- Company

-

Specialized Products

Warehousing Solution

Specialized Freight Solutions

Multimodal Freight Solutions

GSA, CSA & SC

- Service

- Blog

- Cargo Tracking

- Contact Us

- Site Map

The Power of Logistics to Move the World!

It's the Power of extrans.

EXTRANS GLOBAL - Air Freight News - Week 43 2024

Air Cargo General

1) Trends in Air Logistics from China to the Americas

- Overall air freight volume from the Asia-Pacific to the US remained roughly at the same level in Week 41 (October 9-15) compared to the same period last year; however, the volume from China to the US decreased by 19% year-on-year.

- This decline represents the largest annual decrease in the China-US market this year and is part of the trend of decreasing cargo volumes from China to the US in the second half of the year.

- The reduction is attributed to intensified customs inspections on air cargo from China entering the US, particularly at Los Angeles (LAX) since July.

- Cargo volume from China to LAX decreased by 39% year-on-year, which is also affected by China's Golden Week holiday. Based on the entire month of September, cargo volume from China to the US decreased by 8%, while China-LAX cargo volume dropped by 19%.

- However, spot rates for shipments from China to the US rose by 8% from the previous week to $5.28/kg, rebounding from a 7% decrease the week before, marking an 11% increase compared to last year.

- Spot rates for shipments from the Asia-Pacific to the US also partially recovered, rising by 3% from the previous week to $6.11/kg, which is 45% higher than the same period last year.

- Cargo volume from China to Europe also showed partial recovery. After a 17% decrease, there was a 5% recovery in Week 41, but last year, this week nearly fully recovered after the Golden Week holiday.

- However, in Hong Kong, where e-commerce plays a significant role, cargo volume to Europe has remained at a consistently high level over the past five weeks, with Hong Kong-Europe cargo volume increasing by 26% year-on-year.

- The intensified customs inspections in the US have led to a sharp decline in air cargo volume from China, indicating the need to continuously monitor the impact of future trade policies or customs procedures on logistics flows.

- Spot rates between China and the US rebounded from recent declines and showed year-on-year increases, likely due to reduced supply and increased demand following the holidays. Given the volatility of rates, it is necessary to establish flexible logistics planning.

- (Strength of E-commerce in Hong Kong) – The volume of e-commerce cargo from Hong Kong to Europe has consistently remained high, demonstrating that e-commerce is playing an increasingly important role in the global logistics market.

- (Resilience of China-Europe Trade) - Cargo volume between China and Europe has partially recovered after the Golden Week holiday, but full recovery has not been achieved. This suggests that the pace of market recovery is not as rapid as before, indicating a potential need for long-term adjustments in supply chain strategies.

2) The expectation of a rebound in peak season demand requires attention to market cargo trends after the Chinese holiday!

- Recently, the air cargo market showed a brief quiet period due to China's Golden Week holiday. However, as it is still peak season, many market participants expect demand to become active again.

- In particular, air freight rates have been fluctuating slightly downward and rebounding until recently, but it is noteworthy that they are showing an upward trend again following the end of the holiday in China.

- Some European cargo airlines are expected to gradually restore the transport capacity to China that they reduced during the holiday.

- In North America, shippers have been preparing goods in advance for a potential port strike, leading to a significant decrease in demand for urgent air cargo. As a result, the strike did not have an immediate impact on the air cargo market, and currently, many companies are holding excess inventory; however, it is widely believed that this situation may change soon.

- The fourth quarter is traditionally the peak season for the air cargo market. In particular, Chinese e-commerce giants Shein and Temu are preparing for the Christmas season, and an increase in the transportation of industrial goods is also expected, leading the industry to maintain a strong outlook for fourth-quarter demand.

- However, there are also opinions that the peak season may not hold much significance. One official pointed out that "demand has not increased as significantly as expected, and many companies tied to high contracts with airlines are not able to reduce prices competitively, resulting in actual market rates not being very high."

- Accordingly, both the global air cargo market and the Korean market analyze that the demand trends during Week 43 (October 20-26) will be a crucial period that could determine the success or failure of this peak season.

- Additionally, it was mentioned that "if e-commerce demand from China does not serve as a major support, this peak season will not hold much significance, and volumes must continuously increase until mid-November for the market to stabilize. General cargo peak season demand alone may not be sufficient for market satisfaction."

3) Concerns of 'Delays in Air Cargo Exports to the U.S.' Due to Requests from the U.S. FAA to Strengthen Safety Procedures for Airlines

- Concerns are growing about delays in air cargo exports to the U.S. ahead of the year-end peak season. The FAA has recently recommended airlines to strengthen procedures to address safety issues arising from the surge in electronic product shipments before the end of the year, leading to analyses in the market about the potential for temporary delays and disruptions in air cargo transport.

- The FAA expects an increase in cargo that includes electronic products, battery-operated devices, and flammable materials, which raises warnings about smoke, odors, and fire hazards on aircraft.

- As a result, airlines are thoroughly reviewing risk assessments for cargo and related procedures, and they have received guidance to enhance crew safety response capabilities.

- In particular, the U.S. Customs and Border Protection (CBP) announced that starting November 12, exports with unclear cargo descriptions will be refused entry. In practice, using vague descriptions like "gifts" could make it difficult for such cargo to enter the U.S. This measure is aimed at enhancing safety management, and stricter customs procedures are expected to continue.

- This action will particularly impact export companies in China and South Korea that are planning to export electronic products and other consumer goods during the year-end peak season. Many companies concentrate their exports during this period, so there is a possibility of logistical delays due to the strengthened procedures and regulations.

- Experts advise that "it is important to provide clear descriptions and strictly adhere to safety regulations," and "there is a need to enhance safety management procedures, especially through close cooperation with airlines." Accordingly, companies preparing for air cargo exports to the U.S. during the year-end season should carefully review the new regulations and procedures from the FAA and CBP and prepare corresponding countermeasures.

4) The need for forwarders to prepare in advance for this year's peak season.

- This year, the air cargo market is expected to experience a strong peak season wave, making it urgent for forwarders to prepare in advance.

- According to 'Xeneta', signs of a surge in this year's air cargo peak season have already been evident since the second half of last year. The main causes of this wave are identified as the 'Red Sea incident' and the volume of 'e-commerce from China'.

- Due to these factors, freight rates have been steadily rising on major Asian routes even during the typically off-peak summer season.

- In particular, air freight rates in Asia have increased by 25-40% compared to last year, and the average load factor for air cargo has also risen by 4%. As a result, it is predicted that rates will surge even more as the peak season fully sets in.

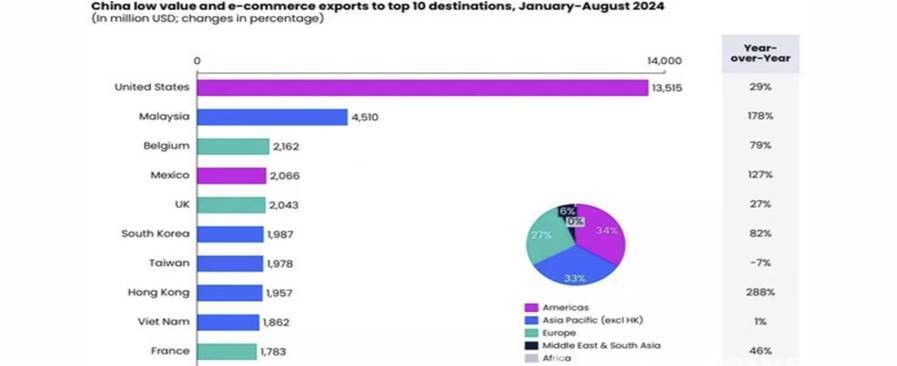

- In August, the transaction volume of e-commerce from China recorded the second-highest level ever, with the highest record being $8.7 billion in December 2023.

- However, it appears that e-commerce from China will once again set a new record during this year's peak season. This is expected due to a surge in demand for low-priced Chinese products in major developed countries ahead of the Christmas season and New Year.

- Additionally, the Red Sea incident remains unresolved, which increases the likelihood of some maritime cargo shifting to the air cargo market, suggesting that this year's peak season wave may rise even higher.

- As demand for Asian routes surges, Qatar Airways (QR) and Air France-KLM are reducing cargo supply on routes to Latin America and Africa, focusing instead on Asian routes.

- However, as of September, global air cargo capacity has only increased by 3% compared to the previous year. In particular, the Atlantic routes are expected to see a 20% reduction in belly supply during the winter season due to decreased passenger demand.

top