엑스트란스 - 항공 물류 업데이트 - 12주차 블로그

항공화물 General

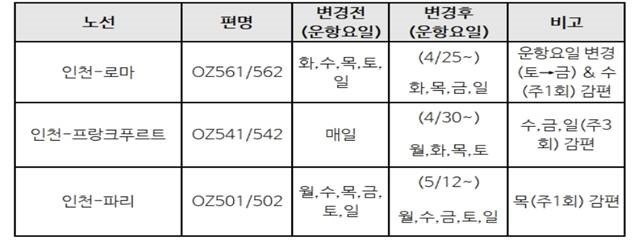

1) 아시아나항공, 4월 말부터 유럽 일부 노선 감편

- 아시아나항공(OZ)이 유럽 노선의 독과점 우려 해소를 위한 유럽연합(EU) 경쟁당국의 시정조치 사항으로 4월 말부터 유럽 일부 노선을 감편.

- 아시아나항공은 지난해 12월12일 대한항공 자회사 편입과 동시에 감편 예정편에 대한 판매를 중단.

- 아시아나항공의 유럽 3개 노선(프랑크푸르트, 파리, 로마)의 운수권 일부는 국적항공사로 이관되어 국적사의 유럽노선 공급력은 그대로 유지.

- 아시아나항공은 4월 25일(금)부터 인천-로마 노선은 주 5회에서 주 4회로 주 1회 감편하고, 4월 30일(수)부터 인천-프랑크푸르트 노선을 기존 주 7회 운항에서주 4회 운항으로 주 3회 감편. 또한 , 5월 12일(월)부터 인천-파리 노선은 주 6회에서 주 5회로 주 1회 감편.

- 아시아나항공은 3월 17일(월)부터 해당 항공편 기 예약 고객들을 대상으로 변경되는 항공편 일정을 별도 안내하고, 공식 홈페이지를 통해 관련 안내문을 공지.이후 고객 요청에 따라 목적지 및 일자 변경 지원, 환불 및 재발행 수수료 면제, 타항공사 대체편 등을 제공.

- 또한 항공편 일정 변경에 따른 손실 보상, 감편 일자 운항 취소편 고객 대상 보상 정책 마련 등 고객 불편 최소화.

- 여행사나 온라인 여행 플랫폼을 통해 구매한 고객의 경우, 구매처를 통해 환불 및 예약 변경이 진행, 아시아나항공 관계자는 "고객들께 불편을 드려 죄송하다"며,

- "여정에 차질이 없도록 고객이 원하시는 일정으로 예약을 변경하거나 타항공사 대체편을 제공하는 등 적극적으로 지원할 계획이다"고 전언.

2) 글로벌 항공화물 수요 운임 안정적 : 한국발 유럽 물량은 11% 감소

- 글로벌 항공화물 시장이 최신 수요와 운임이 안정적인 추세를 보이고 있음.

- 급변하는 지정학적·무역 환경 속에서 10주차(3월 3일~9일) 전 세계 총 톤수는 전주 대비 안정세를 유지했으며, 전년 동기 대비(YoY)로는 +2%

- 특히 아아 태평양 출발지의 운임허용 중량은 전주 대비(WoW) +5% 추가 상승하며, 설 연휴(LNY) 기간의 변동을 거친 후 1월 중순 수준에 근접한 회복세 그러나 이러한 아시아 태평양 지역의 화물량 증가는 중남미(-9%, WoW), 유럽(-3%), 북미(-2%), 중동·남아시아(MESA, -1%), 아프리카(-1%) 등 기타 지역 물량 감소로 상쇄.

- 9주차와 10주차를 합산한 2주 평균 톤수는 전년 대비 약 +4% 증가했으며, 이는 아시아 태평양 출발지의 +8% 성장에 힘입은 결과다.

- 이에 따라 10주차 전 세계 평균 현물 운임은 킬로당 2.55달러로 전주 대비 안정세를 유지했으나, 아시아 태평양 출발지는 -1% 하락. 하지만 전년 동기 대비로는 +8% 상승했으며, 아시아 태평양의 현물 운임은 +11% 증가.

- 아시아 태평양 지역을 세부적으로 살펴보면, 중국과 홍콩에서 미국으로의 평균 현물 운임은 10주차에 킬로당 3.78달러로 전주 대비 안정세를 보였고, 화물량은 1월 중·후반 수준으로 회복.

- 아시아 태평양에서 유럽으로의 화물량은 10주차에 전주 대비 +4% 반등했으며, 이는 중국(+5%), 홍콩(+6%), 일본(+7%), 대만(+7%), 베트남(+3%), 태국(+9%), 싱가포르(+9%) 등 주요 시장의 증가에 힘입은 결과. 다만, 한국은 화물량이 -11% 급감했으며, 이는 같은 주 한국출발 화물기 공급 용량 감소와 일치.

- 이에 아시아 태평양에서 유럽으로의 평균 현물 운임도 10주차에 킬로당 3.91달러로 전주 대비 -3% 하락했다. 이는 중국(-5%), 홍콩(-2%), 베트남(-7%)에서의 운임 하락이 주요 원인으로 분석..

3) 미국 관세 전쟁 불구하고 세계 무역은 성장할 것 : DHL Trade Atlas 2025 보고서

- 미국의 관세 정책과 지정학적 긴장이 지속되는 가운데, 세계 무역은 예상보다 강한 성장세.

- ‘DHL Trade Atlas 2025’ 보고서에 따르면, 글로벌 무역은 2024년 회복세를 보이며 2029년까지 지난 10년보다 빠른 속도로 성장할 전망. 특히 미국이 중국을 공급망에서 완전히 배제하기 어려운 현실이 이러한 추세를 뒷받침하고 있음.

- 미국과 중국 간 무역 갈등이 심화되고 있음에도, 미국의 중국산 제품 의존도가 실질적으로 줄지 않았다고 지적. 2016년 미중 직접 무역은 세계 무역의 3.5%를 차지했으나, 2024년 첫 9개월 동안 2.6%로 소폭 감소. 그러나 미국은 여전히 중국에서 수입하는 비중이 세계 평균과 유사하며, 제3국을 통한 간접 수입과 중국산 부품 사용을 고려하면 의존도는 더 높아짐. 이는 중국이 반도체, 전자제품 등 핵심 중간재 공급에서 여전히 대체 불가능한 위치를 점하고 있음을 시사.

- 미국의 관세 정책은 도널드 트럼프 대통령의 재선 이후 더욱 강화되고 있지만, 보고서는 트럼프가 선거 공약으로 내건 모든 관세가 시행되고, 다른 국가들이 보복 조치를 취하더라도 글로벌 무역 성장은 멈추지 않을 것이라고 전망. 다만 성장 속도는 현저히 둔화될 수 있음. 물류 전문가들은 “중국을 완전히 배제하려는 시도는 공급망의 비효율성과 비용 증가를 초래하며, 단기적 대안으로는 한계가 명확하다”고 분석.

- 특히 인도, 베트남, 인도네시아, 필리핀이 2029년까지 무역 성장 속도와 규모 면에서 선두 예상되는데, 이들 국가는 아시아 지역의 새로운 생산 허브로 부상하며, 관세 회피를 위한 대체 경로로 주목받고 있음 .

- 미국과 중국 간 지정학적 갈등은 공급망 다변화를 가속화. 기업들은 프렌드쇼어링(Friendshoring)과 멀티소싱(Multi-Sourcing)을 통해 리스크를 분산시키고 있으며, 이는 물류 비용 증가와 효율성 관리의 필요성을 강조. 예컨대, 2024년 미국과 중국의 직접 무역은 줄었지만, 제3국을 경유한 우회 무역은 증가. 이는 공급망의 복잡성이 높아지고 있음을 뜻함.

4) LCC 최장수 CEO' 정홍근 티웨이 대표 3월 31일 퇴임 - 차기 대표는 대명소노 추천 '대한항공 출신' 신임 사내이사

- 대명소노그룹에 인수되는 티웨이항공을 지난 10년 가까이 이끌어온 '국내 저비용항공사(LCC) 최장수 최고경영자(CEO)' 정홍근(67) 대표이사가 이달 말 임기를 마침. .

- 신임 대표이사는 대명소노그룹의 추천으로 오는 31일 정기 주주총회를 거쳐 이사회에 진입할 인사 중에서 선임될 전망.

- 정 대표는 티웨이항공에는 2013년 합류해 영업서비스본부장을 맡았고, 2015년 일본지역본부장으로 이동했다가 그해 12월 대표이사직에 올랐다. 이후 2018년 기업공개(IPO), 2O20년 LCC 첫 자체 안전훈련센터 개관, 2022년 인천∼시드니 LCC 최초 취항, 2024년 유럽 진출 등의 굵직한 사업을 진두지휘하며 사세를 확장.

- 정 대표는 3연임을 거쳐 이달 말까지 9년여간 재임하면서 국내 LCC 9개사 대표 가운데 가장 오랜 기간 자리를 지켜 왔고, 당초 항공업계 일각에서는 안정적인 회사 운영을 위해 정 대표가 다시 한번 연임할 가능성도 제기했으나 결국 퇴임 수순을 밟게 됨. .

- 차기 대표는 '새 주인'인 대명소노그룹이 추천한 대한항공 출신 신임 사내이사 후보 3명 중에서 나올 것으로 보임. .

- 모두 현재 소노인터내셔널 소속인 이상윤(51) 항공사업 태스크포스(TF) 총괄 임원과 안우진(50) 세일즈마케팅 총괄 임원, 서동빈(49) 항공사업 TF 담당 임원 등.

- 이 총괄은 지난해까지 20여년간 대한항공에서 정비·인사·정책기획 등 보직을 거쳤으며, 안 총괄은 대한항공에서 12년간 국내선 심사분석·영업기획 등을 맡다가 2015년 소노인터내셔널로 옮겼고, 서 담당은 2003∼2010년 대한항공과 진에어에서 근무한 이력.

- 항공업계 관계자는 "티웨이항공은 대한항공에서 유럽 노선을 이관받고, 운항 승무원 파견과 항공기 대여 등을 통해 긴밀히 협력하고 있는 만큼 대한항공과 원활히 소통할 수 있는 대표이사를 선임하려는 것으로 해석된다"고 함.

top