旭辉空运国际 - 第23周25年航空业更新

航空货运概况

1) 特朗普关税违法判决:即刻上诉并暂停执行,关税持续征收

- 当地时间 5 月 28 日,美国联邦国际通商法院(CIT)判定特朗普总统依据《国际紧急经济权力法》(IEEPA)加征的所有关税及行政命令违宪。

- 具体涉及因国别对等、芬太尼及边境等理由对中国、加拿大、墨西哥加征的关税 —— 法院认为,总统所征关税未针对 “国家安全面临的非正常且特殊威胁”,未满足 IEEPA 的前置条件。

- 判决明确该类关税将被撤销(Vacated)并永久禁止(Permanently enjoined),应无缓冲期立即失效;但因行政部门提出上诉且上诉法院批准临时暂停执行(stay appeal),关税征收恢复。

- 预计上诉审理需数月,涉及多重程序,无论结果如何,原告(5 家中小企业 + 12 个州政府)与被告(特朗普行政部门)均可能上诉至最高法院。

- 有观点认为,此次一审判决显著降低了关税局势恶化的可能性,削弱了特朗普对全球普遍加征关税等强硬手段的合法性。前奥巴马政府美国贸易代表办公室副代表称:“谈判国家可能会暂缓对美作出额外让步,直至法律层面明确化。”

- 但需注意,特朗普仍可利用《贸易扩张法》232 条、《贸易法》122 条等既有法令对特定国家或商品加征关税。

- 6 月 9 日起的临时暂停执行听证会若延长暂停,关税将持续征收至上诉审结;若驳回,关税征收将在上诉审结前中止。

2) 特朗普施压下,苹果印度扩产计划遇阻

- 特朗普行政部门对苹果在印度扩大 iPhone 生产表示不满,强烈要求其扩大美国本土制造。

- 美方批评称 “在美国销售的 iPhone 应在美国生产”,指责其通过印度生产规避关税。

- 此前,因美中贸易战导致中国生产成本上升,苹果计划至 2026 年底从印度采购超 6000 万台面向美国市场的 iPhone。

- 印度组装主要由富士康、塔塔集团负责,印度政府已批准富士康与印度 HCL 合作建立 iPhone 核心零部件工厂,计划 2027 年起每月生产 2 万套零部件。

- 截至 2025 财年,印度已组装超 4000 万台(同比 + 60%),占全球 iPhone 产量的 20%,目标至 2026 年底增至 8000 万台以上。

- 专家指出,美国本土生产 iPhone 面临高人力成本、复杂供应链问题及熟练工人短缺,短期内难以落地。

- 美国银行(BoA)预测,即使苹果仅将 iPhone 16 Pro Max 的最终组装迁至美国,价格也将上涨 25% 以上;若 100% 美国生产,售价可能增至 3 倍以上。

- 目前苹果以美国售价为基准统一全球定价,若美国本土涨价,将带动全球 iPhone 价格同步上升,削弱价格竞争力。

- 此外,零部件供应链主要位于中国,若美国禁止零部件出口,可能导致生产中断及价格上涨。为保证产品良率,中国工厂的工程师和熟练工人需赴美现场安装产线并优化工艺,但存在美国政府拒绝发放签证的风险。

- 印度同样面临熟练劳动力短缺问题,当前工艺良率不足 50%。

3) 亚洲航空货运需求回暖?—— 以越南、中国台湾、中国大陆航线为核心的运价上涨

- 近期美中关税政策波动加剧了航空货运市场的不确定性,但部分地区航线显现需求回暖迹象。

- 5 月第 3 周全球货机运力较前 4 周平均增长 4%,其中亚洲 - 欧洲航线增幅最高达 11%,亚太 - 北美航线增长 8%(亚洲 - 北美西向航线增长 7%),中东 - 亚洲区间也增长 11%。

- 此外,自 4 月底至 5 月初货机停飞事件后,亚洲内部需求持续走强。

- 尤其为应对越美间需求增长,中国南方航空、中国国际航空、中国东方航空等中资航空公司推出 “河内 - 中国 - 美国” 空空中转(A2A)服务。分析认为,该服务将缓解旺季越南发往美国的运力短缺问题。

- 5 月 12 日起,美国客户订单量开始增加,但目前多通过海运处理,航空货运需求预计 6 月中旬后正式回暖。

- 值得注意的是,中国台湾航空货运市场因 AI 及尖端技术需求拉动对美航空出口,相关航线运价呈上涨趋势;中国华东地区至美国的航空货运价格上涨约 10%,预计 5 月底部分航班将停飞。

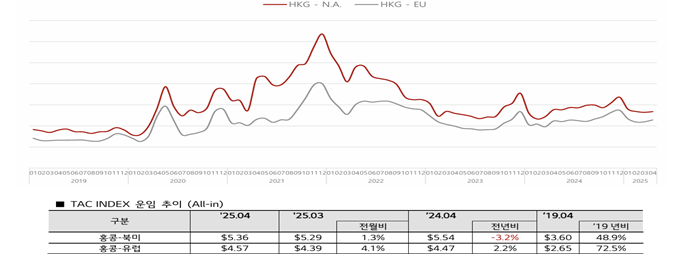

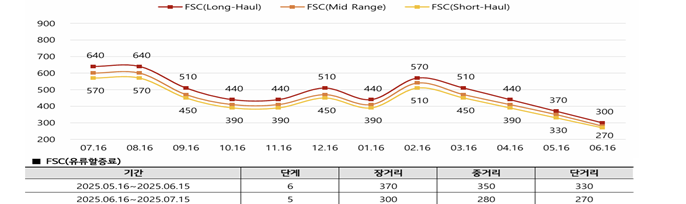

4) 运价参考:香港出发 TAC 指数及首尔出发 FSC 最新动态

- 香港出发 TAC 指数(全包价)(包含香港-北美和香港-欧洲航线及价格的环比变化)

- 首尔出发 FSC(长距离 / 中距离 / 短距离)近期趋势

top