EXTRANS GLOBAL - Air Freight News - Week 16 2024

Air Cargo General

1) Delivery of Boeing 777F delayed due to engine component supply issue

-

Recently, in the global air cargo market, there have been some unexpected concerns that the delivery of Boeing's latest freighter aircraft is being delayed, which could result in a decrease in air cargo supply in the second half of the year.

-

Boeing has been unable to deliver the planned 11 units of the latest B777F to customers in the first quarter as ordered by global airlines. Consequently, market experts express concerns that despite the gradual expansion of demand until recently, overall cargo supply may decrease during the year-end peak season.

-

The delay in the delivery of Boeing's freighter aircraft is primarily attributed to the fact that the engines, which should be installed on the aircraft model, have not yet arrived. In other words, there are currently 11 so-called 'gliders' (aircraft without engines) awaiting engine delivery. Boeing has completed the aircraft production, but the engine delivery is indefinitely delayed due to GE's engine precision inspection and supply chain issues," explained the statement.

-

GE also reported that such a situation has arisen as deliveries have been delayed by component suppliers since last month. Furthermore, analysis suggests that the aerospace supply chain is still recovering from issues such as layoffs during the pandemic period.

-

Additionally, the shortage of inspection slots required for engine inspections after manufacturing is also contributing to the delay in engine delivery. Regarding this matter, an official stated, "Engine inspections take about 90 days, but securing inspection slots takes about a year," according to the statements of the officials.

-

As a result, airlines that have contracted with Boeing are concerned about the possibility of sequential delays in the delivery of a total of 55 freighter aircraft. Particularly in the fiercely competitive market for Airbus A350F and Boeing's 777-8F, there is a high likelihood of order cancellations depending on the delivery schedule. Some airlines have already been reported to have canceled their orders, which raises concerns about the overall contraction of cargo supply due to a decrease in the market responsiveness of airlines that were preparing for the introduction and operation of freighter aircraft.

-

Meanwhile, air cargo demand has been on the rise in recent months, driven by the demand in e-commerce. According to the IATA's announcement, based on CTK, there was a 181.1% increase in January and a continued growth of 11.9% in February.

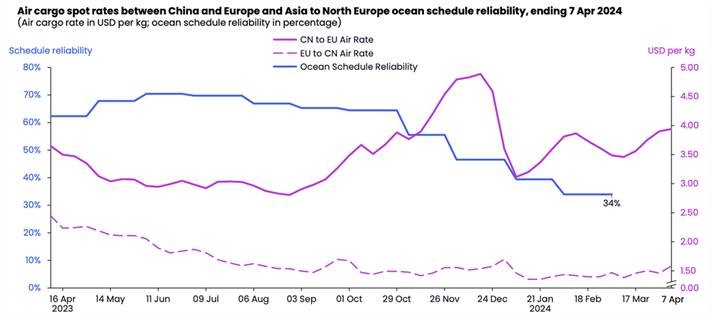

2) Chinese-European air freight rates reach record high of $3.94/kg

-

In the first week of April, air freight rates on the China-Europe route reached a record high of $3.94/kg, the highest level so far this year. This is a significant increase of 76% compared to the period before the 2019 pandemic.

-

Despite being in the non-peak season in early April, the strength in air freight rates continues. On the Europe-China route, the rates are maintaining the average level at $1.59/kg, which is 5% higher than the pre-pandemic level in 2019.

-

The ongoing strength in air freight rates from China to Europe is attributed to the increased demand for alternative transportation due to the disruptions in ocean shipping caused by the Suez Canal incident.

-

According to Sea-Intelligence, an ocean data analysis organization, the schedule compliance rate of regular liner services from Asia to Northern Europe dropped significantly to 34% in February. As a result of this decline in regular liner schedules, some urgent cargo has been redirected to air transport as an alternative.

-

In addition, there has been a significant increase in combined sea and air transportation services, particularly via the Middle East region. In Dubai (DXB), air cargo to Europe in March doubled compared to the previous year.

-

According to the freight benchmarking platform Xeneta, the average load factor for air cargo on the China-Europe route in April reached a record high of 96%. However, the average load factor for air cargo on the Europe-China route in April was 46%, lower than the 57% in March.

3) Chinese airlines allowed to expand passenger flights on North America routes (increasing weekly flights to 50 in April)

-

It has been announced that Chinese airlines will significantly increase their flights to the United States, leading to a simultaneous increase in belly cargo capacity.

-

The U.S. Department of Transportation (DoT) has approved Chinese airlines to increase their weekly flights between the U.S. and China from 35 to 50 starting in April.

-

In relation to this, the U.S. DoT has evaluated the progress made in normalizing air transportation routes between the U.S. and China in preparation for the summer season.

-

With this approval, Air China will operate 14 flights per week, China Southern will operate 10 flights per week, China Eastern will operate 12 flights per week, Xiamen Airlines will operate 5 flights per week, Hainan Airlines will operate 6 flights per week, and Sichuan Airlines will provide 3 flights per week.

-

However, compared to the pre-pandemic period when there were over 150 weekly flights, the current 50 weekly flights still remain at a lower level. Nevertheless, the air cargo market is paying attention to these measures as the recent increase in airfares from China to the United States, albeit slight, continues.

-

In particular, there is a focus on how the increased belly capacity will impact the freight market, considering the rapid growth of cross-border e-commerce demand from China. Dimerco, a freight transportation company, has reported that most block contracts for shipments to the Americas have been sold out due to the increased demand from Chinese e-commerce platforms such as Temu, Aliexpress, and Shein.

-

On the other hand, the three major U.S. airlines announced in March that the resumption of flights to China, which had been suspended during the pandemic, would be postponed until at least the end of October.

4) Severe logistics bottlenecks are expected due to geopolitical risks in the Middle East.

-

According to logistics specialist media Roadstar, air cargo from Asia to Europe may face severe bottlenecks and freight rate increases due to heightened tensions in the Middle East. It is also analyzed that sea-air transshipment departing from Dubai will be affected.

-

On the 13th, CNBC reported, citing Jordan's state-owned media Al-Mamlaka, that Israel has closed its airspace after Iran attacked Israel, and both Jordan and Iraq have also closed their airspace.

-

Major airlines temporarily suspended flights to Israel due to drone attacks. Air India canceled flights to Tel Aviv (TLV) until April 20, and Lufthansa Cargo suspended round-trip flights to TLV, Eilat, and Amman until April 17.

-

Since the closure of Russian airspace due to the invasion of Ukraine in 2022, airlines have relied on Iranian airspace as a crucial hub for trade between Asia and Europe, raising concerns of significant bottlenecks in the Asia-Europe air cargo routes due to airspace closures.

-

Mark Zee, the founder of OPS Group, an aviation monitoring company, analyzed to Reuters that the Asia-Europe trade will likely be limited to two alternative routes via Turkey, Egypt, or Saudi Arabia.

-

If the Strait of Hormuz is considered a high-risk area similar to the Malacca Strait, there is a possibility of blocking access to Jebel Ali Port in Dubai, one of the busiest ports for maritime-air transportation.

-

If access to Dubai Port is restricted, maritime and air cargo volumes are likely to be diverted to Colombo or Bangkok, both of which are already experiencing severe logistics bottlenecks due to the situation in the Malacca Strait.

-

However, Hans-Henrik Nielsen, Global Development Director at CargoGulf, based in Dubai, expressed the opinion that a complete closure of the Strait of Hormuz is highly unlikely.

-

He added, "Even Iran does not want to be completely isolated, and their economy would suffer as a result." Nevertheless, there is a warning that the cost of maritime-air transportation from Dubai may increase due to geopolitical tensions.

5) Airline/GSA Event update

(1) Etihad Airways (EY) to increase Abu Dhabi route starting May 2nd

The Incheon-Abu Dhabi route will be increased from 7 flights per week to 11 flights per week.

ICNAUH EY857 1800/2300 DAILY & EY859 0055/0550 D1246

(2) CMA CGM AirCargo announces Incheon route operation starting June

With the delivery of two B777-200F aircraft this year, the first deployment is planned for the ICN, ORD, and HKG routes.

The second deployment is planned for mainland China to North America routes.

(3) Air China (CA) Cargo division establishes long-term cooperation with Hong Kong TAM Group for North American cargo

CA operates globally with 9 B777F and 3 B747-400 aircraft, covering 21 cities and 24 routes.

Cooperation has been established for the JFK route, cargo operations via ORD to Chile in partnership with LATAM, and belly cargo for North America.

(4) Alaska Airlines (AS) introduces scheduled cargo flights on the LAX route

Two converted B737-800F freighters will be deployed on this route, transitioning from passenger to cargo aircraft.

The capacity of the two aircraft is approximately 4.5 tons more than the supply of three B737-700F aircraft.

top