旭辉空运国际 - 第11周25年航空业更新

航空货运概况

1) 정부, 아시아나 품은 대한항공 10년간 운임·좌석 등 감독 계획

- 政府将对韩国航空与亚细亚航空合并后是否实施有关航空运费和座位供应的整改措施进行为期10年的监督。

- 公平交易委员会和国土交通部于6日在政府首尔大厦举行了实施监督委员会的成立仪式,以检查韩国航空的整改措施落实情况。

- 韩国航空在与公平交易委员会和国土交通部协商后,组建了由9名专家组成的实施监督委员会,这些专家来自公平交易、消费者权益、航空和会计审计等领域,能够独立执行监督工作。

- 委员会由4名航空专家、2名公平交易专家、2名消费者权益专家和1名会计/审计专家组成,成员的任期为两年,可以连任。

- 实施监督委员会的运作期限为自合并之日起10年。

- 根据公平交易委员会的整改措施,实施监督委员会将要求韩国航空提供相关信息或提交材料以履行职责,并在必要时进行现场检查。

- 此前,公平交易委员会在去年12月外部竞争机构完成审查后,确认了韩国航空与亚细亚航空合并的整改措施。

- 基于此次谅解备忘录,两个机构计划在航班时刻、航权的撤回与再分配、里程整合方案的制定、以及航空运费和里程制度的监控等方面密切合作。

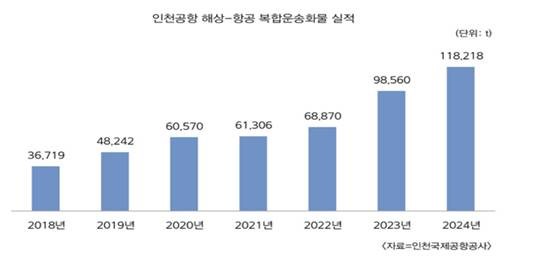

2) “电子商务效应”下的仁川机场实现海空联运新纪录

- 去年,仁川机场的海空联运货物创下118,000吨,较前一年增长20%。这是机场开业以来的最高业绩,之前的记录为98,000吨。

- 仁川国际机场公司分析认为,全球电子商务行业的增长推动了这一业绩。海空联运主要涉及从中国生产的电子商务商品通过海运运送至仁川,然后再通过空运转运至全球目的地。仁川机场凭借优越的地理位置,与中国的接近性以及连接192个城市的优势,成为了一个有利的枢纽。

- 经过仁川机场的海空货物的最终目的地主要集中在北美和欧洲等远程地区。约有50,000吨和34,000吨的货物分别经过仁川机场,区域市场占有率为42%和28%。然而,从货物量来看,亚洲、拉丁美洲和中东等地区的货物量从21,000吨增加到35,000吨,增长了67%,远高于北美和欧洲平均7%的增长率。随着来自中国的电子商务需求多样化,最终到达的国家数量从去年的35个大幅增加到今年的47个。

- 在仁川机场出发前,货物到达的主要港口依次为仁川港、平泽港和群山港,货物量分别为43,000吨、41,000吨和33,000吨,分别占37%、35%和28%。

- 预计今年航空货物需求将保持强劲。尽管由于美国新政府的关税政策变化,整体贸易可能会在一段时间内放缓,但通过电子商务运输的中国至美国的航空货物总量预计不会发生重大变化。即使美中关系紧张,电子商务货物主要集中在监管较少的消费品上,而中国消费品的单价较低,预计对免税额调整的影响也会较小。

- 尽管SEA & AIR可能因美国的监管而经历短期波动,但长期增长仍然被预测。

- 同时,预计今年下半年亚细亚航空的货运业务重组以及韩国航空货运中心的更新可能导致供应中断。

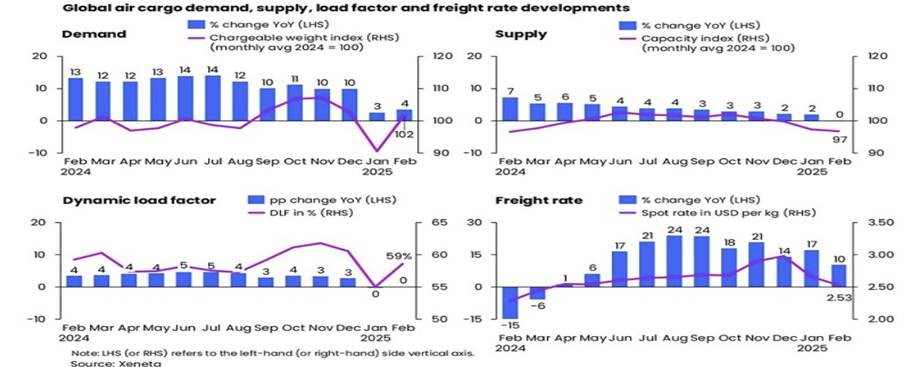

3) 2月航空货运市场电子商务需求不稳定迹象显现——美国监管影响

• 2月航空货运市场整体保持增长,但电子商务相关监管加强的影响开始显现。

- 2月航空货运市场整体保持增长,但电子商务相关监管加强的影响开始显现。

- 市场分析机构Xeneta最新数据显示,2月航空货运需求同比增长4%,动态载货率保持在59%,平均市场运价上涨10%至每公斤2.53美元。

- 特别是上海是首个受到电子商务货量减少影响的地区。专家指出,尽管考虑到春节假期季节性因素和年初电子商务需求放缓,中国货物“de minimis”免税门槛的暂时取消可能是反映对航空市场影响的信号。

- 从供应角度看,尽管电子商务货量减少,香港和中国南部地区的可用供应量增加,表明上海可能是最先受到冲击的地区,2月市场确实出现了这一现象。

- 越南等替代中国市场的地区预计会出现价格上涨。一些企业可能将供应链转移到中国以外的地区以规避美国额外关税,这可能导致越南等替代市场的航空运价上涨。

- 与此同时,美国计划对中国船舶征收额外港口使用费,海运市场的混乱可能进一步影响航空货运市场。

- 在这些变化中,航空公司和货运代理不可避免地需要调整策略以应对市场波动。航空公司可能将运力从中国市场重新分配到东南亚或跨大西洋航线,而货运代理可能会谨慎审查包机协议并密切关注市场动态。

4) CMA CGM计划投资200亿美元推动美国供应链创新——包括以芝加哥为中心的航空货运扩展

- 全球海运、陆运和航空物流领军企业CMA CGM集团宣布,作为美国籍船公司APL的母公司,未来四年将投资200亿美元,支持美国航运经济和国内供应链创新。

- CMA CGM计划在未来四年大幅扩展美国籍船队,提升东西海岸主要集装箱港口的处理能力,并在全国范围内建设先进的物流仓库。

- 此外,公司还表示将在芝加哥建立大型航空货运枢纽,以加强与美国客户和公共机构的合作。

- 首先,CMA CGM通过此次投资计划与美国政府近期强调的增强造船能力政策保持一致,计划扩展APL的美国籍船队,并通过航运人才培养和先进技术引入,加强美国航运基础设施。这些投资有望巩固APL作为负责美国政府货物运输的核心船公司地位,同时助力实现美国的经济和国家安全目标。

- 为扩大美国航空货运能力,CMA CGM将在芝加哥建立新的航空货运枢纽。为此,公司将新引进5架波音777货机,并建立由美国飞行员运营的体系,以确保紧急货物和关键物资的稳定运输。

5) GSA及航空公司动态

- 从5月1日起,荷兰皇家航空(KLM)将把ICN-AMS航线的航班从目前的每周5班增加至每周7班。KL856航班将使用B777-200执飞,时间为ICN 22:25 - AMS 05:25+1。

top