EXTRANS GLOBAL - Air Freight News - Week 51 2024

Air Cargo General

1) 2025 Air Cargo Market Outlook – B2B Air Freight Sector

- "This year, 2024, e-commerce is evaluated as a strong growth factor in the global air cargo market, but forecasts suggest that demand will also increase in the traditional B2B air cargo market next year, 2025.

- The freight benchmarking platform Xeneta analyzed in its 2025 outlook report that the relatively stagnant B2B air cargo market in 2024 is likely to rebound next year. In particular, the increased demand for AI-related semiconductor products is expected to have a positive impact on the air cargo market.

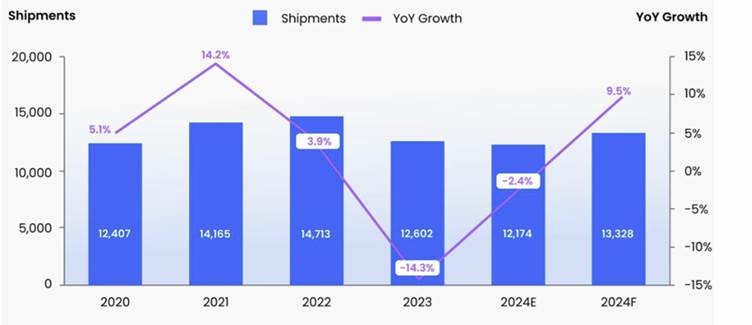

- Notably, the Semiconductor Industry Association (Semi) has projected that global silicon wafer shipments will increase by 10% in 2025 after a 2% decline this year.

- Wafers are a key material in semiconductor manufacturing and are mostly transported via air cargo. Xeneta explains that air cargo routes originating from Asia will grow due to increased semiconductor demand.

- The AI boom is expected to revitalize the stagnant B2B air cargo market; however, it is believed that global demand will not have the destructive power to significantly fluctuate due to events such as the Red Sea crisis and the rapid growth of e-commerce in 2024.

- Xeneta also analyzes that, as predicted by the International Monetary Fund (IMF), the global GDP growth rate is expected to stabilize at 3.2% next year, which will positively impact air cargo. However, it also mentions that disinflation will play an important role.

- Disinflation could be hindered by rising raw material prices due to geopolitical trade tensions and labor shortages caused by U.S. immigration controls."

2) Three Trends in Air Cargo for 2025 (Contribution from FEDEX)

- "The air cargo industry is achieving remarkable results despite facing significant geopolitical and economic uncertainties.

- In particular, there are several factors contributing to the increasing demand for air cargo services in Korea. What are the three major trends to watch in 2025?

-

-

Korea Emerging as an E-commerce Hub in the Asia-Pacific Region

- One of the biggest factors driving the increase in air cargo demand is the rapid growth of the e-commerce industry. The cross-border e-commerce market, triggered by C-commerce, has expanded significantly worldwide in a short period, leading to a substantial increase in cargo volume.

- Incheon International Airport, one of the busiest air cargo hubs in 2023, has played a crucial role as an intermediary for shipping Chinese e-commerce products, such as those from AliExpress, Temu, and Shein, to the world, strengthening Korea's position as a global logistics network hub. In 2023, the Sea & Air combined transport volume through Incheon Airport reached a record high of 98,560 tons since its opening.

- Both Korean companies and the government are responding quickly to this environment. Domestic e-commerce companies are expanding support for advertising and logistics costs for sellers competing against Chinese e-commerce. Additionally, the government is implementing support measures for small and medium-sized enterprises in e-commerce exports, so cross-border cargo volumes are expected to continue to rise. As Incheon International Airport enhances its function as an e-commerce cargo hub, it is anticipated to positively impact domestic e-commerce companies.

-

Air Cargo Benefits from Maritime Transport Restrictions

- Due to geopolitical issues, there is an increasing demand for the shift from sea to air transport. The Red Sea crisis and severe drought in the Panama Canal have significantly restricted shipping routes, leading to delays in transport and supply chain bottlenecks as maritime transport opts for air transport as an alternative. Additionally, there is a shortage of available vessels, and freight rates have increased, causing cargo that was previously transported by sea to shift to air.

- Recent data from Incheon International Airport confirms this change. In the first half of 2024, the international cargo handled at Incheon International Airport was 1,447,358 tons, a 10.1% increase compared to the same period last year. Additionally, transshipment cargo through the airport also rose by 7.7% to 576,929 tons.

- With the continuous increase in air cargo demand, air freight rates have also risen further. However, as demand has increased more significantly than last year, it is likely to remain strong until maritime routes are fully restored, and air freight rates are expected to continue their upward trend compared to the previous year.

- As a result, there is fierce competition among air cargo companies to attract demand for cargo such as automotive parts and energy equipment, which were primarily transported by sea.

- Air transport is expected to maintain high demand despite risks from the Middle East during the peak season for maritime transport. In addition to sea cargo, semiconductors that can only be transported by air will support profitability. In particular, the domestic semiconductor market is showing robust growth, injecting vitality into air cargo.

-

Sustainability in the Aviation Industry Requires Collective Efforts

- As air cargo demand increases, companies must support the development of the aviation industry and build a more resilient future. The global aviation industry has united with the goal of achieving 'net zero' by 2050; however, the transition to SAF (Sustainable Aviation Fuel) presents significant challenges.

- One of the biggest obstacles is the scarcity of SAF and the difficulties in mass production.

- To address these issues, commercial and cargo airlines are collaborating with other aviation-related companies to integrate resources and move to the next stage."

-

3) China – Absorbing E-commerce Volume through Expansion of Zhengzhou (CGO) Route

- "Korean Air (KE) and Incheon International Airport Corporation plan to utilize the expansion of the Zhengzhou (CGO) route to enhance air cargo transport market share as a growth driver for transshipment cargo at Incheon Airport.

- On the 10th, to attract e-commerce air cargo from China, the corporation and Korean Air held a 'Cargo Transport Competitiveness Seminar' targeted at major local logistics companies.

- The seminar was attended by 30 key logistics companies that use the Incheon-Zhengzhou route to transport air cargo to the Americas and Europe, along with employees from the corporation, KOTRA, and Korean Air's China sales team.

- The corporation promoted the air cargo network connecting 190 cities worldwide and showcased operational case studies of the airport-type free trade zone model specialized in e-commerce logistics hub operations.

- Korean Air shared the operational performance of the Incheon-Zhengzhou cargo route (operating three times a week) over the past year and explored cooperation measures for future sales expansion with participants.

- In particular, participants showed great interest in Incheon Airport's excellent accessibility to 44 cities in China via direct flights and the infrastructure competitiveness associated with the grand opening of Phase 4 of Incheon Airport.

- The corporation anticipates a high growth rate for air cargo, even amid the U.S.-China conflict, as Zhengzhou hosts Foxconn's largest factory (Apple's production base in China), and various support measures for developing e-commerce logistics infrastructure are being implemented. As of November of this year, air cargo on the Incheon-Zhengzhou route has reached approximately 16,000 tons, a 67% increase compared to 9,500 tons during the same period last year."

4) Regarding the sale of OZ cargo, the Ministry of Land, Infrastructure and Transport is closely examining the impact on shippers.

- As the approval process from various governments regarding the merger of Korean Air and Asiana Airlines comes to a close, the Ministry of Land, Infrastructure and Transport recently announced measures to enhance competitiveness in the air transport industry.

- The ministry plans to actively expand international air cargo routes. The government emphasized its intention to ensure that there is no disruption to the national logistics network during the sale of Asiana's cargo business through careful licensing and approvals.

- In response to recent changes in the global supply chain, the ministry plans to expand and establish cargo transport rights in countries like India, where domestic production facilities are increasing, and China, where demand for e-commerce transport is surging, thereby actively promoting overseas expansion for Korean companies.

- The ministry intends to attract global logistics companies to establish Global Distribution Centers (GDCs) at airports to increase transshipment volumes and is planning to develop multimodal transport business models that link air and sea transport, preparing actively for the operation of new regional airports.

- On the 11th, the Ministry of Land, Infrastructure and Transport announced the 'Measures to Enhance Competitiveness in the Air Transport Industry' at a ministerial meeting focused on strengthening industrial competitiveness.

- The announcement includes an analysis of major issues and implications in the air transport industry and outlines six key tasks to be prioritized moving forward.

- First, strengthening the international route network. The ministry plans to expand transport rights in South Asia, including India and Bangladesh, to discover emerging markets, and support irregular flights to Africa and Latin America.

- With no restrictions on transport rights, the plan is to gradually increase air liberalization areas to allow for flexible capacity increases based on demand between countries, including the EU, Indonesia, and Australia.

- In the face of fierce competition among Northeast Asian airports, efforts will be made to diversify routes and actively discover and establish new routes from Incheon Airport to develop it as a representative hub airport.

- The core transshipment axis of Incheon Airport, connecting East Asia-Korea-North America, will be solidified, while new transshipment axes to Oceania-Korea-Central Asia will also be developed.

- To this end, the slots at Incheon Airport will be expanded from the current 78 per hour to 80 per hour in the second half of next year.

- Additionally, apart from routes such as Busan-Jakarta and Cheongju-Bali, which have been secured through previous air talks, the ministry plans to continue securing mid-to-long-distance routes for local airports in Europe and South Asia.

- Furthermore, due to the merger of Korean Air and Asiana Airlines, the ministry plans to actively foster low-cost carriers (LCCs) to create a competitive environment and improve the international route network of the merged airline to enhance global competitiveness.

- Initially, the ministry will secure and distribute additional mid-to-long-distance transport rights in Europe and South Asia to expand opportunities for LCCs, and will support LCCs to be the first to enter routes where alternative airlines are needed due to corrective actions by domestic and international competition authorities.

top