EXTRANS GLOBAL - Air Freight News - Week 20 2024

항공화물 General

1) TAMEX, in cooperation with T'way Airline, has commenced cargo sales for 5 European routes

-

Starting from May 16th, TAMEX, a joint venture between Extrans Global and Hong Kong's GSSA group TAM, has officially begun selling air cargo for T'way Airline's European routes.

-

This airline will operate three flights per week on the Incheon (CN) to Zagreb (ZAG) route, using A330-300 wide-body aircraft. This marks the start of domestic cargo sales for this route. Additionally, they plan to sequentially start selling domestic cargo for T'way Airline's upcoming routes to Paris (CDG), Rome (MXP), Barcelona (BCN), and Frankfurt (FRA). T'way Airline plans to operate European routes until the end of this year.

-

Meanwhile, due to the merger between Korean Air and Asiana Airlines, T'way Airline has obtained the operating rights for European routes. The operation will be carried out using five leased A330-200 aircraft from Korean Air, as part of the merger with Asiana Airlines.

-

On the first day, the occupancy rate of the first flight, TW505, from Incheon to Zagreb was 97%, almost full capacity.

-

The Incheon to Zagreb route operates three times a week (Tuesday, Thursday, Saturday), departing from Incheon International Airport at 11:05 AM, arriving at Bishkek Airport in Kyrgyzstan at 3:30 PM, departing from Bishkek Airport at 5:10 PM, and arriving at Zagreb Airport at 7:55 PM local time after refueling.

2) Airline cargo special as commerce explodes in China

- Under the impact of Chinese e-commerce companies known as "Alibaba, JD.com, Pinduoduo" and other Chinese e-commerce companies, domestic airlines have benefited from special cargo needs outside the first quarter of last year.

- According to aviation industry news, according to data from Korean Air, the operating income of the cargo route segment in the first quarter of this year was 99.66 billion won, which was similar to last year (1.485 trillion won).

- Seems to have been maintained.

- Although air cargo freight rates fell by nearly 15% compared to the same period last year, stable performance was maintained due to a significant increase in the volume of cargo handled.

- Initially, the airline industry expected to have enjoyed unprecedented exceptional demand during the COVID-19 pandemic but was likely to experience a downturn in post-pandemic freight rate recovery.

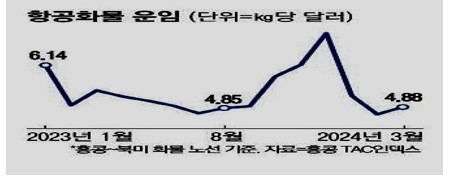

- In fact, according to the Baltic Air Freight Index (BAI), freight costs from Hong Kong to North America were US$6.14 per kilogram in January 2023, compared with US$5.22 per kilogram in January this year, a decrease of 15%. In the following February and March, shipping costs further dropped to around US$4, 6-10% lower than the same period last year.

- However, contrary to expectations, the airline's cargo revenue remained at last year's level despite lower freight rates on the back of higher cargo volumes.

- The industry believes that the prosperity of the e-commerce market led by China's e-commerce is the background for the increase in freight volume.

- According to data from the International Air Transport Association (IATA), global cargo volume increased by approximately 15% from January to February this year compared with the same period last year. Subsequently, CTK increased by 10.5% in March compared with the same period last year, while airlines in the Asia-Pacific region increased cargo demand by 14.3% during the same period, exceeding the average.

- In the long-term Honghai incident, global air cargo volume increased due to logistics disruptions, while the situation in Asia was affected by the expansion of Chinese e-commerce companies such as Alibaba and JD.com.

- Korean Air stated in its first quarter results release last year that it expected to maintain the cargo flow brought by Chinese e-commerce this year and expected an average annual growth of 22%.

3) Let's ride C-commerce (China E-Commerce) - LX Pantos joint venture with Chinese logistics company

-

Logistics company LX Pantos is pushing for the establishment of a joint venture (JV) with Sinotrans, China's largest logistics company. Through this JV, LX Pantos aims to attract global shipping demand from Chinese e-commerce platforms, represented by the so-called "Altesh" (Ali, Tmall, Shein), and expand the scale of the domestic logistics industry.

-

On the 16th, LX Pantos signed a Memorandum of Understanding (MOU) with Sinotrans at the Sinotrans headquarters in Beijing to establish a Sino-Korean integrated transportation business JV and build a strategic partnership.

-

The event was attended by Lee Yong-ho, CEO of LX Pantos, and Song Long, CFO of Sinotrans, among other top executives from both companies.

-

According to a global logistics survey conducted by A&A in October 2023, Sinotrans ranked second worldwide in terms of ocean freight volume, while LX Pantos ranked sixth.

-

As each company represents its respective country's logistics industry, this joint venture signifies intergovernmental cooperation. The Sino-Korean integrated transportation business to be carried out by the JV involves transporting Chinese cargo to South Korea by sea and then by air from Incheon Airport to destinations such as the Americas and Europe.

-

Hanjin has also been expanding the Incheon Airport Global Logistics Center (GDC) since last month, doubling the size of its self-customs clearance facilities. Once the construction is completed, the monthly processing capacity of the GDC will increase from 1.1 million boxes to 2.2 million boxes. The expansion of handling capacity is driven by the significant increase in domestic users utilizing Chinese e-commerce platforms and the corresponding surge in cross-border online shopping volume.This expansion aims to meet the growing demand for handling capacity.

4) Air cargo freight market conditions from Asia to the Americas

- The air cargo rates in Southern China and Hong Kong, the major origins of e-commerce, have been steadily increasing since the end of last year's peak season.

- In the first week of May, the spot rates for general cargo were recorded at $5.24/kg from Southern China to the United States and $4.23/kg from Hong Kong to the United States. Both lanes are still approximately 85% higher compared to the same period in 2019.

- This is not the traditional level of freight rates between these two regions that existed before the surge in e-commerce. As shippers seek alternative available routes, this trend is extending to nearby air cargo hubs.

- For example, in the first week of May, the spot rates for general cargo from Vietnam to the United States increased by almost 60% to $5.02/kg compared to the same period in 2019.

- The departure rates (spot) for general cargo in the first week of May were recorded at $4.43/kg from Eastern China, $4.12/kg from Taiwan, $4.10/kg from Singapore, $4.13/kg from Thailand, $3.73/kg from South Korea, and $2.70/kg from Japan to the United States.

- Securing space strategies are crucial for preparing for the potential "strong peak season" in the future.

5) 항공사/GSA Event update

(1) Ethiopian Cargo Launches 2 New Freight Routes to India

In addition to New Delhi, Mumbai, Chennai, and Bengaluru, Ethiopian Cargo will now operate twice a week cargo services between Hyderabad (HYD) and Ahmedabad (AMD) starting from May 11th.

Ethiopian Airlines currently operates 135 international passenger and cargo routes, including 63 cities in Africa. They offer 67 dedicated cargo flights with a fleet that includes 10 B777Fs, 4 737-800Fs, and 2 767-300Fs.

(2) Air Astana Introduces Direct Flights from Incheon to Astana

Starting from June 16th, Air Astana will operate direct flights between Incheon (ICN) and Astana (NQZ) twice a week. The flights will be operated by an A320NEO aircraft with the flight number KC210 departing ICN at 07:55 and arriving at NQZ at 11:40. The return flight KC209 will depart NQZ at 20:25 and arrive at ICN at 05:55 the next day.

(3) Qantas Suspends Sydney-Shanghai/Pudong Flights

Qantas has announced the suspension of its Sydney (SYD) to Shanghai/Pudong (PVG) route starting from July 28th. Despite resuming operations due to the easing of China's COVID-19 policies, the demand for travel has not recovered as expected, resulting in a passenger load factor of less than 50%.Currently, this route is only operated by Qantas five times a week, along with 11 weekly flights by China Eastern Airlines. The flight numbers for Qantas are QF129 departing SYD at 09:30 and arriving at PVG at 18:25, and QF130 departing PVG at 19:50 and arriving at SYD at 18:25 the next day, operated by an A333 aircraft.

(4) Maersk Launches 90,000 Square Feet Miami Air Cargo Gateway

Maersk has established an air cargo gateway in Miami, covering an area of 90,000 square feet. This move aims to strengthen their air freight services between the Americas, Asia, and Latin America. The gateway will facilitate the transfer of cargo from North America, Europe, and Asia to Latin America through the provision of cargo and belly supply.Following the launch of gateways in Atlanta and Los Angeles for their Central and South American hubs last year, Maersk continues to expand its air cargo services in the US market.

top