旭辉空运国际 - 第31周24年航空业更新

航空货运 General

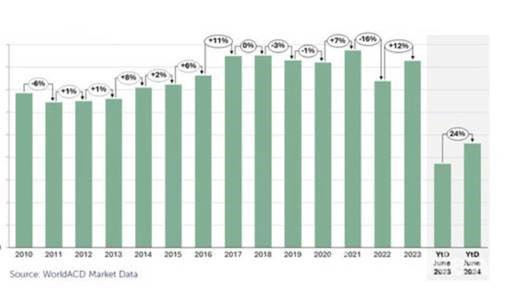

1) 来自中国和香港的航空货运量猛增24%

中国和香港航空货运量增长趋势(%)

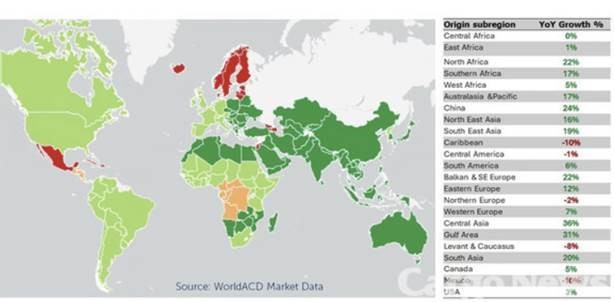

2024年上半年各地区航空货运需求增长

-

今年上半年,中国和香港的出口航空货运量比去年同期增加了24%。这延续了2023年全年12%的强劲增长。据分析,预计中国和香港的航空货运强劲增长势头将在下半年持续。

-

根据WorldACD的分析,上半年航空货运需求同比增长最大的地区是中亚,增长达36%。

-

其次是海湾地区,增长31%。中亚和海湾地区航空货运量大幅上升,是由于红海危机导致的海上供应链问题,使航空货运替代需求增加所致。

-

其他显著增长的地区包括南亚(+20%)、东南亚(+19%)和东北亚(+16%)。

-

6月,全球航空货运运力同比也增加了4%,主要是由于客机腹舱容量的扩张。

-

上半年其他需求强劲增长的地区包括北非(+22%)、巴尔干和东南欧(+22%)、南非(+17%)、澳大拉西亚和太平洋(+17%)以及东欧(+12%)。

-

需求相对较弱的地区包括西欧(+7%)、南美洲(+6%)、加拿大(+5%)、西非(+5%)和美国(+3%)。中非、东非和中美洲与去年相比变化不大。

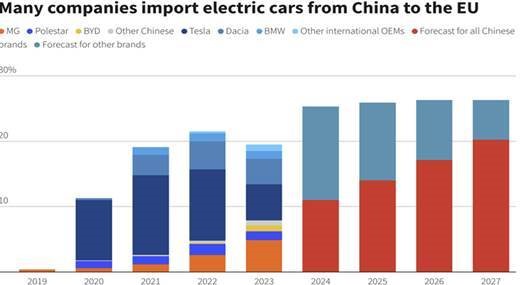

2) 尽管对中国制造的电动车征收关税,但预计出口量不会下降

-

根据全球航运市场分析公司Clarksons最近的一份报告,尽管欧盟已对中国制造的电动汽车(EV)征收关税,但预计中国出口量不会大幅下降。

-

首先,对中国EV征收的关税将在标准关税率的基础上额外增加10%,导致关税率在17%至38%之间,取决于制造商。然而,中国汽车制造商可以通过增加在与欧洲国家有自由贸易协定的国家的产能来避免这些关税。例如,中国公司比亚迪已经在土耳其开始建设一家10亿美元的EV生产设施。

-

此外,东南亚地区汽车需求的增长意味着可以增加对这些地区的出口量,以抵消发达国家征收关税的影响,因为这可以增加成品车海运货量。

-

中国的汽车出口量(海运)在疫情前少于100万辆,但预计到2023年将超过440万辆。为此,比亚迪已在泰国建立了东南亚首家电动车工厂。

-

尽管美国已将对中国EV的关税从25%提高到100%,导致销售价格增加了一倍以上,但中国EV在美国的市场份额不到1%,因此影响很小。

-

这是因为(1)对中国EV品牌的损害是有限的,以及(2)中国EV品牌已经将生产转移到墨西哥,通过近岸外包来避免关税。

-

此外,中国政府大力促进制造业出口,汽车制造商正在采取"不管销量多少,就是要出运"的策略,这意味着关税不太可能降低出口量。

-

一位物流专家指出,中国EV已经占据了主要欧洲港口的空间,中国EV品牌正在不顾定期消费者销售而运送车辆,忽视了存储费用的负担。

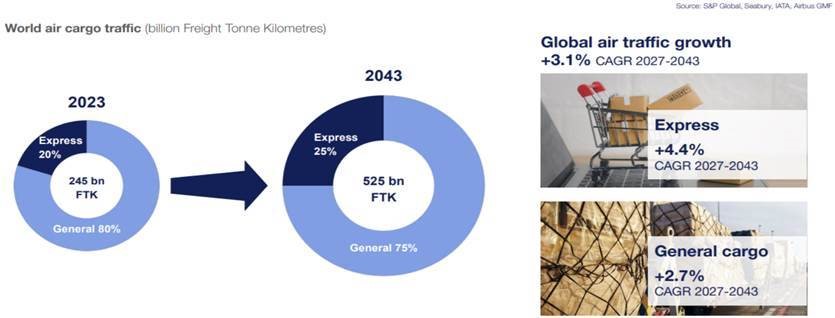

3) 特快货物运输的增长率超过常规货物运输

- 空中客车公司发布2023-2043年航空市场展望报告。报告显示,2023年至2043年,航空货运量将以年均3.1%的速度增长。其中,特快货物和常规货物将分别增长4.4%和2.7%,航空货运需求将在2043年达到525亿吨公里。

- 空中客车公司有关人士表示,"随着经济增长和贸易扩张,航空货运市场将持续增长,特别是特快货物市场将呈现快速增长态势。

4) 综合廉价航空公司的成立"让济州航空紧张不安 - 阴云密布

-

济州航空预计将面临维持其作为行业顶尖廉价航空公司(LCC)地位的困难。正在崛起的竞争性LCC正通过前所未有的行业变革和重组期脱颖而出。

-

济州航空已暗示进行兼并与收购,但行业评估认为这可能无法实现。据24日航空业消息,济州航空CEO金亦培最近提到了私募基金收回对航空公司投资的时间点,表示济州航空积极应对的强烈意愿。这实质上是济州航空强烈意愿兼并与收购的暗示。

-

这背后的主要原因是大韩航空与韩亚航空的合并。一旦合并完成,它们的子公司Jin Air、Air Busan和Air Seoul也将形成一个整合的LCC。此外,在合并过程中接管欧洲航线的T'way Air,以及收购韩亚航空货运业务的仁川航空的竞争力,也成为济州航空的一个心头之患。

-

首先,整合后的LCC规模将远远超过济州航空。 Jin Air、Air Busan和Air Seoul拥有的飞机总数为58架,超过了济州航空的42架。飞机数量直接与绩效挂钩,因此整合后的LCC有很大可能成为行业的龙头。

-

事实上,这三家公司去年的合并收入为2.4785万亿韩元,大大超过了济州航空的1.724万亿韩元。有人认为,由于合并过程中的航线调整,整合LCC的预计收入不应简单计算为现有三家公司的总和。

-

低成本航业第二、第三的地位未来也面临风险。 这是因为德威航空和仁川航空有足够的销售增长空间。德威航空是大韩航空与韩亚航空合并过程的一部分。其接手的罗马、巴黎、巴塞罗那、法兰克福航线,都是年均载客率80%中高的优秀航线,未来销售增长空间充裕。

-

随着德威航空开辟新航线,预计 2025 年销售额将增长 3,900 亿韩元至 4,700 亿韩元。去年,德威航空的销售额为13492亿韩元。

考虑到这一点,未来其销量超过济州航空的可能性很大。 -

仁川航空收购韩亚航空货运部门后,预计销售额也将大幅增长。去年韩亚航空货运部门的销售额为16081亿韩元。

-

同期,仁川航空销售额达707亿韩元。 如果未来完成对韩亚航空货运部门的收购,仁川航空的销售额可能会威胁到济州航空。

-

最终,由于综合低成本航企的创建以及德威航空和仁川航空的竞争力,预计济州航空将难以维持其行业第一的地位。如果不改变,我们将会从行业第一下降三个级别。我们别无选择,只能满足于行业第四名。

-

在这种情况下,济州航空正在考虑合并或收购。其目的是在投资Eastar Jet和Air Premia的私募股权基金复苏后,通过投资资金来扩大它们的规模。不过,业内人士表示,济州航空的并购并不容易。

top