EXTRANS GLOBAL - Air Freight News - Week 29 2024

Air Cargo General

1) Despite Europe's containment measures, the growth of China-based e-commerce cannot be stopped: Liège Airport sees a surge in performance

-

Despite the political attacks against China alongside the United States and European countries, the surge in e-commerce demand cannot be contained.

-

Industry insiders and European logistics market experts indicate that the rapid increase in import volumes of China-based e-commerce has prompted stronger government-level responses across countries. However, these efforts have been insufficient to curb the growing cargo volumes.

-

Particularly in the air cargo sector, major hub airports are seeing rising import volumes. Liège Airport (LGG), considered the de facto e-commerce hub for Europe, reported a 15% year-on-year increase in cargo handling to 566,117 tons in the first half of the year, accompanied by a significant rise in freighter movements.

-

Liège Airport, home to Challenge Group, has emerged as a preferred international airport for many forwarders. Its annual cargo throughput exceeded 10 million tons in 2023. The first-half performance alone is expected to surpass last year's full-year figures.

-

Liège Airport now hosts services from over 40 airlines and more than 50 logistics companies. The diversification and growth of its cargo portfolio are noted.

-

While Liège Airport is also expected to be impacted by the customs crackdown on China-origin e-commerce, its cargo handling performance has continued to rise. Market analysis experts point out that Liège Airport's 21% cargo volume increase to 95,514 tons in June outpaced the 11.4% growth to 178,324 tons at Frankfurt Airport, Europe's largest hub, during the same period. The global air cargo demand growth was 13% during this time.

-

Additionally, Liège Airport has recently welcomed new carriers such as Hong Kong Air Cargo, My Freighter Airlines, Beijing Capital Airlines, Ninatrans, and Fracht Group. Even major airlines like Lufthansa have significantly increased their China-Europe flight frequencies, indicating the unabated rise in China-origin e-commerce demand for Europe.

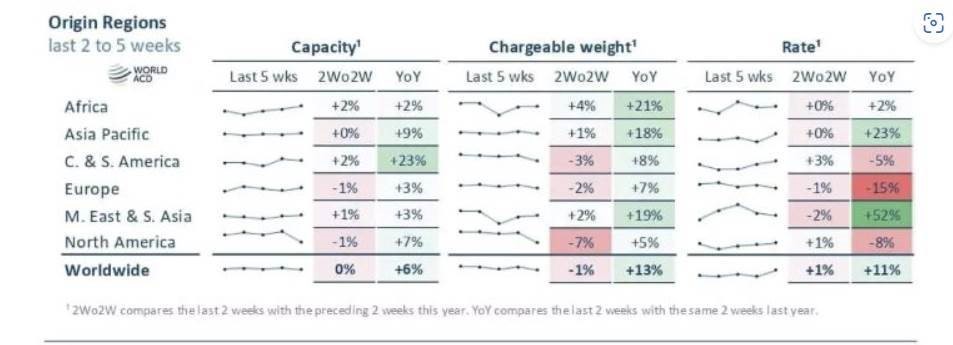

2) WorldACD, 'Air cargo rates in the Asia-Pacific region continue to rise in the first week of July

-

According to the performance data for the 27th week (July 1-7) released by WorldACD, which announces global air cargo market data, while the overall market volume decreased by about 5% due to the impact of the Independence Day holiday in the US, the demand increase in the Asia-Pacific region maintained the global average freight rates at a high level.

-

WorldACD reported that in the 27th week, outbound volumes from North America decreased by 13%, Europe by 4%, and the Asia-Pacific region by 3%, but freight rates continued to rise.

-

The global average freight rate in the 27th week recorded $2.57 per kg, which is a 2% increase from the previous week's market average. This is because the freight rates from the Asia-Pacific region increased by about 3%, which is 14% higher than the same period last year.

-

Particularly, the spot market price for shipments from Asia-Pacific to the US averaged $5.72 per kg in the 27th week, a 68% increase year-on-year. Freight rates from mainland China were $5.34 per kg and from Hong Kong were $4.84 per kg, up 38% and 12% respectively compared to the same period last year.

-

The concern is that the increase in freight rates in the surrounding Southeast Asian markets is not ordinary. An industry insider pointed out that the freight rate from Vietnam to the US was $6.62 per kg, showing the highest year-on-year increase (+147%) among the Asia-Pacific to US routes. Freight rates from Thailand were $6.46 per kg and from Singapore were $7.02 per kg, which have continued to be strong in recent weeks and have already more than doubled compared to the same period last year.

3) Another analysis: Air cargo market 4th quarter demand slowdown "Not this year" - "This is just a story about the shipping market, air cargo is unrelated"

- The demand in the sea container transportation market has reached a record high, surpassing even the pandemic-driven demand levels. Both the maritime and air cargo market players are still unable to shake off the doubts about the traditional peak season.

- Some market experts are concerned that the current surge in market demand is an "illusion," and that the influx of cargo is more a result of shippers "pushing" volumes ahead of the fourth-quarter peak season, rather than a normal inflow of demand.

- According to the data from major global container transportation market analysis firms, the container volume transported by sea in May 2022 reached 15.94 million TEUs, exceeding the previous record of 15.72 million TEUs set in May 2021 during the peak of the pandemic.

- In particular, the container demand originating from the Asia-Pacific region has been explosive, with China's export container transportation volume reaching a record high of 6.2 million TEUs in May, accounting for 39% of global container trade volume.

- There are concerns that the current record-breaking volumes may decrease during the traditionally recognized peak seasons in the shipping and air cargo markets. Moreover, the air cargo peak season typically starts from mid-September, raising doubts about whether the current demand trends will continue until then.

- The pessimists view is that while the air cargo market is seeing a surge in e-commerce demand, the "demand diversion" volume caused by the supply chain congestion in the shipping market is not a natural increase in market consumption, but rather a "push out" of volume due to shippers' concerns about the cost of the supply chain market in the 4th quarter. In other words, this is eroding future market demand.

-

Regarding the question of whether air cargo demand will be maintained as it is even after the 4th quarter, this industry source said, "Of course, the air cargo market is still robust due to e-commerce demand. The issue is whether global manufacturing will expand, as manufacturing PMIs and export orders worldwide have been in a downward trend for the past 3 months since June. If the actual purchasing power of consumers decreases, concerns about the market demand in the second half of the year will become a reality."

-

However, there are also indications that this rise in ocean container freight rates is favorable for the air cargo market. One source commented, "The fact that ocean freight rates have surpassed air freight rates means the cost difference between the two modes is narrowing, and air cargo transportation is becoming a more attractive option for shippers."

-

One source emphasized, "Concerns about the peak season market can be applied to the ocean shipping market. But not to the air cargo market. At least this peak season, the market demand will further erode the market supply with a greater increase than in previous years. In the worst case, even if the demand contraction in the ocean shipping market is rapid, the impact on the air cargo market will not be that significant. Even with concessions, this year's peak season is not as bad."

4) Despite being the off-season, the strength in air freight rates originating from Asia is continuing

-

According to the analysis by S&P, cross-border e-commerce parcel volumes were around 1.7 billion pieces in 2022, and are expected to increase by 50% compared to 2022 by 2027.In particular, the Chinese online platforms led by Alibaba and JD.com are purchasing the majority of China-origin air cargo capacity to meet the demand generated in North America and Europe.

-

Air freight rates out of major Chinese hubs have been rising slowly but steadily since Q1, exceeding $6/kg by the end of Q2. After a slight stabilization in July (off-peak season), they are expected to rise again in September.

-

The continuous increase in Shanghai-North America air cargo rates is making the industry more tense, as this is still the off-peak season before the year-end Black Friday sales on online shopping platforms.

-

Air freight rates originating from Southeast Asia, especially Vietnam, have surged tremendously. This is due to the congestion at major China or Hong Kong hubs caused by e-commerce volumes. Vietnam express delivery rates are expected to exceed $10/kg by the end of Q3.E-commerce companies are anticipating a strong peak season, with 20-30% more transaction volumes (up to 60% more in the weeks before Black Friday).

-

Industry experts expect strong Q4 sales, and the air cargo capacity imbalance is expected to reach a peak due to the new Apple product launch (iPhone 16). The global cargo analysis firm Xeneta is warning the industry to prepare for further freight rate increases in Q4.

-

Air cargo capacity out of Asia is mostly sold out for Q4 2024.

top