EXTRANS 将物流的力量推动到全世界.

旭晖空运国际 - 第42周2025年航空业更新

1. 航空货运概况

1) A350F 货机正式启动组装生产 —— 计划 2027 年下半年投入运营

空客(Airbus)宣布,近期已正式启动 2 架 A350F 货机的组装与生产工作,预计在 2026-2027 年完成试飞后,搭建全面量产体系。该机型最大载货重量可达 111 吨,续航里程达 8700 公里。

机身尺寸方面:标准型 A350-900 机身长度为 66.8 米,宽体机型 A350-1000 机身长度为 73.79 米;发动机则采用与 A350-1000 相同的罗尔斯・罗伊斯(Rolls-Royce)Trent XWB-97 发动机。

据悉,这款货机相较现有机型,燃油消耗量与二氧化碳排放量最多可降低 40%;同时配备现有货机中最大开启宽度(4.3 米)的货舱门,载货效率优势显著。

空客表示,将把 A350F 打造为 “引领未来航空货运的核心机型”。此外,截至 8 月底,该机型已收到 11 家航空公司共计 65 架的订单,预计 2027 年下半年正式投入运营。

2) 达美航空(DL)货运部 ——10 月起推行 “全包价” 销售模式

达美航空(Delta Air Lines,代码 DL)货运部门宣布,自 10 月 1 日起,将美国出发的出口及国内航线航空货运销售价格调整为 “全包价(All-In Price)”。

不过,安检费(Screening Fees)、税费、附加费等仍需单独收取。

对于此次调整原因,达美航空解释称:“此举旨在为货主提供更优质的服务,提升价格透明度,同时帮助货主从整体航空物流成本角度优化预算。”

此前,曾有多家航空公司为取消燃油附加费、简化销售价格,尝试推行全包价模式,但因货主反对均以失败告终。典型案例为阿联酋航空(EK)——2017 年引入全包价模式后,仅 2 年便宣布终止。

3) 10 月第一周航空货运运价环比上涨 1.9%—— 台风影响下中国出发货量激增

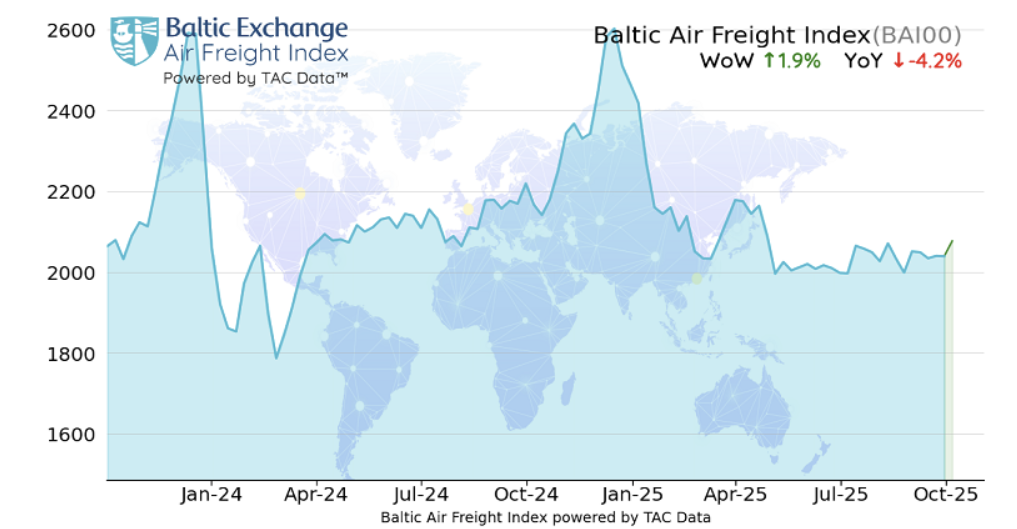

全球航空货运运价重回上涨趋势。根据 TAC Index 数据,截至 10 月 6 日的一周内,全球波罗的海航空货运指数(BAI00)环比上涨 1.9%。

尽管该指数仍较去年同期低 4.2%,但受台风 “拉卡萨(Ragasa)” 影响而延误的中国出发货物集中处理,推动运价呈现明显回升态势。

中国出发的航空货运运价表现分化:跨大西洋(欧洲)航线运价上涨,跨太平洋(美国)航线运价小幅下跌;同时,东北亚至印度、澳大利亚、墨西哥、西班牙航线运价同步上涨,区域间运价不均衡状况有所缓解。

香港出发的现货指数(BAI Spot)在台风后恢复交易,周初大幅上涨,但周末逐渐回落;综合指数(BAI30)环比上涨 1.5%,同比下跌 2.3%。

上海出发的运价同样环比上涨 1.3%,同比下跌 5.3%,走势与香港类似。东南亚地区方面,越南出发至欧洲、美国航线运价随之下跌;曼谷出发运价虽有上涨,但受今年航空运力扩张影响,仍较去年同期大幅下跌。

不过,东北亚地区不同出发地运价呈现分化:台湾出发至欧洲航线运价下跌、至美洲航线上涨;首尔出发至欧洲航线上涨、至美洲航线下跌;印度出发至欧洲航线上涨、至美洲航线下跌。从同比来看,所有航线运价仍处于低位。

4) 作为后发者,帕拉塔航空(Parata Airlines)旗下 A330 可实现 1.2 万公里直飞

“若无法成为第一,便要与众不同。”(罗蕾塔・林)

“细分市场突破” 虽被视为营销教科书的基础策略,但在实际操作中,却是难度最高、风险最大的策略之一 —— 毕竟 “无人涉足的路,或许本就不是路”,唯有承担失败风险才有可能成功。

韩国国内现有 9 家航空公司,在被称为 “饱和” 的韩国航空市场中,今年新入局的帕拉塔航空(Parata Airlines)正处于这样的 “破局” 赛道。

尽管帕拉塔航空的前身是飞江原航空(Fly Gangwon),定位低成本航空(LCC),但该公司计划将服务品质提升至接近全服务航空(FSC)水平,并拓展长途航线。

目前,帕拉塔航空正加速筹备长途航线运营,目标 11 月开通国际航线;客舱座椅专属娱乐系统(IFE)的具体形式已交由相关部门研究,机上餐食等服务的提供方案也在探讨中。帕拉塔航空方面表示:“我们正通过不定期航班运营,密切关注客户反馈;对于可能引发乘客不适的座椅设施或指引标识,将在正式开通定期航班前研究优化。”

当前多家航空公司均在寻找市场机会,而帕拉塔航空瞄准的是 “全服务航空(FSC)与低成本航空(LCC)之间的中间地带”,即所谓的 “混合模式航空(Hybrid Airline)”。尽管空气 Premia 航空(Air Premia)也在推行类似定位,但帕拉塔航空正通过更具性价比的服务与强化长途航线竞争力,打造差异化优势。

此外,以岛屿航线运营为核心的济州航空(Jeju Air)、正在搭建地方机场航线网络的 High Air 与 Korean Express Air 等航司,也在筹备业务突破。

航空市场 “重组之风” 再起,韩国航空市场极有可能形成 “1 家全服务航空 + 多家差异化定位航司” 的竞争格局。在此背景下,作为后发者的帕拉塔航空,似乎已做好 “以差异化立足” 的准备。

5) 航司动态

- 联合航空(United Airlines,代码 UA):宣布自 2026 年 9 月 4 日起,新开通仁川(ICN)- 纽约(纽瓦克,EWR)每日直飞航线。

- 全日空(ANA)- 加拿大航空(Air Canada):9 月 15 日宣布,启动日韩航线代码共享(联合运营)合作。

- 斯堪的纳维亚航空(SAS):9 月 15 日新开通仁川(ICN)- 哥本哈根(CPH)航线。

- 马丁航空货运(Martinair Cargo,代码 MP):自 10 月 28 日起,开通仁川(ICN)- 香港(HKG)- 阿姆斯特丹(AMS)货运航线(每周 1 班)及仁川(ICN)- 阿姆斯特丹(AMS)直飞货运航线(每周 2 班),机型均为 B744。

top