EXTRANS GLOBAL - Air Freight News - Week 34 2024

Air Cargo General

1) Independent LCCs (Low-Cost Carriers) also moving towards mergers

-

The merger of Korean Air and Asiana Airlines is being finalized within this year, shaking up the low-cost carrier (LCC) industry. The fact that the subsidiaries (Jin Air, Air Busan, Air Seoul) of the two airlines will be integrated into a 'giant' LCC is now essentially confirmed, and Jeju Air, the current No. 1 LCC, is hinting at an acquisition and merger (M&A), creating a standoff. Private equity (PE) firms that own LCCs are also rushing to exit (recover their investments), signaling a new phase for the LCC market.

-

The alliance of 'Jin Air, Air Busan, Air Seoul' emerging from the Korean Air-Asiana merger is shaking up the LCC market.

-

The united LCC is expected to easily surpass Jeju Air, which has maintained the No. 1 position for the past 20 years. Based on last year's figures, the combined revenue is 2.4785 trillion won and the number of passengers is 51.44 million, far exceeding Jeju Air's revenue of 1.724 trillion won and 12.3 million passengers.

-

The industry expects the LCC market, which was previously divided, to be reorganized into a 'big three' structure. The competition is likely to be between the united LCC, Jeju Air, and Tway Air, which has recently acquired 4 European routes from Korean Air and is growing in size.

-

An industry official said that the emergence of a large LCC company will not only change the rankings but also affect the performance of existing LCCs.

-

Additional mergers and alliances among existing LCCs are expected to cope with the aggressive pricing policies leveraging economies of scale.

-

Jeju Air has hinted at M&A intentions. The CEO recently sent an email to employees saying that airlines owned by PEs will eventually become acquisition targets, and that Jeju Air will actively respond when M&A opportunities arise.

-

Tway Air's second-largest shareholder JKL Partners has sold its 26.77% stake in Tway Air to Daemyung Sonongroup in two transactions. Industry expects Daemyung Sonongroup to take over the management rights by further increasing its shareholding.

-

Air Premia, another LCC majority-owned by a PE firm, is also expected to be put up for sale. Integration with Jeju Air, which focuses on short-haul routes, could generate significant synergies.

-

Korean Air aims to complete the merger with Asiana Airlines within this year. The remaining step is final approval from the US competition authorities. The industry expects the approval process to be finalized by October at the latest.

2) Asiana Airlines - Purchased 2 B747-400F aircraft from China Airlines

-

China Airlines, a Taiwanese national airline, has sold two Boeing 747-400 freighters to Asiana Airlines.

-

The transaction, which was facilitated through the aviation brokerage firm Aviation Management Solutions (AMS), is reportedly valued at around $51 million (696.5 billion won).The purchase is believed to be part of Asiana Airlines' efforts to improve its on-time performance and replace its aging cargo fleet.

-

Asiana Airlines currently operates 10 B747-400 freighters, with 8 of them being over 25 years old and 3 over 30 years old. The aircraft acquired from China Airlines are reported to be 22.77 and 21.92 years old, respectively, and are currently stored in Victorville, California.

-

This cargo aircraft acquisition by Asiana Airlines appears to be part of the ongoing preparations for the final merger with Korean Air, after the latter signed a "basic business sale contract" with Air Incheon on August 7th to acquire its cargo business.

-

Notably, Air Incheon has been actively preparing for the merger, including recently securing an equity investment from Hyundai Glovis, in order to support the subsequent operations of the combined Asiana Airlines.

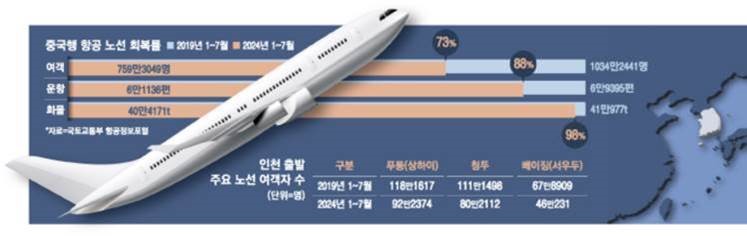

3) Airlines are competing to cut back on routes to China

-

Domestic airlines are flying aircraft to maintain their flight rights in the hope of a recovery in China travel, but the recovery is falling short of expectations. Due to the strong dollar and high-cost structure, the operating profits of low-cost carriers (LCCs) have plummeted in the second quarter, and there is a growing sentiment that they should give up unprofitable China routes with low profitability.

-

Korean Air has resumed the Incheon-Changsha route 3 times a week and the Incheon-Zhengzhou route 4 times a week. Asiana Airlines has resumed the Incheon-Chongqing, Incheon-Xi'an, and Gimpo-Beijing routes from May and July, and has increased the frequency of some routes. Jeju Air operates the Incheon-Shijiazhuang and Busan-Shijiazhuang routes, while T'way Air operates the Incheon-Shenyang, Jinan, and Wenzhou routes.

-

Airlines need to fly more than 20 weeks a year to maintain their flight rights according to the Ministry of Land, Infrastructure and Transport's flight rights allocation rules. While they are increasing flight frequencies, if the load factor does not support it, the airlines will have to bear increasing monthly losses to maintain the routes.

-

The problem is that the recovery of passenger traffic to major Chinese cities is also slow. For the Incheon-Shanghai route, the number of flights has recovered to 90% of the 2019 level, but the number of passengers is only 78%. At Beijing Daxing International Airport, which opened in 2019, the number of flights this year has reached 860, but the number of passengers is only 130,000, far below the pre-pandemic level of 680,000.

-

As the recovery of China routes is sluggish, the LCC industry is agonizing over whether to maintain the routes. A major LCC company said that they are considering returning the flight rights as the routes are not profitable, even though they will face penalties for not securing routes in the future.

-

The aviation industry, faced with poor performance due to intensified competition and a strong dollar, is reconsidering low-profit routes. T'way Air recorded an operating loss of 21.5 billion won in the second quarter, Jeju Air 9.5 billion won, and Jin Air had an operating profit of 900 million won but a net loss of 5.9 billion won.

-

The increase in demand for air cargo to China is providing some revenue, but for LCCs with a small cargo business, it is not enough to offset the losses. China's e-commerce market led by Alibaba has boosted air cargo volume to China, which reached 400,000 tons in July, 98% of the 2019 level.

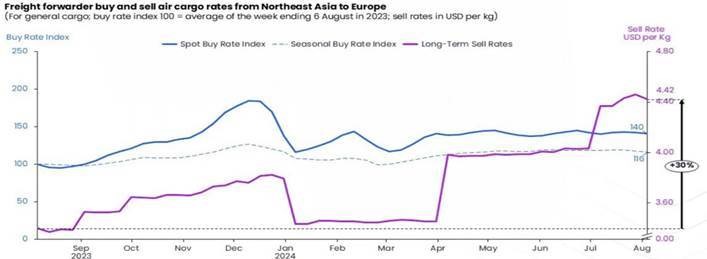

4) This summer season: The Northeast Asia-Europe route is the most popular route

-

The Xeneta freight rate benchmarking platform recently selected the Northeast Asia-Europe route as the hottest route in the global air cargo market this summer.

-

Xeneta stated that in the air cargo market entering mid-August, the market selling rates of forwarders are at the highest level in a year and a half, particularly for the Northeast Asia-Europe route. The long-term contract selling rate for general cargo on this route has risen more than 30% year-on-year to $4.42/kg as of early August.

-

This is analyzed as a result of the basic market rates rising even after the peak season surcharges introduced in May and June due to supply chain disruptions were removed.

-

However, it is noteworthy that the purchase rates (contract rates with airlines) of forwarders are showing a relatively slower increase, with a 16% year-on-year increase according to Xeneta's data.

-

In fact, the purchase rates for general cargo with a validity period of about 1 month have increased by more than 40% year-on-year, but this outpaces the 30% year-on-year increase in the forwarders' selling rates.

-

The increase in spot market rates for general cargo is showing a similar trend to the global average rate increase, driven by strong e-commerce demand and surging semiconductor demand from the AI boom leading to high-performance computer demand."

-

Accordingly, airlines are maintaining a more optimistic outlook for the year-end peak season, and some airlines are even adding more capacity to Europe. This is related to the recent withdrawal of some airlines' cargo flights to Latin America and their redeployment to other regions.

-

However, the imbalance in demand between routes departing Northeast Asia and Europe is cited as a problem, as it has significantly reduced the availability of supply space.

-

With growing concerns about a global economic downturn centered on the US market, and still sluggish consumer spending in Europe, there are concerns that actual peak season demand could contract rapidly, as pre-peak season import volumes have been high.

-

However, the continued geopolitical risks in the Middle East and Ukraine, the strong e-commerce demand, and China's early Lunar New Year in 2025 are analyzed as factors that could keep air cargo rates at high levels.

top