엑스트란스 - 항공 물류 업데이트 - 31주차 블로그

1. 항공화물 General

1) '9번째 LCC' 파라타항공 - 이번주 1호기 도입

- 2일 항공업계에 따르면 파라타항공은 오는 27일 김포공항에서 1호기 도입식 예정, 1호기는 에어버스의 광동체 쌍발형 여객기 A330-200.

- 이날 윤철민 대표이사가 나와 직접 향후 사업 계획도 밝힐 예정.

- 파라타항공의 전신은 2016년 설립한 플라이강원으로 그간 많은 부침을 겪었는데, 강원도 양양공항을 기반으로 강원권 거점 항공사를 표방했지만

저비용항공사(LCC) 시장 포화와 코로나19에 따른 이용 저조로 경영난. 2023년 항공기 6기를 모두 반납하면서 기업회생 절차에 들어갔고,

작년 6월 위닉스에 인수되며 사명 변경.

- 파라타항공은 국토교통부 특별감항증명 발급에 따라 1호기를 도입 가능하게 됨. 특별감항증명은 항공기 제작자 또는 소유자 등이 제시한 운용범위를

검토해 안전하게 운항할 수 있다고 판단되는 경우에 발급해줌. 또한 파라타항공은 연초에 선발한 공채 1기 승무원 60여명의 교육을 이달 초 마치고

재취항을 위한 준비 완료.

- 그러나 아직 AOC 취득을 마치지 못한 상태. AOC는 항공운송사업 운항을 허가하는 증명으로, 조직, 인원, 운항관리, 정비 및 종사자 훈련프로그램 등에

- 대해 국토교통부의 검사를 받아 합격 필요. 항공사의 최대주주 변경 같은 중대한 변화가 발생하는 경우도 재취득 사유에 해당.

즉, 운항증명이 없으면 비행기를 띄울 수 없게됨.

2) '아시아나 화물 합병' 통합 에어인천 - 막바지 내우외환

- 아시아나항공 화물사업부를 넘겨받아 통합법인으로의 출범을 앞둔 에어인천이 막판 진통 중. 2대 주주가 된 창업주가 회사를 상대로

연일 소송을 제기. 다른 환경에서 근무하다가 하나가 된 직원들을 품는 '조직 관리'라는 숙제도 있음.

- 24일 업계와 법조계에 따르면 인천지법 민사14부는 지난 4월 23일 에어인천 창업주 박용광 씨가 사측을 상대로 낸 주주총회 결의

무효 확인 소송을 심리 중인데, 재판부는 아직 별도 기일을 잡지 않은 것으로 파악.

- 지난 2012년 박 씨가 설립한 에어인천은 2022년 사모투자펀드(PEF) 운용사 소시어스가 경영권 지분 51%를 확보하면서 최대 주주에 오름.

지난해 12월 31일 기준 지분 구조는 소시어스 특수목적법인(SPC) 소시어스 에비에이션이 80.3%, 박 씨가 19.4%, 인천시청이 0.3%.

- 대한항공과 아시아나항공 합병에 유럽연합(EC) 집행위원회(EC) 승인 조건으로 아시아나 화물사업부 매각이 언급됐고 에어인천은 이를 인수 결정. .

- 소시어스 입장에서는 몸값을 올려 엑시트(투자금 회수)를 할 수 있는 기회를 얻은 셈.

- 2대 주주가 된 박 씨는 지난해 11월부터 에어인천 행보에 제동을 걸기 시작. 박 씨는 지난해 11월 에어인천 등을 상대로 의결권 행사 금지

가처분 신청, 그러나 인천지법 민사21부는 박 씨 신청을 각하. 박 씨는 결정에 불복해 항고했다가 지난 4월 취하.

- 에어인천은 지난 1월 아시아나 화물사업부를 넘겨받는 계약을 체결했고, 2월에는 아시아나항공으로부터 보잉 747-400F 1기를 임차.

- 박 씨는 2월 열린 에어인천 임시 주주총회에서 아시아나항공 화물사업부 합병과 관련해 결의를 무효로 해야 한다며 소송을 제기.

- 최종 인수일은 7월 1일에서 다음 달 1일로 연기. 아시아나항공이 보유한 21개 해외 화물 노선 중 일부에 대한 일부 해외 경쟁 당국

승인이 늦어졌기 때문. 에어인천은 사옥을 서울 강서구 마곡동으로 옮기는 등 합병 절차에 속도를 내는 중.

- 에어인천이 내우외환에 휩싸이면서 통합법인 출범 후 당면하게 될 과제인 화학적 결합이 쉽지 않을 것이라는 이야기도 나옴.

- 치열해지는 항공화물시장에서 존재감을 드러내야 하는 숙제. 에어인천 관계자는 박 씨 소송과 관련해 "공식적으로 받은 입장이 없다" 고 전언.

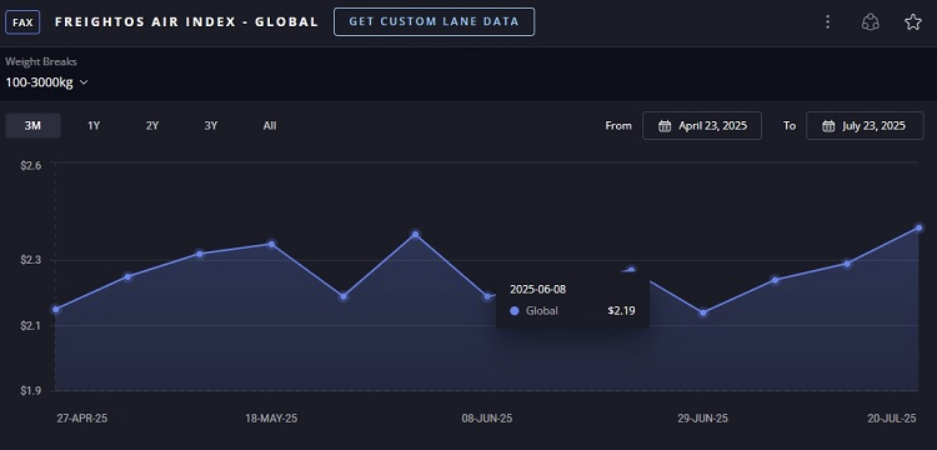

3) 관세 시한 앞둔 항공화물 시장 수요급등 없어 – 운임은 ‘안정세’ 지속

- 미국의 대중국 고율관세 시한 (8월 1일-일부는 18일)을 앞두고도 항공화물 시장에서 뚜렷한 수요 급등 현상 안보임.

- 시장 전반에 걸쳐 ‘선제 선적’이 이미 상당 부분 이뤄졌거나, 무역협상 지연에 따른 관망 기조가 강해지면서 운임은 안정세를 유지 중.

- 프레이토스(Freightos)는 자사의 항공운임 지표인 Freightos Air Index(FAX)를 인용해, 중국-미국 노선 운임은 전주 대비 7% 하락한

킬로그램당 5.17달러, 동남아-미국 노선은 4.84달러로 보합세, 남아시아발은 4% 하락해 4.55달러를 기록.

유럽-미국(대서양 노선) 운임 역시 소폭 하락해 1.77달러 수준.

- 프레이토스는 “관세 종료 시한을 앞두고도 항공을 통한 긴급 수송 수요가 크게 증가하지 않았다”며, 이는 “무역협상 타결에 대한 기대감,

추가 연장 가능성, 혹은 이미 앞당겨 선적이 이뤄진 영향”이라고 분석.

- 특히, 7월 초까지만 해도 일부 화주 사이에서 긴급 물동량이 발생할 가능성이 제기됐지만, 실제 시장은 조용한 흐름을 유지.

- 이는 25~40%에 달하는 관세 인상 부담을 감당하기 어려운 중소 수입업체들이 '기다려보자'는 전략을 택하고 있기 때문으로 풀이.

- 한편, 해상운송 시장은 운임 하락세가 본격화. 특히 아시아-미국 서안 항로의 스팟운임은 6월 중순 FEU당 6,000달러에서 지난주 2,325달러로

60% 급락. 동안 항로 운임도 7,100달러에서 4,100달러로 하락, 전년 동기 대비 57% 낮은 수준.

- 이외에도 주요 해상운임 지표를 보면, * 아시아-북미 서안: 2% 하락, FEU당 2,325달러 *아시아-북미 동안: 10% 하락, 4,411달러 *아시아-북유럽:

2% 상승, 3,572달러 * 아시아-지중해: 6% 하락, 3,568달러.

4) 중국 신규 화물항공사 ‘Hubei International Cargo Airlines’ 설립 - 에저우 화후공항 중심 글로벌 허브 전략

- 중국 후베이성 에저우시가 국제 항공화물 허브 조성 전략의 일환으로 신규 화물항공사 ‘Hubei International Cargo Airlines(후베이국제화물항공)’을

공식 출범. 중국 등 다수의 관련매체들은 에저우 화후국제공항(EHU)을 거점으로 글로벌 화물 시장을 공략하기 위한 신생 화물항공사 내년 공식 출범 보도.

- 신생 화물 항공사는 Reignwood Aviation Group이 90%, 에저우 창다투자지주(Changda Investment Holding Group)가 10%를 출자한 합작법인 형태로

설립됐으며, 후베이국제화물항공은 2026년 6월 30일까지 설립 승인 절차를 완료할 예정.

- 항공사는 출범 후 5년 내 화물기 20대 보유, 10개 이상 대륙간 노선 개설, 연 매출 50억 위안(약 9,500억 원) 달성을 목표, 또한 25년 내에는

화물기 100대 보유, 연 매출 300억 위안(약 5조 7,000억 원) 규모의 종합 국내 물류망을 구축한다는 이른바 “글로벌 운영 전략

(Global Operation Strategy)”를 마련 한 것으로 알려짐.

- 한편 중국 후베이성 에저우에 위치한 화후국제공항(Huahu International Airport은 지난 7월 17일 개항 3주년. 화물 중심의 전문 공항인

화후공항은 지난 3년간 6만 회 이상의 화물 항공편을 처리하며 누적 화물·우편 물동량 200만 톤을 돌파.

- 화후국제공항은 아시아 최초, 세계 네 번째 화물 특화 공항으로 2022년 본격 운영을 시작. 이후 에저우를 기점으로 여객 및 화물 항공노선을

121개까지 확대했으며, 이 중 17개 여객 노선은 중국 내 24개 도시와 연결되어 있고, 104개 화물 노선은 유럽과 아시아 주요 거점을 포함한

48개 해외 도시로 연결.

- 2025년 상반기 국제 화물·우편 물동량은 전년 동기 대비 252% 급증한 22만 톤을 기록했으며, 같은 기간 국제 및 지역 간 항공편은

6,500회로 333% 증가.

top