엑스트란스 - 항공 물류 업데이트 - 44주차 블로그

1. 항공화물 General

1) ANA-NCA 장거리 화물노선 편명 공유 단행

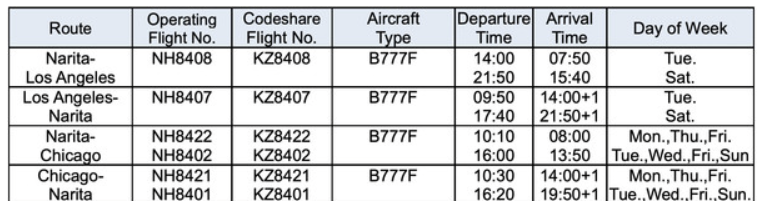

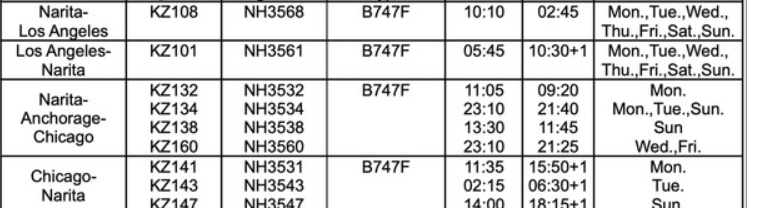

- 전일본공수(ANA, NH)와 일본화물항공(NCA, KZ)은 오는 26일부터 일본과 유럽•북미노선 화물편에 대해 편명공유를 실시 발표.

- 대상은 ANA가 777F 기재로 운항하는 나리타(NRT)에서 시카고(ORD), 로스앤젤레스(LAX) 노선에 대해 NCA가 편명을 공유.

- 또 NCA가 747F 기재로 운항하는 나리타와 시카고, 뉴욕(JFK), 라스(DFW), 로스앤젤레스 를 연결하는 북미노선, 나리타와 암스테르담(AMS), 밀라노(MXP), 프랑크푸르트(FRA)간 유 럽노선에 대해 각각 ANA와 코드 공유를 실시.

- ANA그룹으로 편입된 양 항공사는 이같은 편명공유 확대를 통해 와이드바디 화물기에 대 한 수송력 보완과 고객 편리성 향상을 위해 이같은 편명공유를 단행했다고 밝힘.

- 양 항공사간 편명공유로 ANA그룹은 여객편 네트워크와 함께 ANA의 'B767F 6대, 777F 2 대, NCA의 747F 8대에 대한 보다 효율적인 판매체제를 구축하게 됨.

2) 파라타항공 - 11월 17일 국제선 일본·베트남 등 국제선 첫 취항.

- 파라타항공이 국내선 상업운항 한 달 만에 일본 나리타와 베트남 다낭·푸꾸옥 등 국제선 신규 취항을 확정하며 광폭 행보를 지속 중. 후발주자이지만 신속한 기체 확보와 높은 탑승률, 차별화된 서비스로 연착륙에 다가서고 있다는 분석.

- 파라타항공은 나리타 주 12회, 다낭은 주 7회, 푸꾸옥은 주 4회로 취항한다는 계획.

- 파라타항공은 지난 9월 30일 양양∼제주 노선을 첫 취항하며 후발 저비용항공사(LCC)로 날갯짓을 시작. 이어 10월 2일 김포∼제주 부정기편을 운항하며 국내선 인지도를 높여옴.

- 특히 대형기 A330-200을 투입했음에도 평균 90%에 가까운 탑승률을 유지하고 있어 눈길을 끈다. 열흘에 가까운 추석 황금연휴 기간에도 지연이 발생하지 않은 점도 고무적. '안전과 정시성을 최우선으로 하겠다'는 목표대로 시장에 순조롭게 연착륙 중.

- 특히 대형기 A330-200을 투입했음에도 평균 90%에 가까운 탑승률을 유지하고 있어 눈길을 끄는데, 열흘에 가까운 추석 황금연휴 기간에도 지연이 발생하지 않은 점도 고무적임. '안전과 정시성을 최우선으로 하겠다'는 목표대로 시장에 순조롭게 연착륙하고 있음.

- 빠른 기단 확보도 눈에 띈다. 7월 말 1호기 도입 이후 지난 18일에는 A330-200 2호기를 도입했다. A330-200은 에어버스가 제작한 항공기로, FSC 수준의 쾌적한 기내 환경을 제공. 항속거리가 1만 3000㎞에 달해 북미까지 운항할 수도 있음.

- 파라타항공은 오는 11월 중 4호기 도입도 추진하고 있는데, 파라타항공 관계자는 "현재 5호기 계약까지 완료돼 있다"라며 "오사카와 나트랑 등 일본 및 동남아 노선 확대를 추진하면서, 내년 이후에는 장거리 노선 확대도 장기적으로 준비해 나갈 것"이라고 설명.

3) 한진그룹 - 세계 물류 리더로 새로운 100년 도약 선언

- 진그룹이 창립 80주년을 맞아 대한민국 물류 산업의 성장과 함께 걸어온 여정을 돌아보며, “세계를 연결하는 혁신 기업”으로의 새로운 도약을 선포.

- 23일 서울 용산 그랜드하얏트호텔에서 열린 기념식에서 한진그룹은 ‘VISION 2045’를 통해 미래 100년을 향한 지속가능한 성장 전략을 제시하고, 항공·물류 중심의 글로벌 종합 모빌리티 그룹으로 발전하겠다는 청사진을 밝힘.

- 이날 조원태 한진그룹 회장은 기념사에서 “1945년 한진상사로 출발한 한진그룹의 역사는 ‘한민족의 전진’이라는 의미를 담고 있다”며 “창업주 조중훈 회장의 수송보국(輸送報國) 정신과 선대의 헌신을 기반으로 한진은 새로운 물류의 길을 개척해왔다”고 말함.

- 조 회장은 또한 “고객의 사랑과 신뢰가 한진의 원동력이었다”며 “국민의 성원에 보답하고 고객에게 감동을 전하기 위해 최선을 다하겠다”고 강조.

- 그는 “대한민국의 발걸음이 한반도에 머물지 않도록, 한진그룹은 글로벌 무대에서 책임 있는 역할을 다할 것”이라며 “100년, 그 이후에도 세계가 사랑하는 물류 그룹으로 발전하겠다”고 피력.

- 이날 공개된 한진그룹의 새로운 비전 슬로건은 ‘Moving the world to a better future(더 나은 미래를 향해 세상을 움직인다)’*로, 이를 위해 ▲항공우주·모빌리티·이커머스 확장 ▲AI 기반 초자율 물류기술(Logi-Tech) 선도 ▲우주 물류 솔루션 구축 ▲디지털 전환 강화 ▲관광·호텔·부동산 등 연계사업 확대 ▲물류 전문가 육성 투자 확대 ▲ESG·사회공헌 강화 등 7대 중점 전략을 제시.

- 한편 한진그룹은 이날 새로운 기업상징(CI)도 공개했는데, 새 로고는 한진의 상징 ‘H’를 중심으로 영문명 ‘HANJIN GROUP’과 대한항공의 태극마크를 조화시켜, 그룹의 통합 정체성과 미래지향적 이미지를 함께 담음.

4) 세계 항공화물시장, 아시아 ‘황금연휴’ 이후 급반등 - 중국(+24%), 홍콩(+22%), 대만(+24%), 한국(+96%)

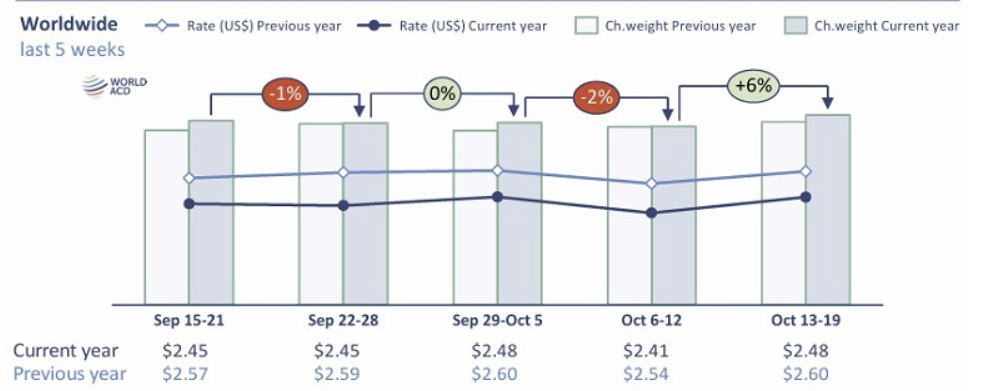

- 글로벌 항공화물 시장이 아시아 지역의 연휴 종료 이후 빠르게 회복세를 보이며 전주 대비 6% 상승.

- 중국 ‘국경절(골든위크)’과 한국·대만의 추석 연휴가 끝나면서 아시아발 화물이 대거 재개된 것이 주요 원인으로 분석.

- 통계는 전주(41주차) -3% 감소했던 글로벌 항공화물 물동량은 42주차에 +6% 반등했으며, 이는 지난해 같은 기간보다 더 큰 폭의 회복세다. 특히 아시아·태평양 지역발 화물은 전주 대비 +14% 증가하며 전체 회복세를 주도했다. 이는 작년 동기간 대비 +8% 높은 수준.

- 이같은 아시아발 수요 회복에 힘입어 글로벌 평균 항공화물 운임 역시 휴일 이전 수준으로 되돌아옴. 42주차 평균 운임은 전주 대비 +3% 상승한 ㎏당 2.48달러로 나타났으며, 이는 9월 하반기(2.45달러/㎏)보다 약간 높지만 전년 동기 대비 -4%..

- 특히 아시아·태평양발 운임이 +2% 상승하며 전체 평균 상승을 견인했으며, 고수익 화물 비중이 확대된 점도 한몫..

- 스팟운임 또한 +2% 상승해 ㎏당 2.66달러를 기록했으나, 전년 대비로는 -3% 낮은 수준.

- 세부적으로 살펴보면, 아시아·태평양발 미국행 화물은 전주 대비 +17% 급증했다. 국가별로는 중국(+24%), 홍콩(+22%), 대만(+24%), 한국(+96%) 등 대부분 지역에서 큰 폭의 회복세를 보임.

- 특히 한국의 경우 추석(10월 5~8일)과 한글날(10월 9일) 연휴 이후 운항이 재개되며 폭발적인 물동량 반등이 나타남. 같은 기간 아시아발 유럽행 화물도 +14% 증가.

- 다만 중국과 홍콩발(CN/HK) 노선을 보면, 미국행 화물은 여전히 전년보다 낮은 반면, 유럽행 화물은 증가세를 보였는데 미국의 ‘디미니미스(소액면세)’ 제도 폐지 이후, 중국발 전자상거래 물량이 유럽 및 기타 시장으로 전환된 결과로 분석.

- 한편 운임 측면에서는, 전주 -4% 하락했던 아시아발 미국행 스팟운임이 42주차에 +7% 반등했다. 국가별로는 중국(+19%), 일본(+16%), 대만(+7%), 한국(+6%) 모두 상승세를 보임.

- 이 가운데 중국발 미국행 스팟운임은 ㎏당 4.90달러로 치솟으며 4월 중순 이후 최고치를 기록. 이는 미국이 다음 달부터 중국산 제품에 추가 관세를 예고하면서, 수입업체들이 선제적으로 화물을 선적(프런트로딩)하는 움직임이 반영된 것으로 풀이.

5) Airlines Movement

- 파라타항공(WE) : 10월 26일부터 김포-제주노선 첫 취항 Daily운항/A330-200

- 에어캐나다 (AC) : 10/31 화물고객 행사

- 델타항공(DL) : 10/31 Cargo Night 고객행사

top