EXTRANS GLOBAL - Air Freight News - Week 49

- Air Cargo General

- The current trend in cargo is dominated by e-commerce, while B2B demand is decreasing, exacerbating the downturn for forwarders.

- Challenges intensify due to reduced demand for air cargo from China, with the Incheon market facing a situation where supply is shifting to meet e-commerce demand originating from China and Southeast Asia.

- This market trend is not exclusive to South Korea but is a global phenomenon, with e-commerce becoming a major driver supporting current market demand.

- Despite the surge in e-commerce volumes, the fundamental B2B demand for general air cargo remains stagnant. Freight forwarders, serving major corporations, are facing continued deterioration in their operations.

- Actual air cargo rates continue to rise independently of demand, and while supply to certain destinations (mostly developed countries) is not significantly delayed, there is a perception among market participants that it is somewhat tight.

- As of November 17th, the global air cargo rate index shows a 14% increase in air cargo rates from China to the United States based on the TAC index, approximately $5.91 per kg. Similarly, rates to Europe have risen by 11%, recording $4.61 per kg.

- However, the overall market demand graph is not on an upward trajectory. Until November, global air cargo volumes were around 4% lower than the same period last year. Even Hong Kong International Airport, one of the busiest, recorded a 1.3% decline in handling volume, indicating a significant difference from the overall market demand decrease. The explosive growth of e-commerce demand is a key factor behind this trend.

- Notably, the B2C volume of e-commerce is expected to increase further. TikTok, a social media platform dominating the U.S. market, has expanded its e-commerce business, aiming to quadruple its e-commerce business size in early 2023, targeting revenues of $20 billion.

- However, traditional forwarders are not benefiting from the rise in rates due to the lackluster B2C demand, while BSA companies, replacing airline supply, are successfully aligning contract rates with the surge in e-commerce demand.

- E-commerce demand is expected to persist regardless of the seasonal cycle, with a focus on market trends until the Chinese New Year.

-

Experts in air cargo are closely monitoring the trends in the Asian export air cargo market, predicting that current demand will continue at least until the Chinese New Year in February.

-

Experts assert that the market is currently in a clear peak season. Considering the current market demand trends, they believe demand will persist until the Chinese New Year next year.

-

Optimistic predictions of demand growth are partly based on statements anticipating the release of new products after the Chinese New Year or the assertion that e-commerce demand will ultimately lead the market.

-

Uncertainty remains regarding whether demand will continue until the Chinese New Year, as short-term peaks may occur and decline. However, it is certain that peak season demand will normalize from mid-December to the end of the month, and e-commerce demand is expected to persist longer.

-

Moreover, e-commerce from southern China to Europe and North America has become a hotspot, indicating that Chinese demand will continue until the Chinese New Year.

-

In conclusion, experts point out a shift in the seasonal peak season in the air cargo market. Regardless of the perceived peak season, e-commerce demand is expected to continue, with the possibility of traditional air cargo items entering the market after the Chinese New Year.

- Alaska Airlines acquires Hawaiian Airlines, merging operations.

-

Alaska Airlines announces the acquisition of Hawaiian Airlines for $1.9 billion.

-

The acquisition is expected to strengthen the cargo business of both airlines, with the brands of both airlines to be maintained post-merger.

-

Hawaiian Airlines currently operates 87 routes to Hawaii, three times more than Alaska Airlines' Hawaii routes. The merged airline aims to significantly expand passenger and cargo services in the Pacific region, including the U.S. mainland and worldwide.

-

Even after the merger, Alaska Airlines plans to continue expanding its investment in the cargo division of Hawaiian Airlines. The merged cargo division is forecasted to generate annual revenues of $20 million.

- "Deglobalization is just a change in the form of globalization; a media-created illusion."

-

Recent discussions on "deglobalization" are challenged as a misconception. Neil Ferguson, a Harvard professor, expresses skepticism about the actual progress of deglobalization, stating that globalization cannot be eliminated.

-

Some argue that even for addressing climate issues, globalization will continue. Switching to clean energy essentially creates a new stage of interdependence worldwide. Considering climate issues, complete dismantling of globalization is unlikely.

-

Ngaire Woods, Dean of Blavatnik School of Government at the University of Oxford, emphasizes that the minimum government action required for climate change is to present consistent climate change goals that do not change with each election.

-

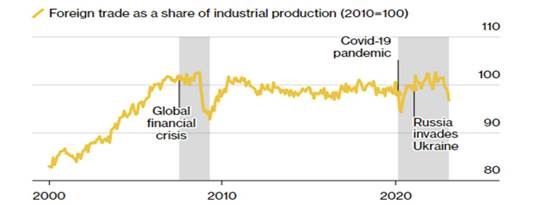

The chart depicts the change in the proportion of trade in global industrial production, showing no significant decrease. Despite the emergence of war, COVID-19, and trade conflicts, global trade remains resilient.

-

Bloomberg has long speculated about the end of globalization, and predictions of the end of globalization have surfaced due to COVID-19, U.S.-China tensions, climate change, and competition for environmentally friendly business dominance. However, globalization is evolving rather than declining.

-

The Wall Street Journal notes that countries overly dependent on China as the "world's factory" are diversifying to Mexico, Vietnam, Bangladesh, and others.

- Airline/GSA Event Update

(1) Incheon Airport's 3rd Cargo Terminal is set to open in 2027, with an annual capacity of 140,000 tons.

- AACT plans to develop and operate a new cargo terminal with an annual capacity of 140,000 tons at Incheon Airport by 2027. AACT, a joint venture between Atlas Air and Sharp Aviation Korea, operates as a global specialist in the field of air cargo operations.

- The new terminal, with an area of approximately 25,000 square meters, is expected to handle around 140,000 tons of air cargo annually. It is scheduled to start full-scale operations in 2027 after design in 2024 and construction beginning in early 2025.

- The new cargo terminal includes dedicated facilities for the cold chain (approximately 3,465 square meters), contributing to the creation of new demand in sectors such as pharmaceuticals and fresh produce.

(2) MSC Air Cargo acquires the 3rd B777F.

- MSC Air Cargo, through an ACMI contract with Atlas Air, introduces its third dedicated freighter. The aircraft is planned to operate on the Hong Kong-Dallas route.

- MSC Air Cargo focuses on expanding its global network, continuously increasing services in Europe, Asia, and North America. Recent additions include twice-weekly connections between Milan (MXP) and Tokyo (NRT), and weekly connections from Saragossa to Mexico City.

(3) Japan Airlines (JL) introduces a converted B767-300ER freighter in February 2024.

- Japan Airlines announces the commencement of freighter operations with a converted B767-300ER on February 19, 2024.

- The freighter will operate from Tokyo Narita and Nagoya Chubu to three international airports: Incheon, Shanghai Pudong, and Taipei Taoyuan.

- The flight schedule includes NRT-TPE on Wednesdays starting from February 19, NGO-ICN on Thursdays starting from February 20, and NRT-NGO-PVG on Mondays starting from March 1, with an additional NRT-NGO-PVG-NRT rotation on Wednesdays starting from March 2.

(4) Kenya Airways resumes Bangkok (BKK) route after a 3-year hiatus.

- Kenya Airways plans to deploy a B787-8 on the NBO-BKK route with operations starting in February next year. Direct flights to Mogadishu (MGQ), Somalia, are also planned.

(5) Etihad Airways (EY) increases summer flights to 11 per week in 2024: ICN-AUH 7W (EY857 0100/0545 + 4W (D1246) EY859 0055/0550 B789.

top