EXTRANS GLOBAL - Air Freight News - Week 15 2024

Air Cargo General

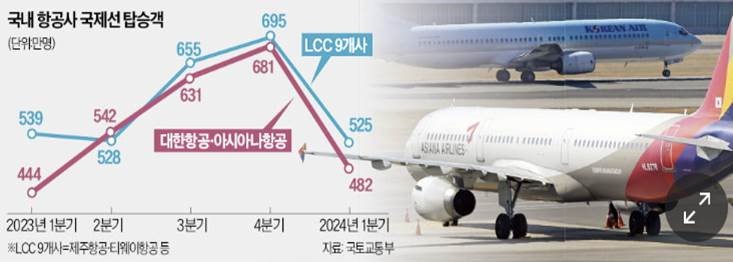

1) FSC major airlines focus on short-distance routes, while LCCs expand into long-distance routes, resulting in overlapping boundaries

- Airbus' 'A321neo' is a small aircraft with 182 seats. Korean Air plans to introduce a total of 50 of these aircraft by 2030. Until last month, they had imported nine and sequentially deployed them on major routes in Southeast Asia, China, and Japan.

- The boundaries between FSCs (Full-Service Carriers) and LCCs (Low-Cost Carriers) are becoming blurred. Korean Air and Asiana Airlines, the "Big 2," have resumed short-distance flights that were suspended after the COVID-19 pandemic or increased their frequency. LCCs like T'way Air and Air Premia are exploring new markets by operating long-distance flights to destinations such as Paris, France, and San Francisco, USA.

- Korean Air will resume flights from Incheon to Chengdu and Changsha in China and from Busan to Bangkok, Thailand at the end of this month. They will operate these routes 3 to 7 times a week. Asiana Airlines also started daily flights to Chiang Mai, Thailand, from March 31. Flights to Chongqing, China, will resume next month, and flights to Xi'an will resume in July.

- FSCs emphasize that there is not a significant price difference compared to LCCs. LCC ticket prices have risen significantly after the pandemic. Although there has been a surge in pent-up demand for overseas travel, the reduction in aircraft maintenance and operational staff during the pandemic has prevented LCCs from increasing flight frequencies as desired. LCC passengers also need to pay separately for baggage and in-flight meals, which, when combined with other ancillary costs, result in a not significant difference in ticket prices. Short-distance travelers, considering mileage accumulation benefits, choose FSCs.

- LCCs are expanding their operations in the medium to long-haul market. T'way Air will start operating flights to Zagreb, Croatia, from next month. They will sequentially launch new routes to Paris, Rome, and other destinations until October. T'way Air plans to lease Airbus A330-200 aircraft, which are owned by Korean Air and are suitable for medium to long-haul flights, for European routes.

- Air Premia will begin operating four weekly flights to San Francisco starting next month. Currently, Air Premia also operates flights to New York, Los Angeles, and Barcelona, Spain. It is known that if Korean Air and Asiana Airlines merge, T'way Air and Air Premia will receive some of the European and North American routes.

- Jeju Air is pursuing the Tashkent route in Uzbekistan, and Air Busan is planning to operate medium-distance routes from Busan to Bali, Indonesia. Industry insiders explain that some LCCs in Korea are significantly different from traditional LCCs in the US and Europe and are closer to "Korean-style LCCs" or "Hybrid Airlines (HSC).

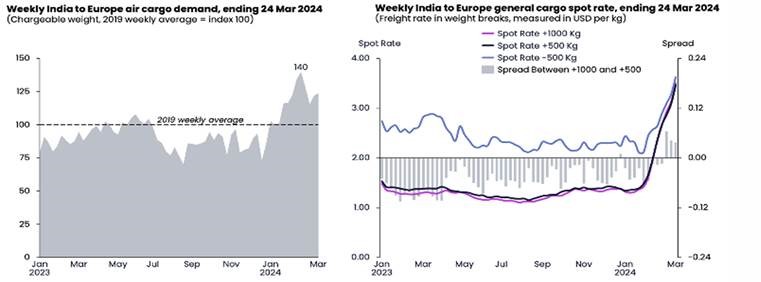

2) Continued increase in air cargo rates from India and Hong Kong

- In reality, cargo space at major hubs in India is insufficient due to the continuous inflow of pure Indian cargo and demand for transshipment cargo.

- Global forwarders state that "in reality, most of the space for India-origin Europe and US-bound cargo is already overbooked, and major airlines are raising fares without prior notice.Currently, the typical transportation period is around 6 to 7 days for the US and 5 to 6 days for Europe. Moreover, to select the desired schedule, airline reservations must be made 8 to 9 days in advance."

- Local industry personnel complain that "major airports such as Chennai, Mumbai, Delhi, and Bengaluru are already experiencing severe congestion. The delay in import cargo is also affecting exports, with a minimum of 36 to 44 hours required for cargo clearance through trucks."

- As of March 24, the freight load factor (L/F) for India-origin cargo bound for Europe reached 87%, the highest level since April 2022.

- As a result, the average market rate is $3.50/kg, which is 158% higher than in early December last year before the Hong Kong crisis broke out.

- However, this fare structure represents the airline's selling price, while actual shippers have contracted around $2.56/kg. Based on this, the rate increase is around 7.6%.

- Recent increased demand from India appears to be concentrated in apparel exports and is heavily influenced by the Hong Kong crisis. It is analyzed that this situation is somewhat different from the situation where China and Hong Kong are stimulated by e-commerce demand.

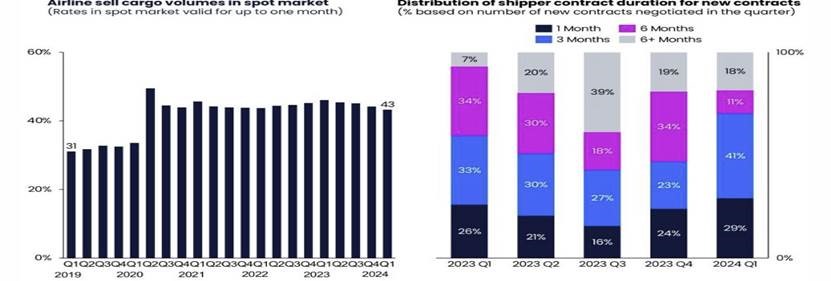

3) During the first quarter of the 24th year, it has been observed that shippers/forwarders prefer spot freight rates

-

In the first quarter of this year, it appears that many shippers have transitioned from long-term contracts to short-term/spot rates.

-

Among all new contracts in the first quarter, the proportion of three-month contracts accounted for 41% of the total, showing an 18% increase compared to the previous quarter. On the other hand, the proportion of six-month contracts decreased by 23%.

-

In the first quarter of 2024, the market share of spot rates accounted for 43% of the total market, which is higher compared to the pre-pandemic era when it was 31%.

-

It is analyzed that more shippers will transition from long-term contracts to spot rates during the first quarter. This is seen as shippers taking short-term risks in the spot market.

-

However, while the air cargo market had a stronger start than expected earlier this year, it is predicted that more capacity will be added as time goes on, leading to overall downward pressure on cargo load factors (L/F) and rates, except for some specific routes.

-

From the perspective of air cargo demand, the most important point is to recognize the significant growth and importance of e-commerce, which should not be underestimated.

-

The surge in e-commerce demand should not be seen as a one-time or temporary phenomenon. E-commerce is a major trend in the air cargo market and should be recognized as a fundamental demand driver for the foreseeable future, according to industry experts.

4) The impact of the Taiwan earthquake on the air cargo market rates

-

Despite the news that the operations of TSMC, the world's leading semiconductor foundry, have resumed following the earthquake in Taiwan, there are concerns that it will temporarily impact air cargo market rates.

-

Although the earthquake did not directly impact TSMC's factories, the evacuation order due to employee safety concerns requires a preparation period for factory resumption. While it may not be a long-term impact, it is expected to temporarily affect air cargo market demand and stimulate rates.

-

Furthermore, there are suggestions that if unexpected complications arise during the normal operation of the factories, the Vietnamese export air cargo market could benefit immediately. Although criticized as premature speculation, the air cargo market is under psychological pressure.

-

Currently, Taiwan accounts for 60% to 90% of global semiconductor market demand through TSMC.

-

Approximately 65% of Taiwan's air cargo market demand is for semiconductors, and 65% of the cargo handling performance at Taiwan Taoyuan International Airport is for semiconductor exports. As of now, the cargo performance of the airport is approximately 706,260 tons, with roughly 459,000 tons being semiconductor volume.

-

Logistics experts state, "Although normal operations and production will resume soon, it is expected that congestion in the supply chain will occur if temporary shipping suspensions and subsequent volume concentration continue, given the nature of logistics. Importers need to find alternative demand immediately, but currently, there seems to be no alternative other than semiconductors produced in Vietnam."

-

In fact, there are rumors that the Vietnamese local market has started redirecting TSMC's volume to Intel factories in Vietnam. Considering that up to 60% of the monthly 1,000 tons of air cargo in the Hanoi market is semiconductor exports, it is expected that temporary volume concentration will significantly stimulate rates.

-

On the other hand, there are also suggestions that Intel in Vietnam cannot replace TSMC's semiconductors. Due to different chip types and the lack of significant production capacity like Taiwan, immediate supply is difficult, and ultimately, reliance on air cargo originating from Taiwan is inevitable.

5) Airline/GSA Event update

(1) Expansion of China-based Airlines' US Routes

The US Department of Transportation (DOT) has approved an increase in the weekly flight frequency of Chinese airlines' US-Mid routes from the existing 35 to 50 flights starting from April.

With this approval, belly capacity will also rise.

*CA 14 flights, MU 12 flights, CZ 10 flights, HU 6 flights, MF 5 flights, 3U 3 flights

The weekly flight frequency of 50 flights is still significantly lower compared to the pre-COVID level of 150 flights.

(2) CMA CGM Air Cargo appoints ECS as GSSA

Global GSSA group ECS has signed a global GSSA contract with CMA CGM Air Cargo starting from April 1st and has begun full-fledged business and services.

The operated aircraft are B777F, currently flying 5 times a week on the Paris (CDG)-Shanghai (PVG) route and 4 times a week on the Paris-Hong Kong route.

Future plans include regular services to the US and Korean markets. Globe Air Cargo Korea, a subsidiary of the ECS group, will provide services in the Korean market.

CMA CGM Air Cargo was launched in March 2021. It currently operates with 3 A330Fs and 2 B777Fs. They plan to introduce an additional B777F within this year and the 4th A350F in 2026.

(3) T'way Air to launch new route to Canada in September

Following the resumption of WestJet's Calgary-Incheon route and the establishment of Air Canada's Montreal-Incheon direct flight, T'way Air is entering the Canadian market.

The Canada-Korea route, which was previously monopolized by Korean Air and Air Canada, now has four participating airlines.

Starting from September this year, T'way Air will operate a new Incheon-Vancouver route. They aim to operate 4 flights per week and have secured a total of 20 large aircraft in operation until 2027.

Korean Air and Air Canada currently operate daily flights on the Incheon-Toronto and Incheon-Vancouver routes. Korean Air will increase its frequency to twice a day for the next five months starting from next month.

WestJet's Calgary-Incheon direct flight operates three times a week starting from May this year, and Air Canada's Montreal-Incheon direct flight operates four times a week starting from June.

(4) Cathay Pacific Airways (CX) resumes Ho Chi Minh route from April 4th

After a four-year suspension due to COVID-19, the Ho Chi Minh route is being resumed.

Flights operate every Thursday in the order of Hong Kong-Hanoi-Ho Chi Minh. The cargo mainly consists of clothing, shoes, fruits, live seafood, and frozen seafood."

top