from China to North America and Europe. Despite global airlines strengthening their capacity on trans-Pacific routes, rates are still on the rise.

- The Freightos Air Index shows that rates from China to North America were just below $7.00/kg last week, significantly exceeding the $5.00 to $6.00 levels seen for most of the year and up to September.

- Rates to Europe are at $3.86/kg, which is 12% higher than in September, but a sharp increase has not yet begun. Concerns are being raised about a continuing shortage of wide-body cargo aircraft in the air cargo industry.

- An Atlas Air representative stated, "The current global air cargo market supply is not meeting demand," explaining that "demand is increasing, especially thanks to companies like Alibaba's logistics subsidiary, Cainiao."

- The challenge is that increasing available capacity is essential to restoring the supply chain, but there are very limited options in the current market to address this.

- The issues Boeing is facing (strikes), delays in introducing new technologies, and the postponement of Airbus's wide-body freighter launches to the latter half of the year are contributing to difficulties in expanding space capacity in the short term due to certification issues with the B777-8 freighter and modified B777-300F models.

- Experts warn that this could put significant pressure on the supply chain market, and the ICAO's 2028 aircraft emissions standards could further limit market supply.

- Ultimately, there are currently no signs that the shortage of cargo supply capacity will be resolved, which has led to rising freight rates depending on the region, imposing economic burdens on freight forwarders and shipper customers.

- Consequently, there is increasing support for the claim that within the next ten years, no solutions will emerge to address the current supply shortage.

4) The global express market is expected to grow at an average annual rate of 7.3% until 2028

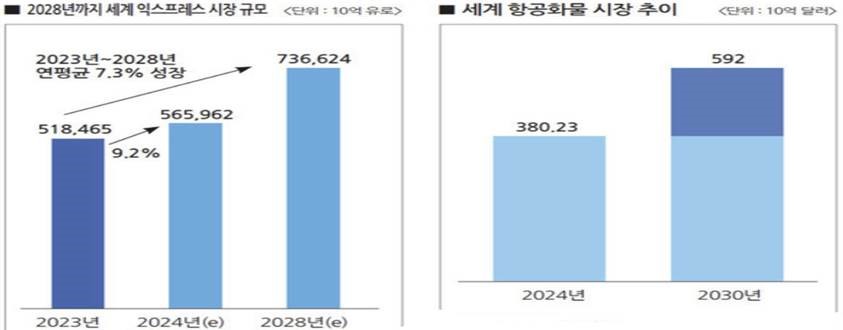

- This year, the global express market is expected to grow by 9.2% compared to the previous year, reaching €56.596 billion (approximately 842 trillion won) due to the growth of e-commerce. By 2028, it is projected to grow at an average annual rate of 7.3%, reaching €73.6624 billion.

- The top three companies in the global express market remain the United States' UPS, FedEx, and Germany's DHL. It is expected that the 'Big Three' will gradually be challenged by China's SF Express, France's La Poste, and Japan's Yamato.

- According to an analysis by Transport Intelligence (TI) in the UK, emerging markets are actually driving the growth of the global express market. The growth of these emerging markets is somewhat compensating for the underperformance in the European market. The North American market saw a slight decline in 2022 but is analyzed to have recovered growth in 2023. Last year's global express market formed a market of €51.8465 billion, growing by 3.8%, primarily driven by e-commerce centered in China.

- Additionally, a recent forecast by Research and Markets suggests that the global air cargo market is expected to grow at an average annual rate of 7.6% by 2030. The market, valued at $38.023 billion this year, is projected to expand to $59.2 billion by 2030.

- Furthermore, Transport Intelligence reported last month that due to crises such as the Red Sea situation, global maritime freight rates have surged. As of August, the freight index was 1,674 points higher than in January and 154.6 points higher than in April. However, while freight rates on major routes rose by an average of 19.1% in July, they decreased by 10.3% in August. Maritime freight rates are rising due to various factors, with this year's supply chain disruptions appearing to be the largest contributor. Ultimately, if these supply chain disruptions are not fundamentally resolved, freight rates are expected to rise further. The increased demand for shipping capacity due to the Red Sea situation has also contributed to congestion at major ports in Asia for this reason.

5) Airline/GSA Movement

-

Air Premia launches flights to Hong Kong on January 25, YP802 departing at 12:45 and arriving at 17:15 (Monday, Wednesday, Friday, Sunday). Newark service increases (from December 17) YP132/EWR 00:01-05:40 +1 ICN (Monday, Tuesday, Wednesday, Thursday, Friday, Saturday).

-

Delta Air Lines will resume LAX-PVG flights starting June 2025. Flights on Wednesday, Friday, and Sunday at 23:25, arriving at 16:05 +1.

top