旭辉空运国际 - 第07周25年航空业更新

航空货运概况

1) 尽管暂停了电子商务免税优惠,但来自中国的需求不会有显著波动。

- 最近,美国政府宣布暂停对中国货物的De Minimis免税优惠,但有观点认为,亚洲电子商务市场不会发生重大变化。

- 在全球物流公司DSV年度业绩发布后的新闻发布会上,首席执行官延斯·伦德表示,公司通过Temu和Shein等在线零售平台处理货物的方式“非常有限”。

- 他提到,美国此次De Minimis规定的变化不会对电子商务平台的需求造成重大影响。

- 即使征收进口关税,他预测电子商务平台仍能保持相较于传统零售商的成本优势。

- 这使得可以直接销售,而无需通过中间商或批发商,他解释道。

- 他指出,这种价格竞争力是推动电子商务市场增长的重要因素。他还提到,制造商可能会迁移到其他国家(例如越南),以继续享受De Minimis的优惠,并表示电子商务市场将继续寻找新标准而不断增长。类似的观点已经被其他行业专家提出。

- Swissport的电子商务副总裁提到,“电子商务货物的平均价值为15到18美元,即使征收20%的税,消费者也能承受。”

- 他强调,中国的电子商务并不是为了利用De Minimis规定而建立的,而是为了提供消费者所需的便宜和快速的商品,并预测即使在征收关税后,仍将比在零售店购买更便宜。

2) 由于美国关税政策加强而导致的航空货运市场危机展望 (1-1)

- 供应链物流平台Flexport解释称,“简单经过受关税国家的货物不会受到影响”,但警告称,如果不遵守关税规定,可能会产生额外费用。

- 此外,Flexport表示:“受关税影响的是在相关国家生产的商品,而不是仅仅经过这些国家的商品”,并补充道:“在2月4日之前没有追溯适用的关税,但之后如果系统未建立完善,可能会追溯适用。”

- 虽然关税对整体影响较大,但电子商务贸易在航空货运行业中也成为主要关注点。

- 昨天,特朗普总统宣布取消对价值800美元以下的中国进口商品的免税优惠(De Minimis豁免)。该措施预计也将适用于墨西哥和加拿大,分析认为对这些国家实际实施关税将产生影响。

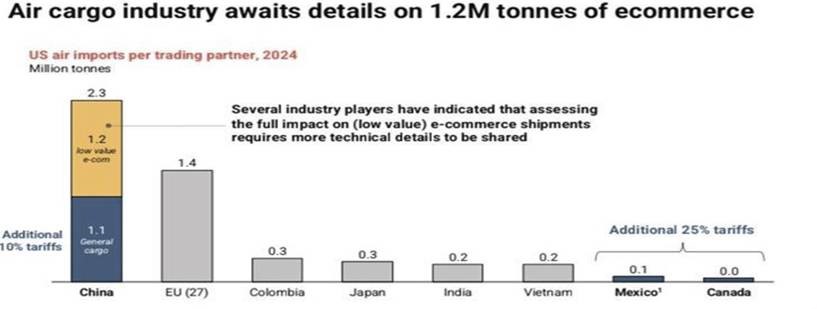

- 去年,美国从中国进口了120万吨电子商务商品,显示出电子商务在航空货运中占有重要份额。然而,与其他类型商品相比,单个商品的价值相对较低。

- 行业人士指出,评估(低价)电子商务货物的整体影响需要更多的技术细节。

- 除电子商务外,根据Rotate的数据,预计到2024年,美国将从中国进口110万吨一般货物。

- 从欧盟进口的货物也达到了140万吨,目前行业关注是否会对这些国家宣布关税措施。相比之下,来自墨西哥和加拿大的进口量相对较低。

3) 由于美国关税政策加强而导致的航空货运市场危机展望 (1-2)

- 随着特朗普总统的关税政策正式实施,全球贸易市场预示着重大变化,货物运输市场也处于紧张状态。

- 然而,有必要谨慎观察对物流市场的实际影响,许多人对供应链市场需求萎缩和经济衰退的可能性持怀疑态度,这与媒体分析相反。

- 针对加拿大和墨西哥的关税措施已被推迟一个月,但预计这些措施将影响近岸外包(nearshoring)的趋势。

- 主要媒体提出了在墨西哥运营的企业可能考虑因关税负担增加而转移生产基地的可能性。然而,分析认为,由于高昂的劳动成本,向美国迁移在实际操作上将非常困难。

- 一位经济专家指出:“即使关税增加,迁移工厂到美国因高成本而不现实,可能更经济的是忍受关税留在墨西哥。”

- 有人认为,尽管美国目前似乎在制衡中国,但人工阻止物流流动是不可能的,这样的措施可能会对供应链稳定性和经济增长产生负面影响,从而可能增强中国的竞争力。

- 在电子商务领域,预计会出现更严格的监管、额外的文书工作和海关延误等问题。然而,尽管取消了最低免税标准,但“Altesh”因具备足够的成本应对能力,预计不会受到重大长期影响。

- 未来,进口商有很大可能性会回归传统的大宗采购和通过美国仓库进行分销的方式,预计还会增加利用第三方物流(3PL)提供商进行清关和仓库运营,以及扩展关税缓缴项目的使用案例。

- 实际上,Temu自去年底以来一直在鼓励中国卖家将库存存放在美国仓库,这一趋势预计会加速。

- 总之,电子商务需求可能会暂时萎缩,但根据美中谈判的结果,其影响可能不会长期存在。特别是,针对中国的电子商务限制和监管可能会对亚马逊等美国企业造成冲击,因此预计美国的压力在某种程度上会受到限制。

4) 大明索诺加强由前韩亚航空高管主导的攻势 – T'way的走向

- 大明索诺集团通过将前韩亚航空高管推到前台,正在加紧争取对T'way航空的管理控制权。

- 索诺国际最近在大邱地方法院对T'way航空提起了两起临时禁令诉讼,并于上个月22日请求查阅股东名册,31日申请股东大会的议案。

- 尽管向T'way航空提交了管理改善要求书,但未收到回应,因此索诺国际选择了法律途径。实际上,索诺国际在上个月20日向T'way的代表郑洪根发出了一份关于即将召开的定期股东大会的股东提案,并请求查阅股东名册。

- 实际上,大明索诺集团作为T'way航空的第二大股东,正在积极行使管理权。

- 值得注意的是,随着此次临时禁令的申请,索诺国际提出的九名新董事会成员名单也随之揭晓。

- 包括大明索诺集团会长徐俊赫在内的其他八名成员的姓名被公开,其中包括三名内部董事(李相允、安宇镇、徐东彬)和四名其他非执行董事(徐俊赫、李光洙、李炳天、权光洙),以及两名外部董事(金宗德、廉永表)。

- 尤其是这三名内部董事,因其航空公司背景,预计将在大明索诺集团进军航空业中发挥重要作用。

- 实际上,这三人是索诺国际最近成立的“航空业务工作组”的核心成员,包括总裁李相允(高级执行官)、负责执行的徐东彬(执行官)和负责销售市场与开发的安宇镇(高级执行官)。

- 李相允和徐东彬是为航空业务工作组相对近期引进的人物。虽然李相允之前担任的职务尚未确认,但他被认为来自韩亚航空。与此不同,安宇镇则是在几年前就加入索诺国际,且已知他在韩亚航空积累了丰富的经验。

top