EXTRANS GLOBAL - Air Freight News - Week 22 2024

Air Cargo General

1) The congestion at the ports has worsened, leading to the unavailability of SEA & AIR services. As a result, the lead time has increased at the transshipment hub in the Middle East.

- The disruptions in the maritime supply chain are ultimately expected to result in a shortage of air cargo capacity.

- As congestion at major ports has increased due to the Red Sea incident, transshipment between Asia and Europe, which has been active for relatively urgent cargo,

- It has been pointed out that SEA &AIR is not actually being implemented.

SEA & AIR specialty market players said, “SEA & AIR services that used to travel through Singapore or Port Klang have virtually ceased to operate as congestion at those ports has increased.

“In particular, in some ports, it takes up to 7 days or more for a ship to arrive and dock, so there are customers who want relatively quick service.”

“We are not meeting the demands of shippers,” he said. - Moreover, in the case of Dubai, it is pointed out that as airport cargo gate congestion has increased significantly, its attractiveness as a transshipment destination along with the port is decreasing.

- An official said, “First of all, the Jebel Ali port in Dubai has been highly preferred by shippers as it can significantly reduce the additional transportation time due to bypassing the Cape of Good Hope.

- It is said that as the number of ships trying to change routes to the Red Sea increases, traffic volume is rapidly increasing and becoming very congested. “This is a similar situation for Dammam, who has played the same role.”

- Accordingly, market experts say that as the aftermath of the Red Sea incident is worsening, the air cargo market between Asia and Europe may soon experience a greater supply shortage.I see that there is. In particular, the sequential aftereffects of the commonly experienced “maritime supply chain crisis >> activation of SEA & AIR >> lack of air cargo supply” will become a reality.

We focus on possibilities.

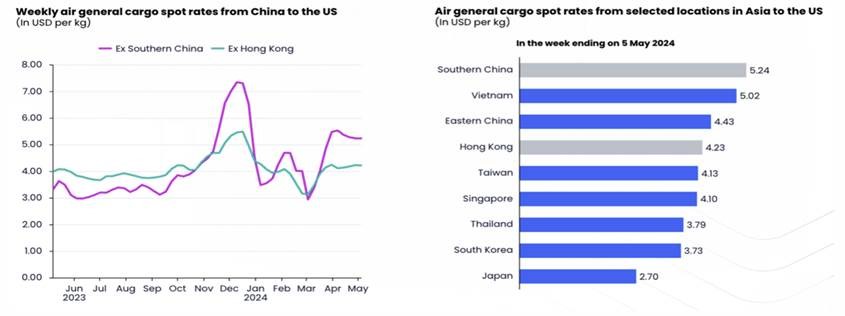

2) Air freight rates from Asia to America

- Air freight rates in Southern China and Hong Kong, major e-commerce origins, have continued to rise since the end of last year's peak season.

- During the first week of May, the spot freight rate for general cargo from southern China to the United States was $5.24/kg.

- Calculated at $4.23/kg from Hong Kong to the United States. Both lanes are still about 85% higher than the same period in 2019.

- This is not the traditional freight rate between the two regions seen before the e-commerce surge. This trend continues as shippers look for other available routes.

Extended to nearby air cargo hub. - For example, in the first week of May, the spot freight rate for general cargo from Vietnam to the United States was $5.02 per kg, a surge of nearly 60% compared to the same period in 2019.

- Departure freight for general cargo (spot) in the first week of May is $4.43 per kg for Eastern China, $4.12 for Taiwan, $4.10 for Singapore, $4.13 for Thailand, $3.73 for Korea,

Japan recorded $2.70 fare to the US. - A strategy to secure space is very important in preparation for the potentially ‘strong peak season’ ahead.

3) Demand for air cargo from China continues to rise

- As of the 20th week of this year (May 13-19), the world's average air cargo rate was $2.48/kg, a slight increase compared to the previous week. A 2% increase compared to the same period last year.

- This is 40% higher than the average fare in May 2019 before the pandemic. Air cargo demand also increased by 9% compared to the same period last year.

- The Asia Pacific region increased by 15% and the Middle East and Southeast Asia increased by 16%, leading the overall upward trend.

- Air cargo demand for European routes, especially from Dubai (DXB), soared by 148%. Accordingly, demand for air cargo from Middle East and Southeast Asia to Europe increased by 31% compared to the same period last year.

- The rapid increase in air cargo from Dubai is due to the rapid increase in the volume of combined shipping and air transport (Sea & Air) via the Middle East due to the Red Sea incident. In addition, 57% came from Sri Lanka,

Bangladesh also increased by 28%. - Due to this surge in demand, the freight rate from Bangladesh to Europe is $4.66/kg. This is a 136% increase compared to the same period last year. The freight rate from India to Europe is $372/kg.

- Increased by 163% compared to the same period last year.

- Air cargo demand from the Asia-Pacific region also increased by 15% compared to the same period last year. Accordingly, freight rates also increased by 10%. In particular, freight rates for European routes in Hong Kong (HKG) and China increased over the past 14 and 18 weeks.

Between them, there was an increase of 23% and 47% respectively. - In the 19th and 20th weeks of the year, air cargo demand increased by 19% and 10%, respectively. Air cargo demand for European routes from Hong Kong and China increased by 31% compared to the same period last year.

- In the past month, fares for European routes from China have risen 22-31%, and fares from Hong Kong have also risen 3-23%. In particular, the freight rate for European routes from Vietnam remains steadily at $4/kg.

It remains strong. This is 120% higher than the same period last year.

4) It is expected that the supply chain will shift to India and ASEAN due to the conflict between the US and China.

- Due to the deepening conflict between the US and China, the weight of the global supply chain is shifting towards India and the ASEAN region.

- In a recent PwC survey of 150 senior executives from companies in Asia, Europe, and North America, India's global corporate supply chain ranking over the next 10 years was:

It is expected to rise from 4th to 3rd place. - ASEAN is also expected to rise one notch to 5th place, while Germany is expected to drop a notch to 4th place and Japan is expected to fall to 6th place.

- ASEAN is expected to benefit from the rebalancing of the electronics manufacturing sector, while India is expected to benefit from the electronics manufacturing, pharmaceutical and medical equipment sectors.

- Global companies are reorganizing their supply chains, including strengthening supply chain resilience while reducing excessive dependence on the single market, but the United States and China will not remain in the foreseeable future.

It is expected to remain an upper supply chain. - PwC predicts that the 10 ASEAN member countries and India will receive attention as alternative supply chains. South Asia and ASEAN are attracting multinational companies due to their high population density and economic growth rate.

This is because it can provide various profitable opportunities. - PwC assesses that business leaders are prioritizing the need to reorganize supply chains and strengthen companies' resilience to external pressures.

5) 항공사/GSA Event update

(1) Ministry of Land, Infrastructure and Transport distributes transportation rights to 30 international routes

What is noteworthy is that Sirius Airlines, which is preparing to launch flights based in Busan, receives 10 cargo routes out of the total traffic rights.

On Korea/Kazakhstan cargo routes, Asiana operates 8 times a week, Air Incheon operates 6 times a week, and Sirius operates 6 times a week. Air Incheon has secured flight rights to Incheon/Ulaanbaatar twice a week.

In addition, Sirius Airlines has secured flights to Korea/Poland twice a week, Korea/Qatar four times a week, and Korea/Istanbul and Ankara twice a week.

Analysis shows that great effort has been put into securing LCC competitiveness through diversification of international routes. Domestic LCCs that have operated mainly in Northeast and Southeast Asia have operated in countries such as India, Uzbekistan, Kazakhstan, and Kyrgyzstan.

It is now possible to operate flights to Southwest Asia and Central Asia. It is expected that mid-distance routes will be expanded to Incheon-Almaty (Eastar twice a week), Korea-Uzbekistan (Jeju three times a week, T'way), Seoul/New Delhi, Mumbai (T'way three times a week), etc.

(2) Demand for 88 B777 cargo planes by Sein and Temu Haru

Chinese e-commerce companies Shane and Temu transport worldwide air cargo reaching 9,000 tons per day. This has a transportation capacity of 88 B777Fs, which is equivalent to the cargo volume of e-commerce companies.

Analysis shows that air cargo rates are maintaining an overall upward trend due to absorption capacity. A huge volume compared to Apple transporting about 1,000 tons of air cargo per day.

As of last year, Temu's sales increased by 241%. Sein's operating profit also tripled. Based on these operating profits, e-commerce companies are gradually strengthening their global logistics territory through air transportation.

Currently, SEIN is used for more than 30% of the world's long-distance cargo charter flights. As of last April, air cargo rates from China increased by 14%.

(3) T’way Air (TW) Paris flight schedule announced

ICNCDG 3W(D136) TW401 1135/1810, CDGICN TW402 2030/1515+1 A332, Part 7/1 * Not a confirmed schedule.

top