EXTRANS GLOBAL - Air Freight News - Week 47

1. Air Cargo General

1) EU's delay in reviewing KE/OZ merger due to missing information.

- The EU competition authorities have not resumed the review of the merger between Korean Air (KE) and Asiana Airlines (OZ) due to missing information in the submitted documents.

- The EU Executive Commission's Competition Division conveyed that the review process is still on hold in response to a written inquiry about whether the evaluation of the merger is ongoing.

- The reason for the delay is cited as "missing information," but the specific details of the lacking information are not disclosed.

- Korean Air submitted a corrective measure plan, including the separation and sale of Asiana's cargo business, to the EU Executive Commission on the 2nd of this month.

- The review was initially halted in May after concerns were raised about potential competition issues in passenger and cargo transportation on European routes following the merger.

- Despite the expectation of conditional approval in January next year after the submission of the corrective measure plan, the recent pause in the review has left the outcome uncertain.

- Korean Air explained that there is an ongoing consultation period to confirm the details before the review resumes. They are actively engaging with the EU Executive Commission, providing additional information as requested.

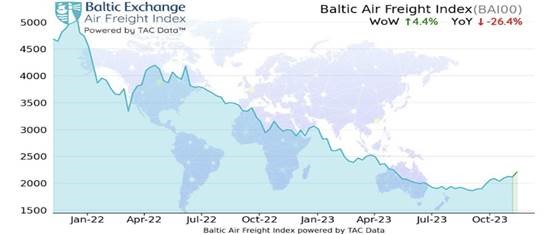

2) TAC Index Indicates Increasing Trend, Sustained Rise in Global Air Cargo Rates in Mid-November

- The TAC Index, analyzing trends in air cargo rates, reported a rising trend in global air cargo rates as of November 13th.

- The Baltic Air Freight Index (BAI00) showed a 4.4% increase compared to the previous month, with a reduced year-on-year decline of 26.4%.

- Airfreight rates had been consistently rising in September and October, with November continuing the upward trend. The significant increase in airfreight rates from China and disruptions in the Pacific transshipment route due to record snowfall in Alaska were contributing factors.

- Cargo rates from China to the United States and Europe showed double-digit increases, with a notable 8.7% rise from Shanghai and a 0.6% increase from Hong Kong compared to the previous week.

- Despite recent fluctuations, airfreight rates for exports from India and Vietnam, particularly for electronic goods, remained relatively stable.

- Demand for air cargo between Asia and North America is on the rise, attributed to strong performance in e-commerce, especially in clothing-related shipments. The congestion is leading to requests for extended lead times from shippers.

- The recovery in automotive-related shipments, coupled with the surge in e-commerce, is driving up airfreight rates to North America. Spot rates to North America are three times higher than pre-COVID levels, and Europe-bound rates are 1.5 to 2 times higher.

3) Hong Kong Air Cargo Market Experiences Definite Peak Season with Increased Demand from E-commerce

- According to a representative from Cathay Cargo, the Hong Kong International Airport is experiencing its most robust peak season due to increased demand for e-commerce exports.

- Despite challenges such as anchorage snowfall affecting cargo operations to the United States, market demand remains at its peak.

- Hong Kong International Airport is witnessing a surge in cargo volume due to the export demand driven by e-commerce from the "Greater Bay Area" region throughout the year. Additionally, the cherry harvest season in South America is contributing to a significant increase in cargo volume.

- In contrast to Hong Kong, the expansion of demand in the surrounding Southeast Asian markets is not as evident. However, with recent increases in load factor (L/F) figures, a positive outlook suggests potential market demand expansion in the Southeast Asian region in the future.

- The current global supply chain reorganization has shifted from the earlier concept of "China +1" to "China +3," including Indonesia and Thailand, as saturation in Vietnam's supply chain becomes apparent.

4) U.S. Treasury Secretary Janet Yellen - Outlook on Constructive U.S.-China Relations

- U.S. Treasury Secretary Janet Yellen, in a recent op-ed for The Washington Post, highlighted the Biden administration's principle of a "constructive economic relationship" with China, emphasizing its stabilizing impact on overall U.S.-China relations and the benefits for workers and families in both countries and beyond.

- Yellen emphasized the economic interconnectivity between the U.S. and China, pointing to the $690.6 billion trade volume between the two countries last year.

- The U.S. imported goods worth $536.8 billion from China, marking a 6.3% increase from the previous year and approaching the record level of $538.5 billion set in 2018.

- Despite intense competition in politics and security, the economic inseparability of the U.S. and China is evident.

- Yellen previously stated in May before the House Financial Services Committee that "decoupling from the U.S.-China trade dispute would be a huge mistake."

- The Biden administration continues the strategy of engaging, aligning, and competing with China, which aligns with the consistent approach outlined by Secretary of State Tony Blinken.

- While both the Trump and Biden administrations share the goal of challenging China as a rising power, their approaches differ significantly. Trump's emphasis on "America First" was confrontational, while Biden focuses on building a united front with allies to encircle China.

- Yellen stressed that protecting core national security interests, including non-negotiable areas, is a continuing policy to safeguard U.S. interests.

5) Airline/GSA Event Updates

(1) Korea-Poland Aviation Agreement:

In recent talks, passenger traffic rights between Korea and Poland were increased to seven flights per week, with an additional three flights connecting Busan and Poland.

Restrictions on cargo operations between Korea and the UK were lifted, allowing cargo carriers to expand services between the two countries. This was agreed upon during the Korea-UK aviation talks organized by the Ministry of Land, Infrastructure, and Transport.

(2) Aeroflot Resumes Ho Chi Minh City Route:

Aeroflot Airlines (SU) is set to resume flights on the Ho Chi Minh City route from December 28th.

The flight schedule includes SU293 departing from SGN to SVO at 1110/1810 on Saturdays and SU292 returning from SVO to SGN at 1940/0940 the next day, utilizing a Boeing 777-300ER aircraft.

(3) Jin Air Cancels Temporary Hong Kong Route:

Jin Air (LJ) has temporarily canceled its Hong Kong route that was scheduled to commence on December 24th.

The daily flight schedule, LJ701/KE5069 departing from ICN to HKG at 0915/1220 and LJ702/KE5070 returning from HKG to ICN at 1330/1805, has been temporarily canceled.

(4) Avianca Airlines Appoints ECS as GSA for Korea, Japan, and India:

Avianca Airlines (AV) has designated ECS as its General Sales Agent (GSA) for cargo in Korea, Japan, and India.

This restructuring of the overall GSA system aims to enhance and differentiate services in the cargo sector to expand sales.

(5) China Southern Airlines Resumes Incheon-Xian and Guangzhou-Brisbane Routes:

China Southern Airlines (CZ) has resumed operations on the Incheon-Xian route from November 23rd and plans to restart the Guangzhou-Brisbane route from December 8th.

The Incheon-Xian route will operate daily with flight number CZ3090 departing at 1425 and arriving at 1710.

The Guangzhou-Brisbane route will initially operate four times a week, with potential expansion to daily flights based on increased demand.

top