旭辉空运国际 - 第24周25年航空业更新

航空货运概况

1)全球航空货运费率一年来首次转跌 ——5 月需求增长 6% 但市场不确定性持续

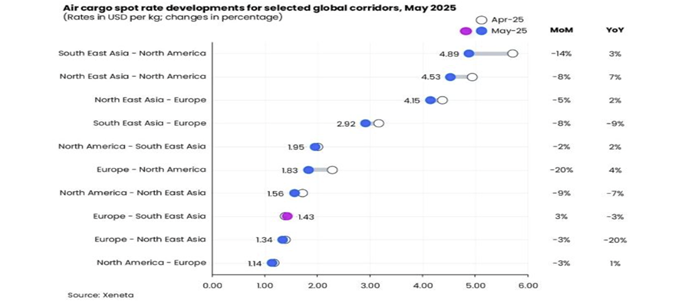

- 尽管 5 月全球航空货运量同比增长 6%,但市场情绪仍因持续的不确定性而动荡。市场调研机构泽内塔(Xeneta)指出,航空货运现货费率一年来首次转向下跌趋势。

- 泽内塔分析称:“尽管有美中关税豁免等积极措施,但逆转航空货运费率疲软已为时过晚。5 月全球航空货运现货费率平均为 2.44 美元 / 公斤,同比下降 4%,为 2024 年 4 月以来首次录得跌幅。航空燃油价格较一年前下跌约 20%,也助长了费率走弱。”

- 过去 5~6 个月航空货运市场的增长放缓 “反映了市场对未来贸易前景不明的氛围”,并分析称 “即使关税谈判达成,其更可能抑制而非促进贸易,预计对航空货运也将产生负面影响”。

- 据此,据悉航空公司在这种不确定性中仍愿意支付 “少量溢价” 以维持运量。

- “2023 年出现过的 FOMO(错失恐惧症)现象可能重现”,并预测 “一旦飞机装载率略有下降,航空公司将更迅速积极地展开费率谈判”。

- 目前美中航空货运量中电子商务占比约达 50%,但贸易环境变化速度过快,导致航空货运行业难以应对,同时指出 “几周前制定的计划又变得无关紧要,当前贸易受挫而航空货运却获得相对收益。与海运费率相比,若为避税目的,则有充分理由接受航空运输成本”。

- 另一方面,截至 6 月 1 日,中国发往美国的航空货运现货费率为 4.31 美元 / 公斤,较 5 月 11 日低点反弹 14%。欧洲航线费率(4.11 美元 / 公斤)较美国劳动节前高点持续下跌,中期市场展望仍持谨慎态度。

- 在迷你关税实施前,中国海关数据显示 4 月中国发往美国的低价及电子商务货物同比增长 30%,低于整体跨境电子商务增长率(45%),表明部分中国产电子商务货物选择了迂回流向。

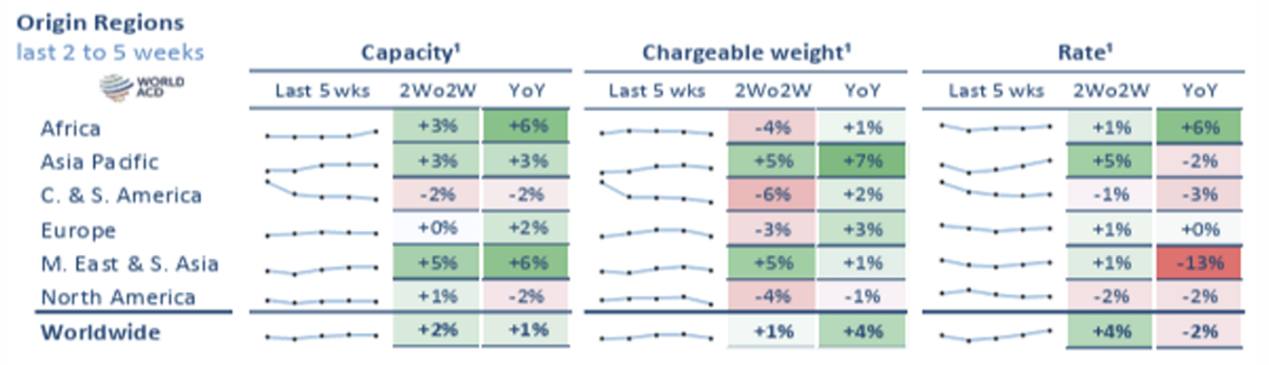

2)全球航空市场第 22–23 周动态

- 全球货运量变化:

- 货运量周环比无大幅波动,保持稳定水平(同比增长 6%,亚太地区增长为主导)。

- 整体需求复苏趋势持续(亚太地区对绝对货运量增长贡献最大)。

- 美洲及欧洲航线主要流向:

- 中国→美国现货费率周环比 + 1%,同比 - 13%。

- 香港→美国现货费率 + 9%,同比 - 4%。

- 中国 / 香港发往美国的货物量同比 - 8%。

- 中国 / 香港→欧洲现货费率小幅上涨,但同比仍处于低位。

- 亚太→北美航线:货运量 + 19% / 北美→亚太航线:货运量 + 13%。

- 中南美→北美航线:因父亲节鲜花需求结束影响,骤降 - 23%(特定事件如父亲节后需求下降反映明显)。

- 中国→美国航线:近期从低点回升,同比改善至 - 5%(这是从 6 周平均下跌 14% 中恢复的结果)。

- 中国→欧洲航线:出口同比 + 11%(但以第 21 周为基准,周环比呈 - 3% 下跌趋势)。

3)东星航空 7 月起研讨釜山~阿拉木图航线 —— 以中亚航空市场为 “扩张窗口”

- 东星航空商务本部长 4 日在首尔广场酒店举行的哈萨克斯坦旅游说明会上表示:“今年正以哈萨克斯坦为中心推进新航线开通。” 并提到 “釜山~阿拉木图航线方面,正在研讨 7 月 15 日首航,这是继 4 月从仁川出发开通中亚哈萨克斯坦最大城市阿拉木图航线后的国内首条该航线”。

- 东星航空成为国内低成本航空公司(LCC)中首个运营仁川~阿拉木图航线的案例。另据悉,在获得釜山~阿拉木图运输权后,正研讨从 7 月起开通该航线。

- 韩亚航空每周运营 2~3 班仁川 - 阿拉木图航线,大韩航空则通过经停塔什干、比什凯克等中亚主要城市的方式运营哈萨克斯坦航线。哈萨克斯坦籍航空公司如阿斯塔纳航空、FlyArystan、SCAT 航空等提供韩国与哈萨克斯坦之间的航班。

- 此前从韩国出发的阿拉木图旅游套餐费用逼近 300 万韩元,近期因包括东星航空在内的航空公司开通航线,价格大幅下降。

- 阿斯塔纳航空营业董事表示:“阿斯塔纳航空不仅每周从仁川运营 3 班航班,还运营连接伦敦等欧洲主要航线的中转航班”,并表示 “计划在哈萨克斯坦旅游之外,为国内消费者带来更多机会”。

4)BSA 长期合同在美中摩擦中 —— 航空公司与货代进入 “谨慎模式”

- 随着美中贸易紧张局势反复,航空货运市场的不确定性加剧,航空公司与货运代理之间在签订长期运输合同时态度明显谨慎,尤其对包舱协议(BSA)的需求与规避同时显现。

- 据悉,专注于中美货运航线的货代对与航空公司签订长期 BSA 合同持怀疑态度。

- 市场专家认为,这是由于美国政府单方面实施的 90 天 “相互关税豁免措施” 进一步增加了政策波动性。美国航空货运协会(AFA)前负责人布兰登・弗里德近期表示:“与几家航空公司交谈后发现,客户接受 30 天短期合同,但拒绝长期合同 —— 因为没人知道 90 天内白宫会做什么。”

- 相反,在德国慕尼黑举行的欧洲航空货运会议上,某货运航空公司相关人士称 “我们与客户的合同续签率非常高”,并表示 “大部分长期合同在正常条件下达成”,呈现相反立场。

- 另一位货运航空公司相关人士称 “甚至航空公司自己有时也拒绝 6 个月以上的长期合同”,分析认为这是由于预计今年下半年需求激增及随之而来的费率上涨。

- 有观点指出,当前全球航空货运市场的不确定性不仅源于美中问题,还影响了整体全球市场情绪。

- 有预测称,若这种不确定性消除,积压的需求将集中释放,市场可能强劲反弹,航空公司可能面临难以承受的时期。专家们的共识是,目前仍处于观望期,除了关注局势发展外别无选择。

5)航空公司动态

- 西捷货运新增 3 条古巴航线:

- 与太阳之翼航空成功完成整合后,西捷货运计划在古巴新增 3 条新航线,并扩大从多伦多和蒙特利尔出发的加勒比航线货运运输。

- 多伦多–巴拉德罗每日运营

▲多伦多–圣克拉拉每周 4 班

▲多伦多–奥尔金每周 3 班。

- 顺丰航空(O3)自 5 月 25 日起开通 EHU(旭川)–JFK–YHZ(加拿大哈利法克斯)–EHU 第五航权货运航线。

- 德威航空(TW)自 8 月 15 日起运营 CJU–SIN 客运航线每周 5 班,9 月 1 日至 10 月 25 日期间每日运营(B737-8)。

top