EXTRANS GLOBAL - Air Freight News - Week 19 2024

항공화물 General

1) Korean Air's first-quarter revenue and operating profit increased compared to last year

-

Korean Air announced that it recorded sales of 3.8225 trillion won, a 20% increase compared to the same period last year, driven by the recovery in passenger transport volume and strong cargo demand in the first quarter of 2024.

-

Despite the increase in operating expenses such as fuel costs, airport and handling fees, and wage increases due to increased business volume, operating profit reached 436.1 billion won, a 5% increase compared to the same period last year.

-

In the first quarter of this year, passenger business revenue reached 2.3421 trillion won, a 32% increase compared to the same period last year, as most routes, except for some Chinese routes, recovered to the level of 2019. By focusing on routes with concentrated tourist demand in Southeast Asia and Japan, the company expanded its supply and improved profitability.In the second quarter, Korean Air plans to expand global supply and operate routes based on profitability to prepare for intensified competition.

-

In the cargo business, revenue reached 996.6 billion won, a slight decrease compared to the same period last year, due to the normalization of the global cargo market after the pandemic.

-

Korean Air plans to strengthen partnerships with related cargo shippers and focus on supplying major routes to attract growing e-commerce cargo from China in the second quarter, aiming to expand its competitiveness.

2) T'way Air prepares for European routes - to introduce leased aircraft from Korean Air next month

-

T'way Air, following the conditions of the corporate merger with Korean Air and Asiana Airlines, is accelerating its preparations for European routes.

-

According to the aviation industry on the 5th, T'way Air plans to lease one A330-200 aircraft from Korean Air by the end of this month. Starting from June 1st to the 25th, the aircraft will be deployed on the Gimpo to Jeju route, operating 2 to 3 flights daily.

-

This aircraft is the first of the five A330-200 leased aircraft that T'way Air will receive from Korean Air by the end of this year. Currently, exterior and interior refurbishment and seat rearrangement are being carried out at Korean Air's tech center in Gimhae.

-

The seating capacity is 246 seats, an increase of 28 seats from the previous 218 seats operated by Korean Air (18 business class seats and 228 economy class seats).

-

T'way Air plans to operate this aircraft on the Incheon to Paris route at the end of June.

-

After the Paris route, they will also deploy the A330-200 on the Incheon to Fukuoka route until the end of October and prepare for smooth operations on other European routes. Starting from the 19th, T'way Air will also introduce the A330-300, a similar medium-haul aircraft, on the Incheon to Fukuoka route to train flight crew (captains and first officers) for long-haul flights.

-

T'way Air stated that they will start training long-haul crew using the existing A330-300 aircraft (3 in total) first this month and when the A330-200 aircraft arrives, they will use it together for training. They also mentioned that the aircraft operating schedule may change flexibly.

-

However, whether T'way Air will be able to operate the Paris route as planned from the end of next month depends on the ongoing negotiations between the South Korean Ministry of Land, Infrastructure, and Transport and the French aviation authorities.

-

The French authorities have expressed the position that T'way Air's operation on the Paris route violates the bilateral air agreement that allows only two Korean airlines to operate flights, and the Ministry of Land, Infrastructure, and Transport is currently discussing whether to revise the regulations or apply exceptions with the French government.

-

In relation to this, Korean Air stated that the operations of Korean airlines will be conducted within the agreed capacity (number of flights) between the two countries, and it is expected to be resolved soon. They also emphasized that there are no issues with the operation of other three routes, including Rome in Italy, Barcelona in Spain, and Frankfurt in Germany.

3) In April, the airline fare market showed a trend of shifting from spot fares to contract fares for cargo transportation

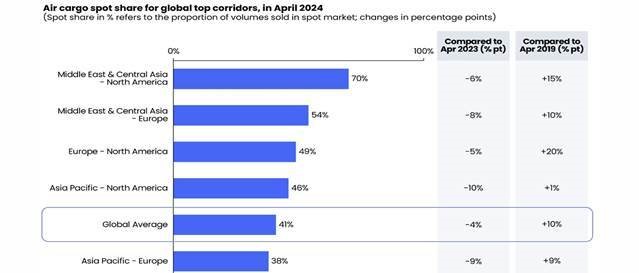

- From the third week of April, spot air cargo rates in this region started to show a downward trend, according to Xeneta.

*Xeneta's spot rate market share represents the percentage of cargo sold in the spot market. - Examining specific routes, the China-US market led the increase in spot rates in April, recording a 20% month-on-month increase to USD 4.87 per kg.

- In April, the average spot rates for Europe and the US increased by a similar rate of +18% compared to the previous month, reaching USD 3.29 per kg and USD 4.79 per kg, respectively.

- In Southeast Asia, spot rates to Europe increased by +14% to USD 3.06 per kg, while rates to the US increased by +12% to USD 4.66 per kg.

- On the other hand, the only major region that experienced a significant decrease in rates was the Europe-US market, with spot rates in April recording a -8% month-on-month decrease to USD 1.93 per kg.

- The Asia-Pacific to North America market witnessed the largest decline in spot rate market share, with a -10% percentage point decrease compared to a year ago, narrowing the gap to only +1% percentage point difference from pre-pandemic levels.

- In contrast, spot market share from Europe to North America decreased by a marginal -5% percentage point. During the same period, spot rates remained 20 percentage points higher than pre-pandemic levels.

- This reflects market expectations that the Atlantic market's rate adjustments will ease as adequate capacity and rate levels approach pre-pandemic levels.

- April is typically the start of the traditional off-peak season for the global air cargo market, and the slowdown in global cargo demand becomes more evident in the last week of April, according to the trend in air freight rates.

- Xeneta has observed more cargo buyers moving volumes in the spot market. The global spot rate market share in April decreased by 4 percentage points year-on-year to an average of 41%, but it still remains 10 percentage points higher than pre-pandemic levels.

- Shippers and major forwarders are securing supply ahead of the anticipated strong peak season in the fourth quarter, considering the demand from e-commerce, and are building flexibility in their space agreements.

4) Ali investing in logistics in Korea, what is the reason?

-

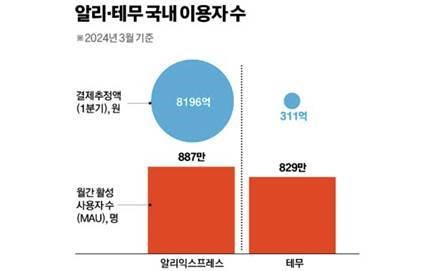

As the number of users of Chinese low-cost shopping platforms such as AliExpress and Tmall rapidly increases, the domestic logistics industry in Korea is quickly responding. Investments are being made to expand facilities and handle the increased customs clearance volume.

-

Hanjin is investing 10 billion KRW to expand the self-clearance facilities at the Incheon Airport Global Logistics Center (GDC). The plan is to double the monthly processing capacity of the self-clearance facility from the current 1.1 million boxes to 2.2 million boxes.

-

CJ Korea Express is also planning to expand the Incheon Airport International Express Center, which handles customs clearance for overseas direct purchase items. They are considering increasing the current processing capacity of 2 million boxes per month to up to 5 times larger.

-

The logistics industry is competing to secure Chinese direct purchase cargo. CJ Korea Express, which has already handled 80% of Ali's domestic delivery volume, is facing high industry attention regarding the extension of customs clearance and parcel delivery contracts with Ali.

- The biggest concern in the industry is whether it can be extended.

-

The contract for customs clearance is expected to be negotiated this month, and the parcel contract by the end of next month. It is highly likely that there will be a renegotiation between CJ Korea Express and other companies to divide the cargo as before, but considering that Ali has introduced a competitive bidding system, there is a possibility that Ali may demand a reduction in parcel delivery fees.

-

There is a keen interest in the background of Ali's plan to invest $1.1 billion (approximately 1.5 trillion KRW) in Korea over the next three years. Ali plans to invest $200 million this year to build an integrated logistics center in Korea with an area of 180,000 square meters, equivalent to 25 soccer fields. They will also invest $100 million in supporting exports by Korean sellers.

-

In the logistics industry, Ali's investment is seen as a strategy to utilize Korea as a hub for its global logistics network rather than solely for domestic delivery in Korea. The method involves sending goods from Ali's logistics centers in China to major ports in Korea, conducting sorting operations at the integrated logistics center established in Korea, and then shipping them by plane to North America, Europe, and other destinations via Incheon Airport.

-

Incheon Airport has a well-established overseas logistics hub network, and the delivery time can be reduced by up to two days compared to shipping directly from mainland China. Korea is considered the optimal region as a global logistics hub for e-commerce companies," explained an industry expert

5) Airline/GSA Event Update

(1) Approval of T'way Air's Paris Route Operation

It has been confirmed that the French aviation authorities have agreed to the operation of T'way Air's Paris route in June, which was one of the conditions for approval by the European Union's executive committee regarding the merger of Korean Air and Asiana Airlines.

(2) Air New Zealand Winter Season Resumption

Incheon-Auckland direct flights will operate three times a week (Monday, Thursday, Saturday) from October 28, with a flight number of NZ24.

(3) Swiss International Air Lines (LX) Commences Cargo Service on Zurich-Incheon Route

Starting from May 8, Swiss International Air Lines will operate regular flights to Korea for the first time in 27 years. The flights, using the 'A340' aircraft, will operate three times a week, mainly for shipping high-tech industry-related cargo.

(4) China Southern Airlines (CZ) to Commence Guangzhou-Budapest Route at the end of June

From June 27, China Southern Airlines will operate four weekly direct flights on the CAN-BUD route. The flight number will be CZ649, departing at 0055 and arriving at 0720. The aircraft type will be B789 with the code D2467.

(5) Eastar Jet (ZE) to Expand Narita Route in July

From July 12, the existing three weekly flights will be increased to daily flights, totaling 21 weekly flights. The aircraft type will be B738. Flight schedule: ICNNRT ZE605 0705/0950 (Daily), ZE601 0800/1030 (Daily), ZE603 1510/1730 (Daily)

top