EXTRANS GLOBAL - Air Freight News - Week 23 2024

Air Cargo General

1) Tway Air is pushing to introduce an additional 5 A330neo aircraft

-

South Korean low-cost carrier T'way Air plans to add 5 more long-haul aircraft capable of flying to Europe. This is because during the merger process of Korean Air and Asiana Airlines, Korean Air had loaned some of its aircraft to T'way Air for use, and now T'way Air needs to find replacement models.

-

T'way Air is diversifying its revenue sources by expanding long-haul routes, in addition to the already confirmed Europe and Vancouver, Canada routes, it also plans to expand to the western United States in the future.

-

T'way Air plans to set up a special task force next month to discuss the specific details of introducing the Airbus A330neo model, such as the number of seats and cabin layout, with the manufacturer, and evaluate the timing of the introduction. The current plan is to lease 5 A330-900 aircraft before May 2026.

-

Considering the expiration of the lease period for the aircraft borrowed from Korean Air, T'way Air urgently needs to secure a supply of long-haul aircraft. Previously, Korean Air had provided 5 Airbus A330-200 aircraft to T'way Air free of charge to help it open 4 European routes (Frankfurt, Paris, Rome, Barcelona), one of which has already been repainted with the T'way Air livery and will be put into operation on the Gimpo-Jeju route next month before being deployed on the European routes.

-

In addition to the merger issue, T'way Air is focused on expanding long-haul routes, hoping to become the "second largest airline". As Korean Air and Asiana Airlines merge, T'way Air is preparing to become an alternative airline. Its goal is to expand its fleet to 50 aircraft by 2027, mainly Airbus models.

-

T'way Air launched its first European route to Zagreb, Croatia on the 16th, which is a first for a low-cost carrier. It also plans to successively open routes to Paris, France; Rome, Italy; Barcelona, Spain; Vancouver, Canada; and Frankfurt, Germany.

-

Industry insiders say that the expansion of long-haul routes still needs further stabilization, but T'way Air not only plans to open routes to Europe and Vancouver, Canada, but is also considering expanding to the western United States in the future, making the introduction of long-haul aircraft necessary.

2) The 'Next China' - Where will the next logistics battlefield be?

-

Logistics companies in the South, Middle East, and Indonesia are adopting various ways to expand into new markets. "Next China" refers to the country that may replace China as the world's largest manufacturing country. This is because China's economy has shrunk significantly after the COVID-19 pandemic, coupled with the intensified China-US tensions, leading to a trend of "decoupling from China", drawing global attention.

-

Recently, the domestic companies have been focusing on countries like Vietnam, India, and Saudi Arabia as potential "Next China". To this end, logistics companies have also been entering these "Next China" countries, establishing logistics centers or joint venture companies as part of their "Next China" strategy.

-

Vietnam's labor costs are lower than China's, and some believe it may become the most promising market to replace China in the future. Therefore, domestic companies mainly enter the Vietnamese market by establishing logistics centers or setting up joint ventures with local partners who are familiar with the market.

-

Last October, the integrated logistics company KCTC announced a joint establishment of a composite logistics center in Dong Nai province, Vietnam, with the Ministry of Oceans and Fisheries and Busan Port Authority. The center covers an area of 21,000 square meters, with a storage area of 12,000 square meters and an annual handling capacity of 4.32 million pallets (1.08 million pallets for general cargo and 3.24 million pallets for refrigerated cargo).

-

Lotte Global Logistics has also established a logistics center in Ho Chi Minh City, Vietnam, capable of handling both general and refrigerated cargo, and has begun a major push into the local market. In May this year, Lotte Global Logistics signed a cooperation agreement with the Korea Maritime Promotion Corporation in Ho Chi Minh City to enhance global logistics supply chain competitiveness and ship procurement.

-

Korean courier company Han Express chose to enter the Vietnamese logistics market by establishing a joint venture company with a local container transportation company Viconship. In January last year, Han Express and Viconship signed a contract to establish the joint venture company VHL (Viconship-Han Express Logistics).

-

In January last year, CJ Logistics also signed a logistics business cooperation agreement with the state-owned retail enterprise Saigon Co-op in Vietnam, planning to jointly operate a new logistics center being built in the west of Ho Chi Minh City and explore other cooperation opportunities.

-

Indonesia and India are also rapidly emerging as new opportunities. Indonesia is not only the world's largest coal exporter, but also the world's first and second largest supplier of battery raw materials for electric vehicles, nickel and cobalt, respectively, attracting great attention. India has also seen many companies shift their production bases there, drawing global investor interest. Recently, CJ Logistics became the first overseas subsidiary of a domestic logistics company to be listed on the local stock exchange in Indonesia, and LX Pantos has also established a joint venture with an Indonesian company, actively expanding into the global logistics market.

3) The rapid increase in China's ultra-low-priced cross-border e-commerce is also pushing air freight rates to soar

- Hong Kong-Europe freight rates surge 14% within a month

-

Air cargo freight rates are also rising rapidly. China's companies are flooding the market with low-priced products, leading to increased global demand. In addition, the "urgent demand" for scarce shipping resources has also fueled the rise in air cargo freight rates, which are expected to continue to rise sharply.

-

Industry insiders say that as of the end of April, the freight rate for the Hong Kong-North America route (referenced to the TAC index) was $5.54 per kg, up 13.5% from March. Compared to the same period last year ($5.2), it has increased by 6.5%, and compared to April 2019 ($3.6), it has increased by 53.9%. The freight rate for the Hong Kong-Europe route in April was $4.47 per kg, up 14% from the previous month. Double-digit increases during the typically slow spring season are very rare.

-

Industry insiders believe this is due to increased demand for low-priced Chinese goods. China's e-commerce platforms are using a large amount of air transportation to achieve "fast delivery". Chinese companies are selling unsold domestic products at low prices overseas, and this demand has increased significantly globally. Normally, China's air cargo would transit through South Korea to the US and Europe.

-

According to Chinese customs data, China's cross-border e-commerce import and export volume in Q1 this year was 577.6 billion RMB (about 108.5 trillion KRW), up 9.6% year-on-year. The industry is concerned that rising ocean freight rates will also drive a sharp increase in air freight rates. Industry insiders say the possibility of tight ocean freight capacity in the peak seasons of Q3 and Q4 is increasing, leading to a surge in air cargo inquiries, as companies "want to lock in cargo space and rates before air freight rises further".

-

Air cargo freight rates typically move in line with the Shanghai Containerized Freight Index (SCFI). Freight rates on the Hong Kong-North America route fell from $7.1 per kg at the end of last year to $5.22 in January and further to $4.88 in February, until the SCFI started rising in March, when freight rates began to rise.

-

Air transport is more expensive than sea transport, and is mainly used for smaller, lighter but higher value electronics like smartphones and semiconductors. Urgent air transport is also selected to meet tight deadlines.

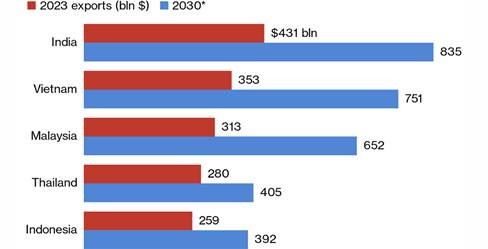

4) With the shift in production hubs away from China, Southeast Asian exports are forecast to double by 2030

-

As more and more companies are shifting their production bases or businesses overseas to avoid trade barriers such as tariffs, it is expected that the export volume of Southeast Asian economies could double within the next 6 years.

-

This forecast is based on the analysis of the trend that companies are shifting their production focus from China to countries like India, Vietnam, Malaysia, and Mexico.

-

The analysis is based on a survey questionnaire of 100 multinational companies and an analysis of global overseas investment trends.

-

Amid the China-US trade tensions, companies are seeking to reduce their dependence on China and diversify their supply chains to mitigate the risks of trade barriers and sanctions.

-

The industries with the most obvious shift in production bases include automotive and parts, electronics, apparel, toys, capital goods, consumer durables, and semiconductors.

-

Among them, US and Japanese companies have led investment in India, while Chinese companies have focused more on Southeast Asian countries.

-

Based on this, it is predicted that Vietnam's annual exports will more than double to over $750 billion by 2030, and Malaysia's annual exports will reach $652 billion.

-

However, even with this trend, China will still remain the main production base for most intermediate products, and it will remain challenging to completely break free from dependence on China.

5) Airline/GSA Event Update

(1) Wynnyx confirmed as the final acquirer of Fly Gangwon (4V), set to be differentiated as a hybrid airline

Wynnyx has been selected as the final acquirer of Fly Gangwon, which had entered rehabilitation proceedings.

After about a year of suspending operations, Fly Gangwon plans to be reborn as a hybrid airline operating both large and small aircraft to secure differentiated service competitiveness.

Aircraft introduction and AOC re-issuance are scheduled for September. The goal is to operate the Yangyang-Jeju route in the 4th quarter.

(2) Jeju Air to launch Bali route this fall

Jeju Air has partnered with Indonesia's Lion Air to operate the Incheon-Bali route daily starting in late October. On June 4, Jeju Air signed a transportation agreement with the Lion Air Group for joint operation of the Incheon-Bali and Batam routes.

After obtaining flight approval from the governments of both countries, Jeju Air plans to operate the Incheon-Bali route 7 times a week in the upcoming winter schedule.

Particularly for the high-demand Bali route, unlimited operation is possible through a joint operation agreement between the designated airlines of the two countries, regardless of route rights.

(3) Tway Air (TW) starts operating the Incheon-Ulaanbaatar route

ICNUBN 4W(D1357) 1140/1410 A333, from 6/2

(4) Qatar Airways (QR) launches 4 weekly direct flights to Tashkent, Uzbekistan

DOHTAS 4W(D1357) QR377 1950/0120+1, TASDOH QR378 0320/0520 from 6/2

top