EXTRANS 将物流的力量推动到全世界.

旭晖空运国际 - 第43周2025年航空业更新

1. 航空货运概况

1) 全球航空货运运价上涨 3%—— 受中国出发海运受阻引发航空需求转移影响

全球航空货运运价上周延续上涨趋势,目前市场已进入旺季阶段,叠加海运受阻导致的航空运输转移需求,共同推动运价上行。

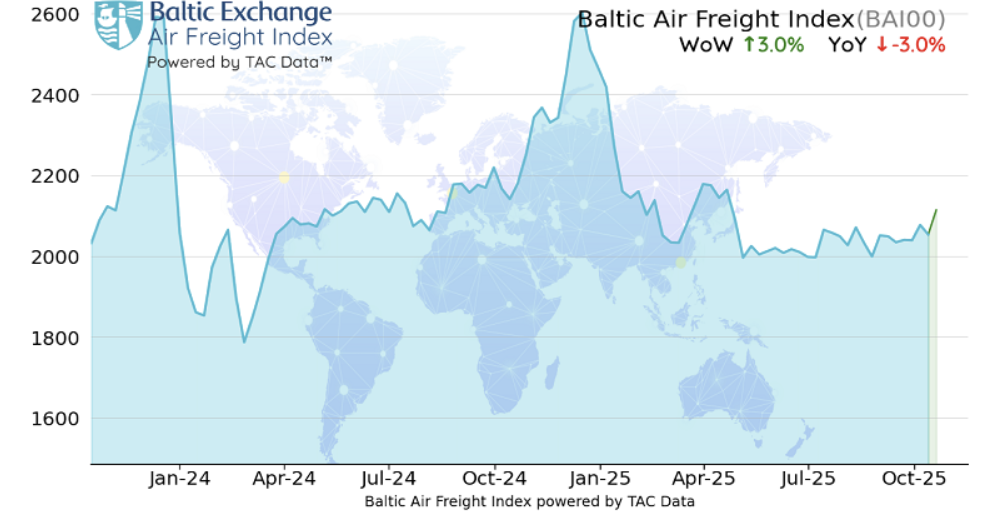

以 10 月 20 日为基准,反映全球航空货运运价的波罗的海航空货运指数(BAI00)环比上涨 3.0%。尽管该指数仍较去年同期低 3.0%,但近几周的温和上涨趋势已愈发明显。

此次运价上涨在亚洲、欧洲出发的主要航线中普遍出现,仅美国出发航线例外,呈下降态势。

分析认为,此次运价上涨除常规年末旺季因素外,还受到部分海运受阻的影响:为应对美国提高港口入港费,中国对本国港口的美国籍船舶征收新费用,导致海运出现中断,因此部分海运货物(尤其前往美洲的航线)被观测到转移至航空运输。

中国出发至欧洲、美国航线的运价均环比上涨,北亚至澳大利亚、印度、墨西哥航线的运价也同步上升。

香港出发至欧洲、美洲航线的现货运价同样呈上涨趋势,香港出发全航线综合指数(BAI30)环比上涨 0.7%,同比跌幅收窄至 2.0%;上海出发航线运价大幅飙升 6.9%,同比跌幅收窄至 5.2%。

越南出发至欧洲、美洲航线运价虽环比上涨,但仍低于去年同期水平;韩国首尔出发航线(往返方向)均呈上涨趋势;中国台湾出发航线则呈现 “欧洲方向上涨、美洲方向下跌” 的分化态势。

值得关注的是,近期美中港口费用争端影响海运船期,已观测到部分货主将运输方式转向航空。尤其中国出发至美洲航线的运价回升,被认为是这一短期因素的体现。

不过,美国出发航线的持续疲软,表明航空货运市场的区域不均衡仍在加剧。11 月年末旺季需求全面启动后,运价能否进一步上涨,将成为市场复苏的关键。

2) 中国航司强烈反对,美国航司则表示欢迎

针对美国禁止中国航司经俄罗斯领空运营美国航线的措施,中国航司提出强烈反对。

以中国最大国有航司中国国际航空(CA)为首的 6 家航司,近期向美国交通部(DOT)提交请愿书,称美国此举不仅给两国航空旅客带来不便,还将导致航空运价上涨,因此要求美国政府立即撤销该措施。

相反,美国航司对此表示积极支持。联合航空(UA)甚至提出,应将该禁令扩大至中国香港籍的国泰航空(CX)。

目前,中国航司每周运营 81 班飞往美国的航线,主要目的地包括洛杉矶(LAX)、纽约(JFK)、旧金山(SFO)等。

3) “下一代人工智能‘智能体 AI(Agentic AI)’将重塑物流行业格局”

在 “若现在落后,甚至可能无法生存” 的危机感下,韩国物流企业代表于 9 月 30 日在小公洞乐天酒店,以 “人工智能转型与物流产业发展方向” 为主题,召开了由大韩商工会议所(会长崔泰源)主办的第 53 次物流委员会会议。

出席本次会议的人员包括大韩商工会议所物流委员长申英秀、常务副会长朴一俊,以及 LX Pantos 代表理事李容镐、KCTC 副会长李俊焕、鲜光集团副会长沈忠植、三荣物流代表理事李相根、阿신物流代表理事梁在勋等。

LG 人工智能研究院应用 AI 研究组组长金承焕表示:“下一代人工智能的核心是能够自主定义问题、并完成规划与执行的‘智能体 AI(Agentic AI)’。尤其物流行业涉及需求预测、库存管理、配送路径优化等复杂变量,是人工智能引入效果极为显著的领域。”

他强调:“智能体 AI 在制造、流通领域已展现出实际成效,例如缺陷产品检测、客户咨询、工厂运营优化等;在物流领域,它不仅能实现简单的效率提升,还能推动实时决策与运营创新。”

仁荷大学教授(韩国物流学会会长)朴敏英指出:“人工智能不仅是提升效率的工具,更在重塑物流运营模式本身。基于人工智能的实时监控、自动装卸系统、车辆共享物流网络等技术,不仅能降低成本、提高生产力,还正在成为满足生鲜物流、线上到线下(O2O)、最后一公里配送等新需求的核心基础设施。”

不过,朴教授也提出:“从社会层面看,人工智能的普及可能会扩大首尔圈与地方、大企业与中小企业、正式员工与非正式员工之间的差距。政府需由公共部门率先投资人工智能物流示范项目,并推广共享物流中心等包容性物流基础设施,让中小企业能以低成本使用。”

另一方面,大韩商工会议所常务副会长朴一俊表示:“人工智能转型(AX)是包括物流企业在内的所有企业生存与发展的必要战略。政府与行业需合作,通过人工智能物流基础设施建设、法律法规完善、研发投入等,推动人工智能技术在物流行业快速普及,这一点至关重要。”

4) 易斯达航空(Eastar Jet)短期内仍由 VIG 控股运营

此前深陷出售传闻的易斯达航空,预计短期内将继续在私募股权基金(PEF)管理公司 VIG Partners 的控股下运营。尽管该航司业绩有所改善,且正全面扩大机队与航线,但市场认为其尚未稳定在增长轨道上。

据 16 日投资银行(IB)行业消息,VIG Partners 暂无短期内出售易斯达航空的计划。近期的出售传闻被证实是 “出售顾问间的误解事件”:私募股权行业相关人士表示,“出售顾问常规性地提出寻找潜在买家的建议,而 VIG 给出了‘若有合适买家也可能出售’的原则性回应,这一对话被夸大后引发了传闻。”

实际上,VIG Partners 认为当前并非出售易斯达航空的合适时机。尽管该航司已触底反弹,但尚未达到市场预期水平,且仍处于累计亏损超过资本金的 “资本侵蚀” 状态。

VIG Partners 于 2023 年通过第 4 期盲池基金以 400 亿韩元收购易斯达航空,截至目前该笔投资亏损 149 亿韩元,资本侵蚀率达 199.4%。截至去年年底,虽通过增资等方式注入超 2000 亿韩元资本金,但市场认为其距离稳定仍有较长距离。

即便如此,盈利转正的不确定性依然存在。航司盈利对油价、汇率、需求复苏节奏、竞争强度等因素极为敏感,这些变量短期内难以达到利于出售的水平,且 “亏损竞争” 的风险仍在。目前韩国国内低成本航空(LCC)整体运力增长,但旅客需求增速放缓,行业竞争加剧。

上月初,帕拉塔航空(原飞江原航空)已从韩国国土交通部获得航空运营许可证(AOC)并启动机票销售。韩国国内低成本航空企业数量已增至 9 家(与美国持平),行业若不慎陷入 “斗鸡博弈”,可能会面临运价下行压力。

此外,航空业目前正处于大韩航空与韩亚航空合并引发的低成本航空结构调整等市场重组阶段。在行业剧变期,投资者对变量众多的资产缺乏大胆投资的动力,因此易斯达航空短期内大概率将在 VIG Partners 旗下寻求发展。

投资银行行业相关人士解释道:“出售传闻中提到的 5000-6000 亿韩元估值,其业绩支撑力是否充足仍存疑;且收购后需承担债务、竞争压力、航线获批及监管等多重负担,潜在买家也难以果断入局。”

5) 航司动态

- 帕拉塔航空(WE):自 10 月 26 日起,首次开通金浦 - 济州航线,每日运营(机型:A330-200)。

- 德威航空(T'way Air,代码 TW):10 月 3 日举办仁川 - 法兰克福航线开航 1 周年纪念活动。

- 土耳其航空(Turkish Airlines,代码 TK):宣布计划截至 2034 年新增引进 75 架波音飞机。

- 大韩航空(Korean Air,代码 KE):10 月 17 日举办代理店邀请座谈会。

top