엑스트란스 - 항공 물류 업데이트 - 41주차 블로그

항공화물 General

1) 올해 항공화물 성수기의 파고가 거셀 전망

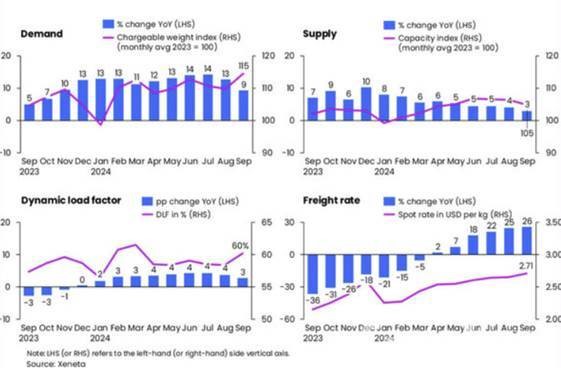

- 지난 9월 기준 세계 항공화물 수요는 전년동기 대비 9% 증가. 하지만 지난 10개월 이상 두 자릿수 증가에서 상승 폭을 다소 축소.

- 제네타(eneta) 분석에 따르면 북미 동안의 항만 파업사태로 당분간 항공시장은 강세를 유지할 것으로 내다봄

- 이같은 항공화물 수요 확대에도 공급력은 3% 확대에 그침. 올들어 가장 낮은 공급력 증가세임. 이는 공급력 확대가 이미 한계점이 있기 때문. 이에따라 항공화물의 평균 적재 육은 60%로 나타남.

- 전세계 평균 항공운임도 271달러/kg으로 전년동기 대비 26%나 상승.

- 최근 항공화물 시장의 견인 역할은 전자상거래 수요 확대를 비롯해 해상운송에서 00원증 로의 전환, 태풍, 중국의 골든위크(10월 1~7일) 등이 다양하게 작용하고 있는데, 이에 더해 북미 동 안 항만의 장기화될 경우 항공 성수기와 맞물려 큰 폭의 상승기류를 형성할 것으로 보임.

- 더구나 현재로선 공급 확대에는 상당한 제한이 있는데, 제네타는 대서양노선을 중심으로 여객 벨 리공급이 축소되면서 올 동계 스케줄동안 약 20%의 공급력이 축소될 것으로 예상.

- 이같은 상황을 종합적으로 볼 때 올 항공화물 성수기의 파고는 상당히 높을 것으로 전망.

2) 대한항공-아시아나 기업결합 가시권 - 메가캐리어 출범이 곧 임박

- 대한항공과 아시아나항공의 기업결합이 가시권 상태임. 기업결합을 위한 마지막 퍼즐인 유럽연합(EU)과 미국 경쟁 당국의 최종 승인 여부가 이달 중 나올 것으로 전망. 세계 10위권 ‘메가캐리어’(초대형 항공사)의 출범이 임박한 모습.

- 5일 항공업계에 따르면 대한항공과 아시아나항공 간 기업결합에 대한 미국 법무부(DOJ)의 결정이 이달 중 나올 예정. 미국의 경우 다른 경쟁국들과 달리 DOJ에서 양사 합병에 대한 별도의 소송을 제기하지 않는다면 자동으로 심사가 종료되고 기업결합이 승인되는 구조.

- 업계에서는 이변이 없는 한 미국의 승인 결정을 받을 수 있을 것으로 보고 있음. 조원태 한진그룹 회장은 6월 한 외신과의 인터뷰에서 “10월 말까지 미국으로부터 아시아나항공 합병에 대한 승인을 받을 것”이라고 밝힌 바 있음.

- 유럽연합 집행위원회(EC)의 최종 승인 역시 이달 중 나올 것으로 보임. 앞서 2월 EC는 양사의 기업결합을 승인하면서 유럽 중복 노선 이관과 아시아나항공의 화물 사업부 매각 등 두 가지를 조건으로 내걸었음.

- 이에 대한항공은 유럽 4개 주요 도시 노선(파리·로마·바르셀로나·프랑크푸르트)을 티웨이항공에 이관. 티웨이항공이 이달 3일부로 대한항공으로부터 이관받은 마지막 유럽 노선인 프랑크푸르트 노선에 공식 취항하면서 이관 작업이 마무리.

- 아시아나항공의 화물사업부 매각은 마무리 단계. 대한항공은 6월 아시아나항공 화물사업부 매각 우선협상대상자로 에어인천을 선정하고 기본합의서(MA)를 체결. 대한항공이 조건부 승인에 대한 시정 조치를 모두 이행함에 따라 EC로부터 최종 승인 결정을 받을 수 있을 것으로 예상.

- 유럽과 미국 경쟁 당국의 승인 절차가 끝나면 대한항공은 장장 4년 만에 아시아나항공 인수를 위한 기반 절차를 모두 마치게 됨. 대한항공은 2020년 11월 아시아나항공 인수 의사를 밝히고 다음 해인 2021년 1월 14일 14개국에 기업결합을 신고한 바 있음.

- 대한항공은 연내 아시아나항공의 제3자 배정 유상증자에 참여해 지분 63.9%를 확보, 최대주주에 오를 계획. 이후 대한항공은 2년간 아시아나항공을 자회사로 운영하면서 통합 작업을 거친다는 방침. 이때까지는 대한항공과 아시아나항공이 독립 운영되며 이후 ‘통합 대한항공’이 출범.

- 다만 기업결합 이후에도 마일리지 통합 등 해결할 과제들이 남아있는데 올해 상반기 기준 대한항공과 아시아나항공의 마일리지 이연수익은 각각 2조5278억 원, 9758억 원으로 합하면 약 3조5000억 원..

- 마일리지 통합을 위해서는 아시아나항공의 마일리지를 대한항공으로 이관하는 작업을 거쳐야 하는데 이때 두 항공사의 마일리지 가치 평가가 관건으로 꼽힘. 통상적으로 대한항공의 마일리지 가치가 아시아나항공보다 높은 것으로 평가되는 만큼 통합 과정에서 소비자들의 불만이 제기될 수 있음. .

- 마일리지 통합 과정은 정부에서도 주목하고 있다. 윤석열 대통령은 3월 민생토론회에서 “두 항공사의 기업결합 과정에서 단 1마일의 마일리지 피해도 발생하지 않도록 정부 차원에서 관리하겠다”고 말하기도 함.

3) 덴마크 DSV, 독일 DB쉥커 인수 - 세계 최대 물류기업 탄생

- 글로벌 물류기업 DSV는 지난 9월13일 독일 국영철도 기업인 도이체반(DB)의 물류 자회사 DB쉥커를 인수하기로 합의했다고 밝힘. 인수금액은 143억유로(약 21조1700억원)로, 물류업계 사상 최대 규모.

- DB는 부채 감소를 목적으로 지난해 말부터 자회사의 매각 절차를 밟아 왔으며 최종 후보로 DSV와 투자회사인 CVC컨소시엄 등 2곳이 선정. 외신에 따르면, DSV가 추후 실적에 따라 인수자가 매도자에게 추가 금액을 지불하는 ‘언아웃’ 조항을 제시했고 DB 측이 이를 수락한 것으로 알려짐.

- 두 기업은 규제 당국의 허가를 조건으로 다음해 2분기에 인수를 마칠 예정. DSV는 쉥커를 독자적으로 운영하다 추후 합병한다는 구상.

- 이번거래를 계기로 DSV는 세계 최대의 물류회사로 도약한다는 구상. 기존 네트워크에 쉥커의 역량과 전문성을 더해 독일 내 물류 경쟁력을 강화할 계획. DSV는 향후 3~5년간 독일에 10억유로를 투자할 예정이라고 발표.

- DSV와 DB쉥커가 통합하면 국제물류(포워딩) 시장에서 세계 최대 기업이 탄생. 지난해 기준 두 기업의 합산 매출액은 약 393억유로(약 58조1700억원). 지난해 포워딩 기업으로 가장 많은 매출고를 올린 독일 DHL의 물류사업부문 실적(362억6300만유로)을 넘어서는 수치.

- 국제화물 운송량도 세계 최고 수준. 미국 물류조사기관인 어소시에이츠 암스트롱에 따르면, 지난해 DSV와 DB쉥커가 기록한 해상 물동량은 각각 251만TEU 174만TEU, 항공 물동량은 130만t 136만t. 이를 단순 합산하면 해상·항공화물 분야 1위를 차지한 퀴네앤드나겔의 해상 운송 실적 (433만TEU)에 육박하고, 항공 물동량(198만t)을 20% 상회.

- DSV는 1976년 육상운송 기업으로 설립한 이래 인수합병(M&A) 전략으로 사업 규모를 확대해 왔다. 2010년대 후반부터 미국 UTi, 스위스 판알피나를 비롯해 중동 어질리티의 통합물류사업부문(GIL)을 잇달아 인수하는 등 대형 계약을 감행.

4) 다양한 공급망 불안요소로 인해 항공전세기 수요 증가세

- 미국 항만 파업이 당분간 종료되었다는 소식은 화주들에게 큰 안도감을 줄 것이지만, 이번 주 항공 전세기 요청이 여러 이유로 급증함.

- 이 수요는 파업으로 영향을 받은 화주들 뿐만 아니라, 크리스마스를 앞두고 물류 지연을 두려워하는 화주들 사이에서도 나타나고 있음. 또한 허리케인 헬렌이 초래한 피해 이후, 인도주의적 및 위기 상황 화물을 처리하려는 들도 분주하게 움직이고 있음

- 에어파트너(Air Partner)의 그룹 전세 및 화물 부문 EVP인 존 코비는 The Loadstar와의 인터뷰에서 "항만 파업 위협과 실제파업으로 인해 항공화물과 화물운송에 대한 수요가 크게 증가함.

- 자연재해와 전세계적인 지정학적 불안정으로 인한 의약품 배송수요 증가로 인해 이미 높은수요가 있는 상황에서 이러한 증가가 나타남.

- 에어차터서비스 (AirCharter Service)의 댄 모건-에반스는 급증한 수요가 이용 가능한 용량에 영향을 미쳤다고 덧붙임.

- 미주동안 항만 파업이 중지됐으나 선제적 대응차원에서 문의가 급증했고 이로 인해 운임에 큰 영향을 미칠 수 있으며, 용량에도 일부영향을 준다고 밝힘.

- 수요증가로 인해 전세가격이 급등하고있으며, 실제로 가격은 코로나 19 팬데믹 때의 매우 높은 수준에 근접하고 있음.

- 당시 가격상승은 공급망 문제와 여객기운항감소로 인한 화물운송기 감소로 주로 발생했지만, 현재는 파업을 넘어서는 글로벌 혼란 요인들이 결합되어 가격이 상승하고 있으며, 이는 성수기 진입 시점에서 화주들에게 가장 좋지 않은 시기에 나타나고 있다고 밝힘.

- 항만파업 관련 전세기요청은 이제 감소할 것으로 보이지만, 중동에서 추가적인 수요가 계속되고 있으며 해당지역에서는 승객기들이 대피목적으로 동원되고 있음.

- 항공전세기 운임은 올해 남은기간동안 계속 높은수준을 유지할 가능성이 클 것 으로 분석됨

top