EXTRANS 将物流的力量推动到全世界.

旭晖空运国际 - 第41周2025年航空业更新

1. 航空货运概况

1) 快递 / 小型包裹市场预计 2030 年前增长 8%

预计到 2029 年,全球物流市场年均增长率将达 3.8%。其中,亚太地区预计以年均 5.9% 的增速引领整体增长趋势,中东及北非(MENA)市场也有望实现年均 4.8% 的增长。

据英国运输情报公司(Transport Intelligence, Ti)近期预测,在整体物流市场中,合同物流市场规模已从 2020-2024 年的 2469 亿欧元扩大至 2956 亿欧元;亚太地区合同物流市场到 2029 年预计将保持年均 6.33% 的增长态势。

去年,全球货运代理市场增长 6.1%,亚太地区占全球货运代理市场份额的 36.1%。

快递及小型包裹市场预计到 2030 年前将增长 7.9%。以 2024 年为基准,全球快递及小型包裹市场规模已达 2727 亿欧元,创下近 5 年来最快增速。

今年,全球电商物流市场预计同比增长 15.5%;以去年数据为准,北美是全球最大电商物流市场,规模达 2004 亿欧元。

2) “亚洲中转枢纽‘超负荷’”—— 旺季东南亚出发航空货运需求激增

康捷空物流(Dimerco Express)在 10 月市场报告中指出,随着亚洲航空货运市场进入旺季峰值,主要中转枢纽正面临巨大压力。

分析显示,9 月末超强台风 “拉卡萨(Ragasa)” 袭击中国南部及香港地区,导致航班取消、物流积压;叠加中欧铁路线路临时停运,共同推动航空运输需求大幅激增。

报告特别提到:“东南亚正主导出口需求。泰国、越南、马来西亚、新加坡等地发往美国及欧洲的人工智能(AI)、半导体、电商相关货物大量集中,使得新加坡、台北、香港、仁川等中转枢纽接近饱和状态。”

报告进一步表示:“尽管当前是航空货运传统旺季,但今年东南亚的需求爆发力尤为突出。与人工智能及高端制造业相关的货物,已基本将中转枢纽推向满负荷运转。”

对此,货运代理建议客户,为避免延误,应至少提前 1-2 周预订货物运输;对于紧急货物,灵活调整出发地或中转枢纽是减少混乱的有效方式。

与之形成对比的是,海运市场持续疲软。由于主要航线需求低迷,航运公司在黄金周期间缩减运力,以稳定运价。

目前船舶供给超过需求,航运公司营业利润率在过去 18 个月跌至历史低位,因此面临 “调控供给、捍卫运价” 的双重压力。集装箱市场相关人士预警,10 月下半月 “空白航行(Blank Sailing)” 可能增加,并提醒货主:亚洲至美国航线需灵活选择运输路径并提前预订,亚洲至欧洲航线需为第四季度持续的运价波动做好准备。

3) 中国:规避中美关税转向新兴市场 —— 低价出口激增下有望创最大贸易顺差

中国为规避美国高额关税,大幅增加低价产品出口,预计今年将创下 1.2 万亿美元的历史最大贸易顺差。

今年 1-8 月,中国贸易顺差规模达 7858 亿美元,较去年同期(6126 亿美元)大幅增长 28.2%。

为避开美国关税,中国大幅扩大对印度、非洲、东南亚等新兴市场的出口,导致相关国家面临反倾销调查压力(例如印度近期已收到 50 起针对中国等国家商品倾销的调查申请)。

彭博社(Bloomberg)评估认为,被中国激进出口策略瞄准的国家,采取积极反制措施的可能性较低,并指出:“已卷入与美国关税谈判的国家,不愿再与全球第二大经济体(中国)爆发贸易战。”

4) 全球平均航空运价降至 2.54 美元 / 公斤,同比下降 4%

以去年 9 月为基准,全球航空货运平均运价为 2.54 美元 / 公斤,较去年同期下降 4%。自去年 5 月以来,该运价已连续 5 个月同比下降 3%-4%。

航空货运的需求与供给均同比增长 3%:9 月航空货运需求(以 2024 年月均为 100 基准)维持在 105 的相对高位,供给(同样以 2024 年月均为 100 基准)也为 105;受此影响,航空货运平均装载率为 59%,较去年同期下降 1%。

值得注意的是,由于美国禁止对单价 800 美元以下小件商品采用清单通关并加征关税,以电商货物为主的美国航线航空货运需求大幅下降,而欧洲航线的电商货运需求则相应增加。

太平洋航线与大西洋航线的运价均环比下降 2%-3%。

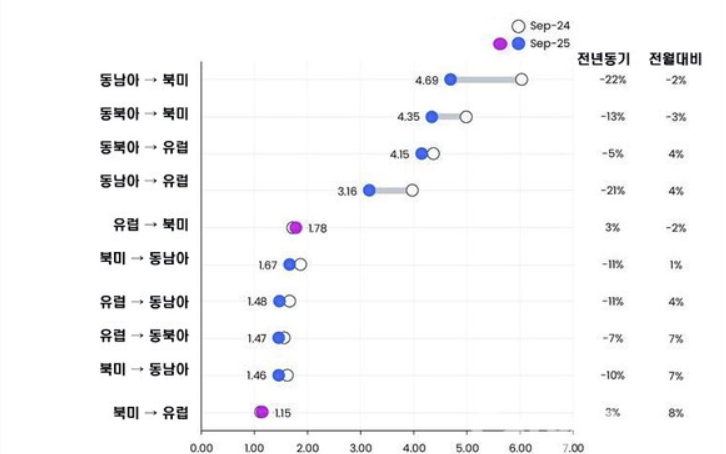

主要航线运价具体情况如下:

- 东南亚 - 北美航线运价为 4.98 美元 / 公斤,同比下降 22%;

- 东北亚 - 北美航线运价为 4.35 美元 / 公斤,同比下降 10%;

- 东北亚 - 欧洲航线运价为 4.15 美元 / 公斤,同比下降 9%。

此外,去年第三季度,货运代理与货主之间的航空运价合同中,6 个月及以下短期合同占比同比上升。以新增航空运价合同为例:1 年以上期限占 2%,12 个月期限占 44%,6 个月期限占 23%,3 个月期限占 20%。同时,第三季度货运代理与航空公司之间 1 个月及以下现货运价合同占比达 48%。

5) 航司动态

- 联邦快递(FedEx,代码 FX):新开通河内(HAN)- 仁川(ICN)- 广州(CAN)每周 1 班货运航线,计划重点支持河内出发的电子产品、纺织品等高频需求品类出口。

- DHL 快递(DHL Express,代码 D0):开通河内(HAN)经香港(HKG)的货运航线,每周运营 6 班(机型:B777、A330)。

- 韩亚航空(Asiana Airlines,代码 OZ):自 9 月 5 日至 12 月 31 日,恢复仁川(ICN)- 法兰克福(FRA)客运航线,每周运营 5 班(机型:A380);并计划于 2026 年 1 月 15 日至 3 月 28 日,将仁川(ICN)- 曼谷(BKK)客运航线班次从每周 11 班增至 14 班(机型:A321N、A359)。

- 马丁航空货运(Martinair Cargo,代码 MP):自 10 月 28 日起,开通仁川(ICN)- 香港(HKG)- 阿姆斯特丹(AMS)货运航线(每周 1 班)及仁川(ICN)- 阿姆斯特丹(AMS)直飞货运航线(每周 2 班),机型均为 B744。

top