EXTRANS GLOBAL - Air Freight News - Week 36 2024

Air Cargo General

1) Background of Korean Air and Asiana Airlines' New Route Launch

-

Korean Air and Asiana Airlines are launching new routes in the second half of the year, joining the competition with low-cost carriers (LCCs) for route operations.

-

Korean Air will sequentially operate the Incheon-Macao and Incheon-Lisbon routes, while Asiana Airlines plans to launch the Incheon-Kumamoto route.

-

Korean Air has been operating the Incheon-Macao route daily since July 1 and plans to operate the Incheon-Lisbon route three times a week (Wednesdays, Fridays, and Sundays) starting on the 11th. Asiana Airlines will operate the Incheon-Kumamoto route three times a week (Mondays, Thursdays, and Saturdays) from November 7 to March 29 next year, in line with the winter schedule.

-

Both airlines have actively created demand by increasing flights and resuming operations since the government's declaration of the COVID-19 endemic in May last year. However, they primarily operate large and medium-sized aircraft, which are advantageous for transporting a relatively large number of passengers on long-distance routes, making them cautious about launching new routes. This contrasts with the strategy of LCCs, which are actively operating direct flights to small cities in Japan and Southeast Asia based on a fleet centered on small to medium-sized aircraft.

-

The new routes recently launched or scheduled to be launched by the two airlines are characterized by being exclusive routes with limited airlines operating them or less exposure to competition.

-

The Incheon-Lisbon route, operated as a scheduled charter flight, is unique as the only direct route departing from Northeast Asia. Previously, passengers traveling to Lisbon had to connect through France or Spain. With the new direct route, passenger journeys are expected to improve.

-

As domestic and international airlines actively expand their aircraft and personnel and increase flight operations, competition is becoming more intense. In this environment, Korean Air and Asiana Airlines aim to create new flight operations and generate synergy with existing routes by leveraging their respective sales and route development capabilities.

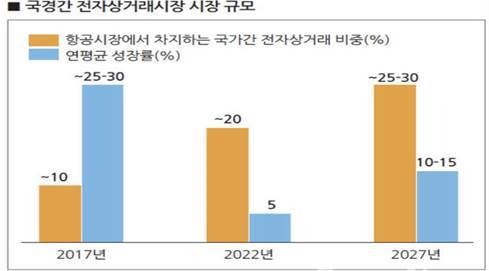

2) E-commerce logistics experiencing an average annual growth rate of 23%

-

The global e-commerce market is experiencing unprecedented rapid growth. The International Air Transport Association (IATA) forecasts that the global air cargo market driven by e-commerce will grow at an average annual rate of 20-30% by 2027.

-

As of last year, the number of online shoppers worldwide reached 2.6 billion, with these shoppers expanding their online e-commerce purchases by over 30% compared to the previous year.

-

Consequently, global e-commerce sales grew to $5.7 trillion last year and are expected to exceed $8 trillion this year.

-

With this growth trend, the number of e-commerce shipments also surged to 170 billion in 2022, and it is projected to expand to 256 billion by 2027. As the e-commerce market expands, the e-commerce logistics market is expected to grow to a $2.49 trillion market by 2032.

-

Last year, the global e-commerce logistics market recorded $386 billion. Consequently, it is expected to achieve an average annual growth rate of 22.6% by 2032.

-

Among these, the growth rate of cross-border e-commerce is expected to accelerate even more. Over 80% of cross-border e-commerce is transported by air. In particular, the expansion of China's e-commerce market is leading the global trend, with China's e-commerce market growing tenfold over the past five years.

-

Fashion-focused online retailer 'Sain' recorded a doubling of its operating profit to $2 billion. With this increase in operating profit, it is reported that they plan to make substantial investments in the logistics sector to enhance customer satisfaction.

-

According to IATA, the global air cargo market grew by 11.9% year-on-year in February. This marks three consecutive months of double-digit year-on-year growth.

-

IATA analyzes that the expansion of the cross-border e-commerce market is key to the growth of the air cargo market. Regionally, the Asia-Pacific region recorded an increase of 11.9%, contributing to the overall expansion of the air market.

3) Yerimdang has no intention of selling T'way Air - Possibility of management disputes with Sono rises

-

As Daemyung Sono Group raises its stake in T'way Air to 26.77%, expectations grow that it will secure management control. Contrary to industry expectations, it has been determined that Yerimdang is also strongly unwilling to relinquish its current status as the largest shareholder. Yerimdang currently holds a 29.99% stake in T'way Air, which is only 3% more than Daemyung Sono Group, increasing the likelihood of a management dispute between the first and second largest shareholders over T'way Air.

-

Currently, Yerimdang and Daemyung Sono Group are maintaining an “uncomfortable coexistence” over T'way Air. An industry insider stated, “There was a prevailing view that Yerimdang would eventually sell its stake in T'way Air, but Vice Chairman Na Sung-hoon is reportedly holding out, saying he will not sell the shares contrary to expectations,” adding, “This has made relations with Sono's side quite awkward.”

-

Daemyung Sono Group has purchased T'way Air shares from the private equity firm JKL Partners in two transactions. In June, it bought 14.9% through its holding company Sono International, and earlier this month, its affiliate Daemyung Sono Season acquired the remaining 11.87% for 70.8 billion KRW.

-

Currently, the major shareholder of T'way Air is Yerimdang. Yerimdang, along with Vice Chairman Na Sung-hoon, holds 46.91% of T'way Holdings, which, together with its related parties, owns 29.99% of T'way Air.

-

Given Vice Chairman Na’s strong determination to secure management control, there are expectations that disputes between the first and second largest shareholders may intensify. Chairman Seo Jun-hyuk of Daemyung Sono Group is also reported to have a strong desire to gain management control of T'way Air. While Daemyung Sono is currently downplaying the possibility of pursuing management control, it is interpreted as illogical to buy shares from JKL at a premium just to remain the second largest shareholder.

-

There are various ways for Daemyung Sono Group to secure the additional 3% stake to become the major shareholder. One method would be to buy shares on the open market. Considering T'way Air's current market capitalization (590.1 billion KRW), the price for the 3% stake would be 17.7 billion KRW. However, if the second largest shareholder continues to buy shares on the market, it would signal to the market that a management dispute is intensifying, likely causing the stock price to rise. If Yerimdang also competitively purchases shares in response, the stock price would inevitably increase further.

-

There are analyses suggesting that Daemyung Sono Group's financial situation is not particularly strong. As of the end of last year, its holding company Sono International had cash and cash equivalents of about 183.2 billion KRW, of which 3.9 billion KRW was restricted due to lease agreements and condo sales-related collateral. Its current ratio is only 122%. A current ratio above 130% is generally considered safe. Ultimately, the second call option was exercised by the affiliate Daemyung Sono Season instead of Sono International, but Daemyung Sono Season also has only 54.6 billion KRW in cash and cash equivalents, indicating that it is not well-equipped financially.

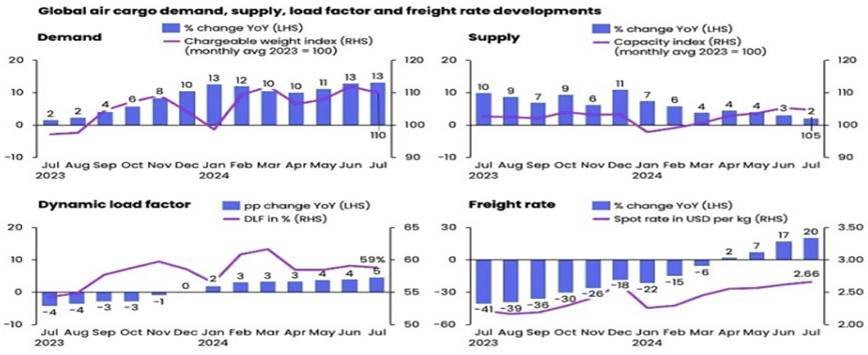

4) Outlook for the Second Half of This Year: Surge in Demand for Air Cargo Market and Supply Pressure

-

Xeneta forecasts that the air cargo market will face unprecedented pressure in the second half of 2024 due to rapidly growing demand and supply shortages.

-

Earlier this year, Xeneta predicted that air cargo demand would grow by “1-2%,” but in reality, demand has increased by 12% compared to the previous year as of July, indicating double-digit growth.

-

Xeneta explains, “This is the result of unexpected changes in circumstances and geopolitical events.”

-

In terms of air cargo demand, the market is experiencing a surge that exceeds initial forecasts. Xeneta pointed out that “global air cargo demand increased by 12% year-on-year in the first seven months of 2024, surprising the market,” particularly noting that explosive growth in cross-border e-commerce demand in Asia has had a significant impact on the air cargo market. Additionally, disputes in the Red Sea and the Gulf of Aden have disrupted maritime transportation, leading to a shift of many goods to air transport. The demand for advanced semiconductors for artificial intelligence (AI) and high-performance computing has also played a crucial role in the increase in air cargo demand.

-

This surge in demand is one of the main reasons for the disruption in the maritime transport market that began at the end of 2023, especially as e-commerce in Asia has significantly risen, further highlighting its impact. If this trend continues, annual air cargo demand in 2024 is expected to see double-digit growth.

-

On the supply side, there has been a limited increase within expected ranges, with air cargo supply in the global market increasing by 4% in the first seven months of 2024. However, the growth rate slowed significantly from 7% in January to 2% in July. This slowdown is attributed to the recovery of passenger networks, issues in the aircraft supply chain, and limited aircraft modification capacity. This limited increase in supply, combined with the surge in demand, is identified as a major factor driving up air cargo rates.

-

Xeneta analyzes that the spot rates in the market have caused an upward trend that goes against the long-standing seasonal patterns of the air cargo market.

-

Air cargo spot rates are rising even during the traditional off-peak summer season, showing a different trend compared to previous years. The disruptions in maritime transport due to the Red Sea conflict and the increase in cross-border e-commerce demand have driven air cargo spot rates to all-time highs. In particular, cargo rates from Asia remain at high levels, indicating a deepening imbalance in the market,” noted a Xeneta analyst.

-

In conclusion, the global air cargo market is expected to continue growing amid uncertainty in the second half of the year. The air cargo market in the second half of 2024 is anticipated to see ongoing uncertainty as it tries to balance strong demand with limited supply. Geopolitical factors such as conflicts in the Red Sea and the Gulf of Aden, political instability in the Middle East and Ukraine, and potential labor strikes at U.S. ports are expected to have a significant impact on the market.

-

In the coming months, the air cargo market is expected to remain under tension, with a high likelihood of additional upward pressure on air cargo rates during the peak season in the fourth quarter of 2024.

5) Airlines/GSA Movement

CMA CGM Air Cargo (2C) has commenced operations on the HKG-ORD route.

- As of August 25, the ORD-ICN-HKG-ANC-ORD route has begun operations, with 3 B777Fs and 3 A330Fs based at the CDG hub.

- Two B777Fs are scheduled for delivery this year, and a third B777F is expected to be delivered in the first quarter of next year, bringing the total to 5 B777Fs. Eight A350Fs are planned for delivery starting in 2026.

-

In early September, there was a sudden decrease in cargo from China and an increase in prices, resulting in a decrease in cargo to the Americas. After a 1000 KRW increase by the national carrier, there is now a 500 KRW decrease.

-

Regarding routes and fleet:

-

Atlas (5Y) has introduced 3 Boeing 747-8 freighters through a financial lease agreement with BOC Aviation.

-

Alaska (AS) and Hawaiian (HA) plan to maintain their target of introducing 10 A330-300P2Fs after their merger.

-

MNG Airlines (MB, Turkish cargo airline) is adding 1 more A330-300P2F on lease.

-

Boeing forecasts that demand for freighters in the Chinese market will grow to three times the current level by 2043.

-

top