EXTRANS GLOBAL - Air Freight News - Week 22 2025

Air Cargo General

1) Europe also begins to implement regulations on Chinese e-commerce cargo

- Following the United States, the European Union (EU) has also officially started to take regulatory measures against air cargo of e-commerce from China, and it is expected that the impact on the global air cargo market will gradually expand.

- Recently, in view of the surge in e-commerce cargo within the EU, the EU is studying a plan to impose a "processing fee" of 2 euros (about 3,800 won) per piece on imported e-commerce cargo.

- In the past year, the volume of listed customs clearance e-commerce goods imported into the EU reached 4.6 billion pieces. Among them, 91% of all imported e-commerce cargo was from China. This has increased from nearly 2.4 billion pieces in 2023. In 2022, it was only 1.4 billion pieces.

- In response to such a surge in the number of listed customs clearance, the European Commission (EC) recently said that it will gradually build a system that can manage and supervise.

- Europe currently allows listed customs clearance for goods below 150 euros per piece. However, it is planning to abolish the listed customs clearance standard in the future and impose a fee of 2 euros per piece on all imported e-commerce cargo. In addition, it also plans to impose a fee of 0.50 euros per piece on e-commerce transiting through Europe. These plans are currently under consideration in the European Parliament and have not yet been finally determined.

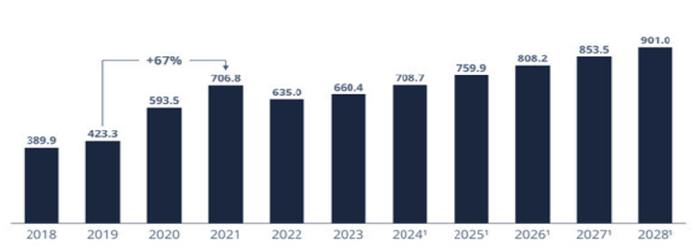

- On the other hand, the sales of the EU's e-commerce market expanded by 67% from the 423 billion US dollar market in 2019 to 706 billion US dollars in 2021. It is expected to expand to a 901 billion US dollar market by 2028.

2) Air cargo from Asia surges by 6% - Demand recovery under the influence of US tariff exemptions

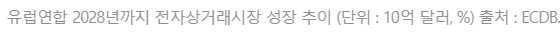

- The global air cargo volume surged by 6% compared with the previous week (May 12-18), showing a clear recovery trend. It is analyzed that the easing trend of tariff policies between China and the United States and the demand recovery after the holidays in Japan and South Korea are the main factors driving the increase in cargo volume from Asia.

- During the 20th week (May 12-18), two-thirds of the global air cargo volume came from the increase in freight chargeable weight in China and Hong Kong (+8% compared with the previous week), Japan (+60%), and South Korea (+21%).

- This is due to the recovery of cargo volume after Japan's Golden Week (April 29-May 6) and South Korea's Children's Day (May 5), driving the overall cargo volume in the Asia-Pacific region to increase by +11% compared with the previous week. The cargo volume from the Middle East and South Asia (MESA, +11%) and Europe (+6%) also rose simultaneously, showing an overall global recovery trend.

- In particular, on May 2, the United States terminated the "de minimis" tariff and declaration exemption applied to low-value small cargo from China and Hong Kong, and implemented a comprehensive tariff increase. As a result, from the end of April, dozens of cargo aircraft services on routes to the Americas were canceled or converted to other routes, and the cargo volume dropped sharply. However, on May 12, a temporary agreement was reached between China and the United States, and the situation reversed.

- This agreement includes the cancellation of some tariffs and a 90-day exemption measure, the relaxation of the de minimis clause, etc., and the tension between China and the United States was temporarily eased. As a result, cargo from China and Hong Kong to the United States rebounded by +19% in the 20th week compared with the previous week, recovering to the level in early April and late February. At that time, before the tariff increase in April, the cargo volume surged in March.

- During the same period, the spot freight rate on this route stabilized at around 4 US dollars per kilogram, which is a 缓和 level after the sharp increase in late April.

- On the other hand, cargo from China and Hong Kong to Europe has also shown a steady upward trend in the past three weeks. In the 20th week, cargo from China to Europe increased by +9% compared with the previous week. As a result, the overall cargo volume from China and Hong Kong to Europe has approached the highest value of this year, recovering to the year-end peak season level.

3) The launch of Integrated Air Incheon is postponed to August

- Air Incheon, which was originally scheduled to launch as "Integrated Air Incheon" in July after acquiring the cargo business of Asiana Airlines, has postponed its launch to August. Since it is necessary to obtain the operation permission of each destination country in order to put cargo aircraft into the international cargo routes acquired from Asiana Airlines after the launch, the delay in this process has led to the postponement of the launch schedule. The Air Incheon side said that it is only that the start-up time of the acquired cargo aircraft is delayed by one month, and there is no major problem in the overall business.

- Air Incheon recently notified the Executive Committee of the European Union (EC) to postpone the start time of the cargo aircraft operation acquired from Asiana Airlines from July 1 to August 1. At present, it is waiting for the approval of the EC for the change plan, and the launch time of "Integrated Air Incheon" has also been adjusted to August. "It is reported that due to the delay in overseas permits for some routes, Air Incheon has requested the EC to postpone the start time of operation to August 1", "Currently waiting for approval".

- Air Incheon is required to obtain the prior approval of the EC when changing major matters in accordance with the conditions for the acquisition of the cargo business. When the EC approved the merger of Korean Air and Asiana Airlines, it took the sale of the cargo business department of Asiana Airlines as a condition, so Air Incheon acquired the business.

- The direct reason for the postponement of the launch is the delay in the permission process for the routes taken over from Asiana Airlines. The 25 routes transferred by Asiana Airlines include the United States (Los Angeles, San Francisco, Seattle, New York, etc.), the United Kingdom (London), Germany (Frankfurt), Austria (Vienna), etc. Air Incheon has obtained all the permits from the Ministry of Land, Infrastructure and Transport for these routes, but the separate approval process for each destination country is still incomplete, resulting in the delay of the schedule.

- Air Incheon aims to obtain permits for all routes by the end of July and launch as "Integrated Air Incheon" on August 1. A relevant person from Air Incheon said: "It is expected that the permits will be completed by the end of July", "Although the integrated launch is delayed by about one month to August, the cargo aircraft securing and operation preparation are proceeding without any problems, so there is no major problem in the overall business."

4) The size of the airline is competitiveness - Air Premia is preparing for aviation M&A

- After Chairman Kim Jung-kyu secured more than 70% of the shares of Air Premia and became the largest shareholder, he officially announced the acquisition and merger (M&A) of the airline. Air Premia, which currently operates 7 routes with 7 aircraft, is interpreted as advancing business expansion with the concept of an industrial restructuring entity.

- Chairman Kim Jung-kyu of Air Premia recently stated, "The aviation industry is essentially based on economies of scale," and "We will cultivate it into a competitive airline through securing additional capital and acquisition and merger (M&A)."

- On the 2nd, AP Holdings, a subsidiary of the Tire Bank Group led by Chairman Kim, secured more than 70% of the shares of Air Premia, thus becoming the de facto largest shareholder and management responsible person.

- Chairman Kim emphasized, "Air Premia is not just a simple airline, but a strategic industry that enhances the national character," and "We will develop it into a high-quality airline that is the pride of the Republic of Korea in the world and a source of national pride." He also said that he will cultivate the airline as a strategic asset of the national industry. He added, "We will strengthen the role of the aviation industry in earning foreign exchange and contribute to the country's foreign exchange earnings."

- Air Premia is a company uniquely positioned as a Hybrid Service Carrier. It was established in 2017. At that time, Air Premia started as an aviation startup at WeWork in Euljiro. The following year, it raised investment for applying for an airline business license.

- The originally targeted investment funds of 30 billion won were raised to 37 billion won. Then, in March 2019, it obtained an airline business license. Due to the COVID-19 pandemic, it was once suspended. After the arrival of the first aircraft in April 2021, it started formal commercial operations.

- There is a view in the industry that most of Air Premia's routes are long-haul, and it faces difficulties in ensuring the efficiency and profitability of capital operation.

- "With the current amount of capital, Air Premia has difficulty ensuring route expansion or operational flexibility," and it was pointed out that "except for securing capital or acquiring the routes of other airlines, there is no other good way," and "the 'economies of scale' mentioned by Chairman Kim should not be simply regarded as an aspiration, but as a necessary issue for the survival of the enterprise."

- Although Chairman Kim did not specifically mention it, the aviation industry evaluates that Air Premia is likely considering the acquisition of Eastar Jet.

- In addition, Air Premia's M&A strategy is also considered to be in line with the overall restructuring trend of the aviation industry. It is reported that the Ministry of Land, Infrastructure and Transport is currently considering the policy direction of guiding structural adjustments among low-cost carriers (LCCs) after the merger of Korean Air and Asiana Airlines. With limited airport parking spaces and restricted route rights, competition among airlines is becoming increasingly fierce, and the Ministry of Land, Infrastructure and Transport has also proposed the possibility of guiding airline mergers to a certain extent.

- Judging from the audit report of Eastar Jet, the acquisition target of Air Premia, which has been frequently mentioned recently, the total liabilities last year were approximately 214.3 billion won, while the total capital was -14.9 billion won. The debt ratio is actually in an incalculable state, and the industry usually classifies it as "capital erosion."

- This indicates that Eastar Jet actually does not have the ability to make additional investments required for independent survival. From the perspective of potential acquirers, this is evaluated as a condition with a very high risk burden of normalizing the financial structure. As of the end of 2023, the debt ratio was approximately 1262%.

- However, M&A is a high-risk strategy. When acquiring other airlines with a fragile financial structure, it faces complex issues such as assuming existing debts, adjusting the human resources structure, and re-signing aircraft leases.

top